In general, you can expect to pay between $150 and $200 for a fairly basic return. However, costs can reach as high as $450.

What Is The Cost Of Tax Preparation Community Tax

Nsa has made the tax preparation fee calculator available as one of its valuable benefits of membership.

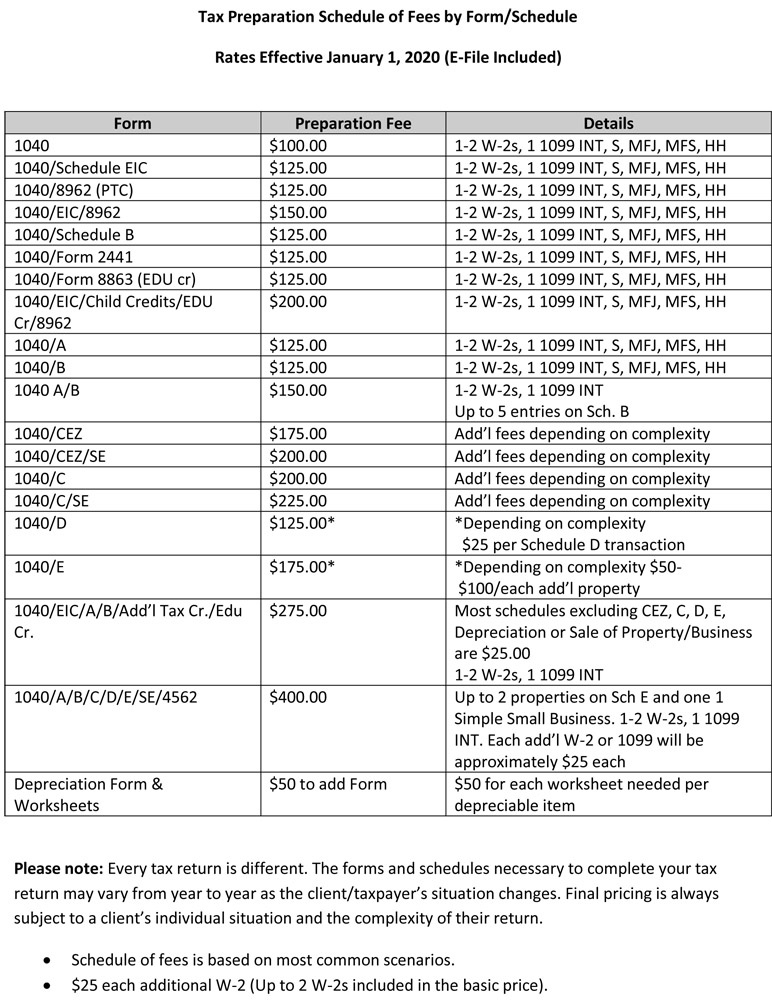

Tax preparation fees 2020 california. 1 that fee covers a standard 1040 and state return with no itemized deductions. Many tax preparers bill their services based on the type (s) of irs tax forms you need to file. Typically each state is around $250 to $350 for tax preparation since it affects both your business and individual tax returns (frankly, state apportionment is a pain in the butt, but it is our pain… and states, especially california and new york, are crazy about it).

If you approach a tax professional who charges by the hour, first find out how much time it’ll take to complete. This will help determine whether you can afford their services or not. The cost of tax preparation depends on how complicated your taxes are.

Whether you have a tax preparer handling your taxes or you are doing them yourself, it helps to be organized. Types of tax forms & costs. On the low end, individual tax preparation fees start at $100.

Some professionals have steep hourly tax preparation fees, sometimes charging hundreds per hour. Ad a tax advisor will answer you now! Data for the service fee wizard comes from the national association of tax professionals' 2019 fee study.

Reduce your tax preparation cost. This site does not provide legal, financial, accounting or tax advice. The tax pricing wizard and its contents are provided for informational purposes only and is subject to change.

According to the national society of accountants (nsa) the average tax prep costs by form range from $63 for a federal unemployment irs form 940 and $806 for a c corporation irs form 1120. Questions answered every 9 seconds. The slightly longer answer is that the cost to file your taxes with a tax pro will vary based on a wide range of factors.

The average cost for tax preparation repair is $225 per return. They include a 1040 with schedules a and b and a california return with form ca (adjustments). My returns are not very complicated.

More complicated taxes require more tax forms, and these extra forms come with extra costs. Commission employees may claim accounting fees and the cost of tax prep software as employment expenses. If you've completed the required 20 hours of continuing education, have a current surety bond, as well as a valid ptin from the irs, now is the time to complete your renewal and pay the $33 registration fee.

The average cost for a basic tax form preparation is about $220. Most preparers charge a flat fee per return, but some may charge an hourly rate. Questions answered every 9 seconds.

If you run a corporation, the tax preparation fee for the 1120 form is close to $700. Hiring a tax accountant to file your taxes, you will likely spend between $35 and $450 per return. There’s no standard fee for tax return preparation.

For example, if you participate in a partnership business, you’ll need to fill out form 1065, and the average tax service fee for that form is $550. As with other employment expenses, have your employer complete and sign a form t2200. If you are, it can cut down on the time you or your advisor spends filing your taxes, thus reducing the tax preparation cost and your tax preparation fees in 2021.

Also, find out how much they charge by the hour. The 2021/2022 renewal registration cycle for ctec registered tax preparers (crtps) starts august 1, 2021 and ends october 31, 2021. The price of tax preparation can vary greatly by region (and even by zip code).

Ad a tax advisor will answer you now! The national society of accountants reported the following average cpa tax preparation fees from the previous year:

How Much Does It Cost For Tax Preparation

United Ways Free Tax Prep Program Helps Households Claim 75m – United Way California Capital Region

Fee Structure – Tax Preparation Fees – Wcg Cpas

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

California Tax Forms Hr Block

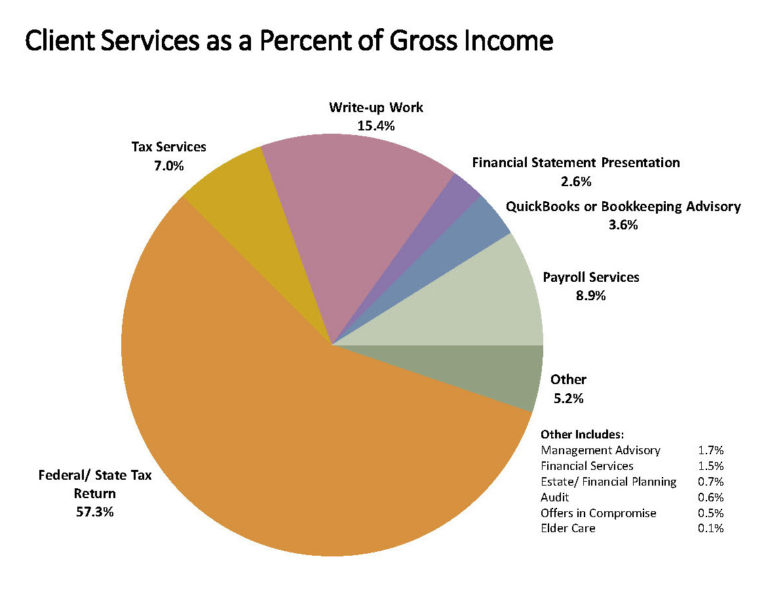

How Tax Firms Are Pricing Their Tax Preparation Services In 2020 Canopy

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

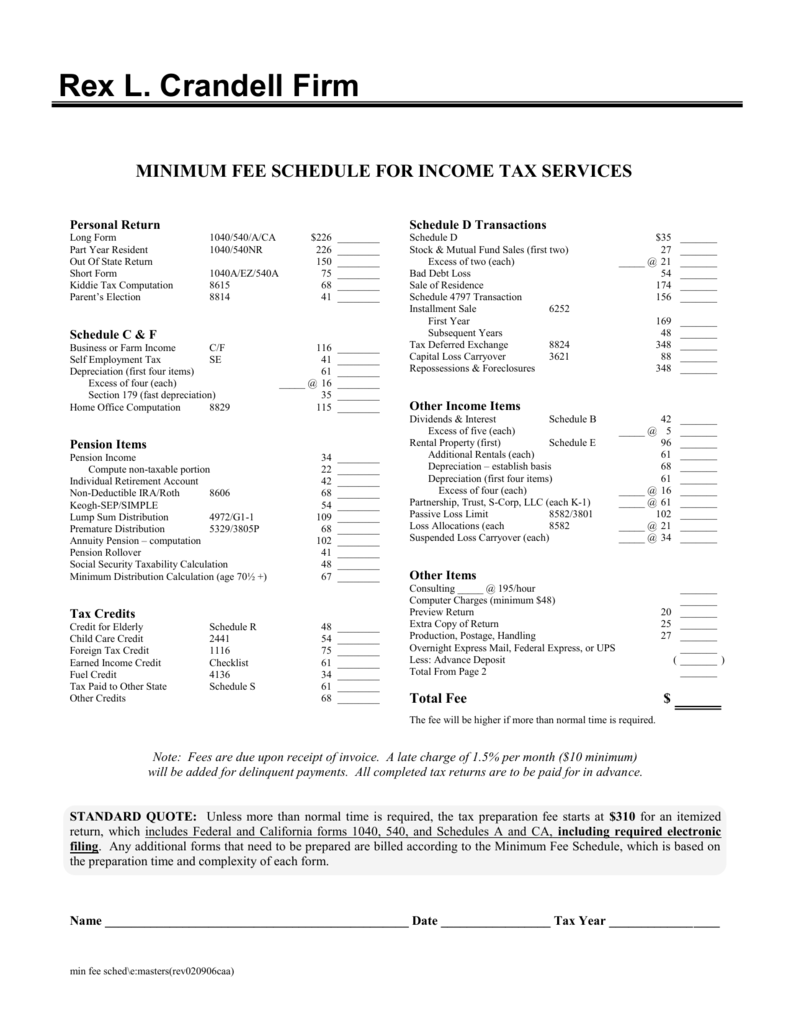

Minimum Fee Schedule For Income Tax Services

California Tax Agencies Shifting Back To Work In Covids Wake 1

Big Jumps Seen In Tax Prep Fees Survey Accounting Today

California Sales Tax Quick Reference Guide – Avalara

New Legislation Requires 40000 Tax Preparers To Provide Fees Upfront And Inform Clients Of Free Tax Services Some Tax Preparers Exempt Business Wire

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040-sr Itemized Deductions Definition

How To Improve Tax Prep For Working Americans

Tax Preparation Individual Income Orlando

California Used Car Sales Tax Fees 2020 Everquote

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif)

How Much Is Too Much To Pay For Tax Returns

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow