Your brand can grow seamlessly with wix. This table lists each changed tax jurisdiction, the amount of the change, and the towns and cities in which the modified tax rates apply.

New Tech And Telecom Industry Tax Concerns Grant Thornton

The california sales tax rate is currently %.

San francisco sales tax rate july 2021. Historical tax rates in california cities & counties. The california sales tax rate is currently %. This is the total of state, county and city sales tax rates.

The progressive tax rate ranges between 0.1% to 0.6% and is assessed on gross receipts sourced to san francisco as determined for gross receipts tax purposes. New tax rate on other tobacco products effective july 1, 2021, through june 30, 2022; The california sales tax rate is currently 6%.

It was raised 1% from 9.75% to 10.75% in july 2021. 2021 california sales tax changes. The newark sales tax has been changed within the last year.

City of south san francisco: The county sales tax rate is %. Metro counties sales and use tax rate guide effective 10/01/2021 ‐ 12/31/2021 other local rate city rate county transit rate state rate combined sales tax county/city hastings*……………………… 0.25% 6.875% 7.125% inver grove heights………….

“we delivered another phenomenal quarter, fueling strong revenue growth, margin and cash flow,” said marc benioff, chair and ceo of salesforce. San francisco’s average home price is up just 5.5 percent over the past year, and the neighboring and more expensive san mateo is up 12.6 percent. Set to go into effect on jan.

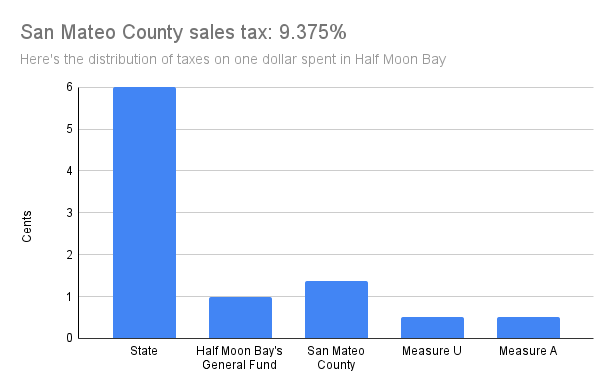

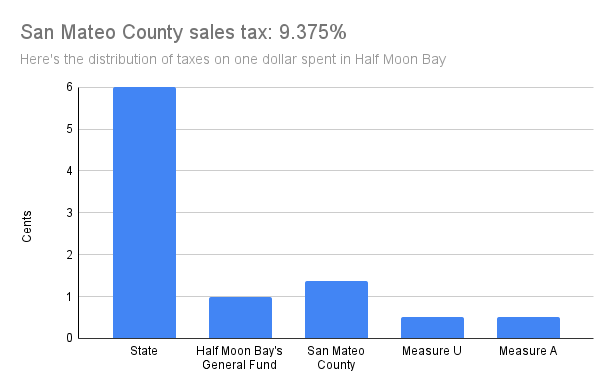

It was lowered 0.125% from 8.625% to 8.5% in january 2021, raised 0.125% from 8.5% to 8.625% in july 2021, raised 0.125% from 8.5% to 8.625% in july 2021, raised 0.125% from 9.25% to 9.375% in july 2021 and raised 0.125% from 8.5% to 8.625% in july 2021. 3 the city approved a new 0.50 percent tax (srtu) consolidating the two existing 0.25 percent taxes (srgf and satg) by repealing these taxes and replacing them with a new 0.50 percent tax. San francisco, ca sales tax rate the current total local sales tax rate in san francisco, ca is 8.625%.

Over the past year, there have been 122 local sales tax rate changes in california. It was raised 0.125% from 9.75% to 9.875% in july 2021. The rates display in the files below represents total sales and use tax rates (state, local, county, and district where applicable).

What is the sales tax rate in san francisco, california? The county sales tax rate is 0.25%. New sales and use tax rates operative july 1, 2021;

To view a history of the statewide sales and use tax rate, please go to the history of statewide sales & use tax rates page. The san francisco sales tax rate is %. The additional tax would either increase the gross receipts tax or the administrative office tax, whichever applies to that business and is effective january 2022.

The minimum combined 2021 sales tax rate for san francisco, california is. Therefore, there is no change to the tax rate. All the other large counties in the state have seen growth in the vicinity of 20 to 25 percent, with san francisco’s relatively affordable neighbors alameda and contra costa seeing higher growth.

The minimum combined sales tax rate for san francisco, california is 8.5%. The december 2020 total local sales tax rate was 8.500%. 1788 rows san francisco* 8.625%:

Important reminders for used vehicle dealers Click here to find other recent sales tax rate changes in california. The county sales tax rate is %.

, ca sales tax rate. The san francisco tourism improvement district (zone 2) sales tax has been changed within the last year. Utilize quick add to cart and more!.

This is the total of state, county and city sales tax rates. The current total local sales tax rate in san francisco county, ca is 8.625%. The san francisco sales tax rate is 0%.

In san francisco, the tax rate will rise from 8.5% to 8.625%. This is the total of state, county and city sales tax rates. Crm), the global leader in crm, today announced results for its third quarter of fiscal 2022 ended october 31, 2021.

This page will be updated monthly as new sales tax rates are released. The roseville sales tax rate is %. The minimum combined 2021 sales tax rate for roseville, california is.

The south san francisco sales tax has been changed within the last year. Ad create an online store. The sales and use tax is rising across california, including in san francisco county.

California Sales Tax Rate Changes In December 2021

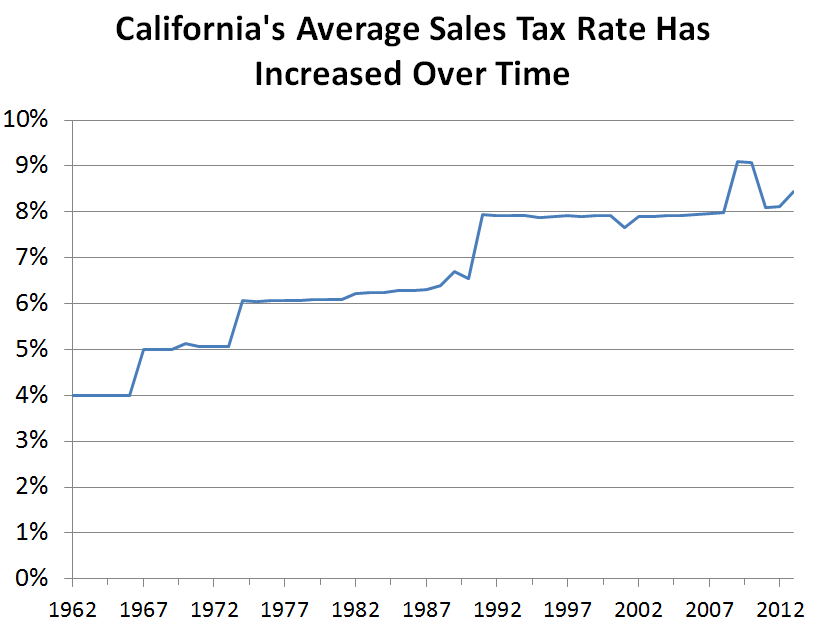

Californias Sales Tax Rate Has Grown Over Time Econtax Blog

Secured Property Taxes Treasurer Tax Collector

States With Highest And Lowest Sales Tax Rates

Quidco Business Model Canvas In 2021 Business Model Canvas Business Model Canvas Examples Business Canvas

California Sales Use Tax Guide – Avalara

Cara Sederhana Dan Mudah Membuat Laporan Arus Kas Financial Planner Finance Personal Finance

What Taxes Are Involved When Selling My Online Business

Setting Up An S Corp In California Issues Considerations In Ma

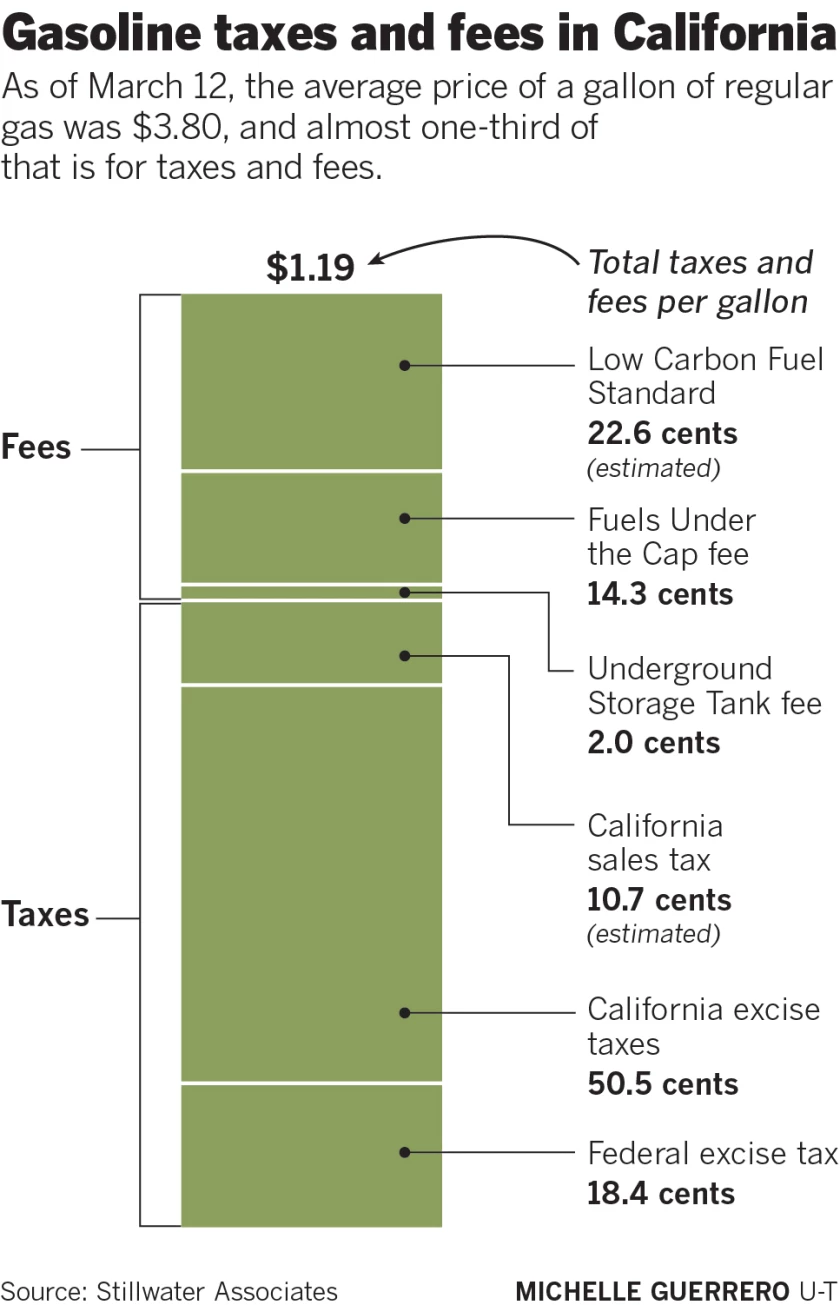

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

Apenft The Nft Token You Cant Afford To Miss Out On In 2021 Blockchain Technology Avatar Sale Event

Prop W – Transfer Tax Spur

Landscape Of Manhattan Self Adhesive Peel And Stick 3d Etsy In 2021 Manhattan Wallpaper New York Buildings New York Skyline

County Begins Collecting Higher Sales Tax Local News Stories Hmbreviewcom

Californias Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Frequently Asked Questions City Of Redwood City

Sales Gas Taxes Increasing In The Bay Area And California

Shrinking The Delaware Tax Loophole Other Us States To Incorporate Your Business

Sales Tax Rates Rise Up To 1075 In Alameda County Highest In California Cbs San Francisco