The south dakota sales tax rate is currently %. The south dakota sales tax rate is currently %.

What Is Sales Tax Nexus – Learn All About Nexus

Use south dakota department of revenue online services for fast, easy and secure completion of dor transactions.

South dakota sales tax rate lookup. As of march 1, 2019, marketplace providers who meet certain thresholds must obtain a south dakota sales tax license and pay applicable sales tax. The winning bidder is the one willing to pay the most for the tax lien. Depending on local municipalities, the total tax rate can be as high as 6.5%.

To calculate sales and use tax only. Depending on where the property is located, the homeowner has approximately three (3) or four (4) years from the date the tax lien certificate was. Counties in south dakota collect an average of 1.28% of a property's assesed fair market value as property tax per year.

This is the total of state, county and city sales tax rates. The olivet sales tax rate is %. The 6.5% sales tax rate in elk point consists of 4.5% south dakota state sales tax and 2% elk point tax.

The south dakota (sd) state sales tax rate is currently 4.5%. The county sales tax rate is %. In south dakota, tax collector's sell tax lien certificates to the winning bidders at the delinquent property tax sales.

You can print a 6.5% sales tax table here. Who this impacts marketplace providers are required to remit sales tax on all sales it facilitates into south dakota if the thresholds of 200 or more transactions into south dakota or $100,000 or more in sales to south dakota customers are met. 6.5% is the highest possible tax rate ( alcester, south dakota) the average combined rate of every zip code in south dakota is 5.076%.

There is no applicable county tax or special tax. 4% is the smallest possible tax rate ( meckling, south dakota) 4.5%, 5.5% are all the other possible sales tax rates of south dakota cities. 4% lower than the maximum sales tax in sd.

In 2020, the average unemployment tax rate paid by experienced employers was 1.13 percent. A south dakota property records search locates real estate documents related to property in sd. Has impacted many state nexus laws and sales tax collection requirements.

The south dakota state sales tax rate is 4%, and the average sd sales tax after local surtaxes is 5.83%. Sales tax is imposed on the sale of goods and certain services in south carolina. The 2018 united states supreme court decision in south dakota v.

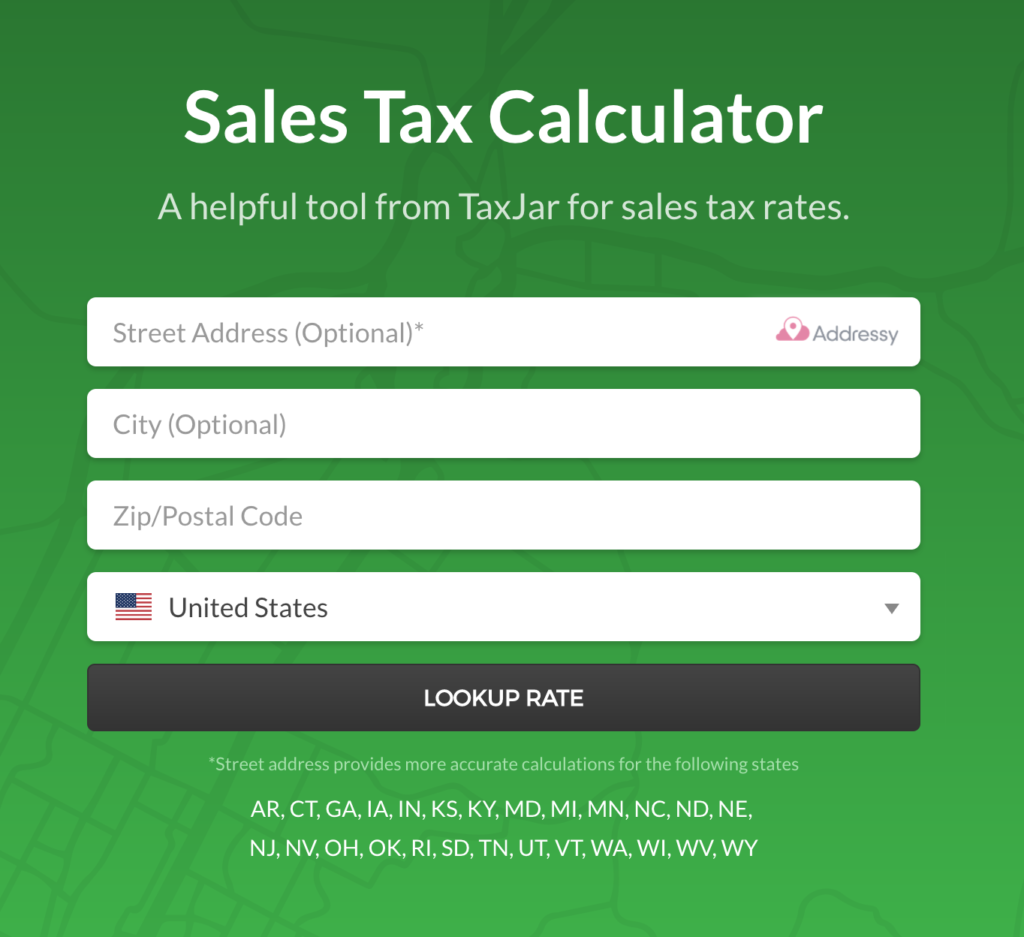

With local taxes, the total. When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. None of the cities or local governments within dakota county collect additional local sales taxes.

31 rows the state sales tax rate in south dakota is 4.500%. Public property records provide information on land, homes, and commercial properties, including titles, property deeds, mortgages, property tax assessment records, and other documents. What is south dakota's sales tax rate?

Employers in south dakota pay unemployment tax on the first $15,000 in wages paid to each employee during a calendar year. South dakota municipalities may impose a municipal sales tax, use tax, and gross receipts tax. The minimum combined 2021 sales tax rate for tea, south dakota is.

South dakota has a statewide sales tax rate of 4.5%, which has been in place since 1933. Tax amount varies by county. South dakota sales tax details.

For tax rates in other cities, see south dakota sales taxes by city and county. Generally, all retail sales are subject to the sales tax. South dakota has a 4.5% statewide sales tax rate , but also has 193 local tax jurisdictions (including cities, towns, counties, and special districts) that collect.

South dakota has state sales tax of 4.5% , and allows local governments to collect. Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 6%; The dakota county sales tax is 0.5%.

The tea sales tax rate is %. What is the sales tax rate in tea, south dakota? What rates may municipalities impose?

South dakota state rate (s) for 2021. The south dakota sales tax and use tax rates are 4.5%. This level of accuracy is important when determining sales tax rates.

South dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax The county sales tax rate is %. The median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00.

Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax. The statewide sales and use tax rate is six percent (6%). Use this search tool to look up sales tax rates for any location in washington.

The south dakota department of revenue administers these taxes.

2

Nebraska Sales And Use Tax Rates Lookup By City Zip2tax Llc

Paypal Sales Tax – Taxjar

Sd Sales Tax Rates

Kansas Sales And Use Tax Rates Lookup By City Zip2tax Llc

Sd Sales Tax Rates

Historical South Dakota Tax Policy Information – Ballotpedia

North Carolina Sales Tax – Small Business Guide Truic

Sd Sales Tax Rates

Wyoming Sales And Use Tax Rates Lookup By City Zip2tax Llc

Avalara Salestax Free Sales Tax Calculator Rate Lookups Sales Tax Tax Map

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

2

Sales Use Tax South Dakota Department Of Revenue

Land For Sale In Mauritius South Apartment For Rent In Mauritius Quatre Bornes

South Dakota – Sales Tax Handbook 2021

Border Sales Tax Workshops North Dakota Office Of State Tax Commissioner

Sd Sales Tax Rates