This can be accomplished by using the. Skip this section if none of the options are applicable.

Tngov

Paper returns will not be accepted unless filing electronically creates a.

Tn franchise and excise tax mailing address. Tennessee department of revenue, 500 deaderick street, nashville, tn 37242. If you have questions about franchise and excise tax online, contact. Start final taxpayer has filed for federal extension end account.

When calculating franchise tax, if the holding entity owns an interest in several other entities, its equity can potentially be taxed more. Tennessee department of revenue r0011301 fae 172 quarterly franchise, excise tax declaration account no. General partnerships and sole proprietorships are not subject to the tax.

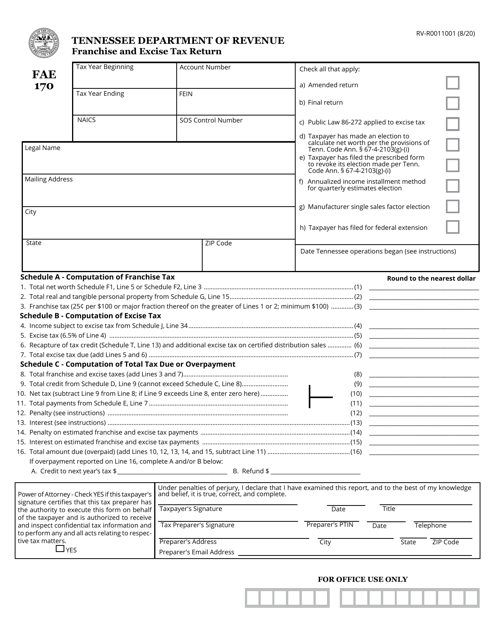

The franchise tax is a privilege tax imposed on entities for the privilege of doing business in tennessee. Total net worth schedule f1, line 5 or schedule f2, line 3. 15) if registering for franchise and excise tax, check the box of any type that applies.

The tennessee franchise and excise tax has two levels: $0.25 per $100 based on either the fixed asset or equity of the entity, whichever is greater. Renewal new exemption tax period covered:

Tennessee department of revenue, andrew jackson state office building, 500 deaderick street, nashville, tn 37242 round to the nearest. Two years ago, bridgestone received approval from the commissioner of economic development to offset 100% of its state franchise and excise taxes using the machinery credit, the lawsuit said. Please visit the file and pay section of our website for more information on this process.

16) if registering as a series llc, provide the fein, entity name, location address, telephone number, and state of domestic certificate of authority for the master llc. Estimates (see instructions) mailing address manufacturer single sales factor election (see instructions) city taxpayer has filed for federal extension state zip code remit amount on line 16 to: The company has yet to get that tax break either, which is.

Franchise & excise tax return mailing address tennessee department of revenue andrew jackson state office building 500 deaderick st nashville, tn 37242 Return this change of address form to the tennessee department of revenue, taxpayer services division, andrew jackson office building, 500 deaderick street, nashville, tennessee 37242. The excise tax is based on net earnings or income for the tax year.

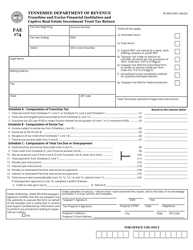

If you had a franchise & excise tax account number before may 28, 2018, the only change to this number is the addition a zero to the beginning of the number. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the secretary of state to do business in tennessee, regardless of whether the company is active or inactive. Yes for office use only fae 170 tennessee department of revenue franchise and excise tax return tax year beginning tax year ending amended return mailing address city legal name.

Please view the topics below for more information. Please view the topics below for more information. All persons, except those with nonprofit status or otherwise exempt, are subject to a 6.5% corporate excise tax on the net earnings from business conducted in tennessee for the fiscal year.

Estimates (see instructions) mailing address manufacturer single sales factor election (see instructions) city taxpayer has filed for federal extension state zip code remit amount on line 16 to: Taxpayer services 500 deaderick street nashville, tennessee 37242 phone: Taxable year beginning ending taxpayer name and mailing address name _____ box (street) _____ city _____ state _____ zip _____ each taxpayer having a combined franchise and excise tax liability of $5,000 or more for the current and prior tax.

Franchise and excise taxes the franchise and excise taxes the excise tax is a tax imposed on the privilege of doing business in tennessee. Place a check mark in the space next to every tax type that will be affected by the change of. All franchise and excise returns and associated payments must be submitted electronically.

Please mail completed applications and annual renewals to: If online filing is not possible, taxpayers may mail the application for franchise, excise tax registration form to the address shown on the instructions. The tax is based on net earnings or income for the tax year.

This form is for income earned in tax year 2020, with tax returns due in april 2021.we will update this page with a new version of the form for 2022 as soon as it is made available by the tennessee government. Tennessee department of revenue attention: 6.5% excise tax on the net earnings of the entity, and;

Franchise & excise tax forms. Available there to explain tennessee's tax system and to answer your questions.

Fae 170 – Fill Out And Sign Printable Pdf Template Signnow

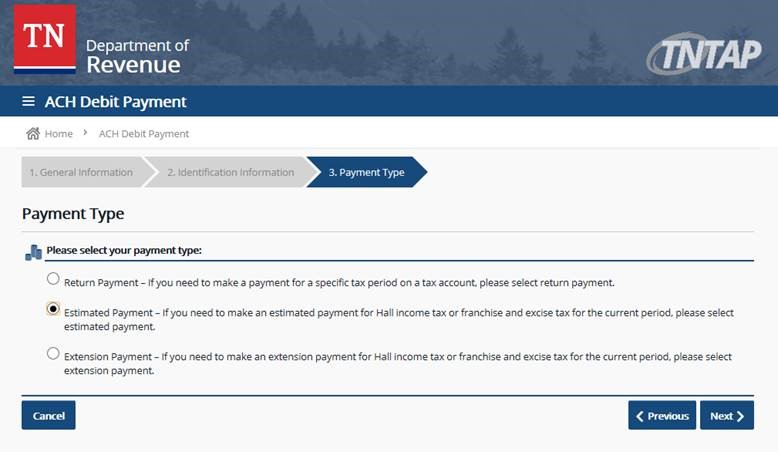

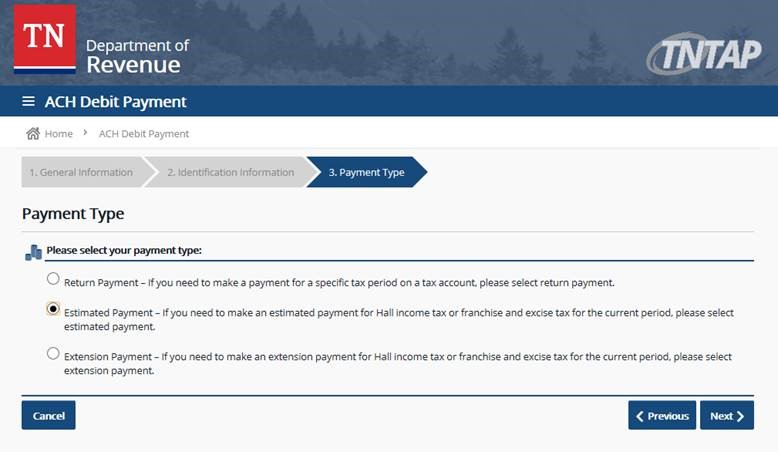

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fillable Online Tn Franchise And Excise Tax Job Tax Credit Business Plan Franchise And Excise Tax Job Tax Credit Business Plan – Tn Fax Email Print – Pdffiller

Tennessee Franchise And Excise Tax Exemption – Fill Online Printable Fillable Blank Pdffiller

Form Fae-170 Franchise And Excise Tax Return Kit

Tngov

Form Fae174 Rv-r0012001 Download Printable Pdf Or Fill Online Franchise And Excise Financial Institution And Captive Real Estate Investment Trust Tax Return Tennessee Templateroller

State Extends Tax Deadlines For Businesses News Wsmvcom

Tennessee Franchise Excise Tax – Price Cpas

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Free Form Fae 170 Franchise And Excise Tax Return Kit – Free Legal Forms – Lawscom

Tennessee Department Of Revenue – Tntaptuesday Reminderfranchise And Excise Tax Is Due July 15 Filing The Minimum 100 Tax Can Be Done From The Tntap Homepage Visit Tntaptngoveservices Select File Minimum

Tngov

Form Fae-170 Franchise And Excise Tax Return Kit

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fillable Online Tennessee Tennessee Department Of Revenue Franchise And Excise Tax – Tennessee Fax Email Print – Pdffiller

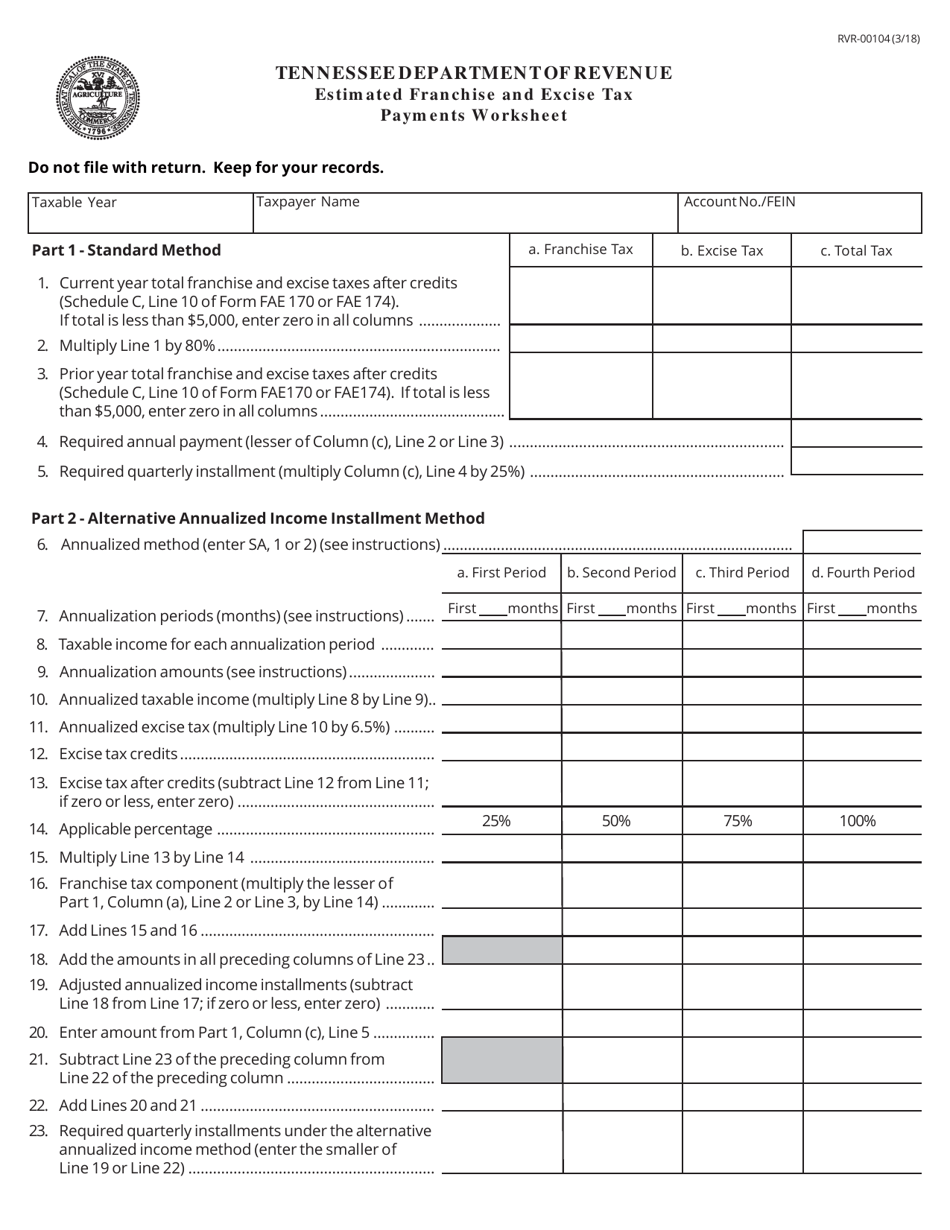

Form Rvr-00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Franchise Excise Tax Workshop – Youtube