Pennsylvania’s tax on gasoline is 58.7 cents per gallon (75.2 for diesel fuel). Additionally, motorists nationwide pay a federal excise tax of 18.4 cents per gallon of gasoline, a rate that has not changed since october of 1993.

Vehicle Miles Traveled Tax Vmt Legislation Update And Outlook – Dmgs

Fuel producers and vendors in pennsylvania have to pay fuel excise taxes, and are responsible for filing various fuel tax reports to the pennsylvania government.

Tax per mile pa. Boesen noted that a proposal floated in pennsylvania suggests using a tax of 8.1 cents for each mile traveled, among other changes, and phasing out the state’s gas tax. Fuel tax is due on the last day of each month for the previous month. Boesen noted that a proposal floated in pennsylvania suggests using a tax of 8.1 cents for each mile traveled, among other changes, and phasing out the state’s gas tax.

That puts pennsylvania just behind california (66.9) and illinois (59.56). A yearly average of 7,500 driving miles would cost $605.50 with a per mile cost. Wolf has tasked his commission with a difficult job, but he is right to consider the future of transportation funding.

Pennsylvania — pennsylvania is one of 17 states considering replacing its gas taxes with a mileage fee. Taxpayers can log miles in various ways (handwritten logs, gps device or apps) the plans and rates in other states are still in the planning stages. A vmt tax would, if we assume a flat rate, need to be levied at 8 cents per mile to raise $8.4 billion.

Under the plan, motorists would pay 8.1 cents per mile of travel. But, the oregon program could be a framework for how other states. Those paying mileage tax receive credit on their bills for fuel taxes they pay at gas stations.

This tax may be as high as 8.1 cents per mile which is to compensate for lost revenue in fuel taxes. A mileage tax around the 4.5 cents per mile and repealing the pa gasoline tax would still increase highway maintenance revenues and not be overly oppressive. According to the pennsylvania motor truck association, that could be a huge savings for truckers.

This average fee would, as mentioned above, have to be adjusted based on weight per axle. This will double state vehicle registration fees, sales tax increases on vehicle purchases, electric vehicle charges, and more. This is part of ap’s effort to address widely shared misinformation, including work with outside companies and organizations to add factual context to misleading content that is circulating.

The commission proposes charging drivers 8.1 cents per mile for traveling on the roads in pennsylvania in five to 10 years, according to the final draft of the proposal. The eastern transportation coalition is advocating using a mileage counter on each vehicle. Pennsylvania motorists are now paying 58.7 cents per gallon in state gas, on top of the federal gas tax of 18.4 cents per gallon.

A carnegie mellon university study of this fee found on average that most pennsylvanians drive around 10,000 miles each year and pay $200 in gas taxes. The rate is 1.5 cents per mile. “charging two cents a mile, drive 10,000.

Pennsylvania has the highest tax on gas in the continental united states. According to the american institute of petroleum, pennsylvania has the highest gas tax in the nation, at 77 cents per gallon. Click the button below to view details on 0 pa fuel tax reports.

Panel Says Pa Could Eliminate Gas Tax By Charging Drivers Fee Per Mile News Sharonheraldcom

Infrastructure Bill Proposes Voluntary Pilot Program For Per-mile Vehicle Fee Not Driving Tax – Factcheckorg

How Should The Government Tax Drivers To Maintain Roads Procon

Infrastructure Bill Proposes Voluntary Pilot Program For Per-mile Vehicle Fee Not Driving Tax – Factcheckorg

Revenuepagov

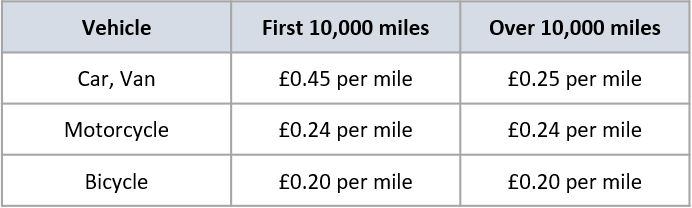

19 Ltd Companies Directors Expenses You Should Claim 2021

How Should The Government Tax Drivers To Maintain Roads Procon

Highway And Road Expenditures Urban Institute

Pa Commission Proposes Adding And Increasing Fees Axing Gas Tax To Fund Transportation Needs Pittsburgh Post-gazette

States With Highest And Lowest Sales Tax Rates

Revenuepagov

Us States With Highest Gas Tax 2021 Statista

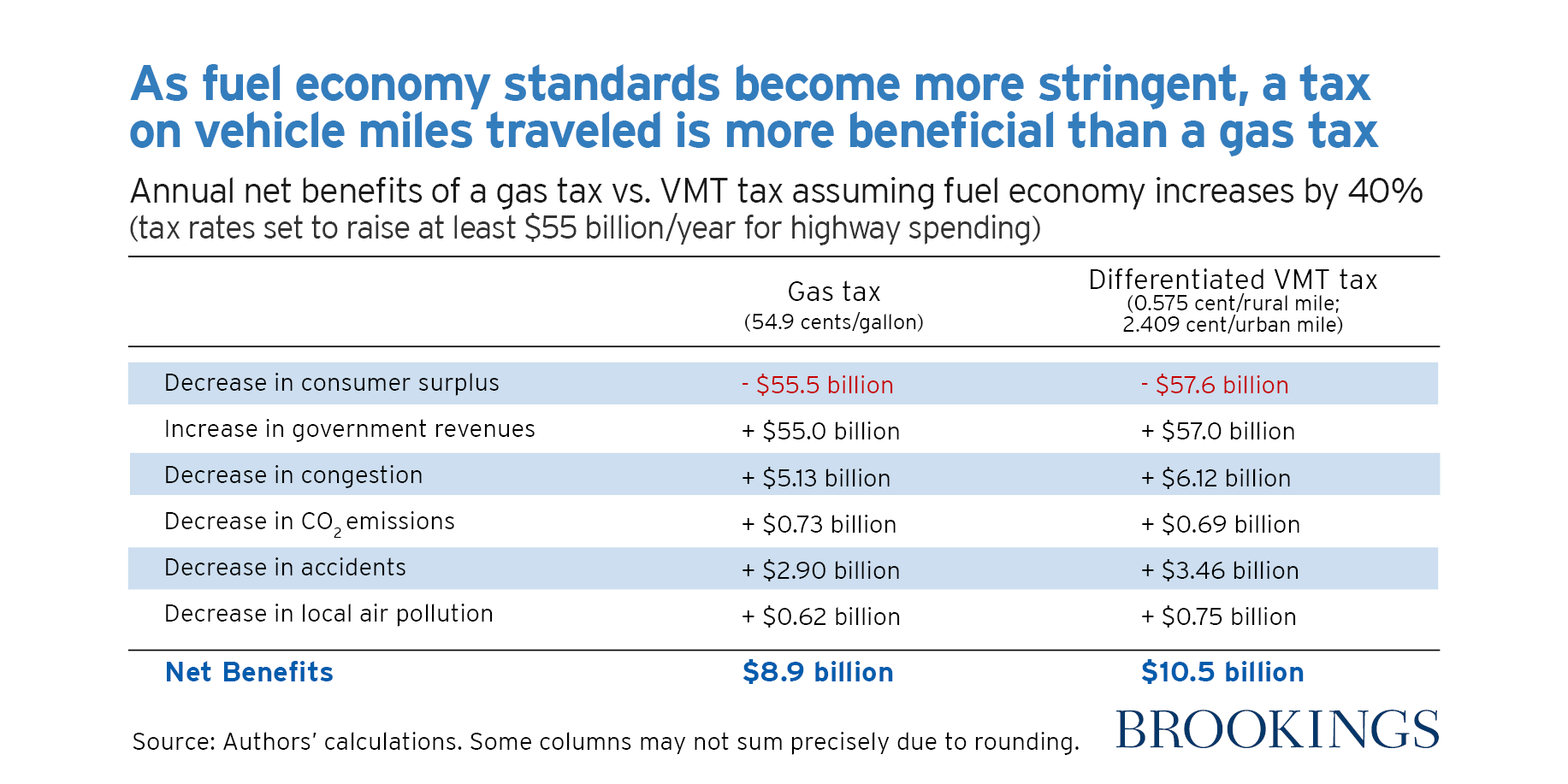

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

A Guide To Company Car Tax For Electric Cars – Clm

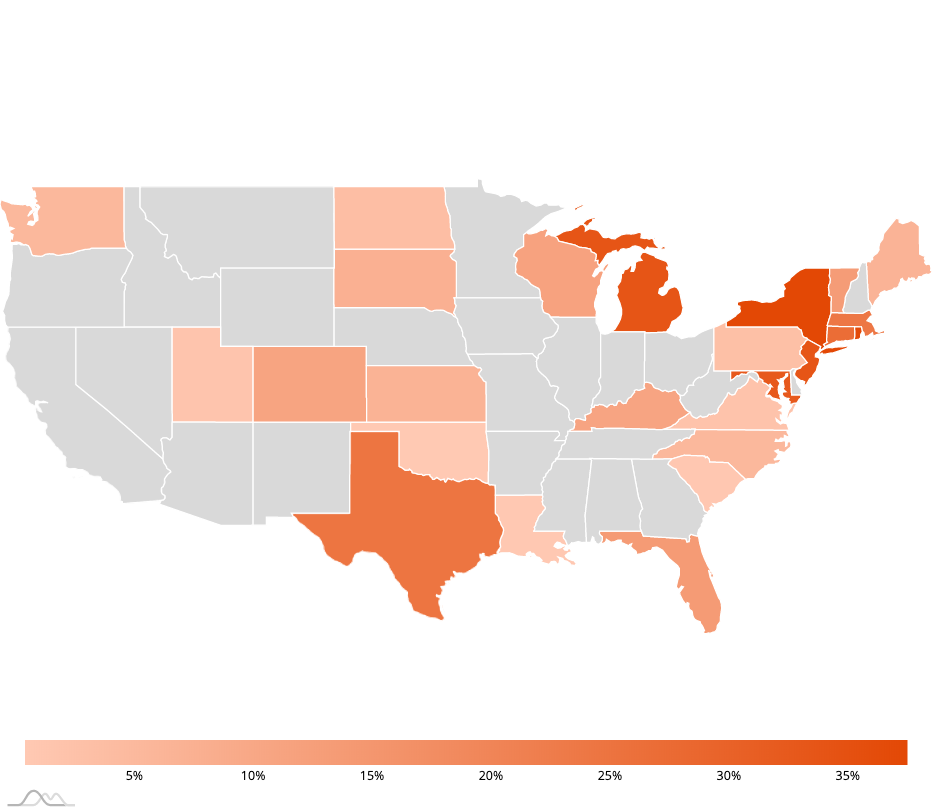

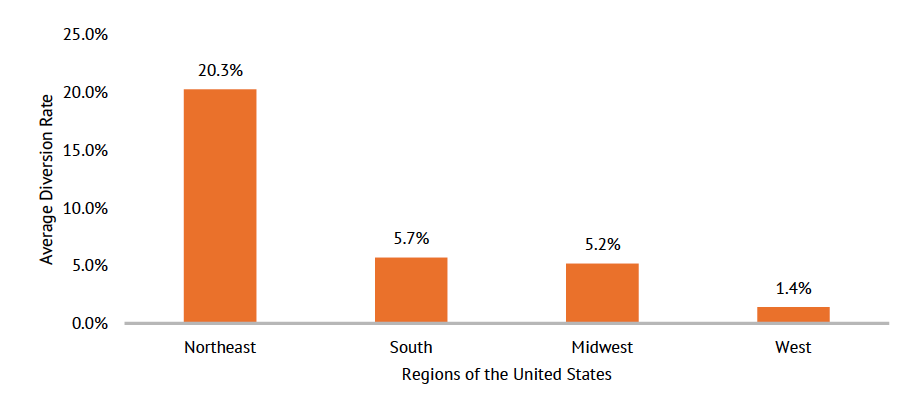

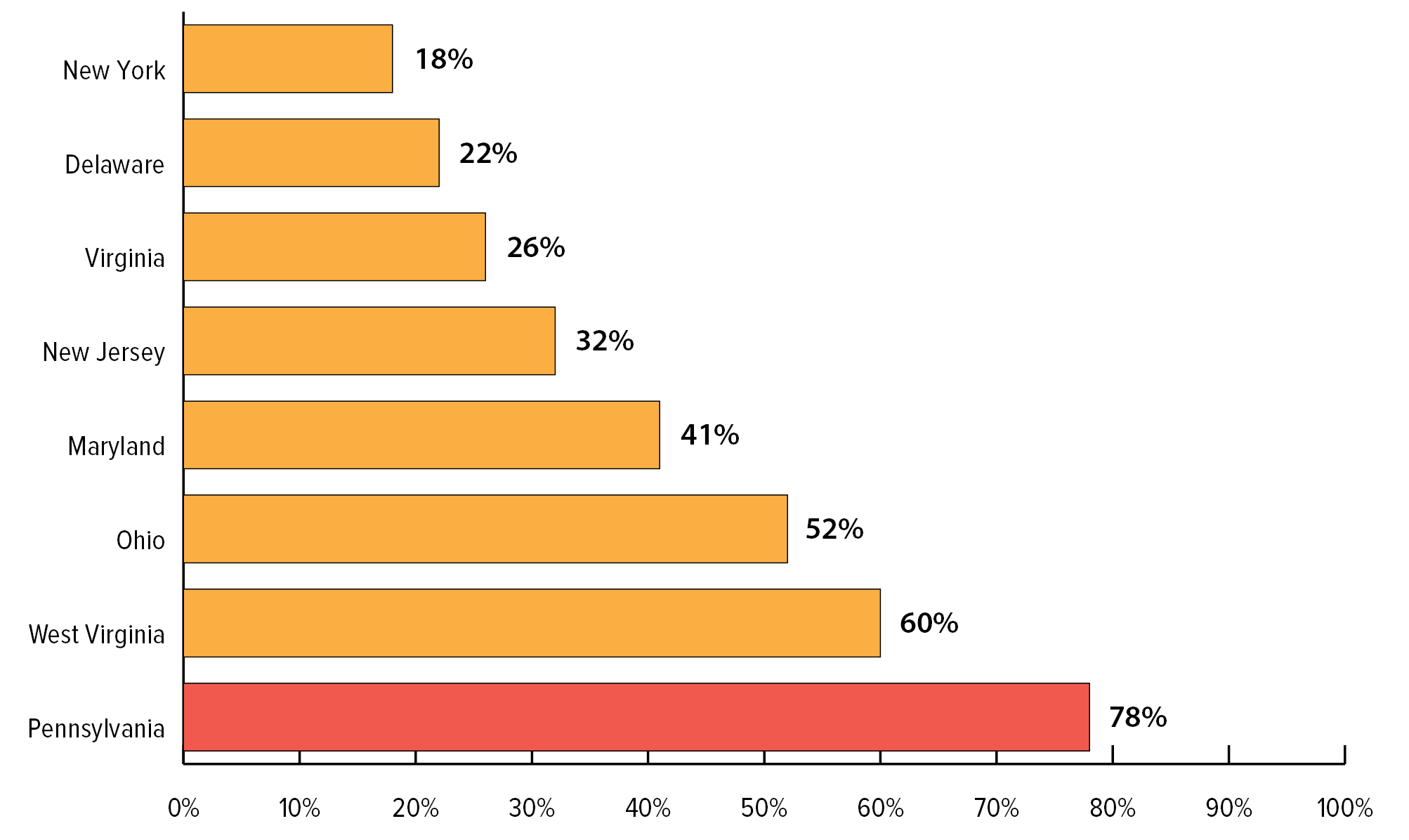

How Much Gas Tax Money States Divert Away From Roads – Reason Foundation

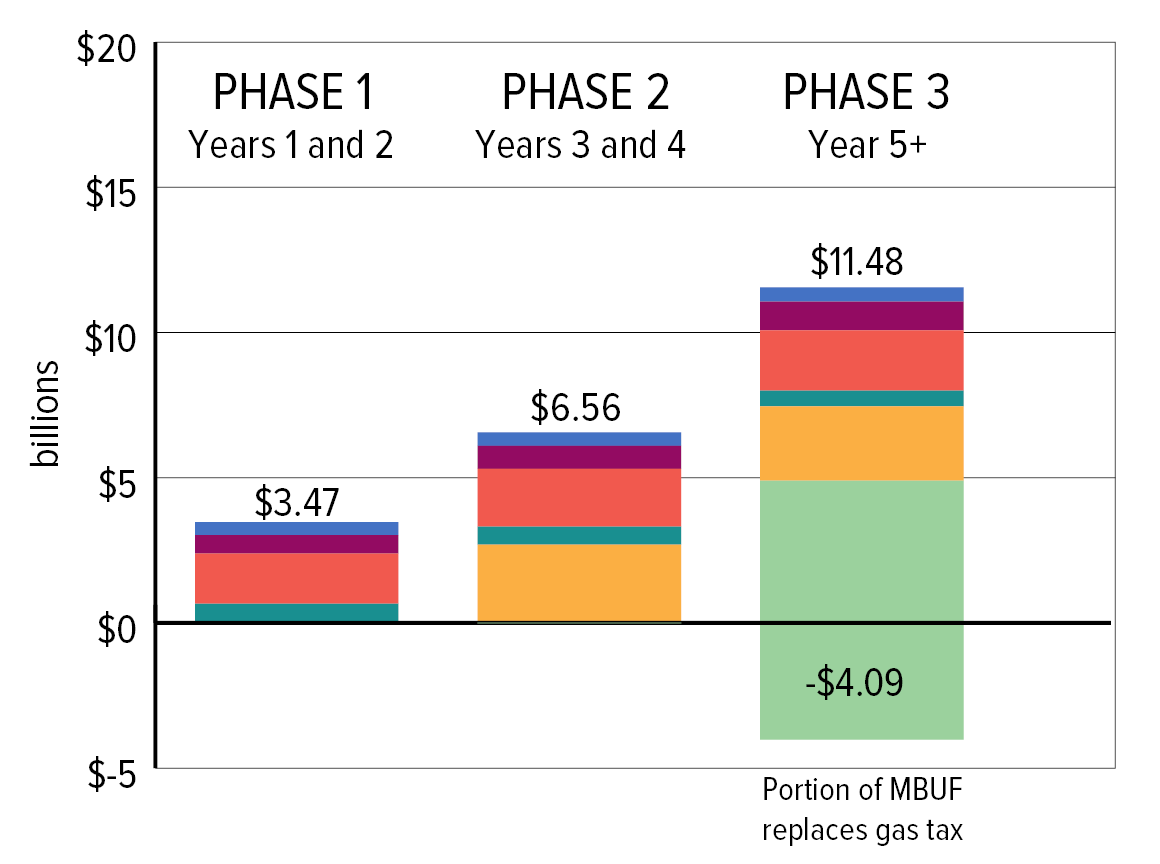

Report Transportation Revenue Options Commission

Pas Transportation Funding Pitch Faces A Rough Road Pittsburgh Post-gazette

How Much Gas Tax Money States Divert Away From Roads – Reason Foundation

Report Transportation Revenue Options Commission