Excise tax calculation gross receipts (do not deduct out any tax before. This includes repair or remodeling of existing real property or the construction of a new project.

2

This includes contractors who repair or remodel existing real.

South dakota excise tax license. There are also excise taxes on activities, such as on wagering or on highway usage by trucks. This book is designed to assist licensees in better understanding the south dakota sales and use tax laws, including the collection and remittance of the tax. Sales and use tax is an essential part of the south dakota tax structure and the more.

What taxes do you pay in south dakota? The south dakota department of revenue requires all contractors who enter “into a contract for construction services” to carry a south dakota contractor’s excise tax license. “the contractors’ excise tax is deposited into the general fund, which is then used to fund various services that benefit the.

You may also have to adhere to south dakota’s 2% excise tax on the gross receipts of your contracting services. Who this impacts marketplace providers are required to remit sales tax on all sales it facilitates into south dakota if the thresholds of 200 or more transactions into south dakota or $100,000 or more in sales to south dakota. Assistant attorney general yvette lafrentz told appellate judges that contractors working in south dakota are licensed by the state, and whether they’re working on or off the reservation, paying excise tax is a condition of that license.

Please complete the following form and submit it to our. Total state tax due add lines 5.2 and 6.2 1. For all general contracting companies operating in south dakota, you will have to obtain a business and occupational license and register for tax identification numbers.

Sales, use, and contractors’ excise tax licenses: Contractor's excise tax is imposed on the gross receipts of all prime contractors engaged in. Snow removal, lawn care or consulting service.

Find a variety of tools and services to help you file, pay, and navigate south dakota tax laws and regulations. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. 10% (.10) of the tax liability (minimum $10.00 penalty, even if no tax is due) is assessed if a return is not received within 30 days following the month the return is due.

Do not staple or paper clip. Engages in business under this chapter without obtaining a contractor's excise tax license after having been notified in writing by the secretary of revenue that the person is a contractor subject to the provisions of the contractors' excise tax laws is. Fixture to real property must have a south dakota contractor's excise tax license.

In addition to education or experience, your local government will probably require that you pass a test based on your. The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's excise tax or use tax levied by the state of south dakota. More information about the contractors excise license is available from the department of revenue.

South dakota requires contractors to pay 2% of gross receipts from construction projects as an excise tax. The business has gross sales into south dakota exceeding $100,000; South dakota law also requires any business without a physical presence in south dakota to obtain a south dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year:

Repealed by sl 2007, ch 65, § 6. Construction services include the construction, building, installation, and remodeling of real property. South dakota state treasurer please write your.

One of the major components of the excise program is motor fuel. Excise taxes are often included in the price of the product. The first buyer is exempt if the dealer has paid the 4% excise tax and licensed a south dakota titled vehicle according to exemption 36.

Do not have a sales tax license. As of march 1, 2019, marketplace providers who meet certain thresholds must obtain a south dakota sales tax license and pay applicable sales tax. The check to the return.

Any person entering into a contract for construction services must have a south dakota contractors’ excise tax license. This application allows for the renewal of the following alcohol and lottery licenses. South dakota’s state sales tax rate is 4.50%.

A suppliers license is required if your business owns fuel within a pipeline system and can withdraw that fuel or authorize its withdrawal at a terminal located within south dakota or, if your business owns fuel within a pipeline system located outside of south dakota, can withdraw or authorize withdrawal of that fuel for sale, use or storage in south dakota and. You’ll have to apply online before you try to get a contractor’s license. Businesses who would like to apply for reinstatement with the secretary of state’s office must first receive a tax clearance certificate from the department of revenue.

Gas Prices States With The Highest And Lowest Gas Taxes

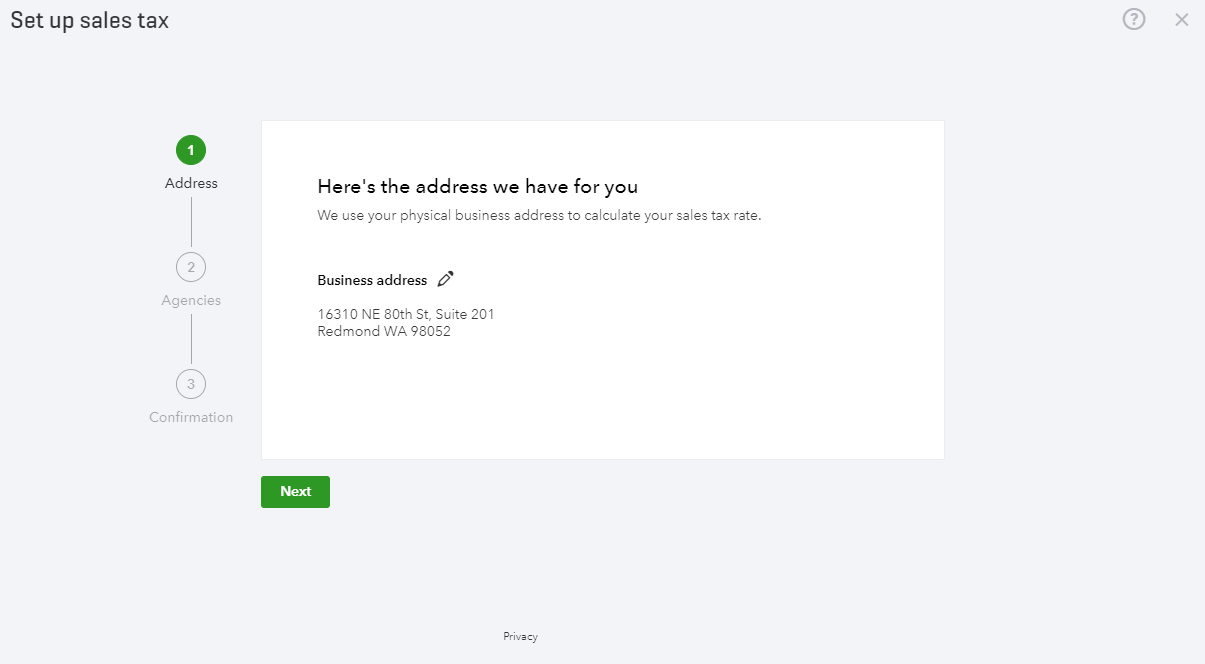

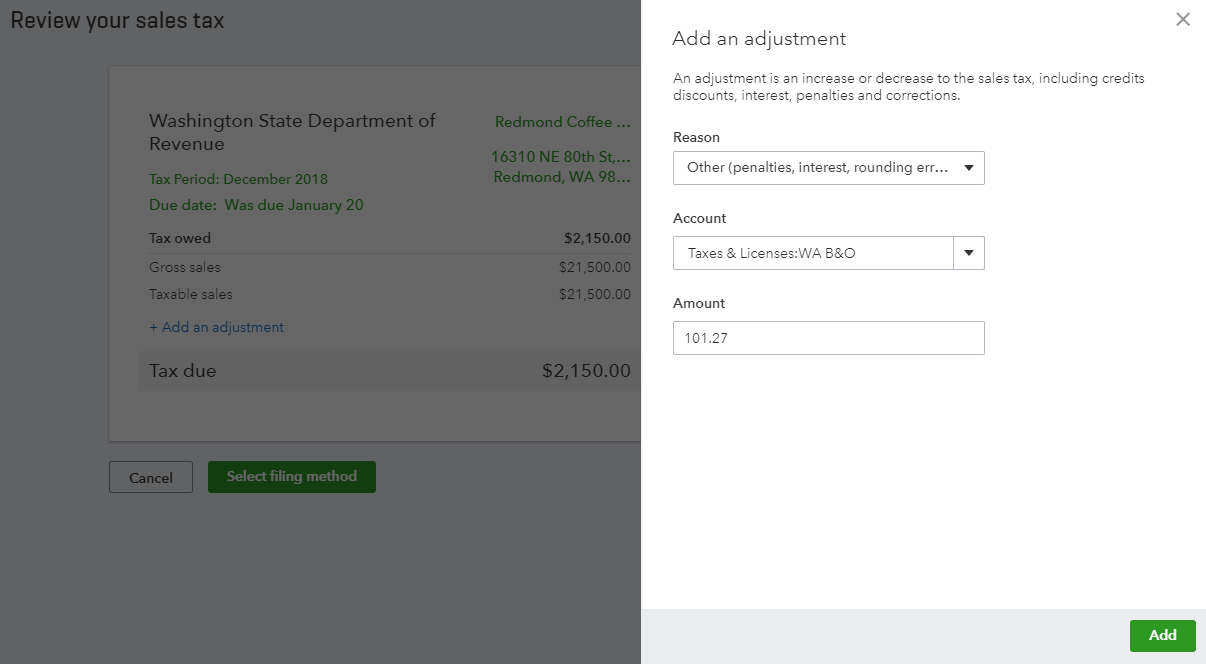

How To Record Washington State Sales Tax In Quickbooks Online – Evergreen Small Business

Blog News Resources And Legal Tips Gordon Law Group

How To Record Washington State Sales Tax In Quickbooks Online – Evergreen Small Business

Penn Fierce Iii Spinning Fishing Reel – Walmartcom Spinning Reels Fishing Reels Spinning

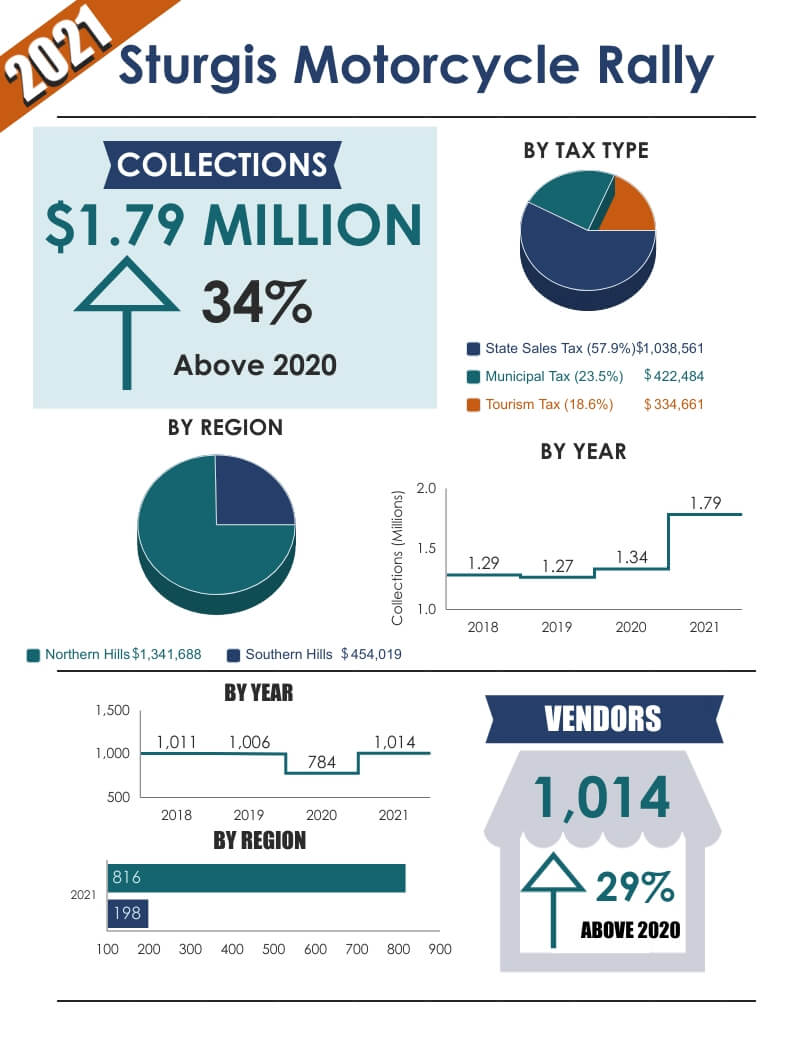

Tax Revenue Scales To 179 Million At 2021 Sturgis Motorcycle Rally South Dakota Department Of Revenue

Blog News Resources And Legal Tips Gordon Law Group

Municipal Tax South Dakota Department Of Revenue

What Is Excise Duty And How Is It Different From Sales Tax Bizfilings

Municipal Tax South Dakota Department Of Revenue

Blog News Resources And Legal Tips Gordon Law Group

2

Pin On Limited Liability Company Llc

2

Tax Collections Bouncing Back At 2021 South Dakota State Fair South Dakota Department Of Revenue

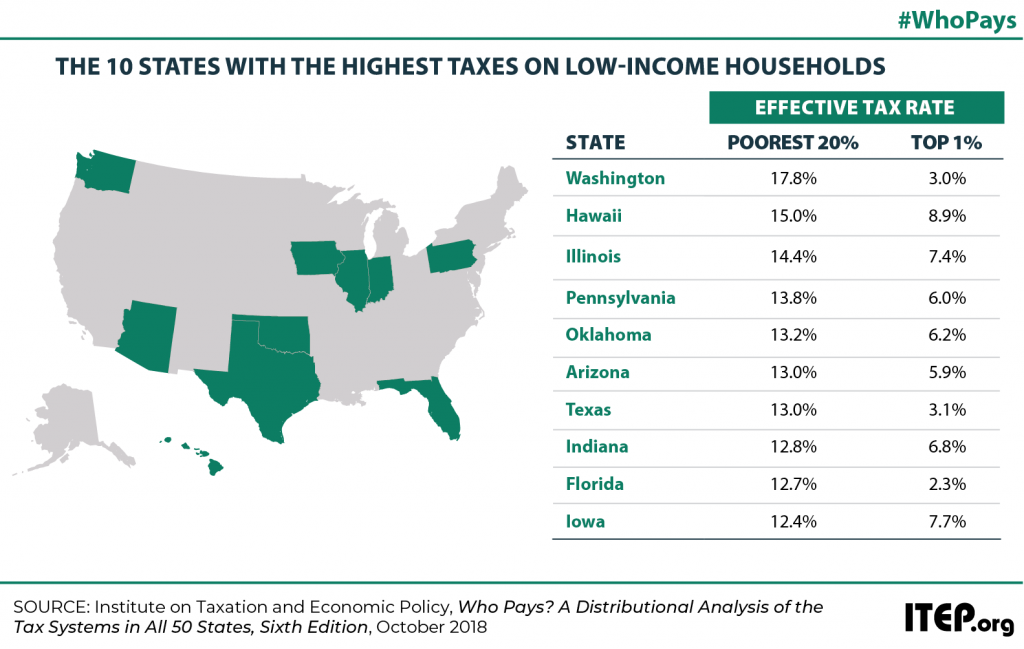

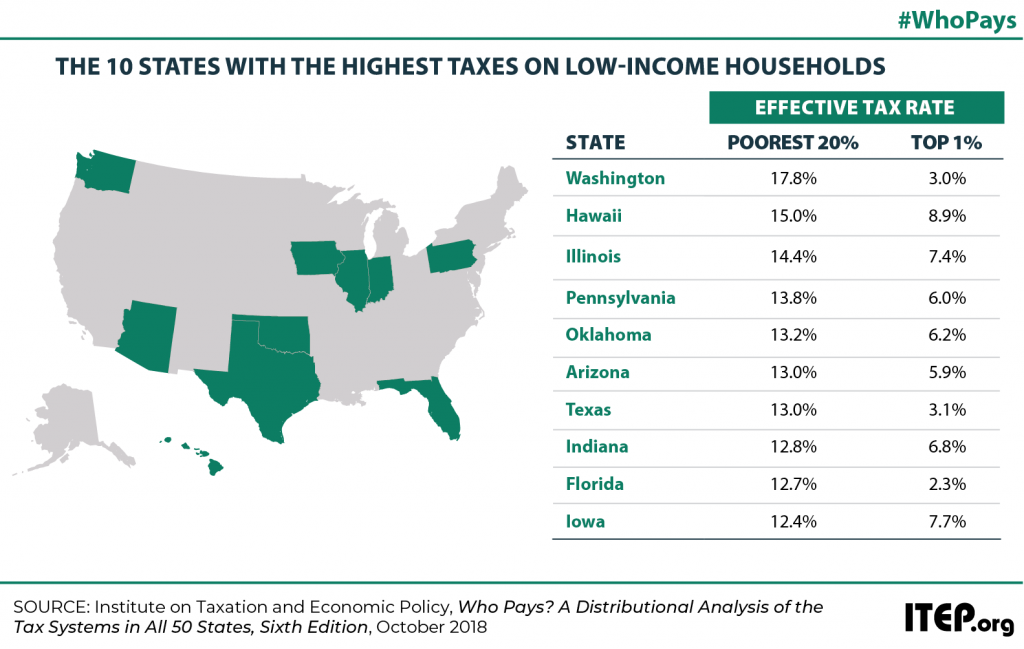

State Tax Codes As Poverty Fighting Tools 2019 Update On Four Key Policies In All 50 States Itep

2

Fyjwbg1eisdimm

Californians Fed Up With Housing Costs And Taxes Are Fleeing State