Please see the sales and use tax rate tables to determine tht rate for your location. Your current sales tax rate is:

Missouri Sales Tax Rates By City County 2021

Springfield has seen the job market increase by 1.1% over the last year.

Springfield mo city sales tax rate. This is the total of state, county and city sales tax rates. The springfield's tax rate may change depending of the type of purchase. Statewide sales/use tax rates for the period beginning october, 2021:

There is no special rate for springfield. The springfield, missouri sales tax rate of 8.1% applies to the following thirteen zip codes: Subtract these values, if any, from the sale.

The minimum combined 2021 sales tax rate for springfield, missouri is. The december 2020 total local sales tax rate was also 8.100%. State income tax rate (highest bracket) 6.00% i:

The missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial institutions tax, corporation income tax, and corporation franchise tax. Enter the sales tax rate you would like to view a rate card for. Ad with secure payments and simple shipping you can convert more users & earn more!.

Auto insurance premiums (average price quotes, for the. More than a dozen taxes contribute to the 7.6 percent sales tax charged in springfield. Springfield city rate(s) 5.975% is the smallest possible tax rate (65809, springfield, missouri) 8.1% is the highest possible tax rate (65801, springfield, missouri)

Our dataset includes all local sales tax jurisdictions in missouri at state, county, city, and district levels. Counties and cities can charge an additional local sales tax of up to 5.125%, for a. 17 rows city sales tax (city, county and state taxes) knoxville, tn :

Ad with secure payments and simple shipping you can convert more users & earn more!. These rates are valid for this location, for this quarter for the sales and leases of tangible personal property items and taxable services. The springfield sales tax rate is %.

Build the online store that you've always dreamed of. Boost your business with wix! An alternative sales tax rate of 5.975% applies in the tax region greene county, which appertains to.

Sales tax rates in greene county are determined by four different tax jurisdictions, greene county, republic (greene co), battlefield and springfield. Exact tax amount may vary for different items. The us average is 6.0%.

The current total local sales tax rate in springfield, mo is 8.100%. Future job growth over the next ten years is predicted to be 28.7%, which is lower than the us average of 33.5%. Springfield has an unemployment rate of 3.9%.

What is the sales tax rate in springfield, missouri? The combined rate used in. 2021 missouri state sales tax.

65801, 65802, 65803, 65804, 65805, 65806, 65807, 65808, 65814, 65890, 65897, 65898 and 65899. Statewide sales/use tax rates for the period beginning may, 2021: Saint charles, mo sales tax rate:.

State income tax rate (lowest bracket) 1.50% i: The tax data is broken down by zip code, and additional locality information (location, population, etc) is also included. Boost your business with wix!

Build the online store that you've always dreamed of. The missouri state sales tax rate is 4.23%, and the average mo sales tax after local surtaxes is 7.81%. Springfield, mo sales tax rate.

A sample of the 1,142 missouri state sales tax rates in our database is provided below. The county sales tax rate is %. The springfield city code chapter 70, article v, requires hotels, motels, and tourist courts to pay a tax equal to 5% of the gross rental receipts paid by transient guests for sleeping accommodations.

Please refer to the missouri website for more sales taxes information. Statewide sales/use tax rates for the period beginning april, 2021 101 rows the 65807, springfield, missouri, general sales tax rate is 8.1%.

The missouri sales tax rate is currently %. Greene county, missouri has a maximum sales tax rate of 8.35% and an approximate population of 218,925. 31 rows raytown, mo sales tax rate:

Statewide sales/use tax rates for the period beginning july, 2021:

2018 Property Tax Rates Mecklenburg Union Counties Property Tax Union County Mecklenburg County

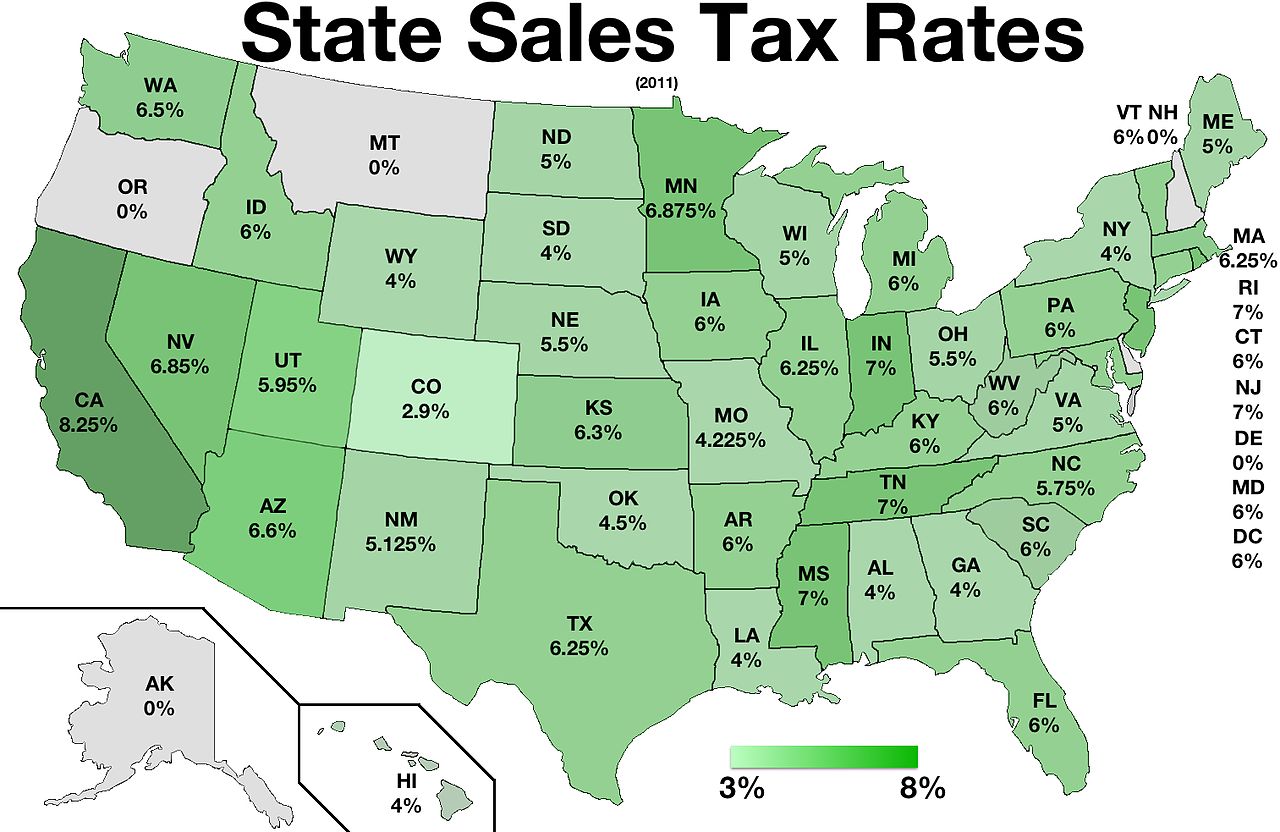

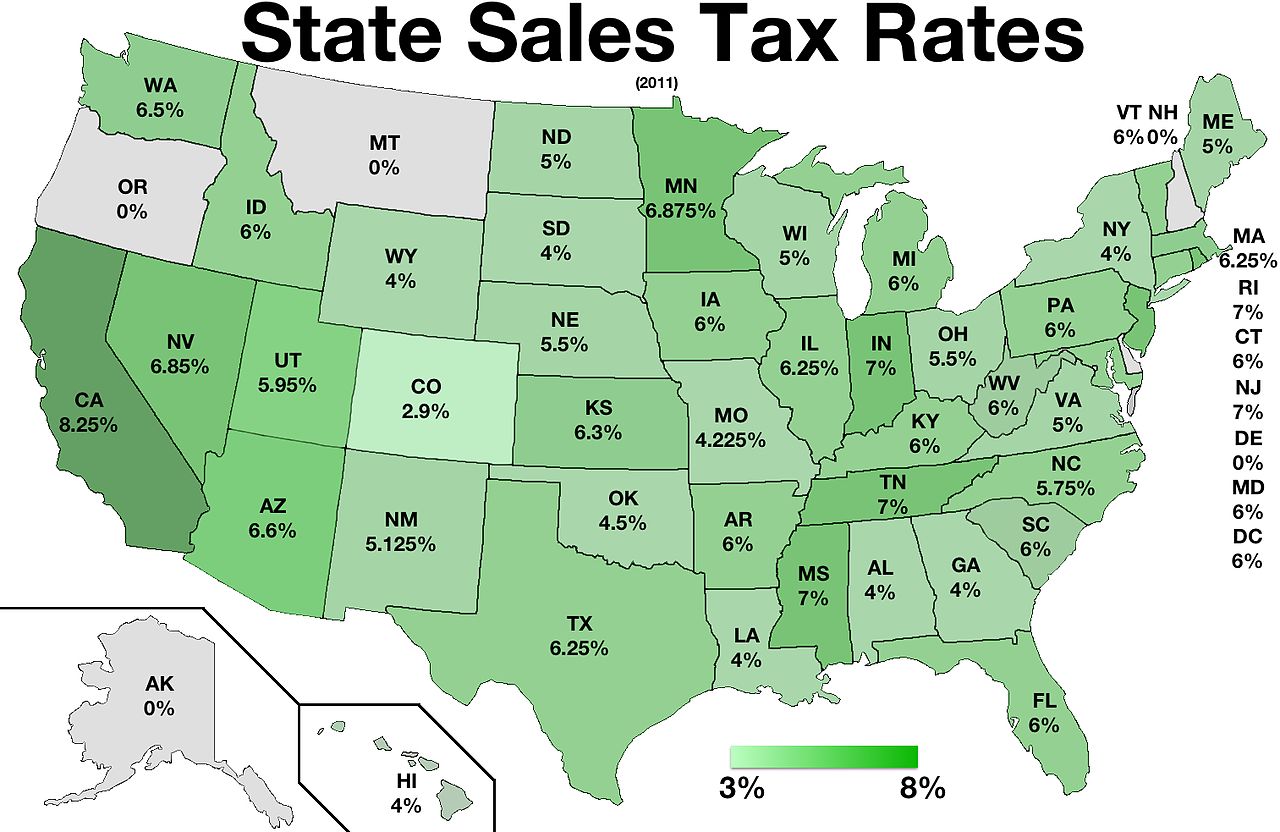

Sales Taxes In The United States – Wikiwand

Sales Taxes In The United States – Wikiwand

Nebraska Sales Tax Rates By City County 2021

Pin On Life In The Ozarks

Sales Taxes In The United States – Wikiwand

Level Property Tax Springfield Mo – Official Website

News Flash Springfield Mo Civicengage

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Car Sales Tax Calculator

Taxes – Springfield Regional Economic Partnership

News Flash Springfield Mo Civicengage

Sales Taxes In The United States – Wikiwand

Missouri Sales Tax – Small Business Guide Truic

News Flash Springfield Mo Civicengage

In A City In Ohio The Sales Tax Rate Is 725 Complete The Table To Show The Sales Tax And The – Brainlycom

News Flash Springfield Mo Civicengage

How To Calculate Cannabis Taxes At Your Dispensary