In 2021, the social security tax limit is $14 Your employer would contribute an additional $8,853.20 per year.

What Is The Social Security Tax Limit Social Security Us News

If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Social security tax limit 2021. If you earn $142,800 per year in 2021, the maximum you'll pay in social security taxes is 6.2% of your income, or $8,853.60 per year. Quarter of 2019 through the third quarter of 2020, social security and supplemental security income (ssi) beneficiaries will receive a 1.3 percent cola for 2021. As of 2021, social security taxes no longer apply to social security benefits that exceed $142,800.

That's because the employee wages are taxed only to a certain limit. For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their social security benefits. The social security tax limit is the maximum amount of earnings subject to social security tax.

For 2021, social security and medicare taxes also apply to wages paid to household employees if the. Be aware that this doesn’t apply to the 1.45% medicare tax. In addition, a person’s future benefit amount does not increase beyond the maximum taxable earnings limit.

Currently, the ss filing window is between 62 and 70. If your combined income was more than $34,000, you will pay taxes on up to 85% of your social security benefits. The amount liable to social security tax is capped at $142,800 in 2021 but will rise to $147,000 in 2022.

The calculation for social security tax in 2021 is much easier when compared to previous years because it only factors in social security wages and social security benefits. An increase from $142,800 for 2021, the wage base limit applies to earnings subject to the tax, known officially as the old age, survivors, and disability insurance (oasdi) tax. This amount could mean a higher tax bill for some high earners in 2022.

The maximum amount of an individual's taxable earnings in 2022 subject to social security tax will be $147,000, the social security administration (ssa) announced wednesday. This means that any income earned above this limit in the calendar year will not be subject to social security taxes. In 2021, you will pay social security taxes on all of your income up to $142,800.

The maximum amount of social security tax an employee will have withheld from their paycheck in 2022 will be $9,114. Each year, the federal government sets a limit on the amount of earnings subject to social security tax. This amount is known as the maximum taxable earnings and changes each year.

If you earned more than the maximum in any year. The maximum amount of earnings subject to social security tax will rise 2.9% to $147,000, from $142,800 in 2021. The social security taxable maximum is $142,800 in.

You can’t file before 62 and it doesn’t make sense to file after 70. That means a bigger tax bill. Here’s how this changes the benefits and reductions if we look at filing at the earliest age and at the latest age.

Each year, the federal government sets a limit on the amount of earnings subject to social security tax. What is the social security tax limit? 2021 social security tax limit in 2021, the wage base that is subject to social security taxes hits a limit at $142,800.

In 2021, the social security tax limit is $142,800, and in 2022, this amount is $147,000. Tax rate 2020 2021 employee In 2021, the social security tax limit is $142,800, and in 2022, this amount is $147,000.

The maximum earnings that are taxed has changed over the years as shown in the chart below. The social security taxable maximum is $142,800 in 2021. Other important 2021 social security information is as follows:

The change to the taxable maximum, called the contribution and benefit base , is based on. In 2021, the social security tax limit. 1, 2021, the maximum earnings subject to the social security payroll tax will increase by $5,100 to $142,800—up from the.

How the 2021 changes will affect social security benefits. The social security taxable maximum is adjusted each year to keep up with changes in average wages. You can’t pay more than $18,228 in taxes for social security in 2021.

Each year, the federal government sets a limit on the amount of earnings subject to social security tax. The social security tax limit is the maximum amount of earnings subject to social security tax. The maximum amount of earnings subject to the social security payroll tax increase in 2021 to $142,800, up from $137,700 in 2020.

In 2021, the social security tax limit is $142,800, and in 2022, this amount is $147,000. The 2021 tax limit is $5,100 more than the 2020 taxable maximum of $137,700 and $36,000 higher. Social security recipients will also receive a slightly higher.

Earnings above $142,800 will not be subject to social security tax.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Xpc9kuks2cth7m

How Much Does An Employer Pay In Payroll Taxes Examples More

Salary Taxes Social Security

Social Security Wage Base Increases To 142800 For 2021

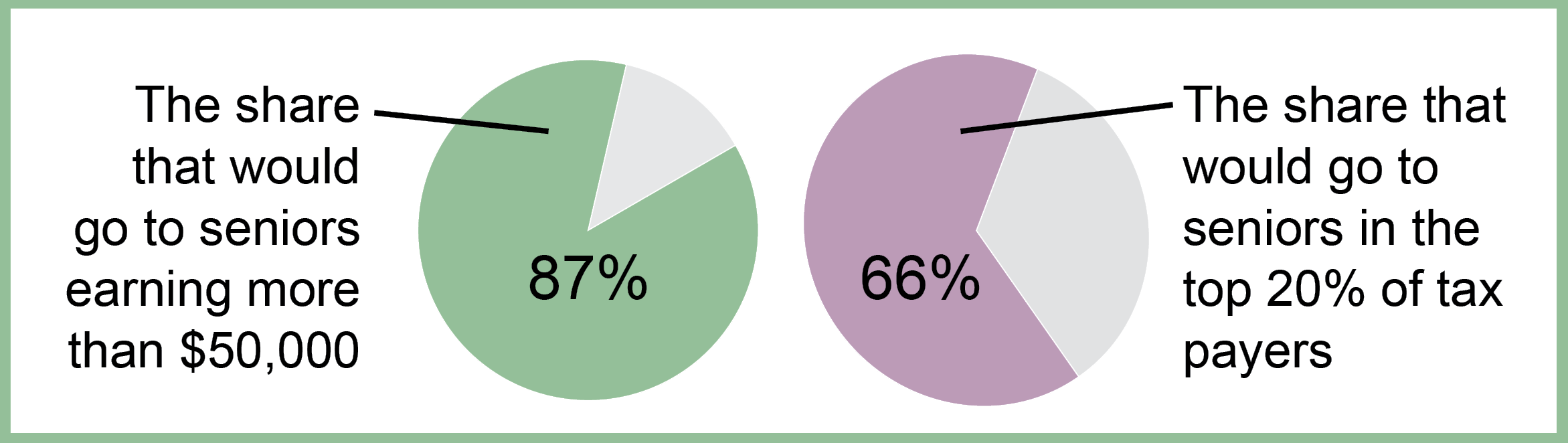

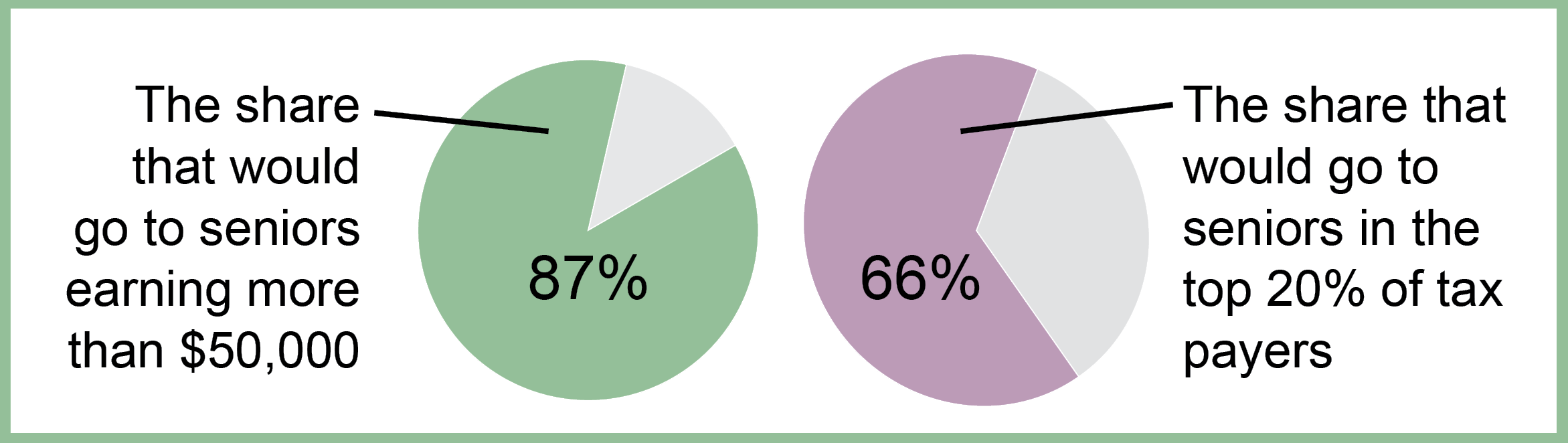

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap – Ascom

How Does Social Security Work The Motley Fool

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Full Retirement Age For Getting Social Security The Motley Fool

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security 2100 Act What Would Change And When Marca

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap – Ascom

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

![]()

How To Earn 3895 In Social Security Benefits Every Month In 2021

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62