Unlike tax avoidance, tax evasion is the use of illegal means to avoid paying taxes. For example, if you're lying on a tax form or hiding income, you're probably evading taxes.

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

While mistakes happen, and the irs will likely penalize mistakes with fines or penalties, tax evasion is a much more serious offense that can lead to felony convictions and even jail time.

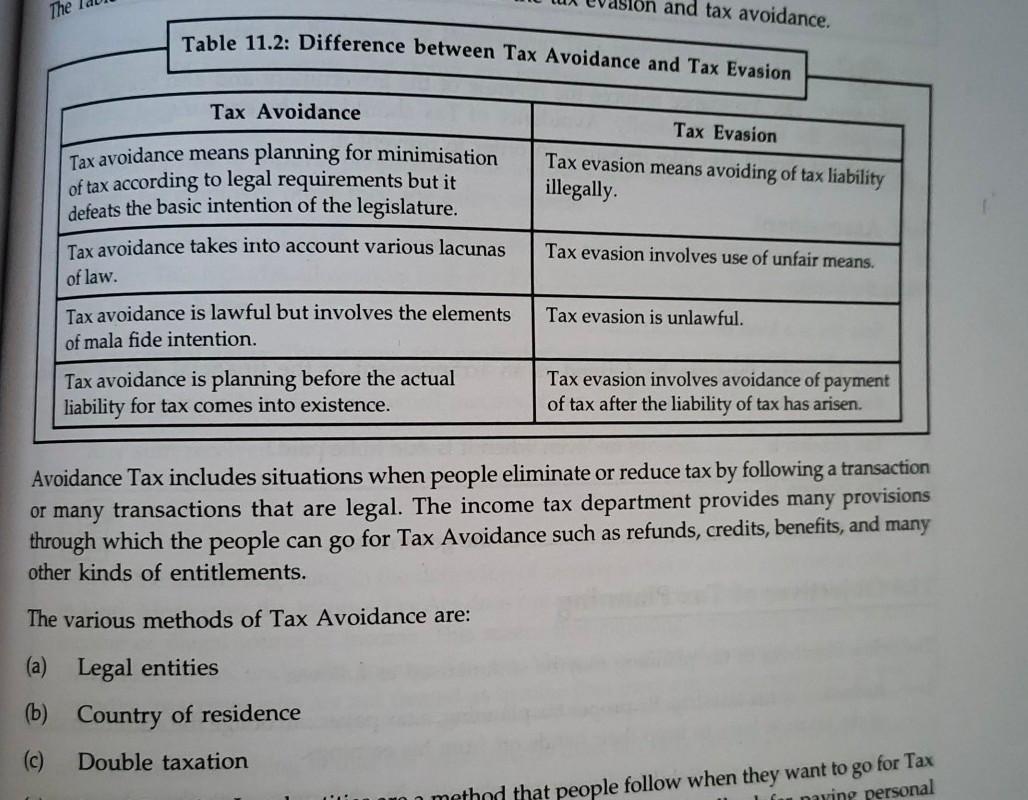

Tax avoidance vs tax evasion examples. Tax evasions and tax avoidances share similarities and differences. Tax evasion — the failure to pay or a deliberate underpayment of taxes. Tax evasion is illegal action in which a individual or company to avoid paying tax liability.

Ad protect your organization from tax avoidance and tax evasion. Contact us to learn more. One is legally acceptable and the other is an offense.

Tax evasion looks like this: There are lawful ways to reduce your tax, and. Tax avoidance means legally reducing your taxable income.

A planning made to reduce the tax burden without infringement of the legislature is known as tax avoidance. Don’t mix up evasion with avoidance. In tax evasion, you hide or lie about your income and assets altogether.

What are the similarities between tax evasion and tax avoidance? Tax avoidance and planning both are permissible, whereas evasion is not at all permissible under any local laws. Both tax evasion and tax avoidance aim to reduce one’s taxes by lowering taxable income.

What is tax evasion and its examples? Tax evasion vs tax avoidance. Ad protect your organization from tax avoidance and tax evasion.

An unlawful act, done to avoid tax payment is known as tax evasion. The government offers various exemptions like retirement plans, mutual funds, municipal bonds, and tax credits. However, tax evasion is illegal, whereas tax avoidance is legal.

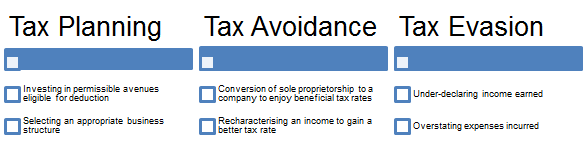

Tax avoidance means legally reducing your taxable income. Tax avoidance is a legal method of reducing your tax burden by deferring income tax by contributing to an ira or 401(k), claiming legitimate tax deductions or credits, and deducting valid business expenses. Tina orem mar 18, 2020

Examples of tax evasion include such actions as when a contractor “forgets” to report the lkr 1, 000,000 cash he receives for building a pool, or when a business owner tries to deduct lkr 1, 000,000 of personal. Falsification of accounts, manipulation of accounts, overstating expenses, or understating income, conducting black market transactions are all examples of tax evasion. While you get reduced taxes with tax avoidance, tax evasion can result in fines, penalties, imprisonment, or even higher audit risk.

Tax evasion means concealing income or information from tax authorities — and it's illegal. Tax avoidance refers to hedging of tax, but tax evasion implies the suppression of tax. Access financial crime compliance information to mitigate risk & prevent tax evasion.

Access financial crime compliance information to mitigate risk & prevent tax evasion. Contact us to learn more. Tax evasion means concealing income or information from tax authorities — and it’s illegal.

In tax avoidance, you structure your affairs to pay the least possible amount of tax due. The following are the major differences between tax avoidance and tax evasion:

2018 Tax Avoidance Vs Tax Evasion By Ioana Cristea

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb – Powerpoint Templates

Tax Evasion Vs Tax Avoidance Know The Difference

Differbetween Difference Between Tax Avoidance And Tax Evasion

What Is The Difference Tax Avoidance Tax Evasion By Shawncaffrey Medium

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Solved The And Tax Avoidance Table 112 Difference Between Cheggcom

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

What Is The Difference Tax Avoidance Tax Evasion By Shawncaffrey Medium

Tax Evasion Vs Tax Avoidance

Tax Planning Tax Evasion Tax Avoidance And Tax Management – Avs Associates

Tax Evasion Tax Avoidance Definition Comparison For Kids

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls

Explain The Difference Between Tax Avoidance And Tax Evasion – Tax Walls