(note, all examples are overly simplified for illustrative purposes: Employee stock purchase plan (espp):

Public Provident Fund- Ppf- What Is Ppf Know All Details About What Is Public Provident Fund Check Eligibility Criteria Public Provident Fund Fund Investing

Now, if you made $50,000 from stock options trading during the year, you’d be taxed at 35% on all gains, meaning you’d keep ~$32,500 after taxes.

Stock option tax calculator canada. Even after a few years of moderate growth, stock options can produce a handsome return. Stock option calculator (canadian) receiving options for your company's stock can be an incredible benefit. This plan allows the employee to acquire shares at a discounted price, (i.e., for an amount that is less than the value of the stock at the time of the acquisition of the shares).

Because you have essentially earned an extra $5,000, that amount is taxable and must be claimed on your income tax return. Get it now for free by clicking the button below and start making money while you sleep! When you exercise your employee stock options, a taxable benefit will be calculated.

According to the option agreement, you can exercise or buy the shares for $10 / share. That means you’ve made $10 per share. This calculator illustrates the tax benefits of exercising your stock options before ipo.

If you own a home, you may be wondering how the government taxes profits from home sales. However, if you are in the business of buying and selling stock, then your gains and losses from options will be. Capital gains taxes on property.

Cash secured put calculator added—csp calculator; Because most employers have one plan for all employees over multiple jurisdictions, the stock option plan may not meet the canadian tax requirements for the 50% stock option deduction. A stock option plan to acquire shares of the (public) foreign parent company.

The taxable benefit is the difference between the price you paid for the shares (the “strike price”) and their value on. This easy to use online alternative minimum tax (amt) calculator estimates your tax liability after exercising incentive stock options (iso). So if you have 100 shares, you’ll spend $2,000 but receive a value of $3,000.

Let’s say you got a grant price of $20 per share, but when you exercise your stock option the stock is valued at $30 per share. A good capital gains calculator, like ours, takes both federal and state taxation into account. The best new auto trading software:

As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller's basis. If, when you exercise the option, the fair market value of the stocks is $15 each, the value of all 1,000 stocks is $15,000. However, it’s just as important that the detailed proposals provide clarity, certainty and objectivity in their application, as stated in a submission to the department of finance canada from the joint committee of taxation of cpa canada and the canadian bar association.

Stock options are also a popular form of compensation because they do not generally affect the company’s cash flow. Automated employee stock options tax implications canada binary. In addition, if the employee provided employment services outside of canada,

Please enter your option information below to see your potential savings. Many espps provide for a delay in the acquisition of the shares: For most people, the gains and losses from call and put options are taxed as capital gains (on capital account).

Iv is now based on the stock's market. The employee includes the benefit either in the year she exercised the employee stock option or, if she acquired ccpc shares, in the year that she sells the shares. Under the current employee stock option rules in the income tax act, employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid.

Employee stock options tax implications canada around 80% in our test; The taxation of employee stock options can be complex, as there are a This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

If the exercise price of the option is fixed at an amount that is not less than the fair. You will only need to pay the greater of either your regular income tax or your amt tax owed, so try to be as detailed and accurate as possible. Stock options are an incentive that aligns the goals of the employees with the goals of the company as both benefit from an appreciation in the stock price.

Therefore, the taxable benefit that will be included in your income at the time of exercise is $20 / share. Generally, options issued to employees will be provided under one of the following three types of plans: In all cases do not deduct ei premiums.

Under the income tax act (canada), when an employee exercises an employee stock option and acquires shares, the employee realizes a taxable employment benefit equal to the excess of the value of the shares at the time of acquisition over the exercise price paid for the shares. Cpa canada believes it is in the public interest to limit stock option benefits in some cases. Poor man's covered call calculator added—pmcc calculator;

They do not take into account your full tax situation and should not be relied upon or considered advice of any kind.) This benefit should be reported on the t4 slip issued by your employer.

8 Canadian Wide-moat Dividend Growth Stocks Seeking Alpha Dividend Canadian Growth

Ek1bihi5h7s1pm

Outsourcing Tax Returns And Preparation Services Tax Services Tax Preparation Tax Prep

Incentive Stock Option Iso Amt Calculator – Secfi

Most Valuable Accounting Software Features Accounting Software Accounting Best Accounting Software

Free Tax Savings Calculator Should You Exercise Your Isos Nsos Pre-ipo – Secfi

Taxation In India Indirect Tax Financial Management Investing

Pin On Projects To Try

Derivative Investment One Of The Best Alternative Investments Option Financial Asset Related Contract Betwe Derivatives Market Tax Deductions Online Trading

Using A Second Mortgage For Debt Consolidation Canada Wide Financial Debt Relief Programs Second Mortgage Debt Consolidation

Weakest Part Of Presidential Cycle The Big Picture Stock Market Chart Marketing

Georges Excel Car Loan Calculator V20 Interest And Amortization Calculator – Yearly Amortization Calculator – Car Loan Calculator Loan Calculator Car Loans

Pin On Quantitative Trading

Incentive Stock Option Iso Amt Calculator – Secfi

Pin On Investing

Free Tax Savings Calculator Should You Exercise Your Isos Nsos Pre-ipo – Secfi

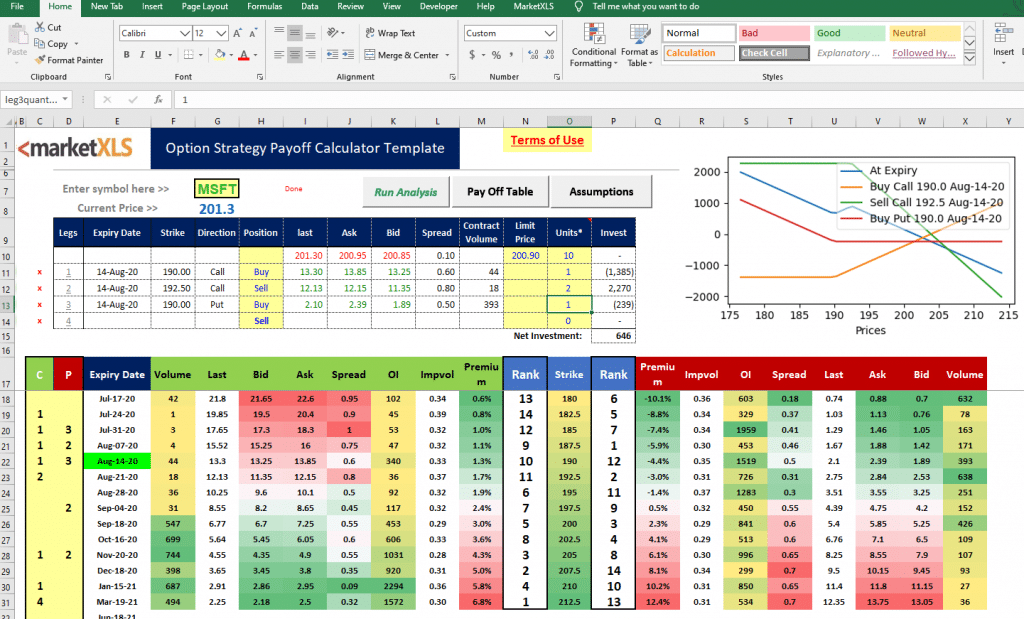

Option Profit Calculator Excel Rank Scan And Analyze Stock Options

Value At Risk Financial Risk Management In Python Risk Management Probability Data Science

Additional Payment Calculator – Mortgage Payment Calculator – Instantly Calculate Yo Mortgage Payment Calculator Mortgage Payment Mortgage Refinance Calculator