Present the card to cashier every time, before making a purchase. Not all states allow all exemptions listed on this form.

Homecoming Dance – Staples High School

Now you may print, download, or share the form.

Staples tax exempt certificate. Press question mark to learn the rest of the keyboard shortcuts. A copy of your articles of incorporation, or if not incorporated, your constitution; Click continue to create a new account.

Include your telephone number and order number if applicable. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: A copy of your current exemption letter with your e99# on it;

Ysu blanket certificate of exemption. Agencies of the f ederal government and the united nations as well as the state of new jersey and its political subdivisions are exempt from paying sales tax provided the agency making This letter is used to send to entities requesting information on our tax exempt status and includes the university of wisconsin’s id numbers.

When setting up tax exemption, you will need to provide: If you are tax exempt: Please forward your tax exempt certificate to:

You can call the hotline number for the customer and see if they have something but if it isn't there then there is a 2 week process they have to go through to get it set up. Does anyone else have trouble with tax. The above exemptions apply to all purchases of tangible property or taxable services.

If you are a tax exempt organization and do not have a staples tax exempt customer number, please follow the steps below. A brief narrative of your purpose; Get a temporary copy immediately and receive a permanent card by mail.

Every single customer that wants to use tax exemption either doesn't have it registered for the state we're in or. If you would like to suggest any additional businesses, let us know and we will contact them. Purchasers are responsible for knowing if they qualify to

Purchaser must state a valid reason for claiming exception or exemption. (vendor’s name) and certifi or both, as shown hereon: If you would like to set up multiple users, please submit all of the required information below for each individual user.

Opening a new request with us here; If you have already registered with staples advantage and have received your logon information, you do not need to fill out the registration form below. Sales and use tax blanket exemption certificate | office of business and finance.

Please also include your company contact information and your existing staples customer number if you already have one. Sales and use tax blanket exemption certificate. Email the following to tax.exempt@target.com.

I understand that by signing this certificate i may make tax free purchases of tangible personal property or purchase taxable services which are for exempt purposes. Send the completed form to the seller and keep a copy for your records. I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable

Enter your staples tax exempt customer number in the field provided and click continue. Sending an email to sbdcanadafax@staples.com; Proof of exemption in png, jpg or pdf format for the state (s) where the items will be shipped.

On a cover sheet, please include your telephone number and order number if applicable. This certificate does not require a number to be valid. Please do not write on your tax certificate.

Press done after you fill out the form. Purchases by organizations with an exempt organization certificate: Use the sign tool to create and add your electronic signature to signnow the office depot tax exemption form.

Name of purchaser, firm or agency address (street & number, p.o. Send us your tax exemption certificate using either of the 3 following methods: I will pay sales or use tax on all tangible personal property used or consumed in a taxable manner.

I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that i know, at the time of purchase, will be used in a manner other than that expressed in this certificate, and depending on the amount of tax evaded, the offense may range from a class c misdemeanor to a felony of the second degree. In your request, please include your business name, city of chicago business account number, contact information, certificate for which you are applying, and a copy of your current certificate (if applicable). No, but must be an exempt organization for sales tax purposes:

I don't care if they have paperwork from the state or us government if staples doesn't have them on record for tax exempt then they aren't getting it. Address the support section or get in touch with our support staff in. Box or route number) phone (area code and number) city, state, zip code :

Press j to jump to the feed. In addition, i understand that i Facebook instagram flickr linkedin twitter youtube maps.

Streamlined sales tax agreement certificate of exemption do not send this form to the streamlined sales tax governing board.

Fillable Form 1040 2018 Income Tax Return Irs Taxes Irs Tax Forms

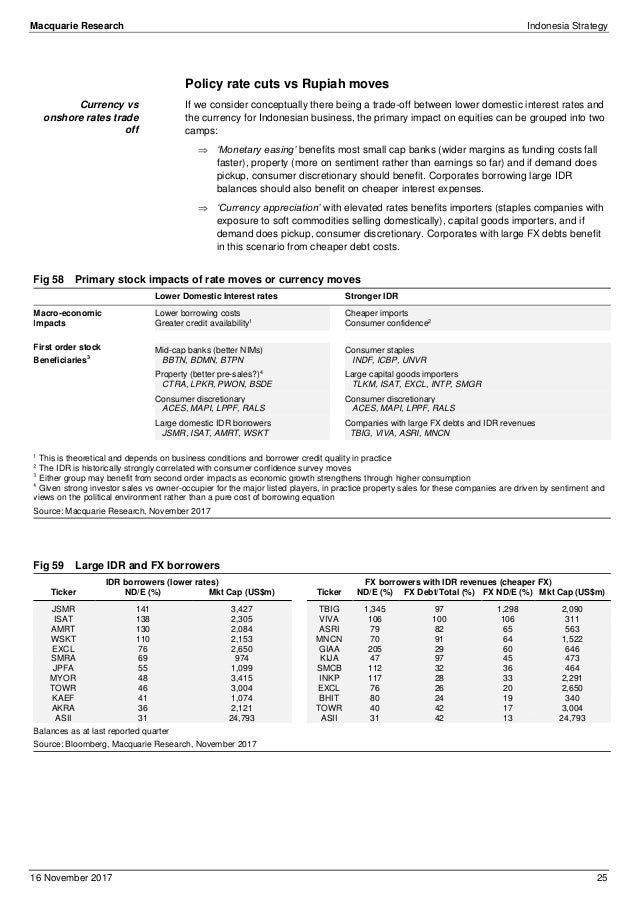

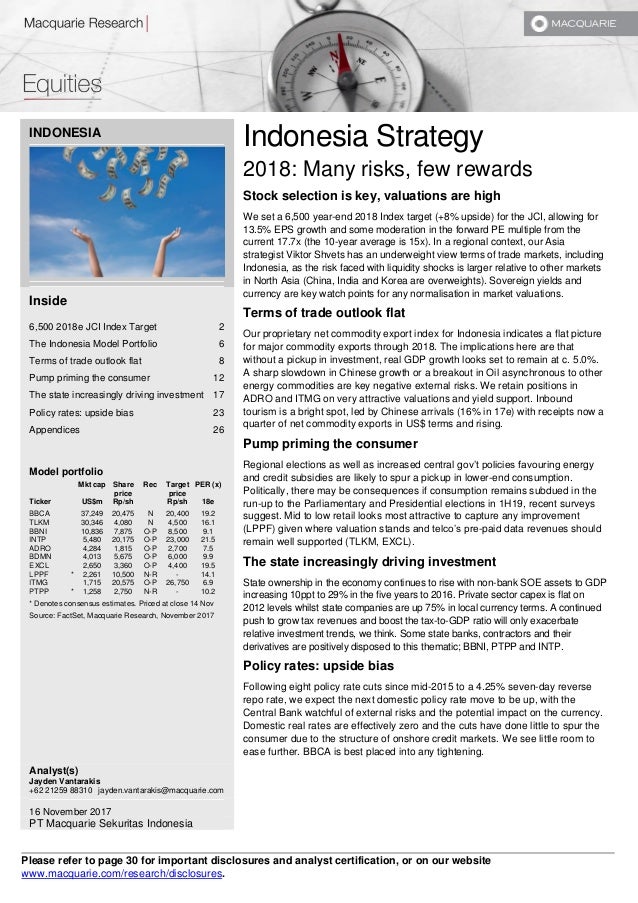

Indonesia Strategy 2018 – Many Risksfew Rewards

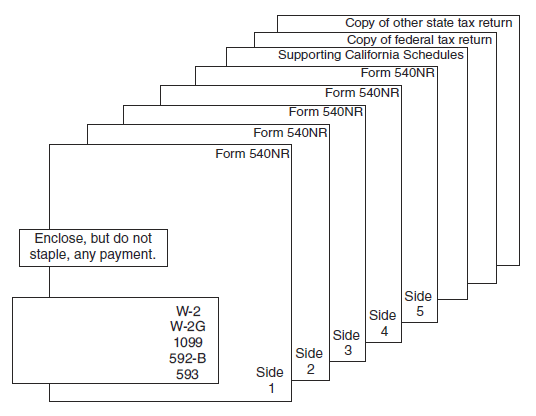

2020 540nr Booklet Ftbcagov

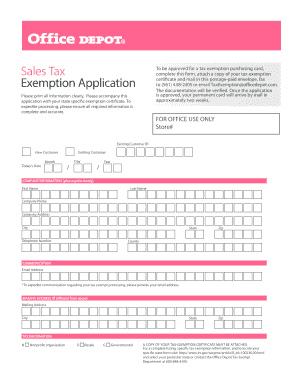

Office Depot Tax Exempt – Fill Out And Sign Printable Pdf Template Signnow

2

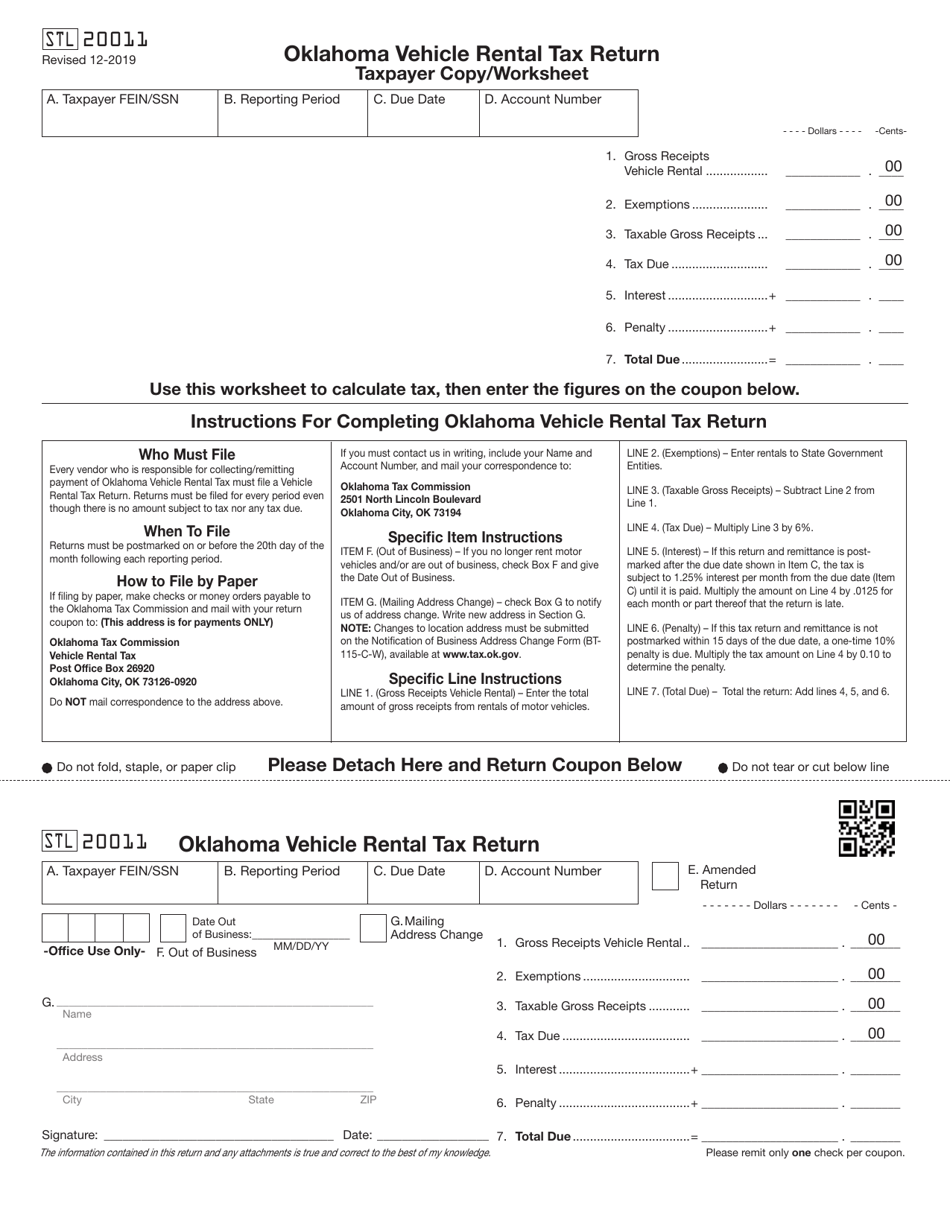

Form Stl20011 Download Fillable Pdf Or Fill Online Oklahoma Vehicle Rental Tax Return Taxpayer Copyworksheet Oklahoma Templateroller

2

2

2

Staplescom Customer Service – Order Support

Inducement Resolution Rushton Place Llc Project

Margie A Dobbs Ea Tax Accounting Service – Home Facebook

2

Staples Tax Exempt Number Ysu

Back Matter In Imf Staff Country Reports Volume 1998 Issue 091 1998

Staplescom Customer Service – Order Support

Staples Tax Exempt Number Ysu

2

Indonesia Strategy 2018 – Many Risksfew Rewards