San antonio, texas vs tempe, arizona. The minimum combined 2021 sales tax rate for tempe, arizona is.

Arizona Income Tax Calculator – Smartasset

There is no special rate for tempe.

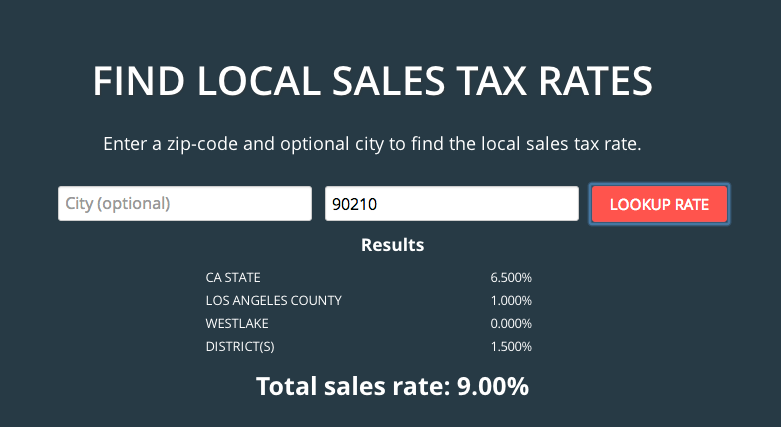

Tempe arizona sales tax calculator. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Arizona provides an exemption if you plan to register the car in one of these states, meaning you will not have to pay a sales tax, even if the transaction occurs in arizona.

The county sales tax rate is %. How 2021 sales taxes are calculated in tempe. For states that have a tax rate that is less than arizona’s 5.6%, tax is collected by the state of.

One of a suite of free online calculators provided by the team at icalculator™. Impose an additional 2.00% bed tax. The tempe, arizona sales tax comparison calculator allows you to compare sales tax between all locations in tempe, arizona in the usa using average sales tax rates and/or specific tax rates by locality within tempe, arizona.

Look up sales tax rates for tempe, arizona, and surrounding areas. 2021 cost of living calculator: All sales prices after tempe finance bonus cash, if applicable, plus tax, license, and $499.95 doc fee.

2020 rates are provided by avalara and updated monthly. The tempe, arizona, general sales tax rate is 5.6%.depending on the zipcode, the sales tax rate of tempe may vary from 5.6% to 8.1% every 2021 combined rates mentioned above are the results of arizona state rate (5.6%), the county rate (0.7%), the arizona cities rate (1.8%). Tax paid out of state.

The arizona sales tax rate is 5.6%, the sales tax rates in cities may differ from 5.6% to 11.2%. Questions answered every 9 seconds. A salary of $84,000 in san antonio, texas should increase to $103,371 in tempe, arizona (assumptions include homeowner, no child care, and taxes are not considered.

The average sales tax rate in arizona is 7.695%. Ad a tax advisor will answer you now! Method to calculate tempe sales tax in 2021.

The arizona department of revenue (ador) is tasked in a.r.s. The 85281, tempe, arizona, general sales tax rate is 8.1%. Any business charging admission for exhibition, amusement or entertainment is taxable under this business activity.

18 cents per gallon of regular gasoline, 26 cents per gallon of diesel. Instruction in dance, instruction in martial arts and instruction in gymnastics are exempt from the transaction privilege tax on amusements in tempe. Title 42, chapter 5, article 10 with collecting the excise tax (imposed only by the state) and transaction privilege tax (state, counties, and cities) imposed on adult use marijuana sales.

Questions answered every 9 seconds. Fields marked with * are required. The combined rate used in this calculator (.

Groceries are exempt from the tempe and arizona state sales taxes Increased to 3.00% effective january 1, 2003. The current total local sales tax rate in tempe, az is 8.100%.

See how we can help improve your knowledge of math, physics, tax, engineering and. Ad a tax advisor will answer you now! This is the total of state, county and city sales tax rates.

The tempe sales tax rate is %. Arizona has a 5.6% statewide sales tax rate , but also has 101. The december 2020 total local sales tax rate was also 8.100%.

You can use our arizona sales tax calculator to look up sales tax rates in arizona by address / zip code. Arizona has been one of the fastest growing states in recent years, as low taxes may have played a. The arizona sales tax rate is currently %.

The tempe, arizona sales tax is 8.10%, consisting of 5.60% arizona state sales tax and 2.50% tempe local sales taxes.the local sales tax consists of a 0.70% county sales tax and a 1.80% city sales tax. The tempe sales tax is collected by the merchant on all qualifying sales made within tempe; How 2019 sales taxes are calculated for zip code 85281.

Sales of food for home consumption will be taxed a different rate effective july 01, 2010.

Arizona Sales Tax – Small Business Guide Truic

Residential Commercial Rentals City Of Tempe Az

Tempe Arizona Sales Tax – Avalara

85283 Sales Tax Rate – Az Sales Taxes By Zip

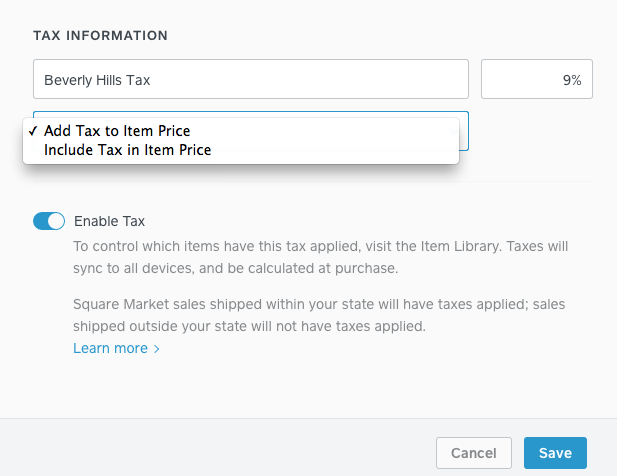

How To Collect Sales Tax Through Square – Taxjar

Arizona Income Tax Calculator – Smartasset

Arizona Sales Tax – Taxjar

Residential Commercial Rentals City Of Tempe Az

Arizona Sales Reverse Sales Tax Calculator Dremployee

How To Collect Sales Tax Through Square – Taxjar

Economy In Zip 85281 Tempe Az

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

How To Collect Sales Tax Through Square – Taxjar

Arizona Sales Tax – Small Business Guide Truic

How To Collect Sales Tax Through Square – Taxjar

2021 Arizona Car Sales Tax Calculator Valley Chevy

2021 Arizona Car Sales Tax Calculator Valley Chevy

Tempe Arizona Az 85282 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Arizona Income Tax Calculator – Smartasset