The irs is behind on processing more than 5.5 million tax returns as oct. This is another way of taxing the money the poor barely have, rather than having too much money.

Forex Binaryoption Bitcoin Forexlife Eurusd Eurtry Usdtry Ekonomi Borsa Tuerklirasi Trading Forexbroker Broker Money Sha Bitcoin Venmo Mastercard

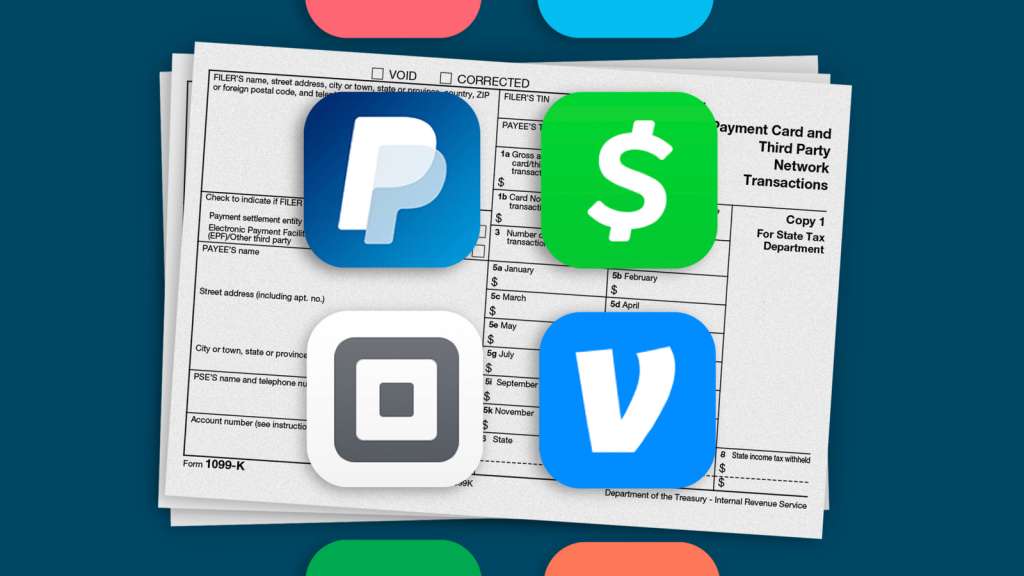

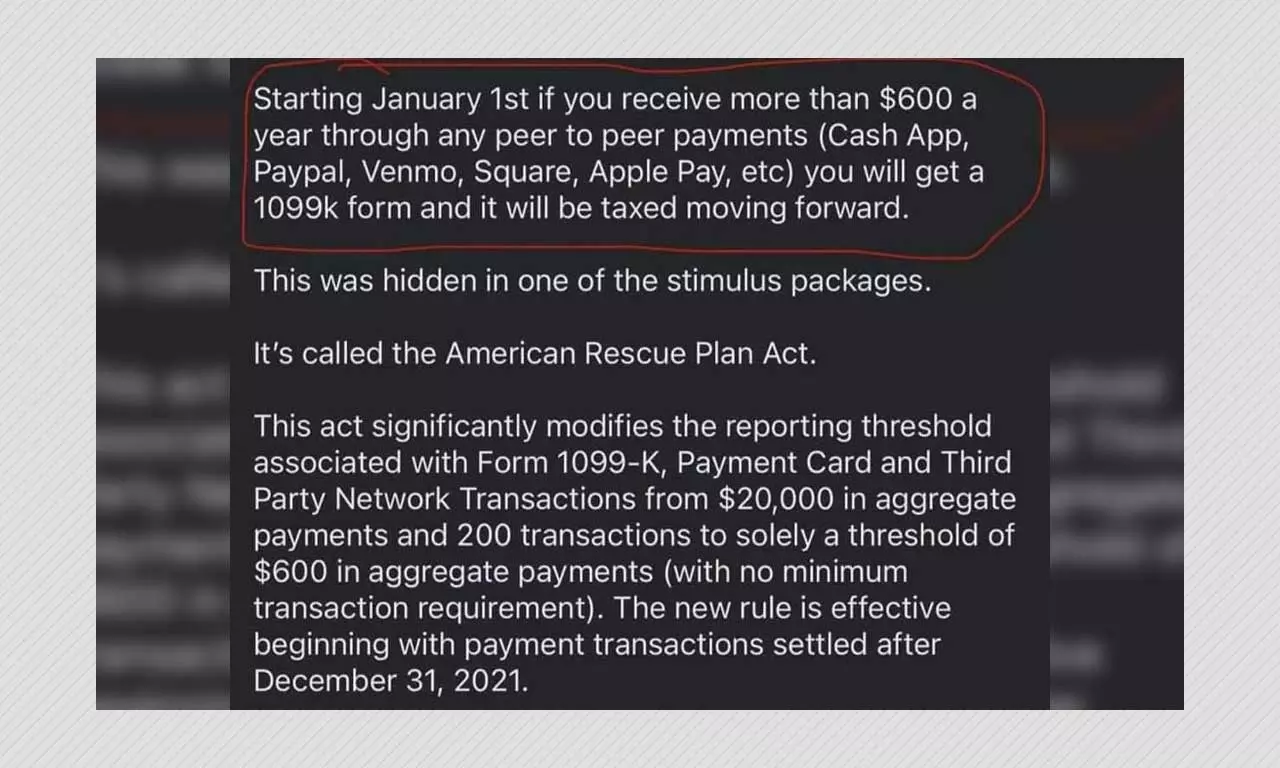

The american rescue plan act will cut tax requirements from $ 20,000 to $ 600 starting next year.

Tax on venmo over 600. Earnings to the individual receiving payment through venmo are taxable to that individual and must be reported in compliance with tax law. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099. The american rescue plan act will be effective on january 1, 2022.

A new rule will allow the federal government to take a closer look at business transactions on these apps when they are more than $600. “the biden administration is attempting to empower the irs to monitor every single withdrawal, deposit, and transaction you make from your personal banking accounts, paypal, venmo, etc.” Users were stating that people who deposit $600 or more annually from smartphone apps like paypal and venmo will be taxed for that income. the post has.

Current tax law, regardless of the new rule, requires anyone to pay taxes on income more than $600 regardless of where it comes from. Venmo, zelle $600+ now taxed! She said splitting rent is not income, it's a shared expense, which means it cannot be taxed.

This is because this income is. Made @joe biden we plan to tax over $ 600 in cash that goes into paypal, cashapp, venmo and more. The american rescue plan act:

One facebook post claims the “new tax bill” would tax transactions exceeding $600 on smartphone apps like paypal and venmo. Me and my boyfriend easily send each other well over $1k a year each using venmo. I keep seeing this rule being shared all over but i’m not sure how i would be affected.

Banking organizations are sounding the alarm over a new rule in president biden’s 2022 budget proposal which would require banks to report to the irs all transactions over $600 in both personal and business accounts, in an attempt to close the tax gap.under the current law financial institutions are only required to share information on transactions over $10,000. The crucial word being income. Current tax law requires anyone to pay taxes on income over $600, regardless of where it comes from.

This proposal would impact accounts that see transactions totaling $600 or more in a year, but again. One facebook post claims the “new tax bill” would tax transactions exceeding $600 on smartphone apps like paypal and venmo. 20 post, which was shared more than 1,300 times in four days.

“that means if you borrow money using any of those things over $600 that money will be taxed again,” reads the sept. Fortunately, the idea that you will have to pay additional taxes is false. There has been a flurry of furious cash app users this past week angrily responding to rumors of president joe biden’s new tax reporting plan requiring taxpayers to report all venmo and cash app income over $600.

Biden taking money from venmo accounts for taxes discussion hey guys so i keep hearing about how next year biden will start to tax venmo accounts over $600 so that the businesses that use it will pay sales taxes, but i'm not a business and i just use venmo to transfer rent money back and forth to and from my roommates. The taxes don’t apply to friends and family transactions, like rent payments or dinner.

Venmo Cash App And Other Payment Apps To Report Payments Of 600 Or More Smart Change Personal Finance Journalstarcom

Threshold For Cash App Payments Drastically Lowered For Tax Payments – Radio Facts

Vegas Businesses That Use Payment Apps Like Venmo Cash App Others Could Face Taxes On Transactions

No Venmo Isnt Going To Tax You If You Receive More Than 600 – 24htechasia

Does The Irs Want To Tax Your Venmo Not Exactly

No Venmo Isnt Going To Tax You If You Receive More Than Us600 – Tech

1k-hsnrd5yzvum

Does The Irs Want To Tax Your Venmo Not Exactly

Tax Changes Coming For Cash App Transactions

Business Users On Cash Apps Will Begin Receiving Tax Forms Heres What You Need To Know Wjhl Tri-cities News Weather

Irs To Start Taxing Certain Money Transfer App Users – Nbc2 News

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099-k Money

Federal Government To Ask For Taxes On App Transactions Over 600

Receiving Freelance Income Through Peer-to-peer Payment Apps Tax Obligations Apply – Cpa For Freelancers

Mt5pn6szcntdsm

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You Wsvn 7news Miami News Weather Sports Fort Lauderdale

American Rescue Plan Act Does Not Tax Payments Made Through Venmo Paypal Boom

New Tax Code Rules In 2022 Eyewitness News

If You Use Paypal Or Venmo For Business Transactions The Irs Might Be Looking More Closely At Your Account Soon It In 2021 Paying Taxes Irs Internal Revenue Service