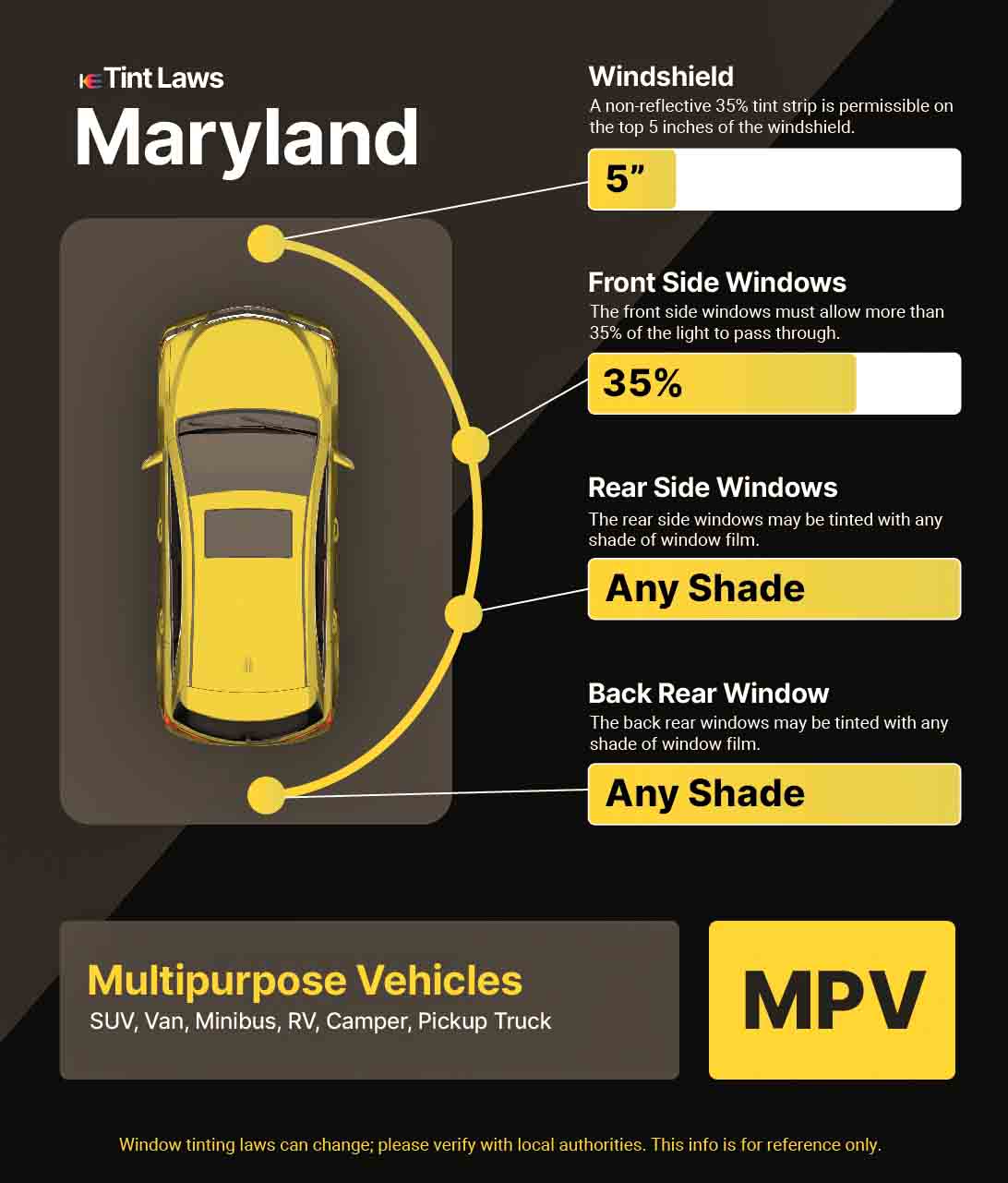

Maryland Tint Law: Window Tint Rules & Limits

Regulations pertaining to vehicular window darkness exist within the state, governing the permissible levels of light transmittance. These legal guidelines dictate how much light must be able to…

The Complete Guide to Understanding the Cost of Living in Maryland

The cost of living in Maryland refers to the expenses incurred by individuals and families residing in the state of Maryland. It encompasses various components such as housing,…

Unveiling Eye Care Innovations at Maryland Eye Care Center

Looking for a comprehensive eye care experience? Look no further than Maryland Eye Care Center! Editor’s Note: Maryland Eye Care Center is pleased to announce the publication of…