Missouri has one of the lowest median property tax rates in the united states, with only fifteen states collecting a lower median property tax than missouri. Statewide sales/use tax rates for the period beginning october, 2021:

Is Food Taxable In Missouri – Taxjar

Create your own online store and start selling today.

Springfield mo sales tax rate 2021. Counties in missouri collect an average of 0.91% of a property's assesed fair market value as property tax per year. The missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial institutions tax, corporation income tax, and corporation franchise tax. The county sales tax rate is %.

What is the sales tax rate in springfield, missouri? The new tax will start on april 1st. There is no applicable special tax.

The 8.1% sales tax rate in springfield consists of 4.225% missouri state sales tax, 1.75% greene county sales tax and 2.125% springfield tax. With local taxes, the total sales tax rate is between 4.225% and 10.350%. Oversight notes, based on the 2021 sales/use tax rate tables published by the missouri department of revenue, there are no cities or counties that have a sales tax rate that exceeds the

The current total local sales tax rate in springfield, mo is 8.100%. The sales tax exemption is. It would be the highest sales tax rate in our area.

Try it now & grow your business! The missouri sales tax rate is currently %. The sales tax rate will increase taxes by 50 cents for every $100 you spend.

Statewide sales/use tax rates for the period beginning july, 2021: Statewide sales/use tax rates for the period beginning april, 2021 The median property tax in missouri is $1,265.00 per year for a home worth the median value of $139,700.00.

Missouri has recent rate changes(wed jul 01 2020). The minimum combined 2021 sales tax rate for springfield, missouri is. The local sales tax rate in greene county is 1.75%, and the maximum rate (including missouri and city sales taxes) is 8.35% as of november 2021.

This is the total of state, county and city sales tax rates. The springfield sales tax rate is %. The base state sales tax rate in missouri is 4.23%.

Find your missouri combined state and local tax rate. Taxes in springfield, missouri are 5.9% more expensive than mount vernon, missouri There is no applicable special tax.

Your current sales tax rate is: Missouri (mo) sales tax rates by city (a) the state sales tax rate in missouriis 4.225%. Exemptions to the missouri sales tax will vary by state.

Missouri sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a. Cities and/or municipalities of missouri are allowed to collect their own rate that can get up to 5.454% in city sales tax. Create your own online store and start selling today.

To report a correction or typo, please email digitalnews@ky3.com Springfield need to raise the sales tax rate. These rates are valid for this location, for this quarter for the sales and leases of tangible personal property items and taxable services.

Try it now & grow your business! Every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (0% to 3.125%), the missouri cities rate (0% to 5.454%), and in some case, special rate (0% to 2.25%). The state general sales tax rate of missouri is 4.225%.

The december 2020 total local sales tax. If the sales tax is added to the ballot and passed, it would bring the sales tax rate to 9.35%. Statewide sales/use tax rates for the period beginning may, 2021:

2021 missouri state sales tax rates the list below details the localities in missouri with differing sales tax rates, click on the location to access a supporting sales tax calculator. The missouri sales tax rate is 4.23% as of 2021, with some cities and counties adding a local sales tax on top of the mo state sales tax. Springfield, mo sales tax rate.

Local tax rates in missouri range from 0% to 5.875%, making the sales tax range in missouri 4.225% to 10.1%.

Individual Income Tax

Sales Taxes In The United States – Wikiwand

Missouri Car Sales Tax Calculator

2

Missouri Sales Tax Rates By City County 2021

Iata List Of Ticket And Airport Taxes And Fees

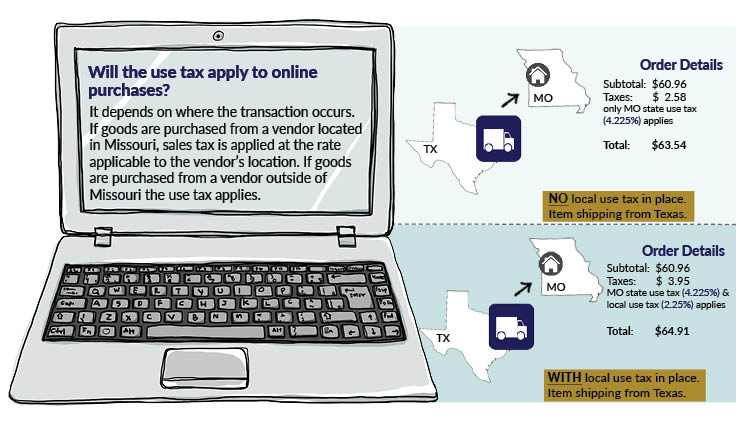

Local Use Tax Proposal – City Of Rogersville Mo

Missouri Sales Tax – Small Business Guide Truic

How To Calculate Cannabis Taxes At Your Dispensary

2

Nebraska Sales Tax Rates By City County 2021

2

Georgia Sales Tax Rates By City County 2021

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Missouri Income Tax Rate And Brackets Hr Block

Sales Taxes In The United States – Wikiwand

Illinois Sales Tax – Taxjar

Missouri Retirement – Taxes And Economic Factors To Consider

Is Food Taxable In Missouri – Taxjar