The 10 percent deduction is based on your net amount payable (i.e., the amount of benefits payable before deductions for earnings, benefit reduction, child support, and bankruptcy intercept, and. Forgiveness”, allows eligible taxpayers to eliminate or reduce their state personal income tax liability.

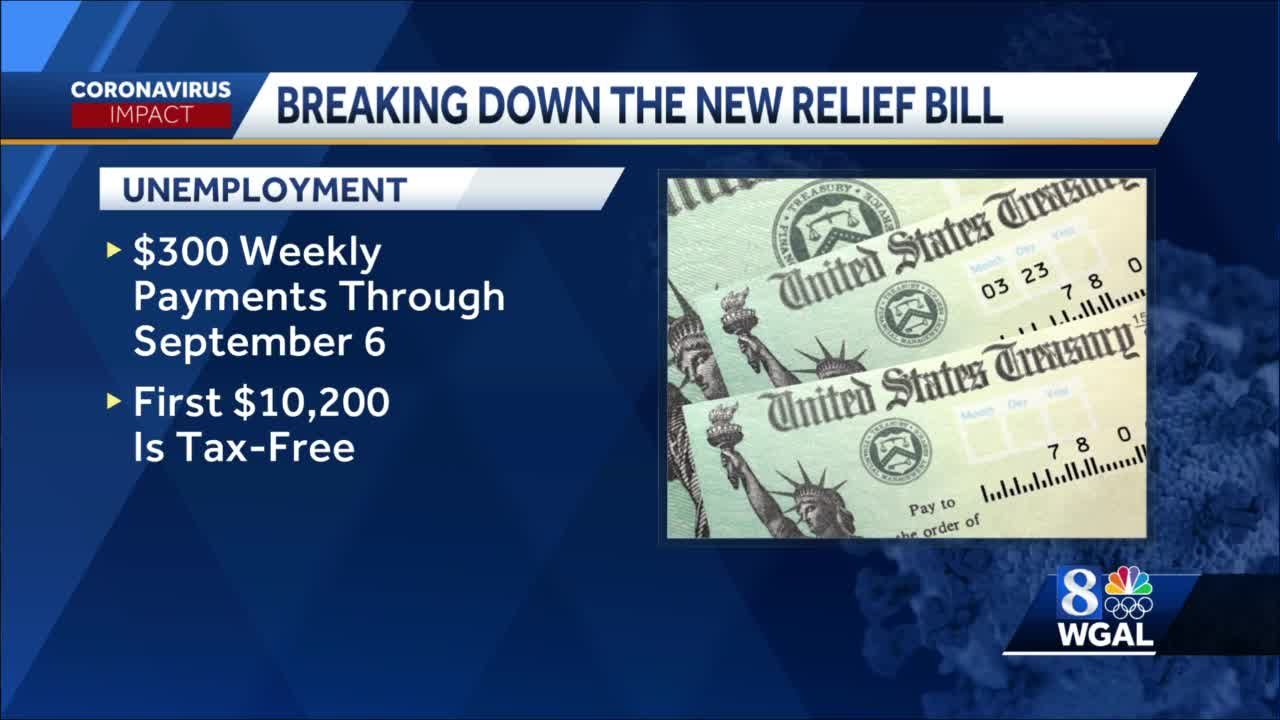

Covid Bill Waives Taxes On 20400 Of Unemployment Pay For Couples

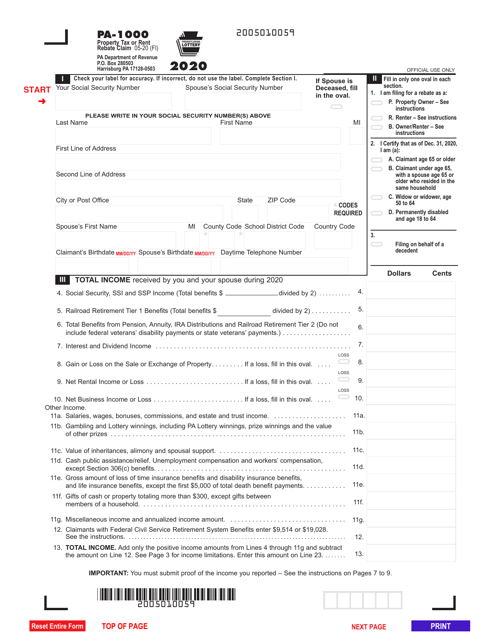

Calculation of tax forgiveness definition of eligibility income taxpayers can apply for tax forgiveness by completing a pa schedule sp along with their state.

Unemployment tax forgiveness pa. Appealing a uc tax rate. These enhanced benefits have been part of different programs called the pandemic unemployment assistance, pandemic emergency unemployment compensation, and federal pandemic unemployment compensation. For everyone else, up to $10,200 is forgiven.

The $10,200 tax break is. If you are married, each spouse receiving unemployment. Provides a reduction in tax liability, and.

For example, 1.0 means you are entitled to 100 percent tax forgiveness, and.20 means you are entitled to 20 percent tax forgiveness. If you are married, each spouse doesnât have to pay federal taxes on unemployment benefits of up to $10,200. Appeal a uc contribution rate.

The amount of tax forgiveness is based on the taxpayer’s income and number of dependents. It is not an automatic exemption or deduction. Tax forgiveness is a credit against pa tax that allows eligible taxpayers to reduce all or part of their pa tax liability.

If your adjusted gross income is less than $150,000, then you donât have to pay federal taxes on unemployment insurance benefits of up to $10,200. Such taxpayers must include in their eligibility income all income as described whether earned within or outside pennsylvania. If convicted you could be fined up to $1,000 or be imprisoned for up to 30 days or both for each false statement or failure to disclose a material fact.

5, 2021, pennsylvania enacted act 1 of 2021 (act 1), specifically excluding forgiven paycheck protection program (ppp) loans and economic impact payments 1 from personal income tax (pit). Refunds set to start in may. A new law allows most individuals to be exempt from paying taxes on the first $10,200 received in the various federal disaster aid programs including the $345 a week from pandemic unemployment assistance and the additional weekly $600 of federal pandemic unemployment compensation and the extra $300 a week through the lost wages assistance.

Then, move across the line to find your eligibility income. This only applies to unemployment benefits that you received in 2020. The $10,200 exemption applied to individual taxpayers who earned less than $150,000 in modified adjusted gross income.

At the bottom of each column is an amount, expressed as a decimal, which represents the percentage of tax forgiveness you are allowed. Senate democrats also added a provision that would grant tax forgiveness for. File and pay quarterly wage and tax information.

A penalty week is a week when you are unemployed and otherwise eligible to receive uc, but benefits are denied because of past fraud. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents (if any).

For employers unable to access ucms, a written appeal will be accepted if received within 90 days of the mailing date of the contribution rate notice. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Moosic, pa » 34° moosic, pa ».

This means they don't have to pay tax on some of it. Do i have to pay taxes on my 2020 unemployment benefits? Register to do business in pa.

You may be charged a penalty equal to 15% of the amount of the overpaid benefits. According to the irs, the average refund for those who overpaid taxes on unemployment compensation $1,265. The pennsylvania uc law also provides for prosecution and penalties for anyone who knowingly makes a false statement or who knowingly withholds information to obtain or increase benefits.

Get information about starting a business in pa. Forgives some taxpayers of their liabilities even if they have not. 2 following the bill’s enactment, the pennsylvania department of revenue (pennsylvania department) released guidance explaining the provisions of act 1 and.

Pennsylvania may claim tax forgiveness if meeting all the eligibility requirements. Register for a uc tax account number. Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns.

Under the new law, taxpayers who earned less than $150,000 in modified adjusted gross income can exclude some unemployment compensation from their income. If your modified adjusted gross income (agi) is less than $150,000, the american rescue plan enacted on march 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you don’t have to pay tax on unemployment compensation of up to $10,200. Report the acquisition of a business.

Qualified children also include grandchildren of grandparents and foster children of. Further, to qualify for the credit, it is necessary to calculate both the. Unemployment benefit payments were extended from september 6, 2020 to march 14, 2021, and then until september 6, 2021, which adds up to.

What do i do next?

Article

Americas Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits – The Washington Post

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill

Pennsylvania Special Tax Forgiveness Credit Do You Qualify – Supermoney

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Are You Eligible For The Pa Tax Amnesty Program – Alloy Silverstein

2

Pa Unemployment Benefits How To Apply Credit Karma

2022 Sui Tax Rates In A Post-covid World Workforce Wise Blog

Article

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

2

Pennsylvania Department Of Revenue Forms Pdf Templates Download Fill And Print For Free Templateroller

2

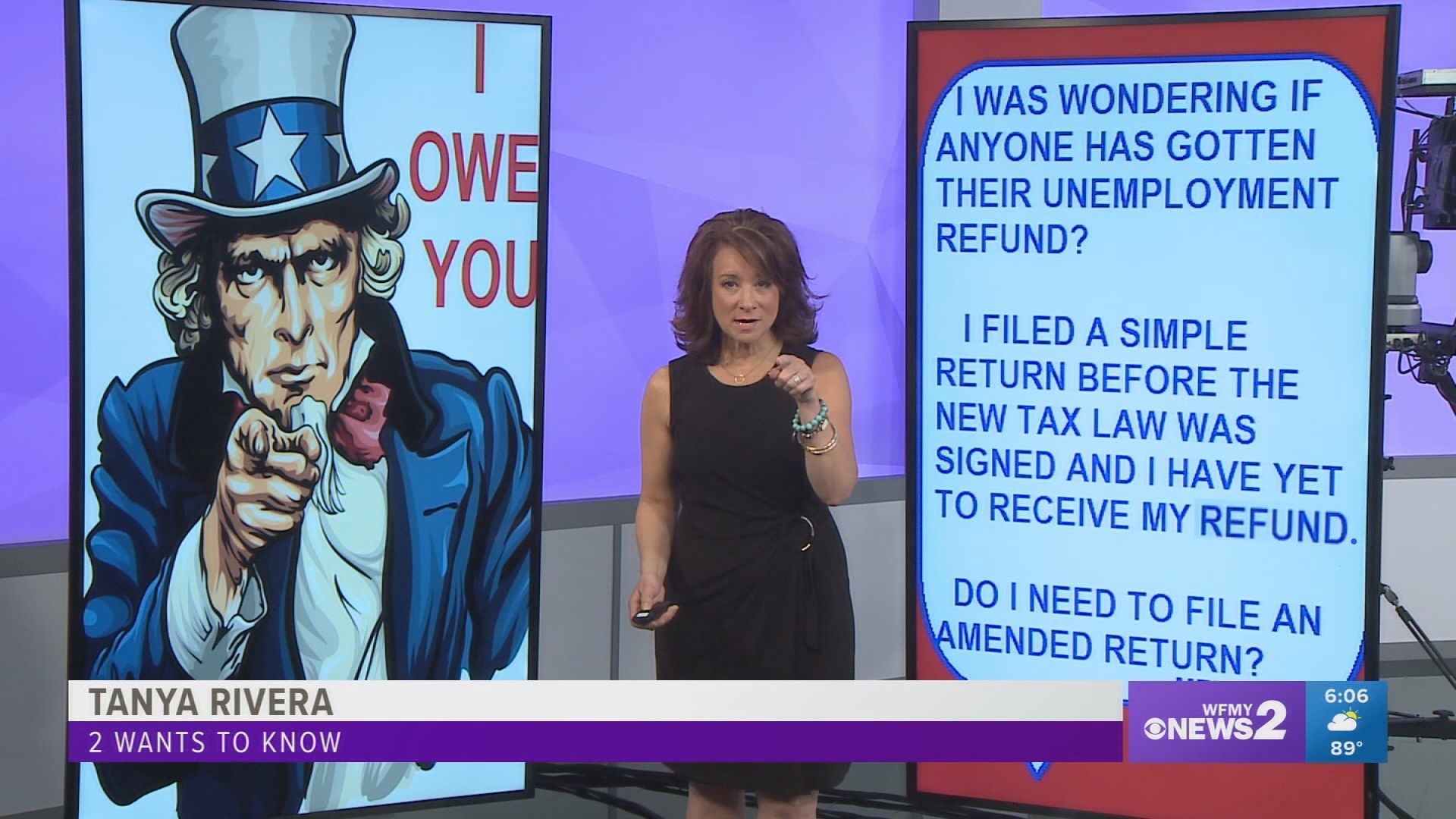

When Will Irs Send Unemployment Tax Refunds Wnepcom

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Wnepcom

More Unemployment Money Included In New Covid-19 Relief Bill

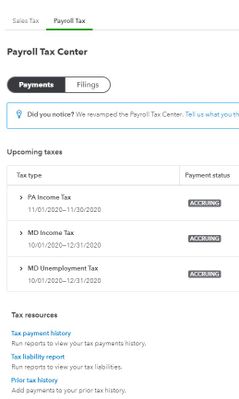

Maryland Income Tax Filings Not Listed Under Fili

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Wnepcom