What is a schedule c? How to apply exemption under item 1 schedule c, sales tax (person exempted from payment of tax) order 2018 (formerly cj5) item 1, schedule c:

Form 1040 Us Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

The schedule c tax form is used to report profit or loss from a business.

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule c tax form meaning. Schedule c details all of the income and expenses incurred by your business, and the resulting profit or loss is included on schedule 1 of form 1040. Any registered manufacturer to import/purchase raw materials, components and packaging materials (excluding petroleum) exempted from the payment of sales tax. Departing alien income tax return for tax period or year beginning , 2021, and ending ,.

It is a form that sole proprietors sole proprietorship a sole proprietorship (also known as individual entrepreneurship, sole trader, or proprietorship) is a type of an unincorporated entity that is owned only (single owners of businesses) must fill out in the united states when filing their annual tax. Schedule c (form 990) is used by: Schedule c is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year.

However, you still need to complete a separate section if you claim expenses for a vehicle. Schedule c is a tax form used by most unincorporated sole proprietors to report their business income and expenses. As you can tell from its title, profit or loss from business, it´s used to report both income and losses.

In regards to united states tax form schedule c, it asks “did you materially participate in the operation. Using this book and schedule c (form 1040) may even help you find new deductions you weren’t aware of—deductions that will put real dollars in your pocket. You fill out schedule c at tax time and attach it to or file it electronically with.

If you have an estimated tax penalty, detail it here and file form 2220. Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. Artcoder august 30, 2014, 3:48am #1.

These organizations must use schedule c (form 990) to furnish additional information on political campaign activities or lobbying activities, as those terms are defined later for the various parts of this schedule. Application can be made online through. You can also use this book in conjunction with schedule c (form 1040) to organize your bookkeeping

Who should file a schedule c tax form? In this segment we'll provide an overview of form 1040, schedule c, profit or loss from business, and discuss how to calculate gross profit and gross income, show you how to identify and deduct expenses, and how to calculate net profit or loss. Your first name and initial.

Deductible, you can estimate your tax liability and find ways to reduce your taxes. Irs schedule c is a tax form for reporting profit or loss from a business. For instructions and the latest information.

This form omits a lot of the detail in the full schedule c and just asks for your total business receipts and expenses. Here’s a list of common schedules. File original and one copy.

Schedule c is the tax form filed by most sole proprietors. Items of income include money received as well as property or services received. A supplementary or explanatory form attached to a document such as a will or deed.

Section 501 (c) organizations, and. This is a plan that covers only you (or you and your spouse). It’s part of the individual tax return, irs form 1040.

Under the cash method, include in your gross income all items of income you actually or constructively received during the tax year. The form is titled “profit or loss from business (sole proprietorship).”. There’s also a more specific meaning for schedule that goes back hundreds of years:

Overview [music playing] [music playing] hello everyone, and welcome to schedule c and other small business taxes. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes.

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 1040-nr Us Nonresident Alien Income Tax Return Definition

Tax Schedule

What Was Your Income Tax For 2019 Federal Student Aid

Form 1099-nec For Nonemployee Compensation Hr Block

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K-1 Beneficiarys Share Of Income Deductions Credits Etc Definition

Tax Schedule

What Is Schedule A Hr Block

/1040x-3fa72efbba54446580f8dcbf8ec947e6.jpg)

Form 1040-x Amended Us Individual Income Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120-s Us Income Tax Return For An S Corporation Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040-sr Itemized Deductions Definition

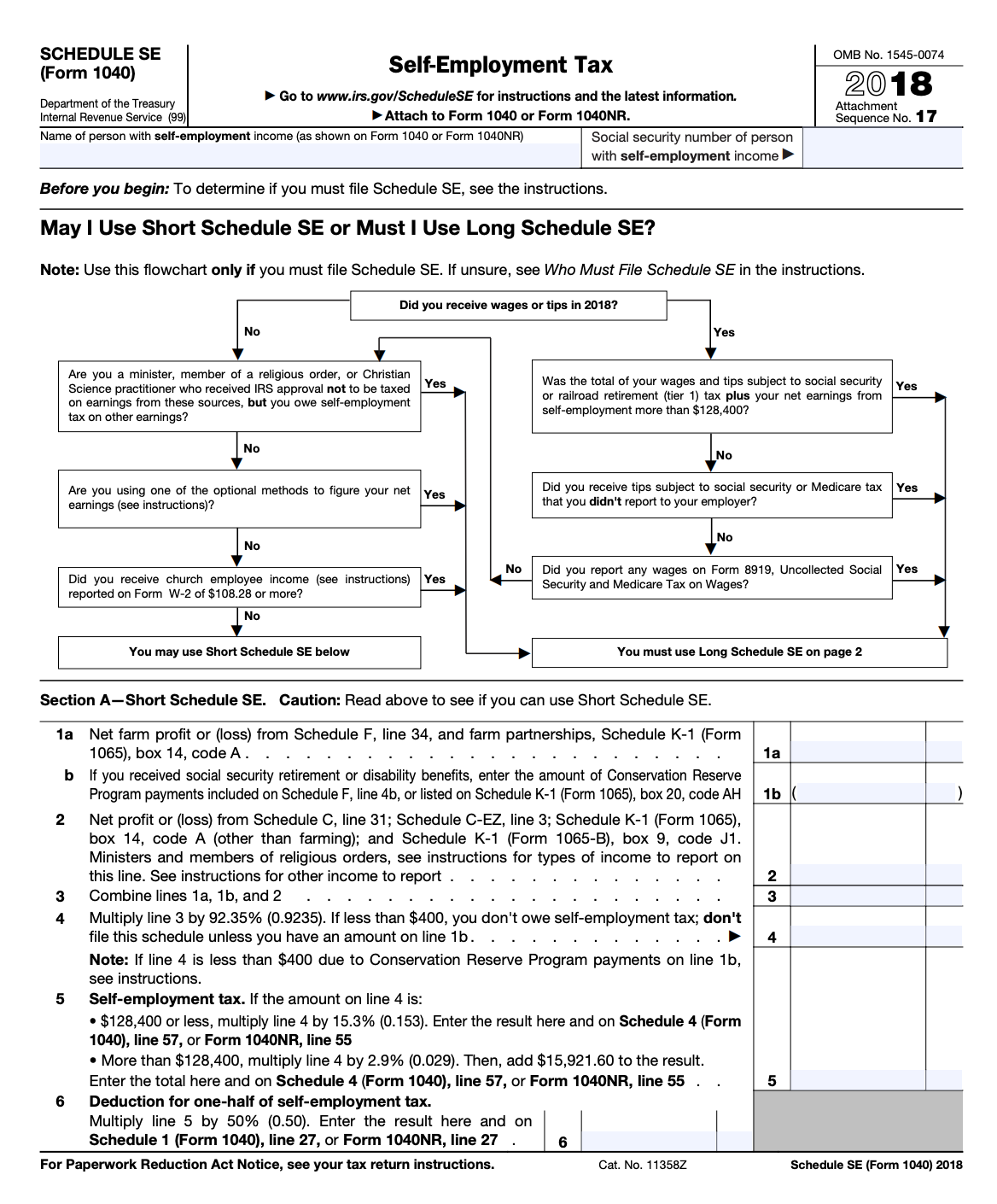

Schedule Se A Simple Guide To Filing The Self-employment Tax Form Bench Accounting

Schedule C Profit Or Loss From Business Definition

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040-sr Us Tax Return For Seniors Definition