The minimum combined 2021 sales tax rate for san antonio, texas is. Mckinney, tx sales tax rate:

2

The sales tax jurisdiction name is san antonio atd transit, which may refer to.

San antonio general sales tax rate. 12 is located entirely within the san antonio mta, which has a transit sales and use tax. A delinquent tax incurs interest at the rate of 1% for the first month and an additional 1% for each month the tax remains delinquent. There is no applicable city tax or special tax.

Some dealerships may charge a documentary fee of 125 dollars. The us average is 4.6%. The us average is 7.3%.

Unincorporated areas of bexar county in zip codes 78101, 78109, 78124, 78152, 78223 and 78263 are partially located within the bexar county emergency. , nm sales tax rate. 78201, 78202, 78203, 78204, 78205, 78206, 78207, 78208, 78209, 78210, 78211, 78212, 78213, 78214, 78215, 78216, 78217, 78218, 78219, 78220, 78221, 78222, 78223, 78224, 78225, 78226, 78227, 78228, 78229, 78230, 78231, 78232, 78233, 78234, 78235, 78237, 78238, 78240, 78241, 78242,.

This is the total of state, county and city sales tax rates. Mesquite, tx sales tax rate: The san antonio, new mexico sales tax rate of 6.5% applies in the zip code 87832.

San antonio, tx sales tax rate. The 8.25% sales tax rate in san antonio consists of 6.25% texas state sales tax, 1.25% san antonio tax and 0.75% special tax. Waco, tx sales tax rate:

Current sales tax rates (txt). San antonio, tx sales tax rate: Find your texas combined state and local tax rate.

The december 2020 total local sales tax rate was also 6.3750%. The 7% sales tax rate in san antonio consists of 6% florida state sales tax and 1% pasco county sales tax. The san antonio, texas sales tax rate of 8.25% applies to the following 71 zip codes:

The san antonio sales tax rate is %. Midland, tx sales tax rate: An additional 1% for each of the following 4 months;

Build the online store that you've always dreamed of. The current total local sales tax rate in san antonio, tx is 8.250%. The december 2020 total local sales.

The county sales tax rate is %. The city of von ormy withdrew from the san antonio mta effective september 30, 2009. The state sales tax rate in texas is 6.25%, but you can customize this table as needed to.

0.125% dedicated to the city of san antonio ready to work program; San antonio, texas sales tax rate details. Odessa, tx sales tax rate:

The san antonio sales tax is collected by the merchant on all qualifying sales made within san antonio. The december 2020 total local sales tax rate was also 8.250%. Plano, tx sales tax rate:

The county sales tax rate is %. 0.250% san antonio atd (advanced transportation district); There are approximately 589 people living in the san antonio area.

The current total local sales tax rate in san antonio, tx is 8.250%. Ad with secure payments and simple shipping you can convert more users & earn more!. The district excludes, for sales tax purposes, any area within the city of saint hedwig.

The property tax rate for the city of san antonio consists of two components: The base state sales tax rate in texas is 6.25%. Texas has recent rate changes (thu jul 01 2021).

San antonio’s current sales tax rate is 8.250% and is distributed as follows: 6% for the first month; 0.125% dedicated to the city of san antonio ready to work program;

0.500% san antonio mta (metropolitan transit authority);. Pasadena, tx sales tax rate: In addition to interest, delinquent taxes incur the following penalties:

What is the sales tax rate in san antonio, texas? The texas sales tax rate is currently %. This is the total of state, county and city sales tax rates.

Boost your business with wix! 1.000% city of san antonio; And an additional 2% for the sixth month, for a total of 12%.

The bexar county emergency services district no. Combined with the state sales tax, the highest sales tax rate in texas is 8.25% in the cities of houston, san antonio, dallas, austin and fort worth (and 108 other cities). Click here for a larger sales tax map, or here for a sales tax table.

The texas sales tax rate is currently %. The san antonio mta, texas sales tax is 6.75%, consisting of 6.25% texas state sales tax and 0.50% san antonio mta local sales taxes.the local sales tax consists of a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). Wichita falls, tx sales tax rate:

The current total local sales tax rate in san antonio, nm is 6.3750%.

How To Calculate Sales Tax – Youtube

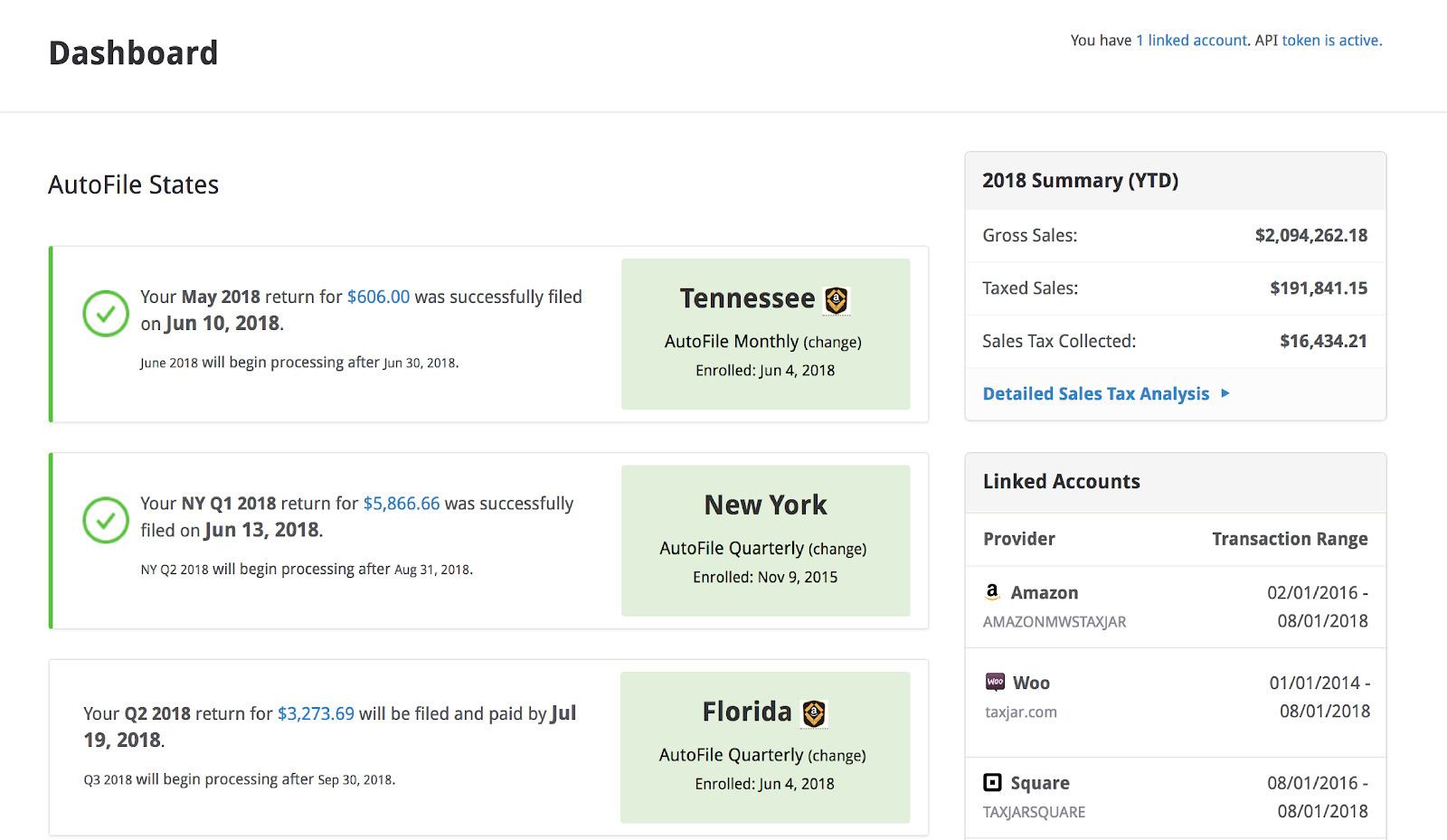

Woocommerce Sales Tax In The Us How To Automate Calculations

Sales Tax Rates In Major Cities Tax Data Tax Foundation

I Overview In Tax Harmonization In The European Community

A State-by-state Analysis Of Service Taxability

Ftz Fueled Mcallens Development – Vbr In 2021 Mcallen Business Leader Rio Grande Valley

What Is The San Antonio Sales Tax Rate – The Base Rate In Texas Is 625

Florida Sales Tax Rates By City County 2021

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Texas Sales Tax – Taxjar

How To Calculate Sales Tax – Video Lesson Transcript Studycom

Browse Our Example Of Direct Deposit Authorization Form Template Payroll Direct Instruction Project Management Templates

Woocommerce Sales Tax In The Us How To Automate Calculations

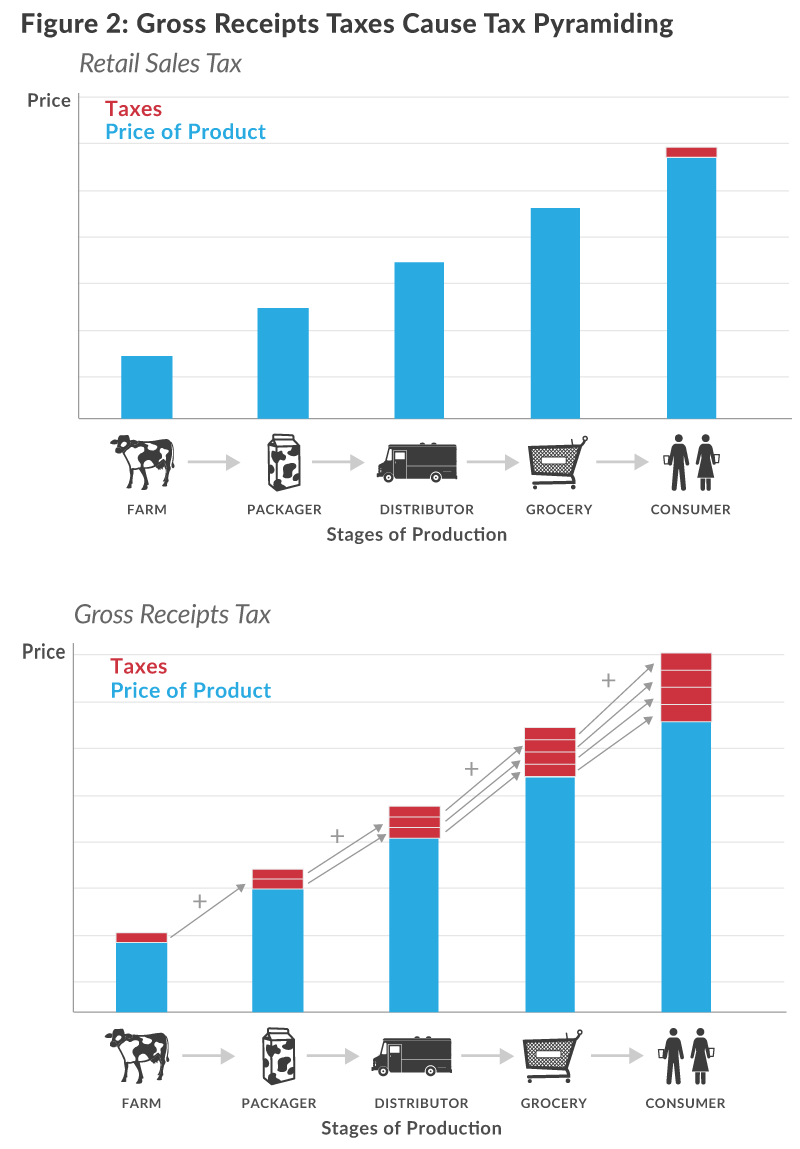

The Texas Margin Tax A Failed Experiment Tax Foundation

Effective Tax Rates How Much You Really Pay In Taxes

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Texas Sales Tax Rates By City County 2021

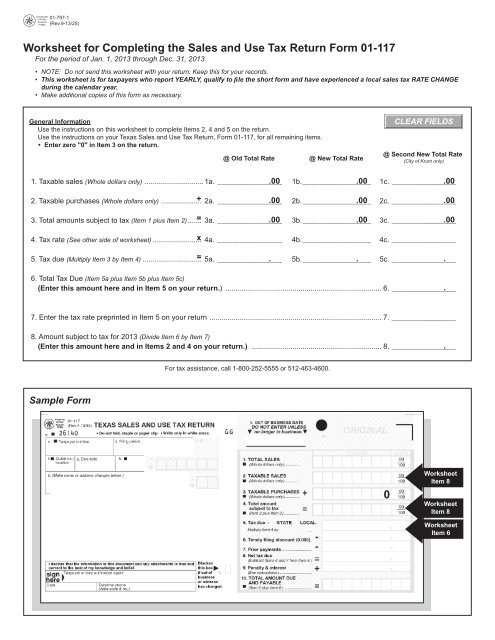

Worksheet For Completing The Sales And Use Tax Return Form 01-117

New Mexico Sales Tax Rates By City County 2021