This notice is intended to help you decide whether to do such a rollover. Special rules that only apply in certain circumstances are described in the “special rules and options” section.

2

This notice is intended to help you decide whether to do such a rollover.

Special tax notice 401k rollover. For more information on special rollover rights related to the u.s. Generally, neither a direct rollover nor a payment to you can be made until at least 30 days after your receipt of this notice. Rules that apply to most payments from a plan are described in the “general information about rollovers” section.

This notice is intended to help you decide A direct rollover is a direct payment of the amount of your plan benefits to a traditional ira or an eligible employer plan that will accept it. Usually, it is included along with the distribution form.

Or if your payment is from a designated roth account, to a roth ira or designated roth account in an employer plan. Or if your payment is from a designated roth account to a roth ira or designated roth account in an employer plan. Special tax notice regarding plan payments your rollover options you are receiving this notice because all or a

If you are under age 59½ and do not do a rollover, you will also have to pay a 10% additional income tax on early distributions (generally, You may obtain financial projections based upon your account balance by. This notice describes the rollover rules that apply to payments from the plan.

How can a rollover affect my taxes? Special tax notice regarding your rollover options you are receiving this notice because all or a portion of a payment you are receiving from the retirement systems of alabama (the plan) is eligible to be rolled over to an ira or an employer plan. You are receiving this notice because all or a portion of a payment you are receiving from the plan is eligible to be rolled over to an ira or an employer plan;

Armed forces, see irs publication 3, armed forces’ tax guide. You also may have special rollover rights if you were affected by a federally declared disaster (or similar event), or if you received a distribution on account of a disaster. Where these rules differ, based on whether the payment is from a designated roth.

You are receiving this notice because all or a portion of a payment you are receiving is eligible to be rolled over to an ira or an employer plan. Thus, after receiving this notice, you have at least 30 days to consider whether or not to have your withdrawal directly rolled over. Part four contains a special tax notice, required by the irs, that explains the tax treatment of your plan payment from a designated roth account and describes the rollover options available to you.

This notice describes the rollover rules that apply to payments from the plan that are not from a designated roth account (a type You can choose a direct rollover of all or any portion of your payment that is an eligible rollover distribution, as described in part i above. You will be taxed on a payment from the plan if you do not roll it over.

Not a designated roth account: View 401k schwab distribution process.pdf from math ii at germantown high school. Your rollover options this notice is provided to you because all or part of the payments that you may receive from the plan may be eligible for rollover to an ira or an eligible employer plan.

That means the notice doesn’t have to be provided until the participant elects a distribution. Special tax notice regarding retirement plan payments — your rollover options you are receiving this notice because all or a portion of a payment you are receiving from the_____[insert name of plan] (the “plan”) is eligible to be rolled over to an ira or an employer plan. While the tax code allows plans to create their.

Special tax notice your rollover options. A different notice is provided for payments from a designated roth account. The special tax notice, also called a rollover notice or 402(f) notice, must be furnished to plan participants any time all or a part of a distribution is eligible for rollover.

This notice is intended to help you decide whether to do such a rollover. Rollover the balance) and will no longer be invested in the investment options available under the plan. The payment amounts indicated in this notice are only examples.

You are receivingthis notice because all or a portion of a payment you are receiving from the plan is eligible to be rolled over to either an ira or an employer plan; This notice is intended to help you decide whether to do such a rollover. Special tax notice your rollover options you are receiving this notice because all or a portion of a payment you are receiving from the plan is eligible to be rolled over to either an ira or an employer plan;

This notice is intended to help you decide whether to do such a rollover. This notice is intended to help you decide whether to do such a rollover. You are not taxed on any taxable portion of your

The attached special tax notice explains the federal income tax consequences of eligible rollover distributions and the types of retirement plans which may receive such distributions. Special tax notice your rollover options.

2

Nbfidelitycom

2

Special Tax Notice – Prudential Retirement

2

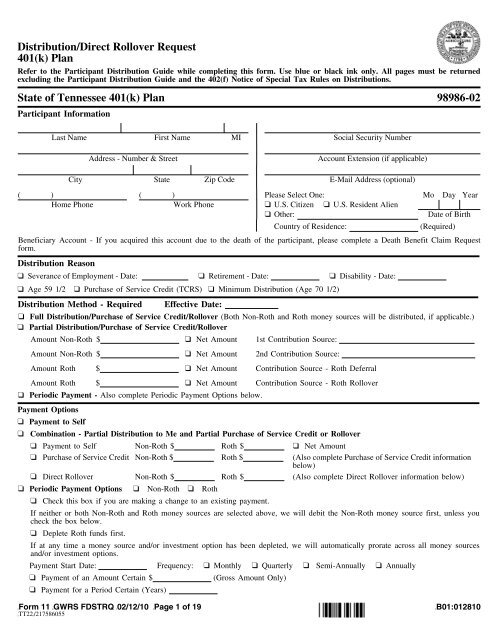

Distributiondirect Rollover Request 401k Plan State Of – Fascore

Your Rollover Options Tax Notice – Visa

Irs 402f Special Tax Notice

2

2

2

Seafarersorg

Eipcorpcom

Jdrurypartnerscom

Gaconnectcom

Seafarersorg

2

2

2