Do not put it off any longer. The dallas county property tax rate is determined by the commissioners’ court and combined with the rates decided by your appraisal district (based on an assessment of local property values).

Sales Tax Rebates For International Shoppers In Texas

Items must be purchased in texas within 30 days of departure.

Texas tax back dallas. How do i apply for a refund for an overpayment or erroneous payment on my property tax account? County property taxes for dallas and the surrounding cities are a major concern. Texas tax forms are sourced from the texas income tax forms page, and are updated on a yearly basis.

As in 2016, the law exempts most clothing, footwear, school supplies and backpacks priced under $100 from sales and use taxes, which could save shoppers about 8%. The state of texas allows international shoppers to receive sales tax refunds on merchandise purchased in texas and within 30 days of departure from the u.s.a. Taxfree recommends that visitors purchase items within the last two weeks before departure to allow for processing time.

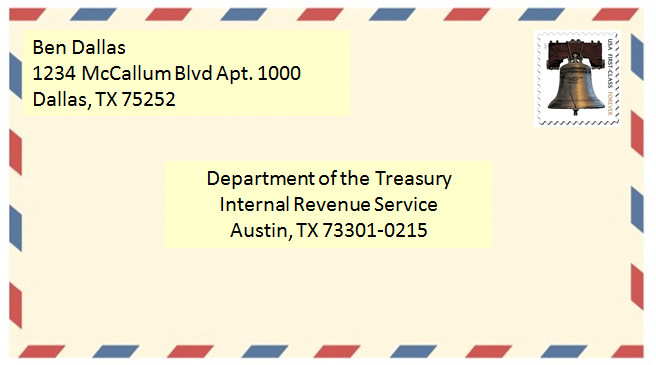

A minimum of $10.00 of texas sales tax per store location is required. Therefore, immediately file your outstanding tax returns before it’s too late. You may also visit one of our many convenient tax office locations.

The irs will relentlessly levy wages, bank accounts, and other assets when a taxpayer owes back. The 2021 state personal income tax brackets are updated from the texas and tax foundation data. Please make sure the texas forms you are.

Before the official 2021 texas income tax rates are released, provisional 2021 tax rates are based on texas' 2020 income tax brackets. You can find detailed information about how your rate is calculated on the dallascounty.org website. Texas is one of seven states that do not collect a personal income tax.

Overpayments and/or erroneous payments over $5.00 are researched and generally refunded without a request from. Do not put it off any longer. Process your refund at one of our 17 locations.

Texas tax free dates below. The average tax rate in dallas county is about 1.99%. As of december 3, dallas county, tx shows 1,227 tax liens.

Purchases must be taken with you when you depart texas and the usa. Texas sales tax holiday 2021 details released by texas comptroller of public accounts. Also called a privilege tax, this type of income tax is based on total business revenues exceeding $1.18 million.

Texas tax free weekend 2021 starts august 9th, 2021 and ends august 11th, 2021. Home buyers and investors buy the liens in dallas, tx at a tax lien auction or online auction. The faq page identifies the small processing fee:

Texas tax back is located on the third floor and offers certain tax refunds on items bought. Texas has no individual income tax as of 2021, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. 8 published august 5, 2021 • updated on august 6, 2021 at 8:49 am nbc universal, inc.

Interested in a tax lien in dallas county, tx? 400 ferris avenue | waxahachie, tx 75165. How does a tax lien sale work?

Back taxes attorney in dallas & tyler, tx the irs has stepped up collections and prosecutions of taxpayers who have failed to file returns and owe back taxes. The texas comptroller estimated that shoppers will save $107.3 million in state and local taxes over the three days on purchases of about $1.3 billion worth of. The dallas county tax office is committed to providing excellent customer service.

Your average tax rate is 16.9% and your marginal tax rate is 29.7%.this marginal tax rate means that your immediate additional income will be taxed at this rate. If you make $55,000 a year living in the region of texas, usa, you will be taxed $9,295.that means that your net pay will be $45,705 per year, or $3,809 per month.

Texas Tax Back At The Galleria – A Shopping Center In Houston Tx – A Simon Property

Earn Money From Home Tax Refund Earn Money From Home Tax Time

Community Tax Centers – Home Facebook

Why Are Texas Property Taxes So High Home Tax Solutions

New Tax Law Take-home Pay Calculator For 75000 Salary

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure – Tax Ease

Tax Increment Financing Districts City Of Dallas Office Of Economic Development

How To File And Pay Sales Tax In Texas Taxvalet

States Like Texas With No Income Tax Not Always More Affordable Study Says – Dallas Business Journal

Tax Increment Financing Districts City Of Dallas Office Of Economic Development

Tax Increment Financing Districts City Of Dallas Office Of Economic Development

Dallas Tax Centers Dallasctc Twitter

How To Charge Your Customers The Correct Sales Tax Rates

Get Income Tax Services In Dallas Tx From Experts Tax Services Income Tax Tax Preparation

Dallas County Web Site

Taxes International Students And Scholars Office

Texas Tax Free Weekend – Family Eguide

Heres How Much Money You Take Home From A 75000 Salary

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up – Mansion Global