Several action steps are encouraged, with handy links and examples, along with connections to various irs resources (see the sidebar). Our identity verification & authentication solutions help you mitigate fraud risk.

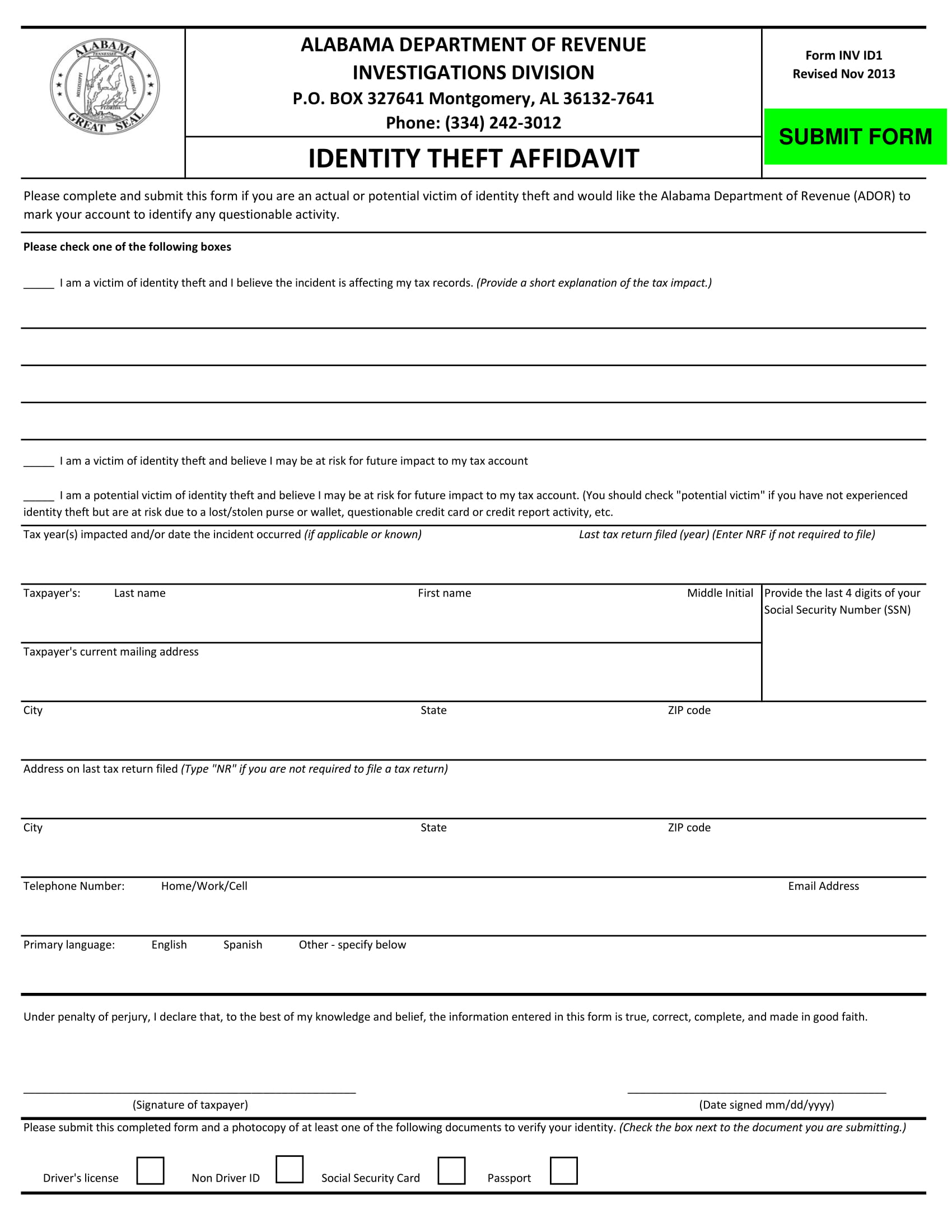

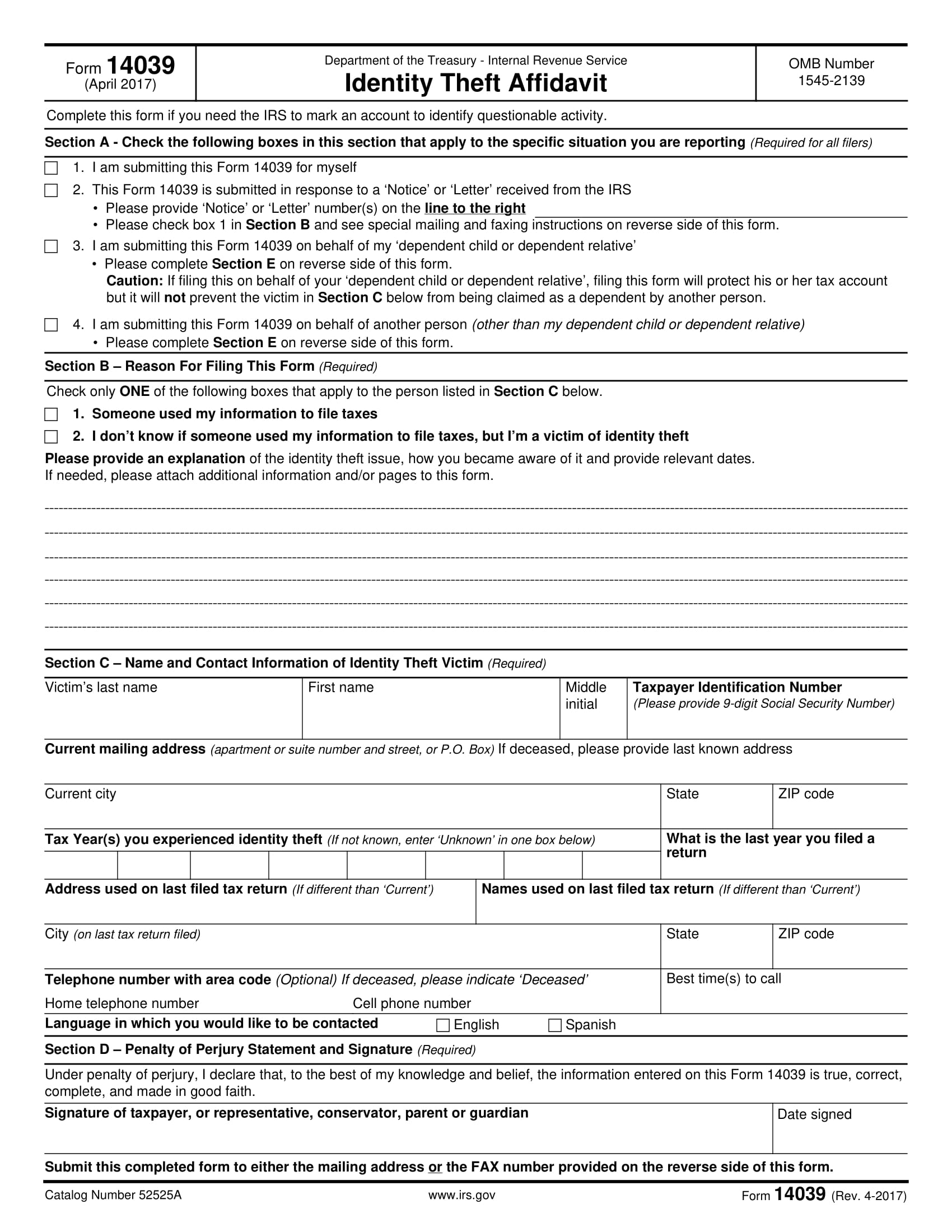

9 Id Theft Affidavit Examples – Pdf Examples

Some common identity theft techniques are:

Tax identity theft examples. These include the use of phishing emails, fake invoices, and tax filing. You can also be charged with identity theft trafficking for selling or transferring pii with the understanding that the recipient will use the pii for an unlawful act. The definition of identity theft explains it as the theft of personally identifying information including a person’s name, date of birth, driver’s license, social.

According to a recent aicpa survey, 48 percent of u.s. Sophisticated identity thieves can be extraordinarily patient. My first experience with stolen identity happened when my parents told me to get a credit card.

Some examples include employee theft, tax fraud, or embezzlement, bribery, or insurance fraud. Use this toolkit to tackle tax identity theft issues with your clients. Examples of business identity theft scams.

People can be charged with identity theft for nonconsensual use of someone’s personal identification information (pii). Credit card fraud impacts the most consumers above the age of 19, as that age group generally do not own credit cards yet. Ad lexisnexis® risk solutions helps you see right through the most sophisticated fraudsters.

Tax identity theft is usually identified when the victim goes to file their tax return and finds that one has already been processed for them. Some fraudsters might email your employees or customers while pretending to be your business. Tax identity thieves steal taxpayers’ names and taxpayer identification numbers (like social security numbers or individual taxpayer identification numbers) for one of two reasons:

Id theft through a tax professional External fraud is committed by any individual or entity outside of the company. Only five of these 369 examples mention the individual taxpayer identification number and each of these five cases describes a scheme to engage in refund fraud not employment related fraud.here are the five examples published by the irs:fiscal year 2015 “former irs employee sentenced for wire fraud and identity theft scheme“on aug.

Our identity verification & authentication solutions help you mitigate fraud risk. There are a number of tactics identity thieves use to profit off your small business. Ad lexisnexis® risk solutions helps you see right through the most sophisticated fraudsters.

Pretending as legitimate employees they ask. Personal tax id theft happens when someone has stolen your personal information in order to file a fraudulent return. The most recognizable types of data breaches included internal theft of data by a current or former employee, internal hacking or unauthorized intrusion of a network by a current or.

Governmental documentation or benefits fraud. Other common identity theft claims involve: This type of identity fraud happens when someone uses your personal information, including your social security number, to file a tax return in your name and collect a refund.

Children’s information can remain dormant for years. Identity theft is an ongoing national crisis. This type of identity theft occurs when the perpetrator wants to take on the identity of another in order to conceal his true identity.

We analyzed the irs' sample of 2013 identity theft tax refund fraud cases, and we determined that the fraudsters obtained the pii to commit their crimes via internal or external data breaches. Tax fraud identity theft examples. It also encompasses insider theft — such as familiar fraud, when identity theft is committed by a family member or friend, or employees at companies where you do business, who exploited their access to paper or digital records.

We asked our community for identity theft case examples, and unfortunately, we got plenty of horrifying stories in return. Adults think it’s at least somewhat likely identity theft will cause them financial loss in the next year, and 6 percent report that they or family members have had someone obtain a tax refund in their name. Her insurance company immediately got her in touch with us.

An identity theft victim from sarasota, florida realized she was a victim of identity theft when someone used her social security number to file taxes with the federal government. Below are some recent identity theft stories from real people. For example, an illegal immigrant may steal a person’s identity.

9 Id Theft Affidavit Examples – Pdf Examples

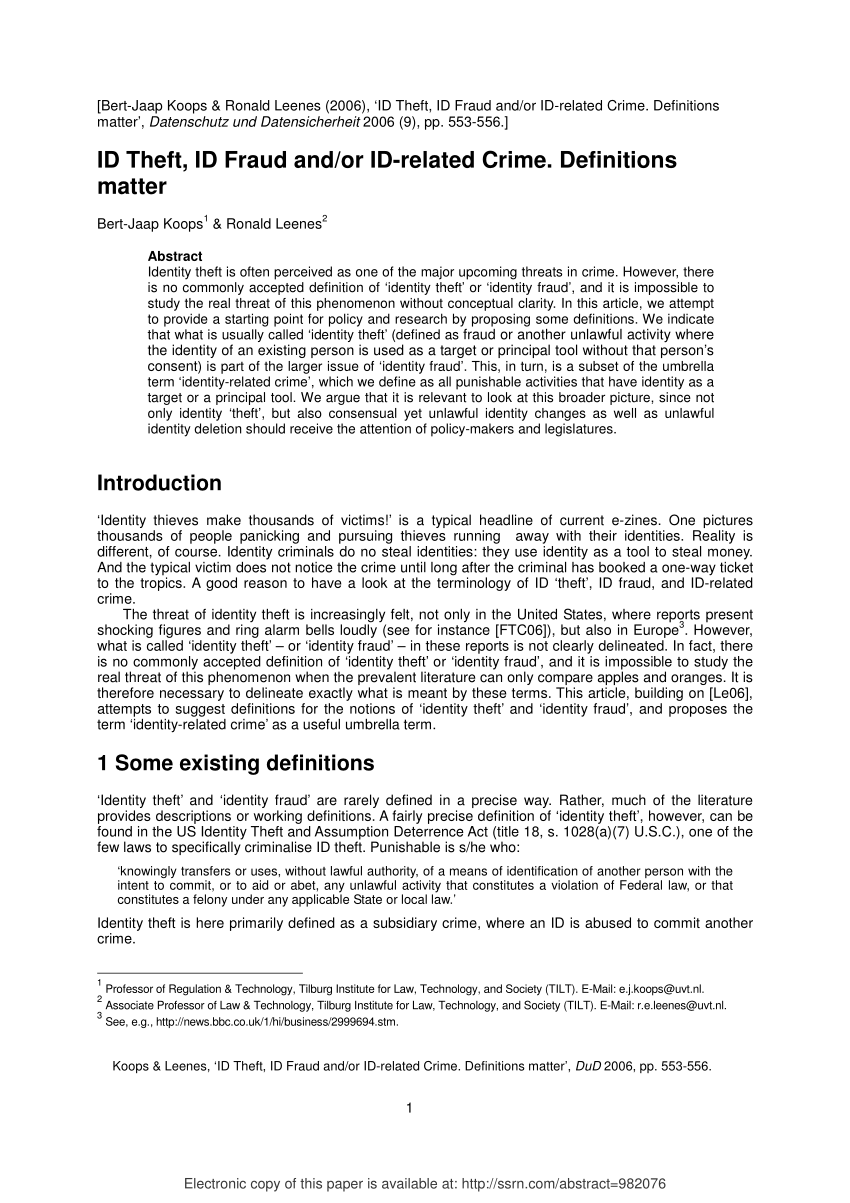

Pdf Identity Theft Identity Fraud Andor Identity-related Crime

Tax Related Identity Theft Is On The Rise Identity Theft Identity Theft Prevention Identity Theft Protection

How Common Is Tax Identity Theft – Experian

Protect Yourself Against Identity Theft With These Tips Texanscreditunion Identity Theft Online Safety Technology Updates

What Is Tax Identity Theft American Family Insurance

Irs Letter 4883c – Potential Identity Theft During Original Processing Hr Block

How To Protect Yourself From Identity Theft Money

What Is Identity Theft Definition From Searchsecurity

What Is Tax Identity Theft American Family Insurance

What Happens After You Report Tax Identity Theft To The Irs Hr Block

Identity Theft Examples In Real Life – Fully Verified

Identity Theft Or Tax Fraud No More Tax

Identity Theft Examples In Real Life – Fully Verified

2

Irs Letter 5071c Sample 1

Types Of Identity Theft And Fraud – Experian

5128 Identity Theft For Collection Employees Internal Revenue Service

Understanding Your 5071c Letter What Is Letter 5071c Community Tax