The subsequent falls in income and rising unemployment exacerbated the narrowing of the base further and by 2010 over 45% of earners were exempt from income tax and just over 13% were liable to the higher rate. Consider roth ira conversions a thoughtful strategy utilizing roth conversions can be an effective way to hedge against the threat of facing higher taxes in the future.

Tax Strategies For High Net-worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazoncom Books

Minimize use of taxable bonds.

Tax strategies for high income earners book. It will detail how you can reduce your taxes based on current tax law by maximizing your deductions based on your wealth strategy, shift income from high tax rates to lower tax rates, and maximize your tax credits. If we add in the nc state tax (5.25%) and some self. If a high earner was to have a big income year due to a bonus or other large income, by frontloading a 529 plan, they would get significant tax.

You can also read our guide on 7 secrets to high net worth investment, management, estate, tax and financial planning. In fact, tax rates are scheduled to increase after 2025 when most of the current tax law provisions expire. Our marginal tax rate for 2019 was 35% just from the federal side.

When you inherit real estate, particularly in the state of california with community property rules, you get a full step up in basis, making your property tax go up. The family company, also known as a holding company or bucket company, is taxed at 30%, so that’s another $9000. Not only does giving money to others in need feel good, but it’s also a great tax break for high income earners.

Depending on your province of residence, you may be subject to tax at a rate of 50% or higher when your income exceeds $200,000. Because she stays at home, she only has to pay $13,500 in taxes. Superannuation contribution options to reduce taxes:

Tax avoidance isn't always the best goal. For the sake of this post, we'll consider anybody in the top three tax brackets as a high income earner. Because his income is so high, any extra income will be taxed at the highest rate, currently at 46.5%.

That means that if you earn more than $163,301 in gross income as a single earner and $326,601 if you're married filing jointly, you are a high income earner. Tax strategies are different from typical practices of cpas. In addition, the guide explains the 3.8% net investment income tax and additional 0.9% medicare tax and includes the strategies necessary to limit your client's exposure to these taxes.

The secure act, which became law at the end of 2019, includes several provisions that apply to high income. Ppc's guide to tax planning for high income individuals contains the detailed strategies you need to help clients minimize the impact of the 37% ordinary income and 20% capital gains rates. Like equities, taxable bonds produce capital gains every time the fund manager buys or sells securities, as this fidelity article makes clear.

Find out how to lower your tax bill for 2020. The tax cuts and jobs act of 2017 (tcja) limited the allowable losses that could be deducted for noncorporate taxpayers to $250,000 for individuals and $500,000 for married filing joint taxpayers. The use of these strategies will vary based on personal circumstance.

One of the tax reduction strategies for high income earners that i think a lot of people don’t fully understand is selling inherited real estate. So, the money was distributed to mary. When implementing tax strategies for high earners, it's important to ensure you're pursuing only legal and ethical methods.

Debt paydown should be a relatively high priority for high earners. 40% of income earners were exempt from income tax and only 20% of earners were liable to the higher rate of tax. You mention, for the next three years until retirement. they are 57 now, plan to retire around 61, and that means they still have 4 years prior to medicare, and that means managing costs based on the irmaa table would be one consideration because, ssa determines if you owe an irmaa based on the.

Amazoncom The Book On Advanced Tax Strategies Cracking The Code For Savvy Real Estate Investors Tax Strategies 2 9781947200227 Han Amanda Macfarland Matthew Books

How Do Taxes Affect Income Inequality Tax Policy Center

Top 2021 Tax Strategies For High Income Earners Pillarwm

Tax Strategies For High Net-worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazoncom Books

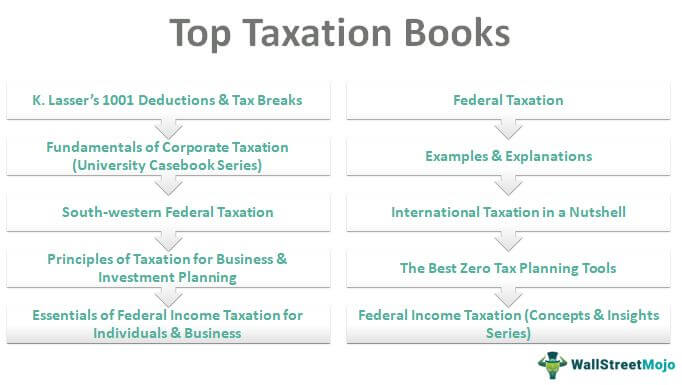

Taxation Books – Top 15 Tax Books To Read In 2021

Amazoncom Tax Strategies For High Net-worth Individuals Save Money Invest Reduce Taxes Audible Audio Edition Adil N Mackwani Will Stauf Ma Wealth Audible Books Originals

Tax Strategies For High Net-worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazoncom Books

Ppcs Guide To Tax Planning For High-income Individuals Corporations Tax Thomson Reuters

Top 2021 Tax Strategies For High Income Earners Pillarwm

5 Outstanding Tax Strategies For High Income Earners – Debt Free Dr – Dentaltown

Top 2021 Tax Strategies For High Income Earners Pillarwm

The Tools Techniques Of Income Tax Planning 7th Edition – Kindle Edition By Leimberg Stephan Jackson Michael S Katz Jay Scroggin John J Keebler Robert S Professional Technical Kindle Ebooks

Top 2021 Tax Strategies For High Income Earners Pillarwm

The Best Tax Saving Strategies And Tips How The Smartest Individuals Reduce Their Taxes Jefferys Scott Jeffreys Scott 9781457517143 Amazoncom Books

Amazoncom Tax Strategies For High Net-worth Individuals Save Money Invest Reduce Taxes Audible Audio Edition Adil N Mackwani Will Stauf Ma Wealth Audible Books Originals

The Top 9 Tax Planning Strategies For High Income Employees

Tax – Wikipedia

How To Achieve Tax Compliance By The Wealthy A Review Of The Literature And Agenda For Policy – Gangl – 2020 – Social Issues And Policy Review – Wiley Online Library

Bestselling Author David Mcknight Company