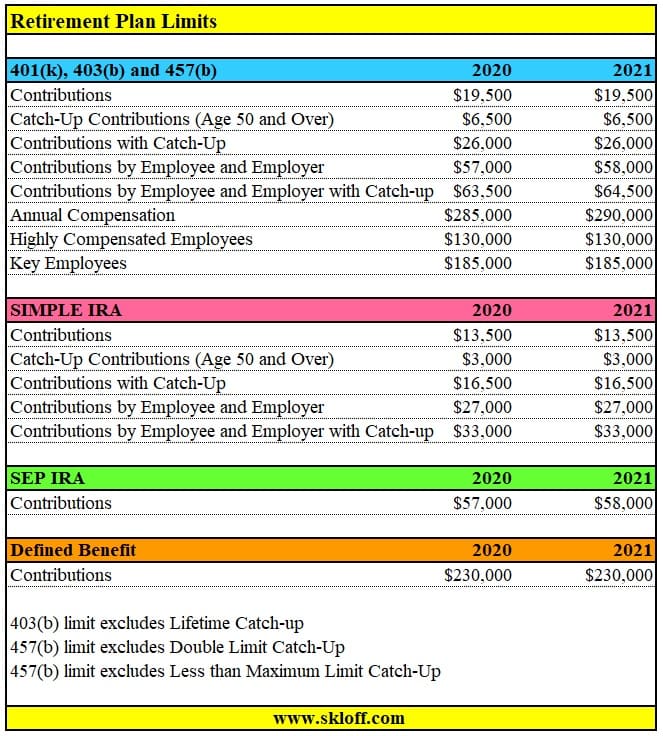

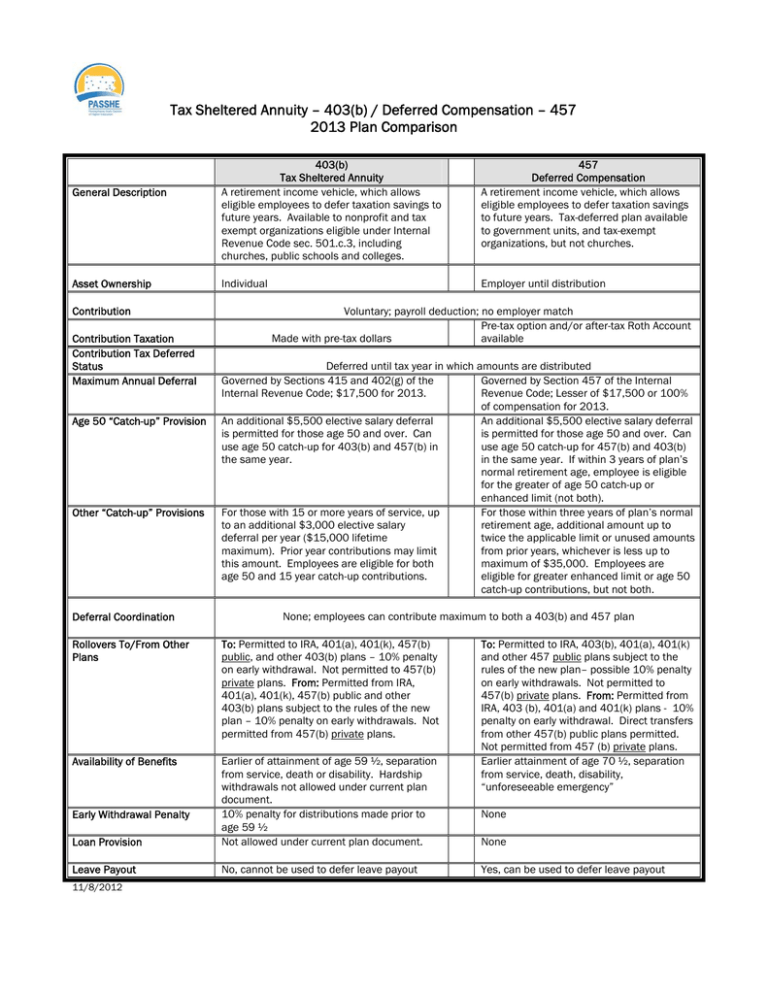

For example, for tax year 2021, a participant could elect to contribute up to $19,500 to a 403(b) plan and up to $19,500 to a 457 plan, for a total contribution of up to $39,000. The maximum annual benefit under a defined benefit plan is unchanged.

Adminksgov

The combined employee and employer contribution limit for 403(b) plans in 2021 is $58,000 for employees under the age of 50.

Tax sheltered annuity limits 2021. 2021 intern al revenue code (irc) limits and comparison chart. For 2021, the most you can contribute to your tda is $19,500.3 however, depending on your age and your years of service, your maximum may be higher. This amount is up $1,000 from 2020.

Only the following employees can participate in a tsa: In 2021, employees may contribute a basic maximum of $19,500 to the tsa program. The irs has updated the benefit limits for 2021.

Through such an arrangement, you make a series of payments into an insurance company’s account and, at some designated point in the future, receive disbursements from that account. Jump on these tax perks for those age 50 and older to save even more of your money for the future. Employees of public educational systems

Contributions to a 403(b) plan are not offset by contributions to a 457 plan. In 2021, everyone has the option to stash away an extra $500 in their company retirement plan, whether it’s a 401(k) or 403(b), with limits rising from $19,000 to $19,500 annually. But people 50 and over can tack.

California state univerisity (csu) tax sheltered annuity (tsa) (403[b]) program, state deferred compensation (457[b]) and. The dollar limit on the maximum permissible allocation under a defined contribution plan is increased from $57,000 to $58,000. For the 2021 tax year, the contribution limit is 100% of adjusted gross income at a maximum of $19,500 per year.

The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403(b) accounts) generally is the lesser of: For 2021, the limit on annual additions has increased from $57,000 to $58,000. For the 2021 calendar year, the limits are as follows:

This amount is up $1,000 from 2020. Visit the retirement page to view the new limits and other retirement resources. $57,000 for 2020), or 100% of includible compensation for the employee's most recent year of service.

However, this general limit is reduced by the amount of elective deferrals an employee makes to: Age 50 or above at any point in 2021: As of 2021, the most you can contribute to your tda is $19,500.

For 2021, the limit on elective deferrals remains unchanged at $19,500. $61,000 in 2022 ($58,000 for 2021; “ 2022 limitations adjusted as provided in section.

$20,500 in 2022 ($19,500 in 2021 and in 2020; The irs is a proud partner with the national center for missing & exploited children® (ncmec). For employees age 50 and older, the limit is $64,500, meaning employers can contribute up to $38,5000 to a worker’s account, if the worker has maxed out their.

Both contribution limits will remain the same as 2020 limits. The limit on annual contributions to a tsa for 2021 is the lesser of $58,000 or 100% of compensation, increased from $57,000 for 2020. Salary reduction simplified employee pension (sarsep) plans;

Tax-sheltered Annuity Definition How Tsa 403b Plan Works

Pasadenaedu

The Tax Sheltered Annuity Tsa 403b Plan

Mutual Of America – Know Your Contribution Limits For 2021

Bcpshrss3sharpschoolcom

Tcgservicescom

Retirement Plan Limits 2020 And 2021 – Skloff Financial Group

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax-sheltered Annuity Definition

Irsgov

Npsdk12wius

Tax Sheltered Annuity 403b Deferred Compensation 457

Afdcalpolyedu

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-691573537-e0ad139ceab54c78a53e922204b34899.jpg)

403b Plan Contribution Limits For 2021 And 2022

Pleasanthillk12orus

Irsgov

2021 Retirement Contribution And Income Limits – Money Fit Moms

2021 2022 401k 403b 457 Ira Fsa Hsa Contribution Limits

The Tax Sheltered Annuity Tsa 403b Plan

2021 And 2022 Retirement Plan Maximum Contributions Tax Benefits For Retirement Planning