Total child tax credit payments between 2021 and 2022 could be up to $3,600 per kid. Many parents have been spendingthe money as soon as they get it on things like rent and uniforms, and already the payments have helped fewer children go.

Stimulus Update If Your Child Tax Credit Payment Was Less This Month This Could Be Why

The payments are due on the 15th of every month, so the september payment was expected to hit bank accounts or be sent to tens of millions of americans last wednesday.

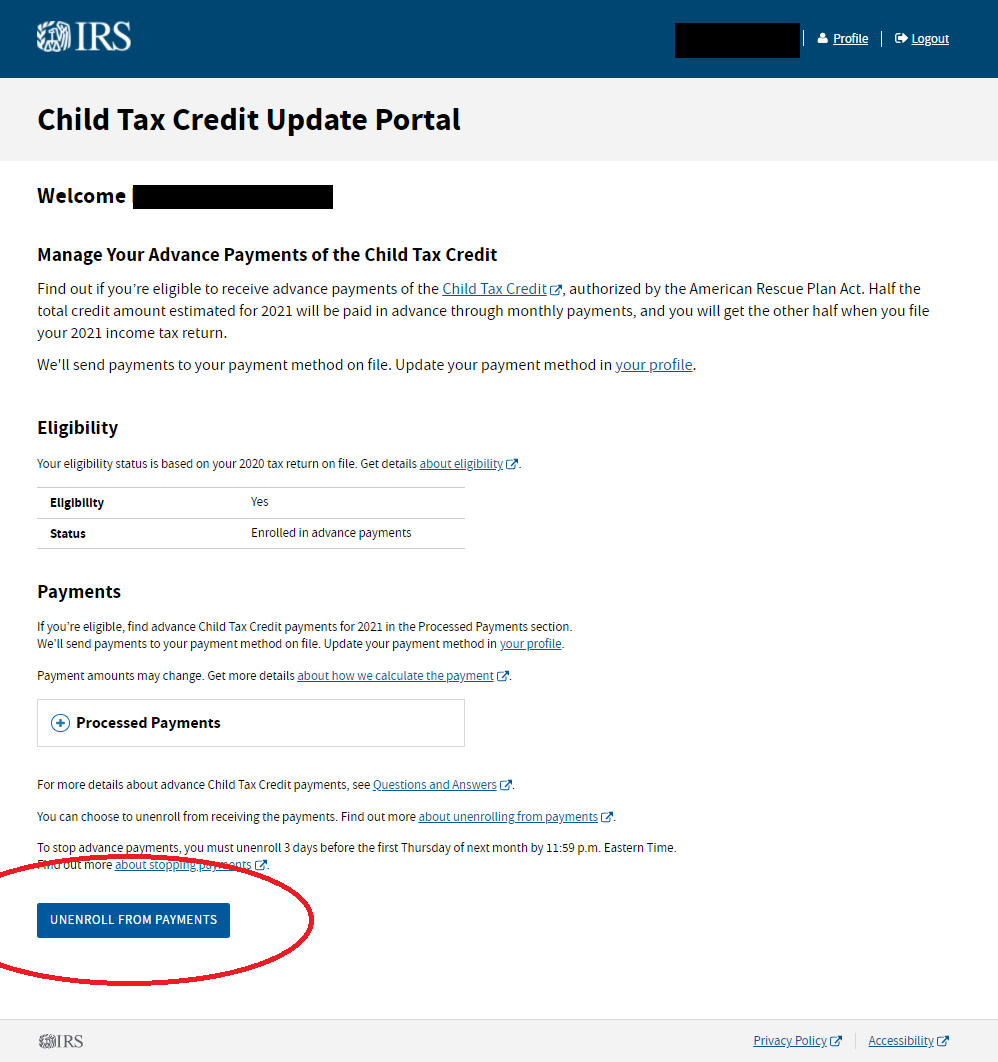

September child tax credit payment short. For parents of eligible children up to age 5, the irs will pay up to $3,600 for each kid, half as six advance monthly payments and half as a 2021 tax. September 17, 2021 — irs statement about the september advance child tax credit payments. There are reports, however, the september payment was short or did not come at all.

Families can receive 50% of their child tax credit. The third round of child tax credit payments from the internal revenue service (irs) goes out this week. (wjw) — while some parents didn’t receive the september child tax credit payment because of a glitch in the system last month, others did get a.

The first half of the credit is being delivered in monthly direct deposits, from july through december, of $300 for children under 6 and $250 for those aged 6 to 17. The irs sent out the third child tax credit payments on wednesday, sept. American families have complained that they have been shorted money in their september child tax credit payment.

Then subtract that from your regular monthly payment to get your expected payments for remaining months. After almost 10 days, parents are finally receiving child tax credit payments they should have gotten on sept. Millions of eligible families are currently receiving up to $300.

My october payment will now be $778 my november payment will now be $779 my december payment will now be $779 whatever you were overpaid in september, divide it by 3. Millions of eligible families received their second advance child tax credit payment last month and are due to receive their third payment on sept. In any case, guardians are asking when precisely the cash will show up.

Eligible households must have gotten their 3rd payment from the internal revenue service today of up to $250 or $300 per child. Here are the basic rules this time around: The third installment of the advance monthly payments of the child tax credit is set to hit the bank accounts of millions of americans on sept.

The internal revenue service (irs) has made 2021 advance child tax credit payments since july. The irs acknowledged the issue with the september payments in a short statement over the weekend. The monthly child tax credit payments of $500, along with the pandemic unemployment benefits, were helping keep his family of four afloat.

You'll need to print and mail the completed form 3911 from the irs (pdf) to start tracing your child tax credit payment. Under the american rescue plan, the maximum child tax credit rose to $3,000 from $2,000 per child for children over the age of 6 and it rose to $3,600 from $2,000 for children under the age of 6. You could be getting up to $300 for each kid under 6 years old.

Keep going month’s check came on august 13 for those with direct store, or before long for those ward on the u.s. The first half of the credit is being delivered in monthly direct deposits, from july through december, of $300 for children under 6 and $250 for those aged 6 to 17. September 17, 2021 this week, the irs successfully delivered a third monthly round of approximately 35 million child tax credits with a total value of about $15 billion.

Under the american rescue plan, the maximum child tax credit rose to $3,000 from $2,000 per child for children over the age of 6 and it rose to $3,600 from $2,000 for children under the age of 6. Here’s how to track it down “last week, the irs successfully delivered a third monthly round of approximately 35 million child tax.

Many families could be looking at an extra $450 a month or more, depending on the size of the family and the ages of the children. Last week, the irs began delivering the september installment of the advance child tax credit payment, but some families have yet to receive their stimulus checks. Angry parents took to twitter revealing that the money, which was due almost two weeks ago, has still have not been deposited in their accounts.

As a result, the irs released a statement last week about the issue. If you need help completing the form, contact your local tax consultant. The arp increased the 2021 child tax credit from a maximum of $2,000 per child up to $3,600.

The second half will come when families file their 2021 tax returns next year. Didn’t get your child tax credit? The credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17.

The installment, which had already been under controversy for being eight days late, arrived for some families hundreds of dollars short.

Child Tax Credit August Update How To Track It Online Marca

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc – Tas

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs – Fingerlakes1com

The Next Child Tax Credit Payment Pays Out Aug 13 Here Is What You Need To Know Forbes Advisor

October Child Tax Payments Were Sent Has Yours Arrived Forbes Advisor

Child Tax Credit Heres Why Your Payment Is Lower Than You Expected – The Washington Post

What To Know About The First Advance Child Tax Credit Payment

Wjcvtv2hodyx6m

Childtaxcredit – Twitter Search Twitter

Irs Child Tax Credit Payments Start July 15

Psa Didnt Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

November Child Tax Credit Deadline To Opt Out Near Irs Reveals Updated Payment Dates – Fingerlakes1com

Childtaxcredit – Twitter Search Twitter

Irs Number For Child Tax Credit How To Get Your Questions Answered – Cnet

Latest Child Tax Credit Payment Delayed For Some Parents – Cbs News

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Updates Why Are Some Ctc Payments Lower In October Marca