This means that the estate pays the taxes owed to the government, rather than the beneficiaries paying. You should also keep in mind that some of your property won’t technically be a part of your estate.

South Carolina Sales Tax – Taxjar

According to the law of succession in south africa, inheritance tax is payable within one year from the date of death, or 30 days from date of assessment if you complete the assessment within one year of the death date.

South carolina inheritance tax 2021. The top estate tax rate is 16 percent (exemption threshold: Washington, oregon, minnesota, illinois, new york, maine, vermont, rhode island, massachusetts, connecticut, hawaii, and the district of columbia. Surviving spouses are always exempt.

There are both federal estate taxes and state estate taxes. The internal revenue service (irs) requires estates to exceed $11.4 million to file a. For deaths that occur in or after 2025, there will be no.

Eight states and the district of columbia are next with a top rate of 16 percent. Puerto rico tax forms are sourced from the puerto rico income tax forms page, and are updated on a yearly basis. However, the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies.

There are no inheritance or estate taxes in south carolina. If you don’t meet these deadlines, an interest rate of 6% on late payments may be. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

No estate tax or inheritance tax No estate tax or inheritance tax. State inheritance tax rates range from 1% up to 16%.

Data were drawn from mcguire woods llp, “state death tax chart” and indicate the presence of an estate or inheritance tax as of january 1, 2021. Unlike some other states, there are no inheritance or estate taxes in south carolina. It is one of the 38 states that does not have either inheritance or estate tax.

Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. April 14, 2021 by clickgiant. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island:

What are the estate taxes in south carolina? Large estates may be subject to the federal estate tax, and you may need to pay inheritance if you inherit property from someone who lived in another state. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million.

New jersey, nebraska, iowa, kentucky, and pennsylvania. This doesn’t eliminate other expenses related to estate planning expenses, such as inheritance tax that might come from another state or a. Paying inheritance tax in south africa.

Make sure to check local laws if you’re inheriting something from someone who lives out of state. Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024. The top estate tax rate is 16 percent (exemption threshold:

Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15% and 19%. The great state of maryland collects both. South carolina does not assess an inheritance tax, nor does it impose a gift tax.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. South african inheritance prior to march 2021. Twelve have an estate tax:

There is no inheritance tax in south carolina. Usually, the taxes come out of what’s given in the inheritance or are paid for out of pocket. If you have to pay inheritance tax.

South carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. Before the official 2021 puerto rico income tax rates are released, provisional 2021 tax rates are based on puerto rico's 2020 income tax brackets. But if you live in south carolina and you receive an inheritance from another estate, you could be subject to inheritance tax in that state.

The very basics are that only five states apply an inheritance tax: However, you are only taxed. Where a south african living overseas didn’t have an sa id (either lost or never issued), financial emigration (fe) was an.

Estate taxes generally apply only to wealthy estates, while inheritance taxes. However, the federal government still collects these taxes, and you must pay them if you are liable. In canada, there is no inheritance tax.

The 2021 state personal income tax brackets are updated from the puerto rico and tax foundation data. South carolina does not levy an estate or inheritance tax. South carolina does not tax inheritance gains and eliminated its estate tax in 2005.

There are seven states that assess an inheritance tax, so make sure to ask your accountant if you think you may be subject to it.

Revealed Living In South Carolina Vs North Carolina This May Surprise You – Youtube

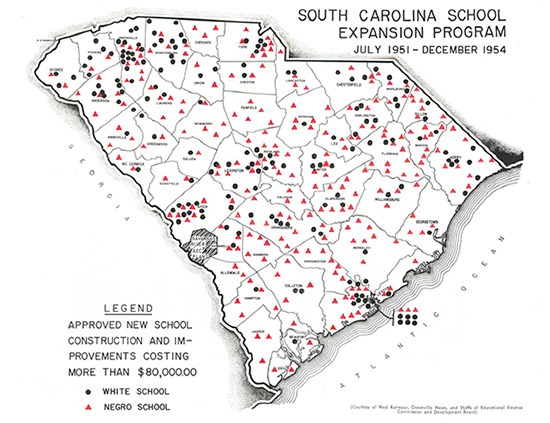

Separate But Equal South Carolinas Fight Over School Segregation Teaching With Historic Places Us National Park Service

File Pay – Individual

Map Of South Carolina Interstate Highways With Rest Areas And Welcome Centers

Map Of South Carolina Lakes And Rivers

South Carolina Vs North Carolina – Which Is The Better State Of The Carolinas

Separate But Equal South Carolinas Fight Over School Segregation Teaching With Historic Places Us National Park Service

Sc Earned Income Tax Credit Increases In 2020

2021 Best Places To Live In South Carolina – Niche

South Carolina Real Estate Transfer Taxes An In-depth Guide For 2021

South Carolina Military And Veterans Benefits The Official Army Benefits Website

South Carolina Retirement Tax Friendliness – Smartasset

South Carolina Inheritance Laws – King Law

The Ultimate Guide To South Carolina Real Estate Taxes

South Carolinas 2021 Tax Free Weekend Kicks Off On Friday August 6

Blush Gold Printable Wedding Invitation Template Floral Etsy In 2021 Wedding Invitation Templates Wedding Invitations Diy Printable Wedding Invitations

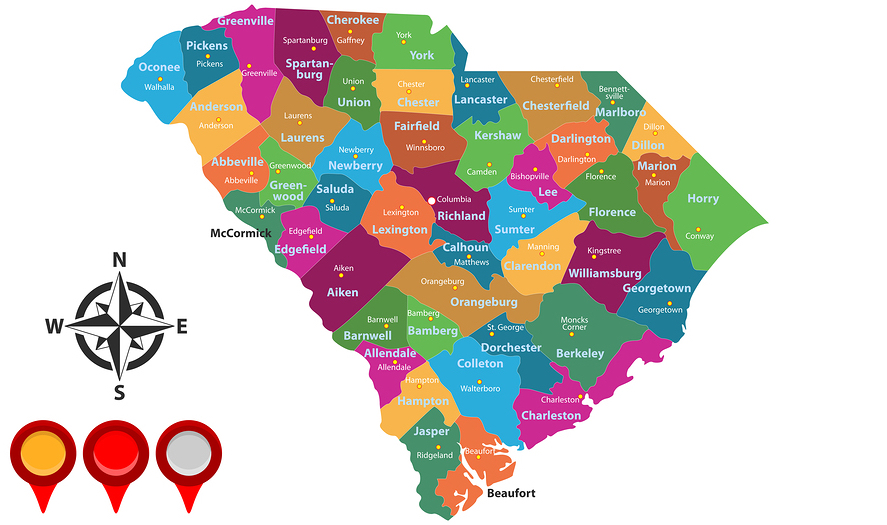

South Carolina County Maps

Relocating To Sc Best Cities To Live In South Carolina

See How South Carolinas Counties Are Growing And Shrinking – Gem Mcdowell Law 843-284-1021 Estate-business-law-local