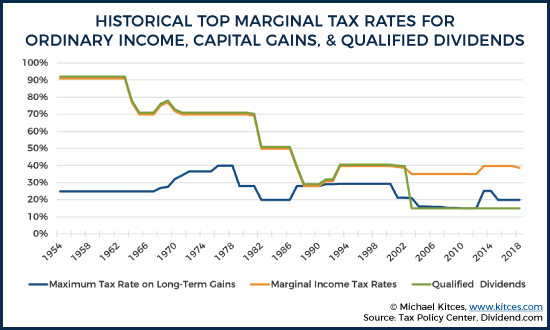

The adjusted net capital gain of an estate or trust is taxed at the same rates that apply to individual taxpayers. However, long term capital gain generated by a trust still maxes out at 20% plus the 3.8% when taxable trust income exceeds $13,050.

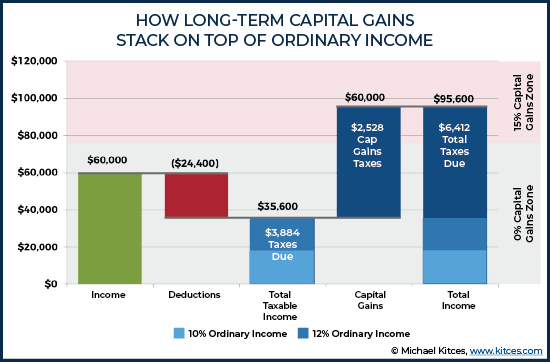

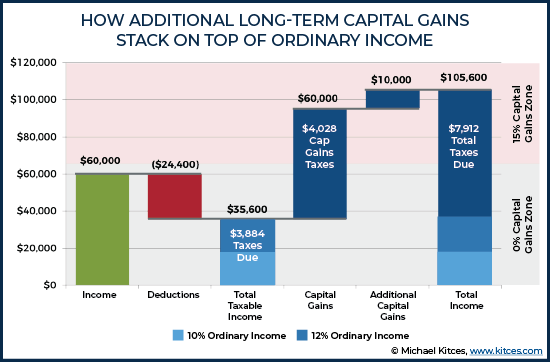

The Tax Impact Of The Long-term Capital Gains Bump Zone

2 surtax applies to the lesser of (1) undistributed net investment income or (2) the excess of adjusted gross income over $12,750.

Trust capital gains tax rate 2019. R2 million gain or loss on the disposal of a primary residence; It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration. My 1041 for 2019 is taxing capital gains at ordinary income rates.

A 28 per cent rate applies to upper rate gains. Treating capital gains as income A 0% rate applies to adjusted net capital gain that, if it were ordinary income, would be subject to the 10% income tax rate;

Under these circumstances the beneficiary wouldn’t pay anything in income taxes, but the trust will pay about $16,000 in taxes on the capital gains income before it is given to the beneficiary as principal. Trustees may be able to reduce the rate of this tax if they qualify to claim entrepreneurs' relief or investors' relief. 1 surtax applies to lesser of net investment income or modified adjusted gross income over threshold.

Trusts and estates pay capital gains taxes at a rate of 15% for gains between $2,600 and $13,150, and 20% on capital gains above $13,150.00. The 0% rate applies to amounts up to $2,650. 20% for trustees or for.

The new tax rates for year 2019 announced.there is slight increase in the estate tax exclusion amount in this year. 31, 2019, may be subject to an estate tax, with an applicable lifetime estate duty exclusion amount of $11,400,000 (increased from $11,180,000 in 2018). The following are some of the specific exclusions:

A trust may only have up to $2,650 (in 2019) of taxable income and still be taxed at 0% on its capital gains and qualified dividends. For tax year 2019, the 20% rate applies to amounts above $12,950. (they are not distributed out to the beneficiaries.)

Capital gains tax for trustees and personal representatives is charged at 20 per cent on gains that are not upper rate gains. Individuals also enjoy a substantial benefit over trusts when it comes to the income taxation of capital gains and qualified dividends. Included in these updates are adjustments to the 2019 tax brackets for estate and trust taxable income.

What is the tax rate on capital gains in a trust? The remaining amount is taxed at the current rate of capital gains tax for trustees in the 2020 to 2021 tax year: Trusts and estates pay capital gains taxes at a rate of 15% for gains between $2,600 and $13,150, and 20% on capital gains above $13,150.00.

In california, for example, trusts and estates are subject to a top tax rate of 12.3%, which may increase to 13.3% if the income is over $1,000,000 and is subject to the mental health services tax. The top marginal rate remains 40 percent.the tax rate. Events that trigger a disposal include a sale, donation, exchange, loss, death and emigration.

Qualified dividends are taxed as capital gain rather than as ordinary income. For the 2020 tax year, the first $2,650 of capital gains earned by trusts are not taxed and there is a 15% tax rate for gains above this amount up to $13,150. For tax year 2019, the tax brackets are 10%, 24%, 35%, and 37% which are different from the 2018 brackets (15%, 24%, 28%, 33% and 39.6%).

The 0% and 15% rates continue to apply to amounts below certain threshold amounts. The highest trust and estate tax rate is 37%. Capital gains and qualified dividends.

The tax rate works out to be $3,146 plus 37% of income over $13,050. The capital gain tax rates for trusts and estates are as follows: It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration.

Irs form 1041 gives instructions on how to file. It applies to income of $13,050 or more in 2021. So a decedent dying between jan.

The income of the trust estate is therefore $300 ($100 interest income + $200 capital gain) and the net income of the trust is $200 ($100 interest income + $100 net capital gain because the cgt discount is applied to halve the $200 capital gain). Income tax is not only paid by individuals. Estates and trusts taxable income $ 0 to 2,600 maximum rate = 0% 2,601 to 12,700 maximum rate = 15% 12,701 and over maximum rate = 20%

At just $13,050 in taxable income, trust tax rates are 37% plus the 3.8% tax imposed with the affordable care act. Gains on the disposals of interests in residential property are upper rate gains.

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Tax Commentary – Govuk

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Tax Relief For Holiday Lets – Sykes Holiday Cottages

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains And Losses Examples Httpontarioincometaxservicescom Capital-gains-and-losses-examples Capital Gains Tax Capital Gain Income Tax Preparation

Bfnbn2regx2uzm

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

12 Ways To Beat Capital Gains Tax In The Age Of Trump

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Guide To Capital Gains Tax – Times Money Mentor

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

The States With The Highest Capital Gains Tax Rates The Motley Fool

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times