The social security tax limit in 2021 is $8,853.60. If you are married filing separately, you will likely have to pay taxes on your social security income.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social security tax is paid as a percentage of net earnings and has an annual limit.

![]()

Social security tax limit. The most income that is subject to the social security payroll tax is a maximum of $118,500 in both 2015 and 2016. This could result in a higher tax bill for some taxpayers. Historical past of social safety tax limits.

The social security tax rate will only be applied up to the limit of 137700 the social security tax limit for 2020 is 137700. The medicare portion (hi) is 1.45% on all earnings. In 2021, the maximum social security tax is $142,800.

In 2016, an employee would pay a maximum amount of social security. You aren’t required to pay the social security tax on any income beyond the social security wage base. This means that you will not be required to pay any additional social security taxes beyond this amount.

The change to the taxable maximum, called the contribution and benefit base, is based on. If you earned more than the maximum in any year, whether in one job or more. Anything you earn over that annual limit will not be subject to social security taxes.

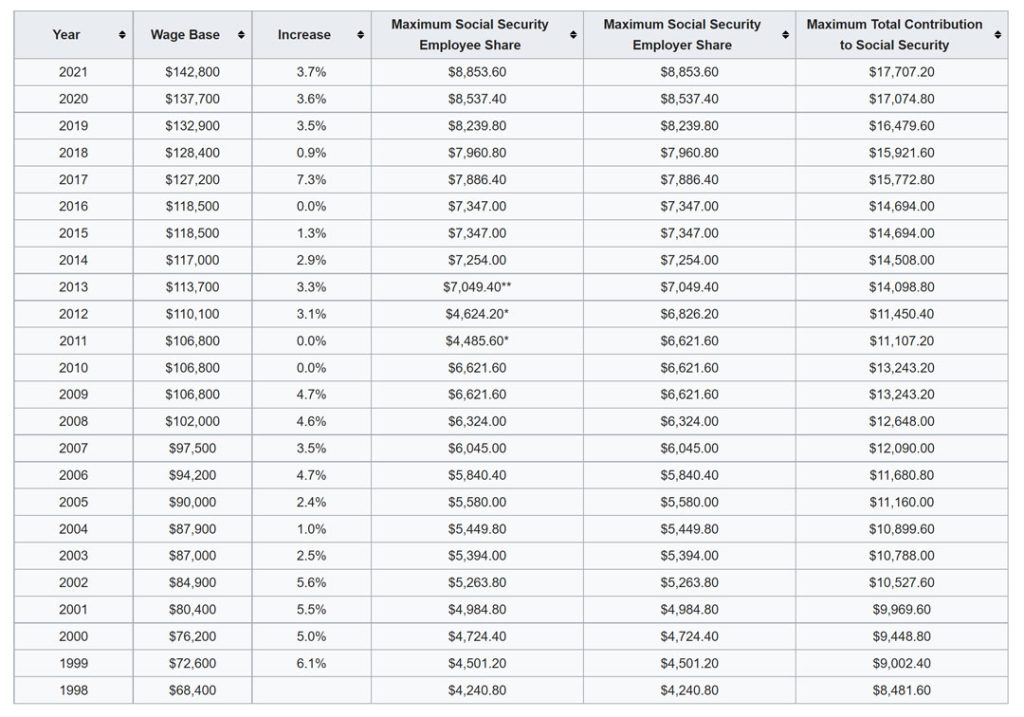

The maximum earnings that are taxed has changed over the years as shown in the chart below. It is also $36,000 more than the 2010 limit at $106,800. This limit is known as the social security wage base.

The social security wage base means that you’ll only ever pay social security taxes on. In 2021, the social security tax limit is $142,800, and in 2022, this amount is $147,000. Any income earned above that amount is not.

The social security portion (oasdi) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The social security tax limit is the maximum amount of earnings subject to social security tax. This also provides a foundation of income for retirees, disabled workers and their dependents, and survivors of deceased workers.

In 2022, the social security tax limit increased significantly, to $147,000. The social security maximum taxable amount is, which is adjusted each year in order to keep pace with the changes in average earnings. This could result in a higher tax bill for some taxpayers.

For 2021, the maximum taxable earnings limit is $142,800. There is no limit to the amount of medicare tax that can be due. However, there is an income limit to which the tax rate is applied.

This amount could mean a higher tax bill for some high earners in 2022. The maximum amount of social. What you need to know about the social security tax rate and limit.

In 2019, you aren’t required to pay the social security tax on any income you earn beyond $132,900. In 2021, this limit is $142,800, up from the 2020 limit of $137,700. The maximum amount of earnings subject to the social security payroll tax increase in 2021 to $142,800, up from $137,700 in 2020.

In addition, a person’s future benefit amount does not increase beyond the maximum taxable earnings limit. Workers pay a 6.2% social security tax on their earnings until they reach $142,800 in earnings for the year. However, you will never pay taxes.

8 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security. The 2021 tax cap is $5,100 higher than the 2020 taxable limit of $137,000. The 7.65% tax rate is the combined rate for social security and medicare.

In addition, your future benefit amount will not. Earnings above $142,800 will not be subject to social security tax. The social security tax limit is the maximum amount of earnings subject to social security tax.

Social security payroll tax limit for 2022. How has the social security tax limit changed over time? Nevertheless, not like the tax charge, the social safety tax restrict is adjusted yearly.

If that total is more than 32000 then part of their social security may be taxable. The social safety tax charge hardly ever adjustments—workers have been paying 6.2% since 1990. In 2022, the social security tax limit increased significantly, to $147,000.

How much you will get from social security.] The rise in the social security payroll tax threshold from $127,200 in 2017 to $147,000 in 2022 indicates a. Social security tax is paid as a percentage of net earnings and has an annual limit.

Medicare taxes are also collected at a rate of 1.45% for both employee and employer. As a result, in 2021 you’ll pay no more than $8,853.60 ($142,800 x 6.2%) in social security taxes. This amount is known as the maximum taxable earnings and changes each year.

This is collected by the social security administration for social security benefits in the form of payroll taxes. Also, as of january 2013, individuals with earned income of more than The amount liable to social security tax is capped at $142,800 in 2021 but will rise to $147,000 in 2022.

This means that, regardless of how much. The limit for joint filers is $32,000. If you earned more than $147,700 in 2021, you won’t have to pay any tax on the income above this limit.

In 2017, the social security administration has announced that it will be increased by 7.3 percent (an increase of $8,700), placing the maximum amount at $127,200. The social security tax rate is assessed on all types of income earned by an employee, including salaries, wages, and bonuses. What is the social security tax limit?

Calculating your social security income tax. The social security taxable maximum is $142,800 in 2021. If your social security income is taxable, the amount you pay in tax will depend on your total combined retirement income.

The social security taxable maximum is $142,800 in.

![]()

How To Earn 3895 In Social Security Benefits Every Month In 2021

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Ncpssm Payroll Taxes Payroll Social Security

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Policy For The Next Administration And The 117th Congress The Heritage Foundation

What Is The Social Security Tax Limit Social Security Us News

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Wage Base Increases To 142800 For 2021

Calculating Taxable Social Security Benefits – Not As Easy As 0 50 85 – Moneytree Software

How Much Social Security Tax Do I Pay The Motley Fool

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Wage Base 2021 And Estimation For 2022 – Uzio Inc

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap – Ascom