House speaker nancy pelosi is fighting to repeal the cap. Under the 2017 tax cuts and jobs act (tcja), the cap expires at the.

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

The revised salt deduction is designed.

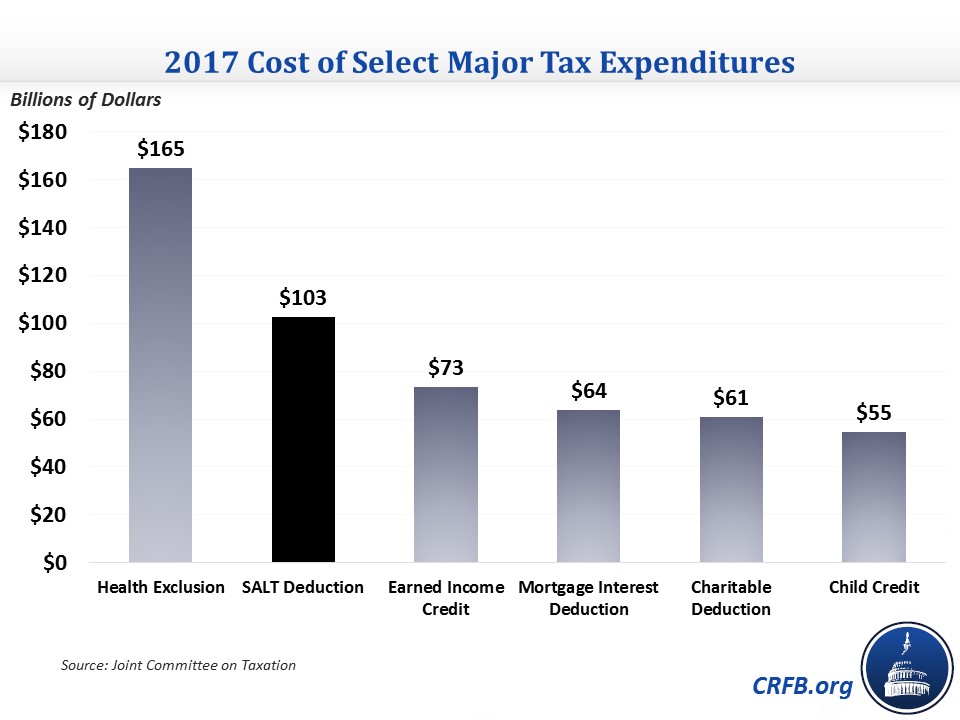

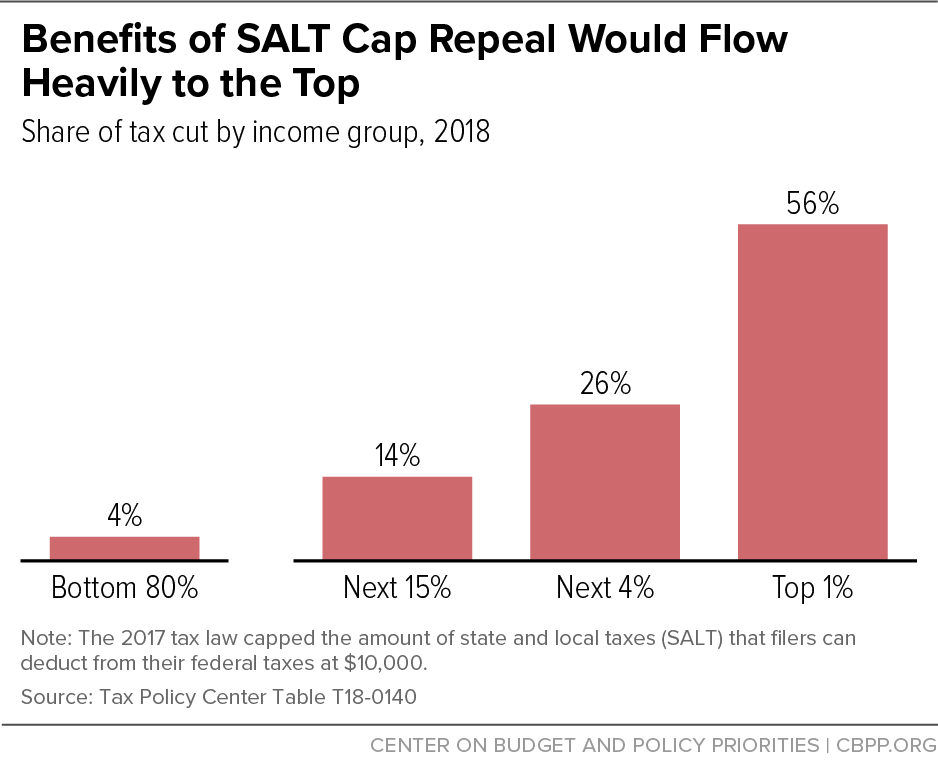

Salt tax deduction repeal. Democrat pork for their rich suporters in blue states. “only about 9 percent of households would benefit from repeal of the tax cuts and jobs act’s (tcja) $10,000 cap on. There is widespread recognition across the political spectrum that the vast majority of the salt deduction benefits the wealthy, and a repeal of the cap on the salt deduction would amount to a tax break for the wealthiest americans.

The tax policy center estimates that 16 percent of households making between $100,000 and $200,000 annually would benefit from an unlimited salt deduction, but that the average benefit would be. Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax (salt) deduction for 2022 and 2023 only. Biden did not propose a repeal of the $10,000 salt deduction cap, which limits the amount of state and local taxes that can be deducted before paying federal taxes, as part of his social spending.

Reinstating the state and local tax (salt) deduction will be in the final legislative package. Repeal of salt deduction in democrats' spending plan is tax cut for the rich. It is important to understand who benefits from the salt deduction as it currently exists, and who would benefit from the deduction if the cap were repealed.

House passed would restore the state and local tax deduction (salt). Thus, someone with agi of $450,000 and $50,000 in state and local taxes could deduct only $30,000. A group of blue state democrats has insisted on some salt fix as their price for.

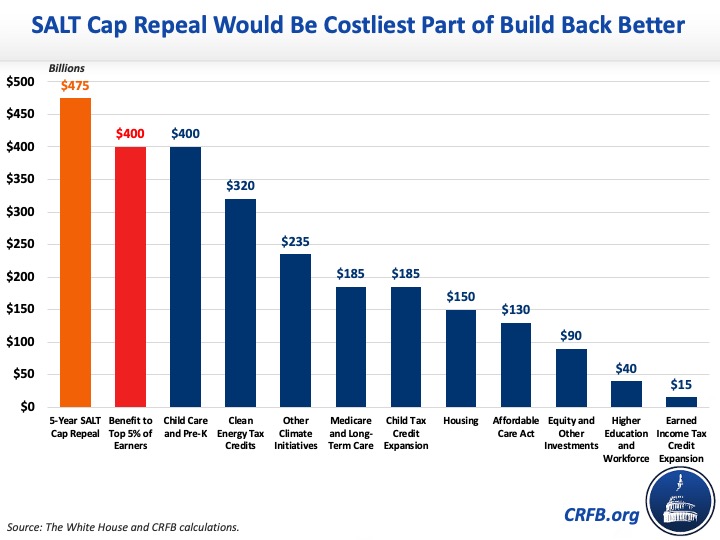

The 2017 tax cuts and jobs act capped the value of the salt deduction at $10,000. Salt cap repeal below $500k still costly and regressive. The committee for a responsible federal budget described the repeal of the salt cap as a “regressive” tax cut, estimating that it would cost.

The plan reportedly would repeal the salt cap for 2022 and 2023 only. Raising the salt cap to $80,000 would reduce federal income tax liability by $55.9 billion in 2021, making it $35.3 billion less expensive than full cap repeal. Those making $500,000 or more could deduct just $10,000.

The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes. The house version of president biden's build back better plan would raise the amount of state and local taxes that americans can deduct from. Congressional democrats on tuesday indicated that a roll back—of some sort—with the $10,000 cap on a federal deduction for state and local taxes would make it into the sweeping spending package that they are trying to finalize.

54 rows some lawmakers have expressed interest in repealing the salt cap, which was originally imposed as part of the tax cuts and jobs act (tcja) in late 2017. The $10,000 cap would, in theory, resume in 2024 and 2025. Nov 19, 2021 | taxes.

According to press reports, the senate is considering repealing the $10,000 cap on the state and local tax (salt) deduction for those making $500,000 per year or less. According to media reports, democratic negotiators are working on a repeal of the salt deduction cap for up to five years, which would cost $475 billion and give the richest 5% $400 billion in tax. In addition to blatant lying, democrats promoting a higher salt deduction cap have refused to.

Proposals on salt may change as negotiations continue. House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes, known as salt. There are no middle income people who pay $80,000 in state and local taxes.

The 2017 tax law passed under president donald trump capped deductions for state and local taxes paid at $10,000 per year through 2025. Since that time, new jersey state and federal politicians have.

Repealing The Federal Tax Laws Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Tpc Impacts Of 2017 Tax Laws Salt Cap And Its Repeal Center On Budget And Policy Priorities

High-income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained – Vox

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction – Vox

Salt Heres How Lawmakers Could Alter Key Contentious Tax Rule

Why Repealing The State And Local Tax Deduction Is So Hard Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law – Center For American Progress

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

5-year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities