Tax law), depending on an individual’s tax bracket. The gain is counted as ordinary income, and the tax rate may be as high as the marginal income tax rate, 37%.

Its Harvest Time Potentially Grow Your Savings Usin – Ticker Tape

Anyone else agree that td ameritrade has horrible gains/loss tracking?

Td ameritrade taxes on gains. They mail me my tax info, i review it, and i do my own taxes so just plug in the tax codes in and it automatically does it for me on turbo tax Regardless of whether you withdrew money from your account or not. Taxes can impact the growth of your portfolio, so it’s important to understand how capital gains taxes work and learn some strategies to use to potentially minimize them:

You must enter the gain or loss on sales of securities, dividends and interest earned, etc. Gainskeeper can help you figure out the tax consequences for any trade. Press question mark to learn the rest of the keyboard shortcuts.

I have $30k cash in td ameritrade, that gives me $120k in day trading buying power at the beginning of the day. Upon settlement, you’ll find the lots you selected applied to the realized gain/loss tab, and td ameritrade will send your selection on to the irs once tax reporting time rolls around. You can also claim losses as long as you don’t rebuy that same stock you claiming as a loss within 30 days.

Press j to jump to the feed. Td ameritrade clients have access to gainskeeper on tdameritrade.com (after logging in to your account, go to my account > tax center). There are two types of capital gains:

Regular tax bracket and 15% for most other taxpayers. Ytd with wash sale adjustments, ytd without wash sale adjustments. This does not show my capital gains from selling stocks though.

If you sell before a year your gain tax is up to 37%. Plus, if you’re interested in using turbotax® to file your taxes, remember all td ameritrade clients get exclusive savings. Hi guys, i am a non us resident and trade using td ameritrade.

You may contact the td ameritrade singapore trade desk at +65 6823 2250 to discuss the process. Internal revenue service (“irs”) on your behalf so no additional tax is due after the year ends. (short term capital gains, very low.

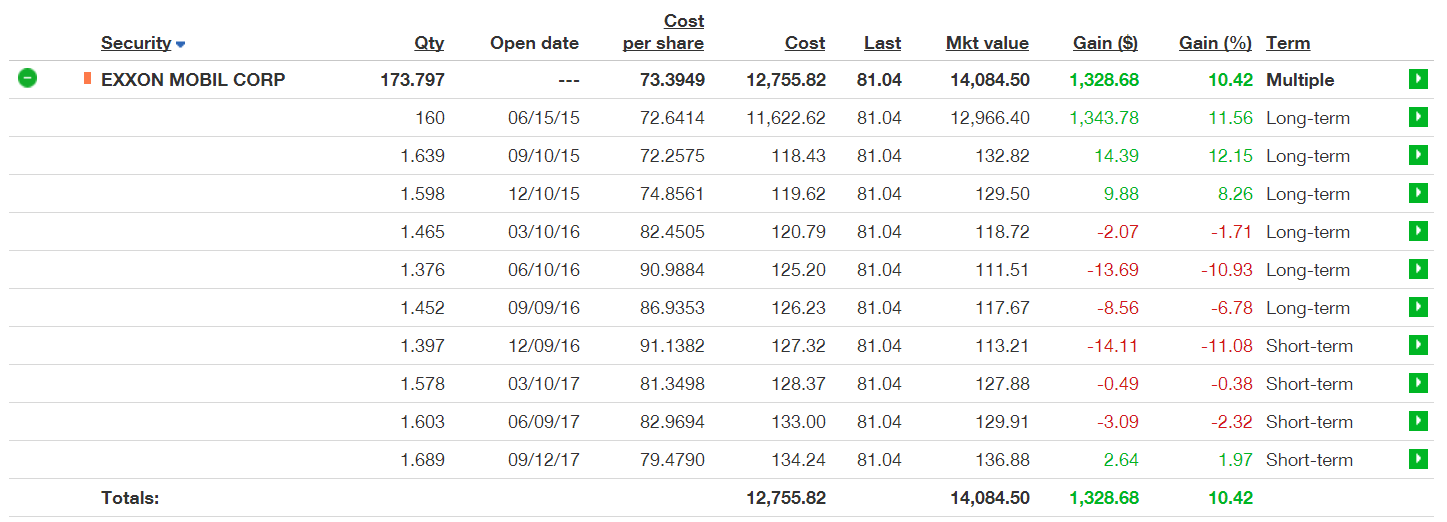

Short term net (gains and losses) wash sale i noticed that td ameritrade provides 2 types of gain/loss reports: The charts on the main page just track your balance and don’t account for deposits. Highest cost does not consider the length of time you held your shares.

The statutory rate is 30%, unless you have claimed an active treaty for your account, in which case it may be lower. I place stock trades worth total $40k. That is withheld by td ameritrade singapore and sent to the u.s.

I currently receive the 1042s tax document which shows some withheld tax on income. On the thinkorswim platform, you can export transactions in a.txf (tax exchange format) file, which you can use with compatible tax preparation software. I can only find the capital gain info under the cost basis section (gains keeper).

We created this 1099 information guide to help streamline tax preparation and ensure accurate reporting of dividends, income, and taxable gains and losses. Check out our extensive archive of articles, tools, and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions. If i made 125k of capital gains on a stonk investment in january, i expect around 20k in taxes on that for 2021.

When i go to their gain/loss page for t. When i go to their gain/loss page for the year 2013, they show a gross proceeds grand total of $$$$$ which is around $30,000 higher. For net gains that would otherwise be taxed in the two lowest regular brackets, the rate is 0% — in other words,

I completed the w8ben file also. I always close all my trades before the end of the day. You are urged to contact us before taking any action on your own if you are assigned on any short options.

Td Ameritrade – Capital Gains Taxes Explained Facebook

2

Pin On Top Iphone Game

How To Read Your Brokerage 1099 Tax Form – Youtube

Its Harvest Time Potentially Grow Your Savings Usin – Ticker Tape

2

Tax-loss Harvesting – Wash Sales Td Ameritrade

Tax-loss Harvesting – Wash Sales Td Ameritrade

Whats My Potential Income The New Dividend Income E – Ticker Tape

2

2

See Your Allocations From The Inside-out With Portfol – Ticker Tape

2

Its Harvest Time Potentially Grow Your Savings Usin – Ticker Tape

2

Learn How To Place Trades And Check Orders On Tdameri – Ticker Tape

2

Td Ameritrade Essential Portfolios Review Smartassetcom

2