The standard mileage rates for 2021 are as follows: 16 cents per mile (was 17 cents in 2020) charity:

Guide To 2021 Irs Mileage Rates Quickbooks

The rate for business travel expenses has dropped from 57.5 cents per mile in the 2020 tax year to 56 cents per mile for 2021.

Tax per mile rate. U n i t e d k i n g d o m in poland you can reimburse 0.5214 polish zloty per km. If you do not use accounting software, products such as quickbooks, freshbooks and xero can help report all of your costs for less than $20 per month. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the armed forces, down 1 cent from the rate.

Users are expressing concerns about the cost of driving and incorrectly stating that it would cost drivers 8 cents a mile, per a usa today story. 14 rows rates in cents per mile source; 14 cents per mile (was 14 cents in 2020) you may also be interested in our free lease mileage calculator

Also contained in the notice are the amounts to be used by taxpayers in computing a business standard mileage rate for depreciation expenses. Similarly, if the company uses the irs rate or less but does not keep appropriate records to substantiate business use of the vehicle for the. If the employer pays a mileage rate that exceeds the 2021 irs business rate (i.e.

First 10,000 miles above 10,000 miles; Beginning on january 1, 2020, the standard mileage rate for the business use of a car (van, pickup, or panel truck) is 57.5 cents per mile. The standard mileage rates were 57.5 cents for business automobiles, 17 cents for medical purposes, and 14 cents per mile for charitable activities.

Paying 6, 8, or 10 cents in new taxes for every mile you drive. A 'driving tax' proposed by president joe biden would cost americans 8 cents per mile Standard mileage rate for business.

Rates per mile which end in 0.5 are rounded down to the nearest whole penny for the advisory fuel rate when the underlying unrounded figure ends in a number less than 0.5 (for example 0.487). 10.000 miles and above 25 pence. A rate of 24p per mile applies to motorcycles and a rate of 20p per mile applies to bicycles.

Beginning on january 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 57.5 cents per mile in the tax year 2020, and 56 cents per mile for the tax year 2021 The rates for cars (and vans) are set at 45p per mile for the first 10,000 business miles in the tax year and 25p per mile for any subsequent business miles.

45p (40p before 2011 to 2012) 25p: 56 cents per mile (was 57.5 cents in 2020) medical / moving: This rate is lower than the 58 cents per mile in 2019 but still higher than 54.5 cents rate for 2018.

4p per mile for fully electric cars For motorcycles it is 24 pence and for a bike 20pence per mile. It may sound small, but at an 8 cent rate, that would be $1,144 in new annual taxes for the average american, who drives about 14,300 miles a year.

45 pence per mile for cars and goods vehicles on the first 10,000 miles travelled (25 pence over 10,000 miles) 24 pence per mile for motorcycles; P o l a n d a portuguese employer can reimburse up to € 0.36 per km. If you have specific questions about calculating cost per mile, it is also a good idea.

You can learn more here: The current mileage allowance rates 2021/2022 tax year: The tax rate is $0.0285 cents per mile.

The federal rate), then the amount over 56 cents per mile (multiplied by the mileage) will be considered taxable income.

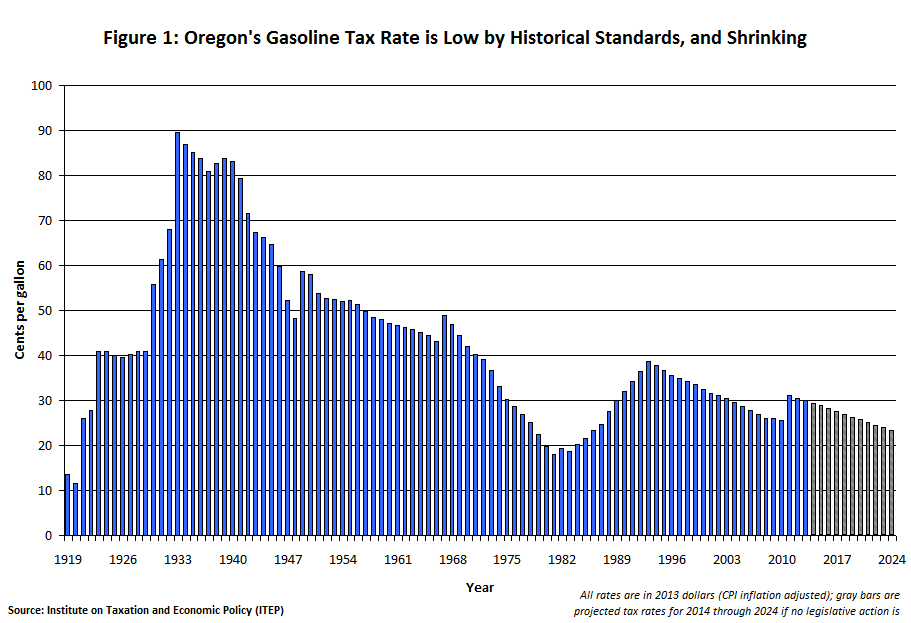

Pay-per-mile Tax Is Only A Partial Fix Itep

Infrastructure Package Includes Vehicle Mileage Tax Program

Mileage Reimbursement Rates What You Need To Know Tax Alert – June 2021 Deloitte New Zealand

Fact Check Does Biden-backed Infrastructure Bill Contains Provision For Per -mile Driving Tax

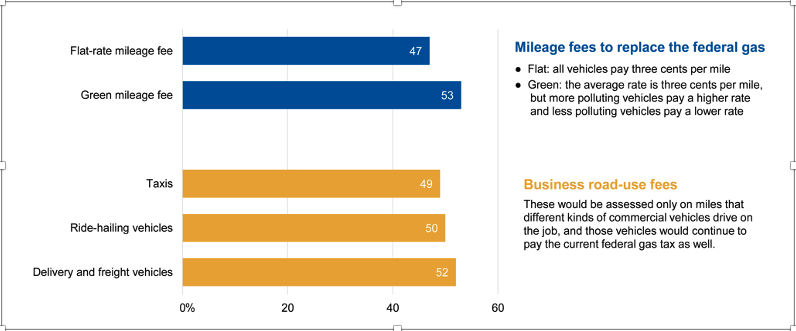

Support Levels For The Tax Options Note Support Is The Sum Of Those Download Scientific Diagram

How A Per Diem Program Can Help Drivers And Carriers Save In Taxes Insights Ksm Katz Sapper Miller

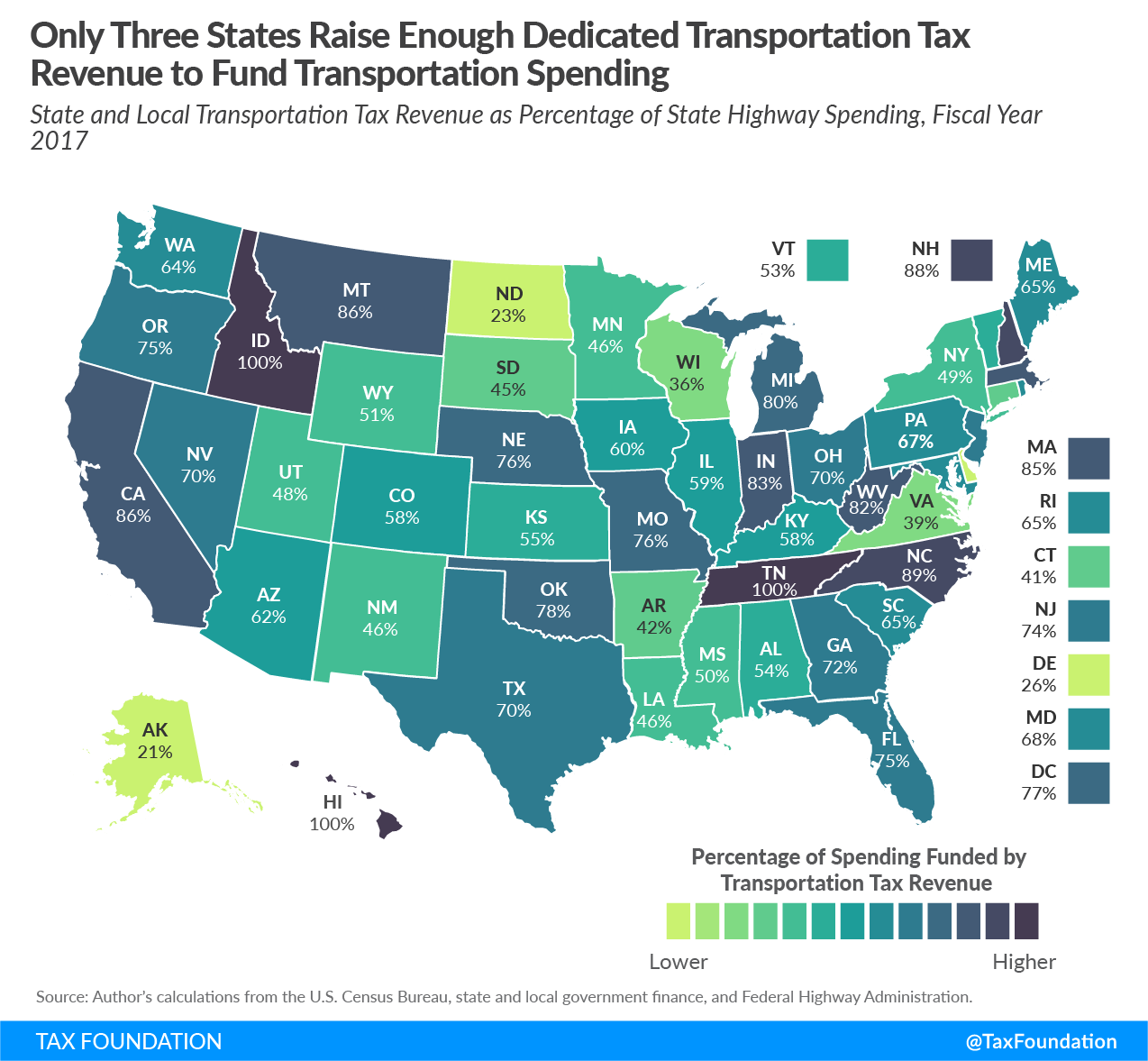

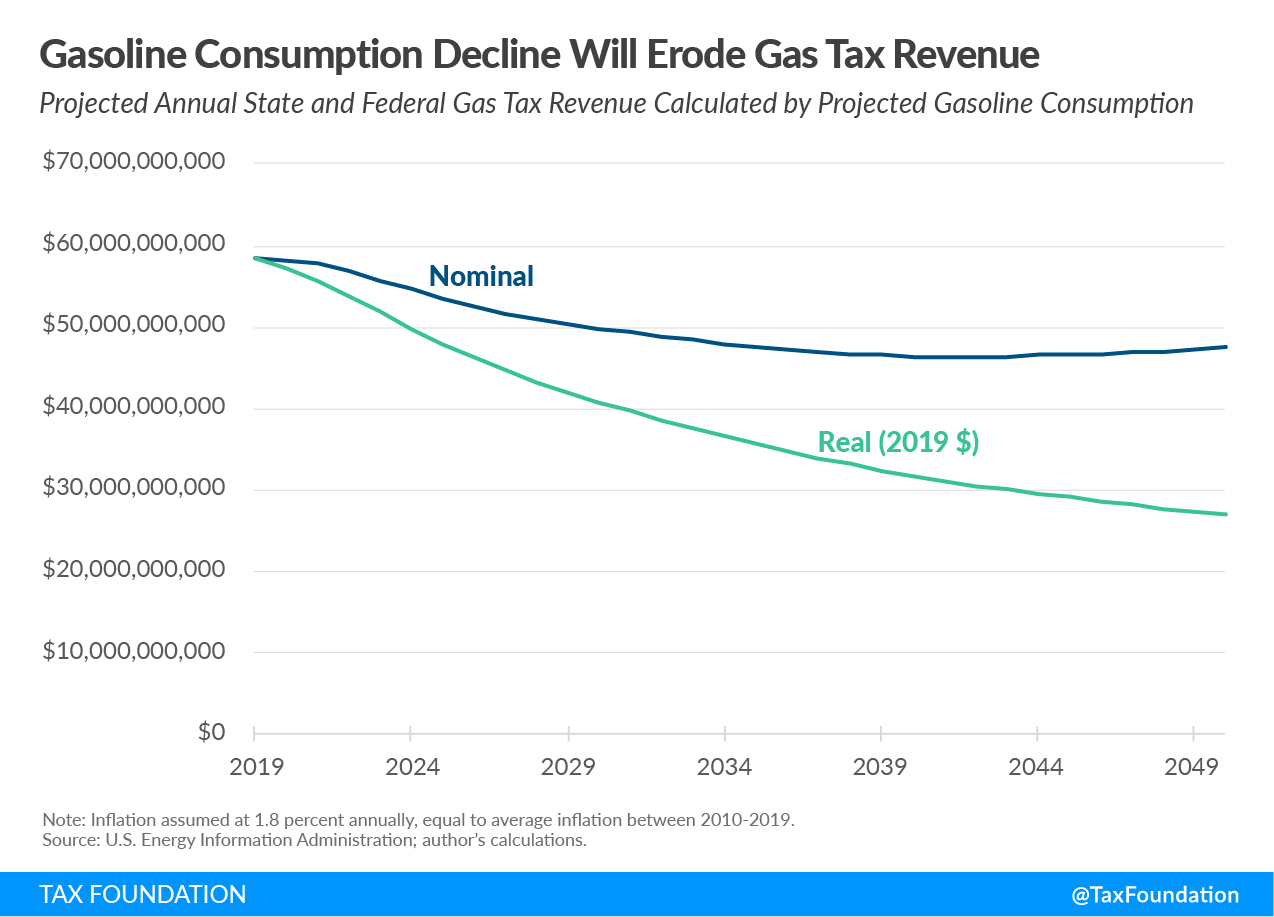

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Mileage Rate In 2021

Public Support For A Mileage Fee Grows To 53 Mineta Transportation Institute

Infrastructure Bill Proposes Voluntary Pilot Program For Per-mile Vehicle Fee Not Driving Tax – Factcheckorg

New 2021 Irs Standard Mileage Rates

By-the-mile Tax On Driving Gains Steam As Way To Fund Us Roads – Bloomberg

Issues And Options For A Tax On Vehicle Miles Traveled By Commercial Trucks Congressional Budget Office

Uk Mileage Rates And Thresholds 202122 – Freeagent

Faqs – The Eastern Transportation Coalition Mbuf Pilot

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction – Turbotax Tax Tips Videos

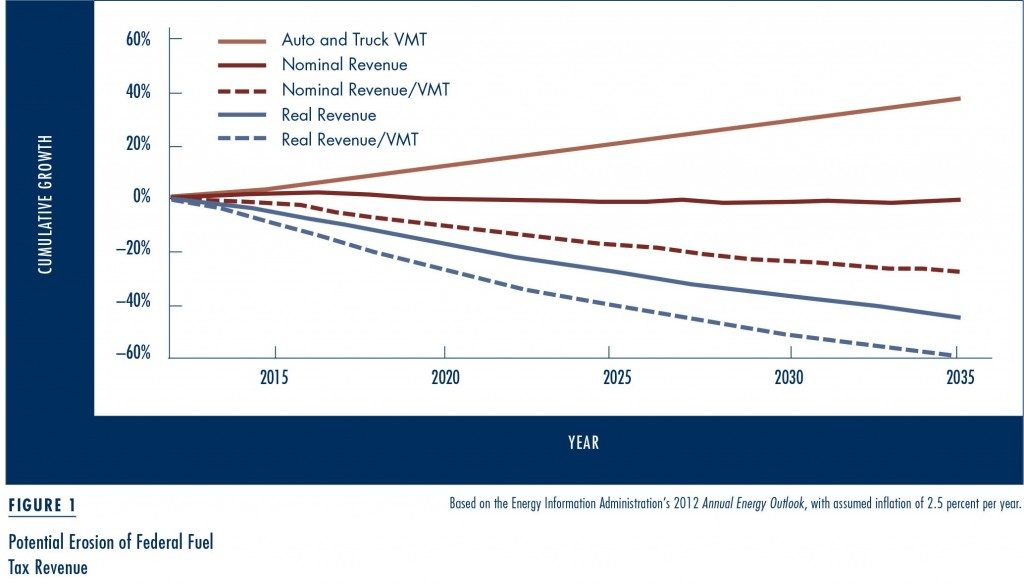

From Fuel Taxes To Mileage Fees Access Magazine

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation