Benefits received by an employee by virtue of a collective bargaining agreement (cba) and productivity incentive schemes provided that the total annual monetary value received from both cba and productivity incentive schemes combined do not exceed ten thousand pesos (php 10,000.00)per employee per taxable year; The computation of net taxable income for this type is as follows:

How Much Do Mckinsey Bain And Bcg Pay – Quora

The lowest salary for a senior tax consultant in philippines is php 20,000 per month.

Tax consultant salary philippines. The expanded withholding tax normally covers services. Interest from currency deposits, trust funds and deposit substitutes: (iii) those earning annual incomes between p400,000 and p800,000 will pay a fixed amount of p30,000 plus 25% of the excess.

Vat — an independent consultant shall be subject to 12% vat if his gross receipts exceed p1,919,500. The average salary for a tax specialist in philippines is ₱492,366. Salary estimates based on salary survey data collected directly from employers and anonymous employees in philippines.

Same manner as individual citizen and resident alien individual: This is the average monthly salary including housing, transport, and other benefits. In other developed countries, the total income of a tax consultant is slightly above $50,000.

In 2019, the four firms combined employed well over a million people worldwide. Subtract your total deductions to your monthly salary, the result will be your taxable income. (ii) those earning between p250,000 and p400,000 per year will be charged an income tax rate of 20% on the excess over p250,000.

What is the lowest salary for a senior tax consultant in philippines? Employee with a gross monthly salary of php 30,000 and. It is estimated that it will reach the 14th position in year 2050.

₱2,202,500 + 35% of the excess over ₱5,000,000. Percentage tax — an independent consultant shall be required to pay the percentage tax of 3% if his gross receipts for the year do not exceed p1,919,500. The highest salary for a senior tax consultant in philippines is php 32,500 per month.

(i) those earning an annual salary of p250,000 or below will no longer pay income tax (zero income tax). At deloitte us, a tax consultant earns $74,000 per year with a base salary of $70,000 and bonuses of $4,000. Salaries range from 11,300 php (lowest average) to 199,000 php (highest average, actual maximum salary is higher).

On the other end, a senior level income tax consultant (8+ years of experience) earns an average salary of ₱688,733. Base on our sample computation, if you are earning ₱25,000/month, your taxable income would be ₱23,400. Visit payscale to research tax specialist salaries by city, experience, skill, employer and more.

The largest industries in philippines are electronics, outsourcing, automotive, mining and natural resources. The independent contractor may generally pass the vat to his local clients. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8% na buwis sa lahat ng kabayarang siningil ng propsesyunal, sa halip na magbayad ng personal income tax at percentage tax.

Philippines economy was in 2011 the 43rd largest on the world by its gdp. A person working in philippines typically earns around 44,600 php per month.

Accenture Salary Information – Adventure Wealth Advisors

15 Cpa Lawyer Average Salary Philippines – Average List Jobs Salary

Electrical Engineer Salary And Income Report In Uk By Salaryhood 2019-2020 Accounting Jobs Salary Assistant Jobs

Accountant Average Salary In Indonesia 2021 – The Complete Guide

How Much Should I Charge As A Consultant In Australia

15 Cpa Lawyer Average Salary Philippines – Average List Jobs Salary

Tax Advisor Average Salary In Philippines 2021 – The Complete Guide

Accountant Salary Philippines – Age Net Worth

Tax Consultant Salary And Jobs Certification And Courses Tax Advisor Tax Analyst Tax Advisor Cpa Exam Payroll Taxes

Bain Salary By Positions Locations 2020 Mconsultingprep

Atlas Copco Group Careers Various Sector Jobs Available Information Technology Services Sales Jobs Pharmaceutical Sales

Masters Degree In Accounting Salary What Can You Expect

Cpa Salary Report How Much Cpas Earn In A Year – Gleim Exam Prep

Baker Hughes Careers Attractive Salary Accommodation Flight Tickets Free Visa Click Here To Business Analyst Staff Recruitment Business Development

Jobstreetcom Releases Cebu Annual Salary Report Jobstreet Philippines

We Do Overseas Massbulk We Do Overseas Massbulk Recruitments For Our Clients In Qatar Oman Saudi Arabia Iraq Recruitment Dubai Mechanical Technician

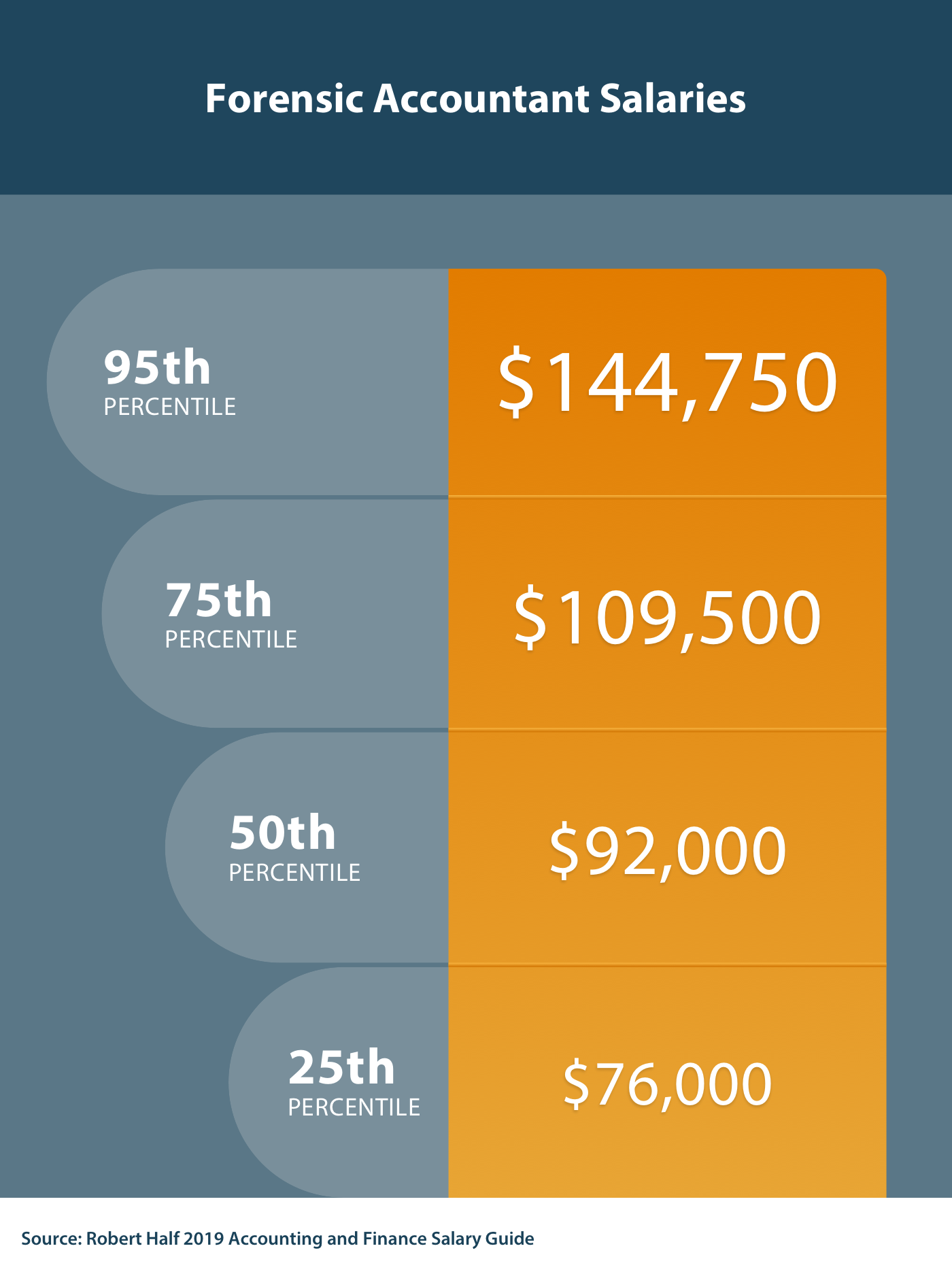

How To Become A Forensic Accountant 5 Steps To Consider

15 Cpa Lawyer Average Salary Philippines – Average List Jobs Salary

How Much Should I Charge As A Consultant In Australia