Franchise and excise taxes the franchise and excise taxes the excise tax is a tax imposed on the privilege of doing business in tennessee. The following will cover certain aspects of tennessee’s franchise and excise tax and give particular focus to the more common exemptions available under the taxing statute.

Franchise Excise Tax – Obligated Member Entities – Youtube

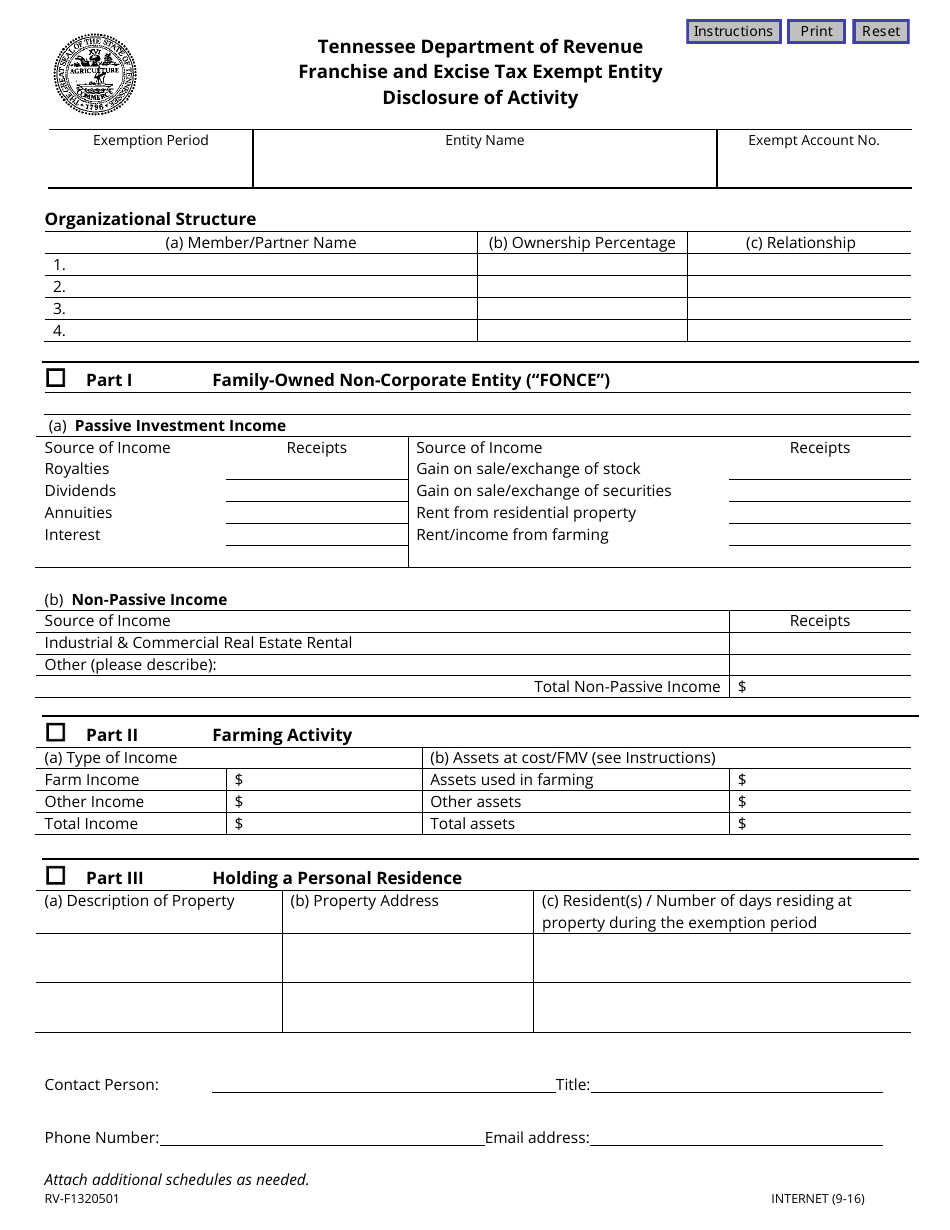

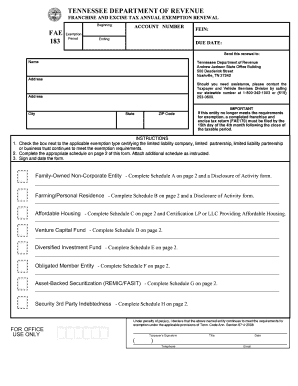

This has to be filed with the tennessee department of revenue within sixty (60) days of the beginning of the first tax year which you claim an exemption.

Tn franchise and excise tax exemption. However, in no case should an exemption application or exemption renewal. There are some exemptions to filing franchise and excise tax. Next, if you don’t file the proper exemption, a tennessee llc is subject to a franchise and excise tax for the privilege of doing business in their state.

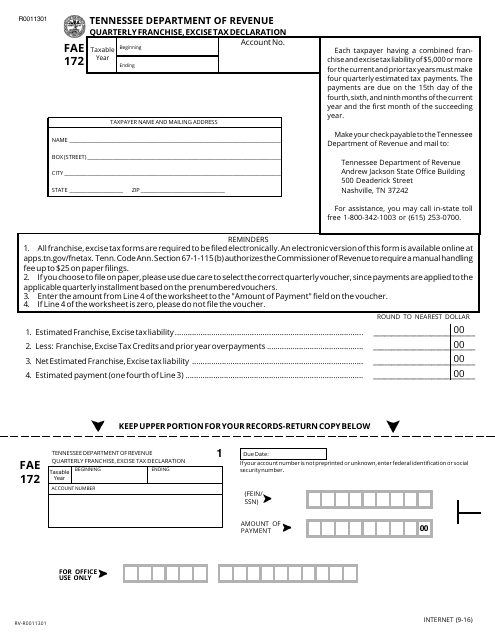

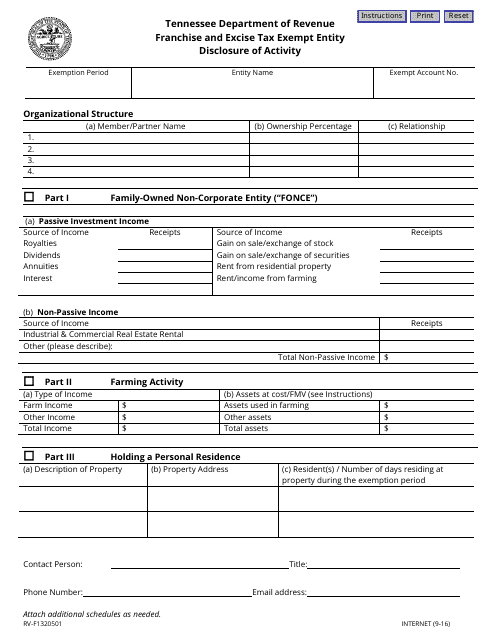

The taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th day of the fourth month following the close of the tax year for which the taxpayer is claiming an exemption. Organizational structure (a) member/partner name (b) ownership percentage (c) relationship 1. General partnerships not seeking llc protection and single member llcs with corporate owners are not required to file separate tennessee tax returns.

Tennessee imposes an excise tax at the rate of 6.5% on the net earnings of certain taxpayers doing business within tennessee, pursuant to tenn. This means that we don't yet have the updated form for the current tax year. At least 95% of the entity’s ownership must be directly held by family members, and substantially all (66.67%) of the activity of the entity is either the production of passive investment income or the combination of the production of passive investment income and farming.

When i called the dept of revenue, i was told the amount was an estimate based upon the lack of filing, so i should register online, and file the form, then they would tell me what i really owed. Application for registration and instructions; The state of tennessee imposes franchise and excise (“f&e”) tax on certain types of legal entities.

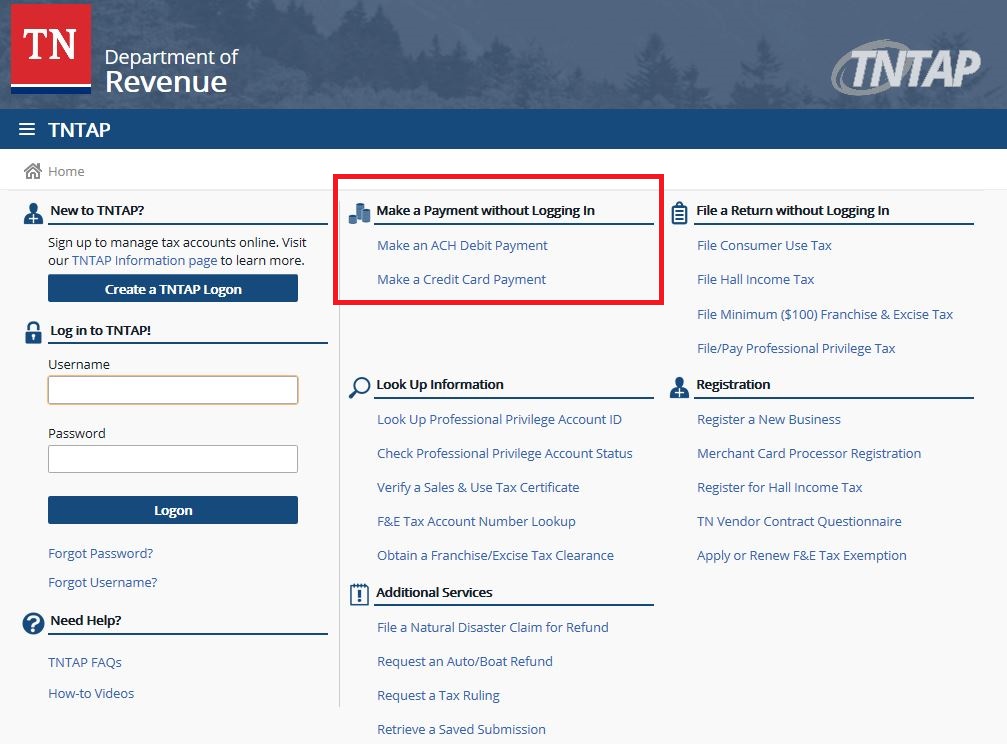

Online registration using the tennessee taxpayer access point (tntap). In order to qualify for the fonce franchise and excise tax exemption, the entity must meet two criteria: The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in tennessee.

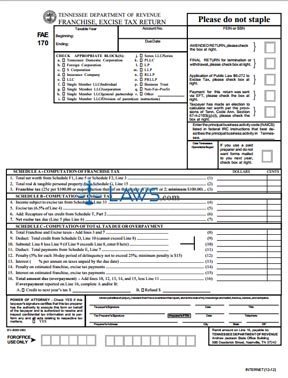

Application for exemption/annual exemption renewal; The tennessee secretary of state if the entity does not meet the exemption requirements in any given year, it is taxable on all activities for that year a completed franchise and excise tax return (fae170) must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the taxable year The form on the reverse side should be completed by entities requesting exemption under provision of these laws.

The tennessee franchise and excise tax has two levels: The tax is based on net earnings or income for the tax year. $0.25 per $100 based on either the fixed asset or equity of the entity, whichever is greater.

6.5% excise tax on the net earnings of the entity, and; How much is the tennesse franchise and excise tax? General partnerships and sole proprietorships are not subject to the tax.

Hello fellow bp'ers, as a fairly new tennessee llc, we received a final notice from tennessee department of revenue requesting $646 for franchise and excise taxes and late fees. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in tennessee or doing business in this state, then you must register for and pay franchise and excise taxes. Entities subject to tax include “c” corporations, “s” corporations, and the.

Under existing law, flps in which at least 95 percent of the ownership interest is owned by members of a defined family group are exempt from the tennessee franchise and excise taxes as long as substantially all of its income is derived from royalties, rents, dividends, interest, annuities and sales or exchanges of securities. This form applies to limited liability companies and limited partnerships that claim an exemption from tennessee franchise and excise taxes. Tennessee department of revenue franchise and excise tax exempt entity disclosure of activity exemption period entity name exempt account no.

Identify tennessee code section and reason for requesting franchise and excise tax exemption. Please check this page regularly, as we will post the updated form as soon as it is released by the tennessee department of revenue.

Nashville Attorneys Esports – Intellectual Property – Business – Entertainment Hg Llp

Tennessee Franchise And Excise Tax Guide – Tngov Franchise And Excise Tax Guide Is Intended As An Franchise And Excise Tax Statutes Or Rules Also Offers A Toll-free Franchise –

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print – Pdffiller

Tennessee Franchise And Excise Tax Guide – Tngov Franchise And Excise Tax Guide Is Intended As An Franchise And Excise Tax Statutes Or Rules Also Offers A Toll-free Franchise –

Tennessee Franchise And Excise Tax Guide – Pdf Free Download

Tngov

Form Rv-f1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

Free Form Fae 170 Franchise And Excise Tax Return Kit – Free Legal Forms – Lawscom

Tennessee Franchise And Excise Tax Guide – Pdf Free Download

Exemption Fonce

Tennessee Franchise And Excise Tax Exemption – Fill Online Printable Fillable Blank Pdffiller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Franchise Excise Tax Workshop – Who Is Subject To Tax And Who Is Exempt – Youtube

Tennessee Franchise And Excise Tax Exemption – Fill Online Printable Fillable Blank Pdffiller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fillable Online Fae 183 Franchise And Excise Tax Annual Exemption Renewal Fae 183 Franchise And Excise Tax Annual Exemption Renewal Fax Email Print – Pdffiller

Form Rv-f1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

Tennessee Franchise Excise Tax – Price Cpas

Tennessee Form Fae-certhousing Certification – Franchise And Excise Tax Exemption – 2020 Tennessee Taxformfinder