The difference between tax evasion and tax avoidance largely boils down to two elements: Tax avoidance and tax evasion are two terms that must be clearly understood by responsible individuals and companies who are earn money especially in the philippines.

Pdf Aggressive Tax Avoidance Corruption And Good Governance

Tax avoidance (aka tax minimization) is a way taxpayers minimize their taxes through legally permissible means, meaning, it is not punishable by law.

Tax avoidance vs tax evasion philippines. But taxes are the law. That’s why you would want to do tax avoidance. Tax avoidance is the use of.

Contact us to learn more. Tax evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts, understating of incomes or overstating of expenses etc., whereas, tax avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country such. Tax avoidance and evasion schemes on the transfer of real properties

Visit our professional site » created by findl. In theory, tax avoidance is the legal means of reducing taxes. Contact us to learn more.

Ad protect your organization from tax avoidance and tax evasion. The difference between tax avoidance and tax evasion boils down to the element of concealing. The legality of tax avoidance, however, is a gray area.

Evade taxes and the other is to avoid them. Tax evasion, on the other hand, involves schemes outside those lawful means that, when resorted to by taxpayers, usually subjects them to civil or criminal liabilities in addition to penalties and interest on the unpaid. In tax avoidance, you structure your affairs to pay the least possible amount of tax due.

An indian court on tuesday said china's bytedance must deposit around $11 million that. Tax avoidance is achieved by taking advantage of loopholes in law but observing with law provisions. Tax evasion, meanwhile, is the use of.

Bir files tax evasion cases vs actor richard gutierrez manila bulletin from mb.com.ph tax evasion is the act of illegally avoiding tax liability, and it is a felony under u.s. In tax avoidance, you’re making use of your tax benefits to lower taxes for your small business. 92] article 1458, civil code of the philippines.

Article 725, civil code of the philippines. [international bureau of fiscal documentation, international tax glossary, 2nd edition, (amsterdam: Tax evasion is achieved by employing unlawful methods for nonpayment of tax.

There seems to be no categorical prohibition on tax avoidance under philippine laws. However, the bureau of internal revenue (bir) rules and decides as if there is. The terms tax avoidance and tax evasion a.

Anyone would like to pay less for taxes, but it is a social and national responsibility to do so. Delaying or postponing the sale of a capital asset until after 12 months to reduce the tax on capital gains to 50%. Tax avoidance is paying the minimum amount of tax using all available legal methods.because the tax laws in most developed countries are so.

The element of illegality distinguishes tax evasion from tax avoidance. Tax evasion, on the other hand, involves schemes outside those lawful means that, when resorted to by taxpayers, usually subjects them to civil or criminal liabilities in addition to penalties and interest on the unpaid. Tax evasion is not paying taxes by using illegal means.

On the other hand, tax evasion is outside of those lawful means and when availed of, it usually subjects the taxpayer. Opting depreciation method in computing deductible expenses. In the philippines, tax evasion is clearly made illegal by our laws.

From my understanding, most of the tax avoidance issue (take note of the term avoidance versus evasion here) has to do with its subsidiary sister company big dipper, which was granted tax incentives by peza, a government body that offers tax incentives to investors (more about peza here).however, peza incentives are in no way illegal, and in fact is a way for the government. While you get reduced taxes with tax avoidance, tax evasion can result in fines, penalties, imprisonment, or. In tax evasion, you hide or lie about your income and assets altogether.

Access financial crime compliance information to mitigate risk & prevent tax evasion. “tax avoidance is structuring your affairs so that you pay the least amount of tax due. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes.

In tax evasion, you’re deliberately reducing your tax liability by lying or omitting numbers when you file your taxes. The biggest difference between the two is that tax avoidance is completely legal. Philippines, vietnam discuss bilateral naval ties.

Access financial crime compliance information to mitigate risk & prevent tax evasion. That’s how you can ethically and. Tax evasion uses illegal or fraudulent methods to reduce or avoid taxes (see the list of tax evasion examples above), while tax avoidance uses lawful means to minimize tax payments.

Payment of tax is essential and compulsory for all individuals in a country even though no one likes to pay taxes, but taxation is a law. Tax avoidance, as it is technically called, is the attempt to minimize tax liabilities by lawful means. Ad protect your organization from tax avoidance and tax evasion.

Tax Avoidance Vs Tax Evasion

Lesson 3 – Tax Its Characteristics And Classification Pdf Double Taxation Tax Evasion

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

Indonesia Selected Issues In Imf Staff Country Reports Volume 2019 Issue 251 2019

Lesson 3 – Tax Its Characteristics And Classification Pdf Double Taxation Tax Evasion

Tax Avoidance – Difference Between Tax Evasion Avoidance Planning

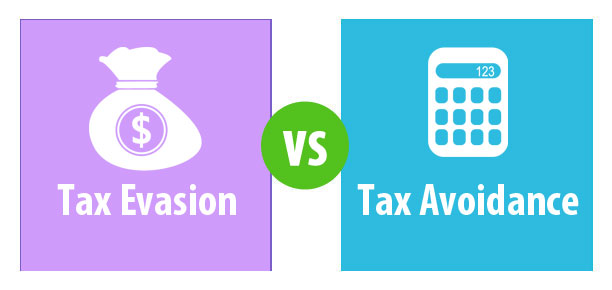

Jrfm Free Full-text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnams Relations With Asean And Eu Member States Html

Tax Evasion From Cross-border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Tax Avoidance Vs Tax Evasion Infographic Fincor

Mon Abrea – Tax Evasion Vs Tax Avoidance Do You Want To Make Sure Youre Doing The Right Thing Visit Wwwsealofhonestyph Now Facebook

Introduction To Tax Policy Design And Development Richard

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Tax Noncompliance – Wikiwand