One thing to note is that tax loss harvesting and wash sales apply only in taxable accounts. Every tax loss harvesting strategy shares the same basic goal:

Capital Loss Harvesting For The Index Investor – Saverocity Finance

Sell an investment for a loss, and;

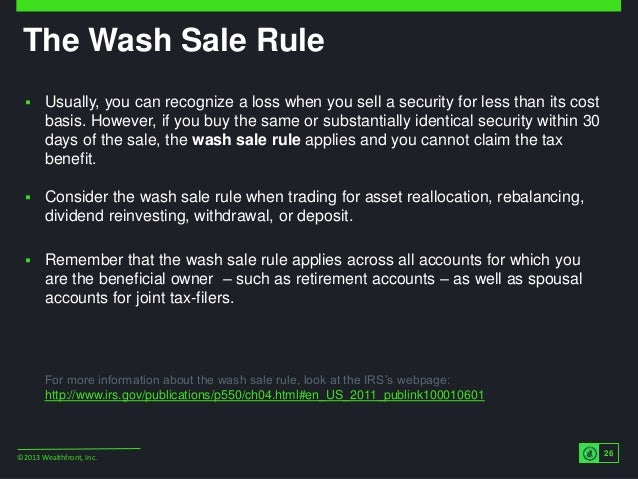

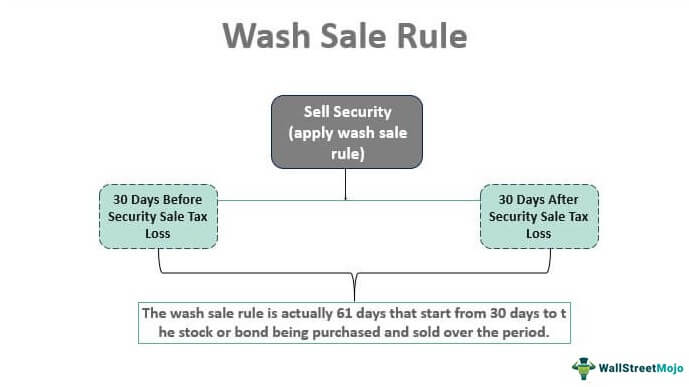

Tax loss harvesting wash sale. Wash sale rules only apply to taxable accounts. Federal government allows investors to use capital losses to offset capital gains in a If you have a loss on an investment that you still want to own, then there are some strategies to avoid the wash sale rules and still harvest the losses.

It applies to most of the investments you could hold in a typical brokerage account or ira,. A tax loophole is helping bitcoin holders save tons of cash by avoiding federal taxes. Buy “substantially identical” securities within 30 days before or after the sale.

By david john marotta and megan russell on april 10, 2016 with no comments. I see that i have a $4000 loss currently in my account. The intent behind the wash sale rule is to prevent the creation of “artificial” losses and the manipulation of tax laws by trading in and out.

Tax loss harvesting and wash sales. Or in the case of roth accounts, you won’t owe any more taxes if you follow withdrawal rules. The first is to buy more of the investment (or a call option if available) you want to sell, then sell your original investment at a.

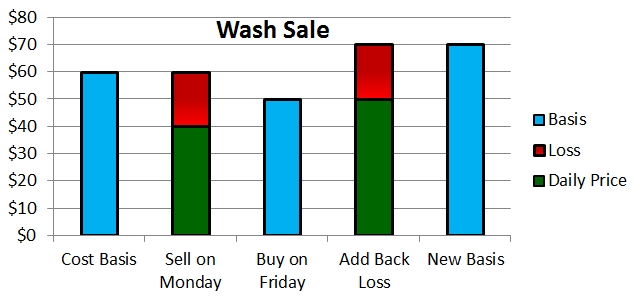

When you sell an investment that has lost money in a taxable account, you can get a tax benefit. With crypto tokens, wash sale rules don’t apply, meaning. The actual cost plus the $7,000 disallowed loss.

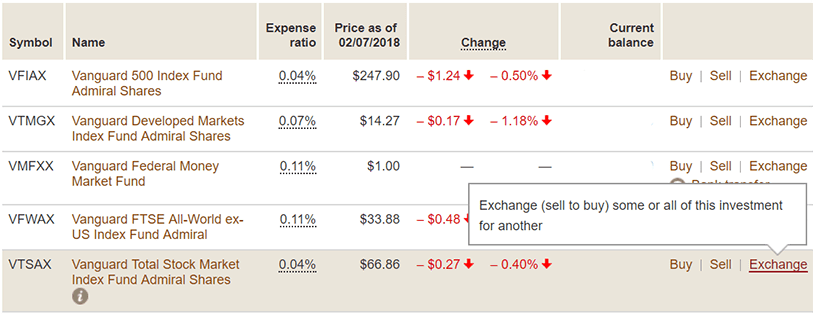

Approaches to tax loss harvesting differ primarily in how they handle the proceeds of the harvest to avoid a wash sale. I dollar cost average into the vanguard total international stock index fund (vtiax) on the 1st of every month. Therefore, you cannot claim the $7,000 loss.

Learn more at td ameritrade. Can i tlh today (18th) into another fund vfwax which is not substantially similar without triggering. Your basis in the new 500 shares is $10,200:

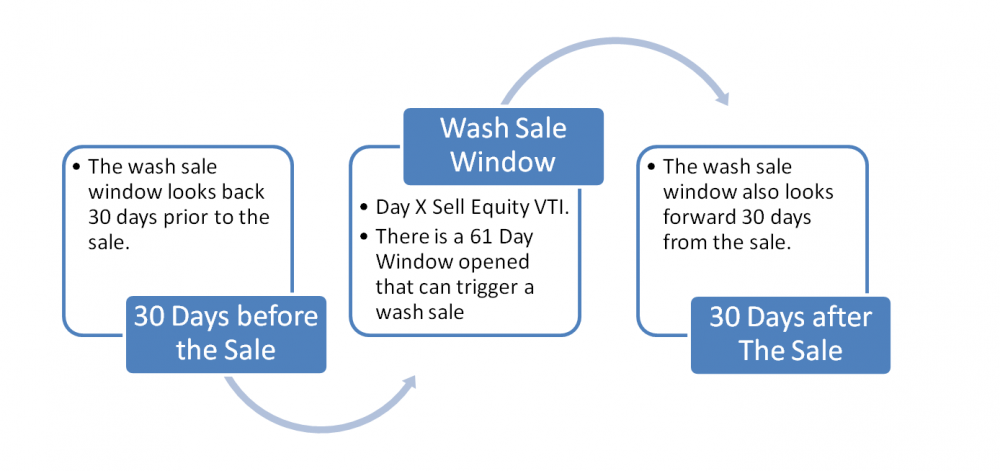

Since the shares were “bought back” within 30 days of the sale, the wash sale rule applies. This allows investors to lower their tax amount with the use of investment losses. The wash sale rule postpones losses on a sale, if replacement shares are bought around the same time.

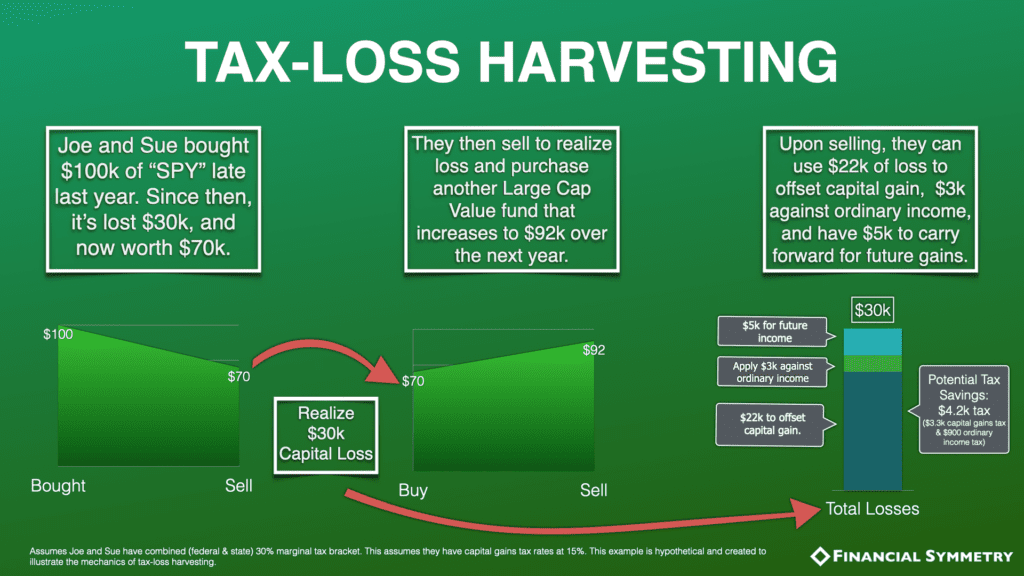

Realizing a loss on a holding and buying the holding back at a lower cost outside of the wash sale window will result in both current year tax. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to “harvest” losses for tax purposes. Whenever you have significant losses in a taxable account, you should consider tax loss harvesting, selling those losses as a part of tax planning and then buying a placeholder security for 30 days.

When a wash sale occurs, the loss is disallowed. Investors can offset up to $3,000 per year, and losses can be kept in perpetuity. A wash sale occurs when you:

The place where people often trip up is by accidentally triggering the “wash sale” rule. If only a portion of the stock sold is bought back, only that portion of the loss is disallowed. One way to defeat the wash sale rule is with a double up strategy.

Tax-loss Harvesting – Capital Loss Deduction Td Ameritrade

Year-end Financial To-do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards

Wash Sales Rule May Now Apply To Your Crypto-assets – Beartax Blog

Why Does My Brokerage Show Adjusted Due To Previous Wash Sale Disallowed Loss When I Sold My Entire Position – Personal Finance Money Stack Exchange

The Definitive Guide To Tax-loss Harvesting And Avoiding Wash – Minafi

The Irs Untold Secret Tax Loss Harvesting Seeking Alpha

Tax Loss Harvesting And Wash Sales Marotta On Money

Tax Loss Harvesting A Silver Lining In Bear Markets – Financial Symmetry Inc

What Is Tax-loss Harvesting – Ticker Tape

The Wash Sale Rule 2013

Irs Wash Sale Rule Guide For Active Traders

Tax-loss Harvesting – Wash Sales Td Ameritrade

Is Tax-loss Harvesting Worth It The Ultimate Guide – Bull Oak Capital

Wash Sale Problems When Tax Loss Harvesting Mutual Funds Etfs

Tax-loss Harvesting – Wash Sales Td Ameritrade

Wash Sale Rule Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting With Vanguard A Step By Step Guide – Physician On Fire

Tax Loss Harvesting And Wash Sale Rules