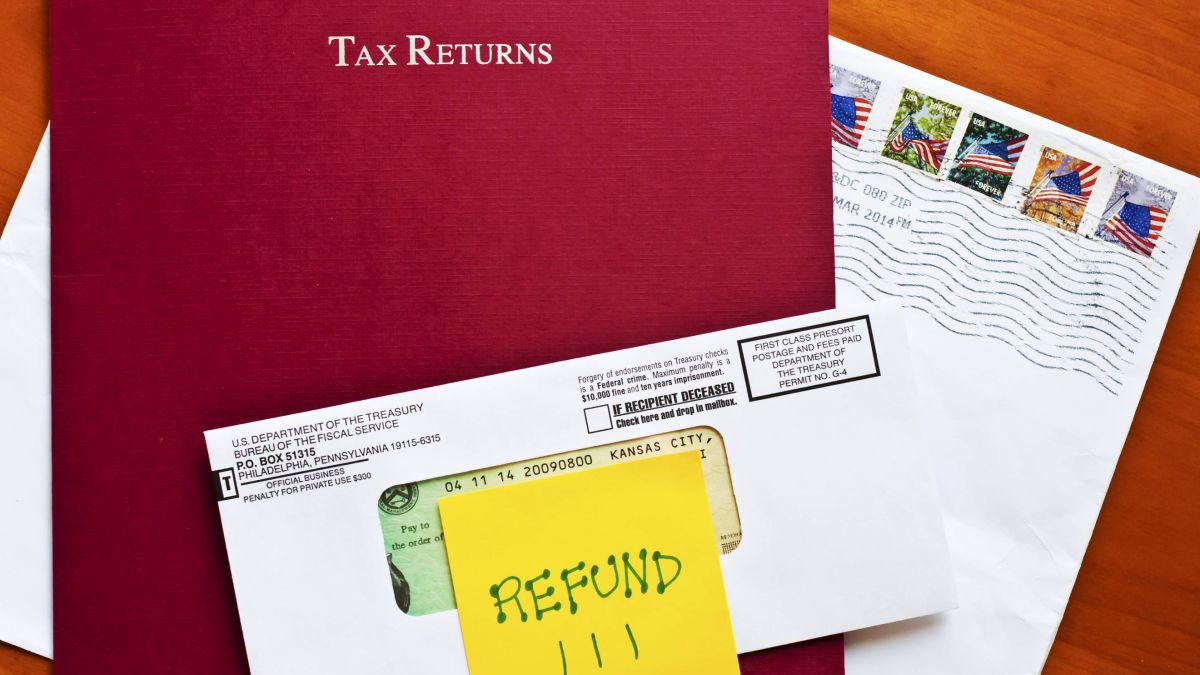

But the bill also forgave taxes on the first $10,200 in unemployment funds taxpayers received in 2020. In total, over 11.7 million refunds have been issued, totaling $14.4 billion.

What You Should Know About Unemployment Tax Refund

The irs usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments.

Unemployment tax refund calculator. Simply select your tax filing status and enter a few other details to estimate your total taxes. Let’s say they were on unemployment last year, which means their income is somewhere between $9,800 to $40,000. And more unemployment relief is to be expected […]

The move was taken to help unemployed americans during the pandemic, but not all benefited from it initially. When it went into effect on march 11, 2021, the american rescue plan act (arpa) gave a tax break on up to $10,200 in unemployment benefits collected in tax year 2020. How to calculate your unemployment benefits tax refund.

After more than three months since the irs last sent adjustments on 2020 tax returns, the agency finally issued 430,000 refunds on monday to those who qualify for the unemployment tax break. The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040 tax form. Since then, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion.

This handy online tax refund calculator provides a simplified version of the irs tax form 1040. Look at a federal tax table to see your amount of tax owed. The internal revenue service said it sent refunds to about 430,000 people who paid taxes on unemployment benefits that were excluded from taxable income in 2020.

Use our tax refund calculator to find out if you can expect a refund for 2021 (taxes filed in 2022). You had to qualify for the exclusion with a modified adjusted gross income (magi) of less than $150,000. Washington — the internal revenue service recently sent approximately 430,000 refunds totaling more than $510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

The irs has sent 8.7 million unemployment compensation refunds so far. If you paid taxes on your 2020 unemployment benefits and filed your tax return early this year, you could be getting a bigger. So, doing a little calculation gives us the following:

This can change if you qualify for earned income tax credit. On wednesday the irs confirmed concrete steps it will take to automatically refund money for americans who filed their tax returns. $10,200 x 0.22 = $2,244.

After more than three months since the irs last sent adjustments on 2020 tax returns, the agency finally issued 430,000. The latest update on irs unemployment refund checks. If you recieved $10,200 or more in unemployed, subtract 10,200 from your taxable income (line 15).

The irs just sent more unemployment tax refund checks with the latest batch, uncle sam has now sent tax refunds to over 11 million americans for the $10,200 unemployment compensation tax exemption. It applied to individuals and married couples whose income was less than $150,000. The difference between the tax you owe and the tax you owed when originally filing should be your refund (line 24 on you 1040).

You will enter wages, withholdings, unemployment income, social security benefits, interest, dividends, and more in the income section so we can determine your 2021 tax bracket and calculate your adjusted gross income (agi). The irs is expected to continue working through the tax returns backlog for the rest of summer at least, meaning that it. The irs says it plans to issue another batch by the end of the year.

Moving on to another example, we’ve a person and they are single. This is the refund amount they should receive. Unemployment income rules for tax year 2021.

Use any of these 10 easy to use tax preparation tools. How to calculate how much will be returned. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy.if there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of irs.

Then get your refund anticipation date or tax refund money in the bank date. Based on your projected tax withholding for the year, we then show you your refund or. The american rescue plan act of 2021 became law back in march.

Irs To Send Refunds For Unemployment Tax Breaks Archive Wkowcom

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs To Start Sending 10200 Unemployment Benefit Tax Refunds In May

Faqs On Tax Returns And The Coronavirus

Unemployment Tax Break Calculating Your 10200 Tax Break Refund Finaffinity 2021

Illinois Dept Of Revenue To Begin Issuing Tax Refunds For Eligible Residents Who Received Unemployment Benefits News Wsiltvcom

Freetaxusa Federal State Income Tax Calculator – Estimate Your Irs Refund Or Taxes Owed

Unemployment Tax Refund How To Calculate How Much Will Be Returned – Ascom

If I Paid Taxes On Unemployment Will I Get A Refund

How To Estimate Your Tax Refund Lovetoknow

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Federal Income Tax Calculator 2020 Credit Karma

Calculate Your Exact Refund From The 10200 Unemployment Tax Break How Much Will You Get Back – Youtube

Unemployment Tax Refunds Irs Says Millions Will Receive One – Mahoning Matters

Paying Taxes On Unemployment Checks Everything You Need To Know – Cnet

Dor Unemployment Compensation

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned – Ascom