The taxpayer certainty and disaster tax relief act of 2019 included retroactive tax relief for tax year 2018. Credit amount limited to 1/3 of total (b) carryover from prior year

Schedule C Also Known As Form 1040 Profit And Loss Is A Year-end Tax Form Used To Report Income Or Loss From A Sole Llc Taxes Tax Consulting Hobbies Quote

Health care information (pdf 100.6 kb) open pdf file, 139.28 kb, for.

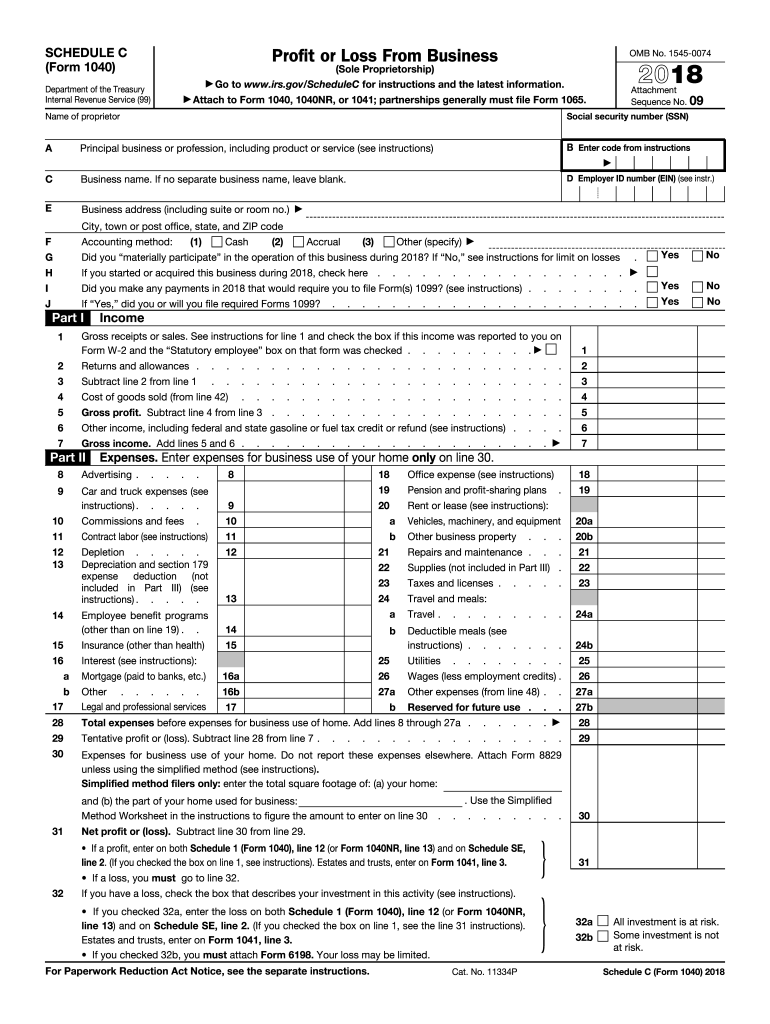

Schedule c tax form 2018. 97 rows 2018 form 1040 (schedule c) profit or loss from business (sole proprietorship). It is used by the united states internal revenue service for tax filing and reporting purposes. A schedule c is a supplemental form that will be used with a form 1040.

When entering expenses onto schedule c it doesn’t matter which line you put your expenses on. Other federal personal income tax forms. Schedule 1 (form 1040) 2018 a)) read aloud add notes additional income and adjustments to.

Enter here and include on form 1040,. The taxpayer certainty and disaster tax relief act of 2019. 7721183 1 218 s corporation tax credits c (100s) taxable year california schedule 2018 • (a)complete and attach all supporting credit forms to form 100s.

This form is for income earned in tax year 2020, with tax returns due in april 2021.we will update this page with a new version of the form for 2022 as soon as it is made available by the federal government. You must file your return by tuesday, april 17, 2018; This calculator can be found at :

Before signing your tax forms and sending them to the irs, use this checklist to spot potential errors on irs form schedule c profit or loss from business. This form describes your earnings and your tax return status, and it is utilized by the irs to gather your tax info. Massachusetts resident income tax return (pdf 263.87 kb) open pdf file, 465.86 kb, for.

Income tax return for cooperative associations for calendar year 2018 or tax year beginning, 2018, ending, 20 2018 form 1 instructions (pdf 465.86 kb) open pdf file, 100.6 kb, for. • to claim more than seven credits, attach schedule.

It requires the filer to fill the form with correct info. Attach form 6251 46 excess advance premium tax repayment. Instead, make the following two substitutions when using these 2018 instructions.

When saving or printing a file, be sure to use the functionality of adobe reader rather than your web browser. The 2018 instructions for schedule c (form 1040) are not being revised at this time. This form is known as a profit or loss from business form.

Schedule c — profit or loss from business (sole proprietorship) (chapter 5304). Attac h form 8962 47 add the amounts in the far right column. We last updated federal 1040 (schedule c) in january 2021 from the federal internal revenue service.

Irs form 1040 federal individual income tax return: This info is then used to figure out just how much tax you owe or to adjust your tax return in the event you. The form analyzes the earnings from the tax filer and calculates just how much to be paid as tax or refund.

Checklist for irs schedule c:

Schedule C Excel Template New Schedule C Spreadsheet Google Spreadshee Schedule C Excel Templates Appreciation Letter Templates

Fast Answers About 1099 Forms For Independent Workers – Updated For 2018 Fillable Forms Independent Worker 1099 Tax Form

Army Counseling Form 4856 Da Form 4856 Financial Counseling Example

12 Irs Non-stimulus Tax Rules Youll Need This Year Tax Rules Irs Tax Questions

The Us Federal Income Tax Process Income Tax Federal Income Tax Tax Forms

Google Image Result For Httpsbookstoregpogovsitesdefaultfilesstylesproduct_page_imagepubliccoversf1040sd Tax Forms Capital Gain Capital Gains Tax

Pin On Houston Real Estate By Jairo Rodriguez

Checklist For Irs Schedule C Profit Or Loss From Business 2018 – Tom Copelands Taking Care Of Business Profitable Business Business Cost Of Goods Sold

When To Worry About Taxes For Your Etsy Shop Hobbies Quote Craft Business Plan Bookkeeping Business

Schedule C Form 1040 Irs Taxes Tax Return Accounting And Finance

Form 12 12a Five Ways On How To Prepare For Form 12 12a Federal Income Tax Tax Forms Income Tax

Fillable Form 1040 2018 Income Tax Return Irs Taxes Irs Tax Forms

Checklist For Irs Schedule C Profit Or Loss From Business 2018 – Tom Copelands Taking Care Of Business Profitable Business Business Cost Of Goods Sold

Fillable Form 2438 In 2021 Tax Forms Fillable Forms Form

2014 Schedule C Form – Aylaquiztriviaco Irs Tax Forms Tax Prep Tax Forms

Form 12 12a Five Ways On How To Prepare For Form 12 12a Federal Income Tax Tax Forms Income Tax

File Your Own Taxes Tax Forms Form Example Income Tax

Pin By Amanullah Khan On Heart Sheet Music Education Attock

Fillable Form 1040 – Individual Income Tax Return In 2021 Income Tax Tax Return Income Tax Return