While congress has stalled on passing legislation that would eliminate, in whole or in part, the current limit on an individual taxpayer's ability to take the itemized deduction for state and local taxes, california has taken a dramatic step toward allowing many of its residents to mitigate the effects. Commentary for tax years beginning in 2018 through 2025, the tcja amended irc sec.

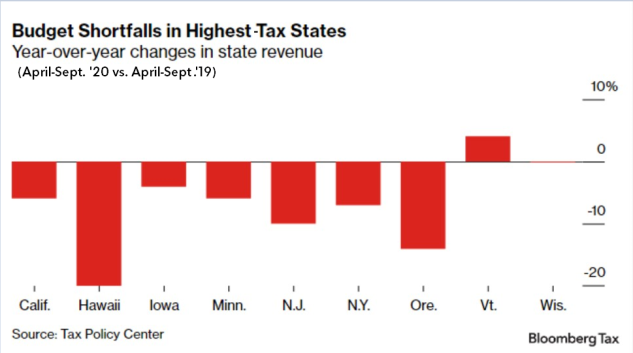

We Dont Know If The Salt Cap Is Driving Away Residents Of High-tax States Tax Policy Center

The itep plan tpc analyzed would allow an.

Salt tax deduction california. House speaker nancy pelosi is fighting to repeal the cap. 150 on july 16, 2021. This is due to the state’s:

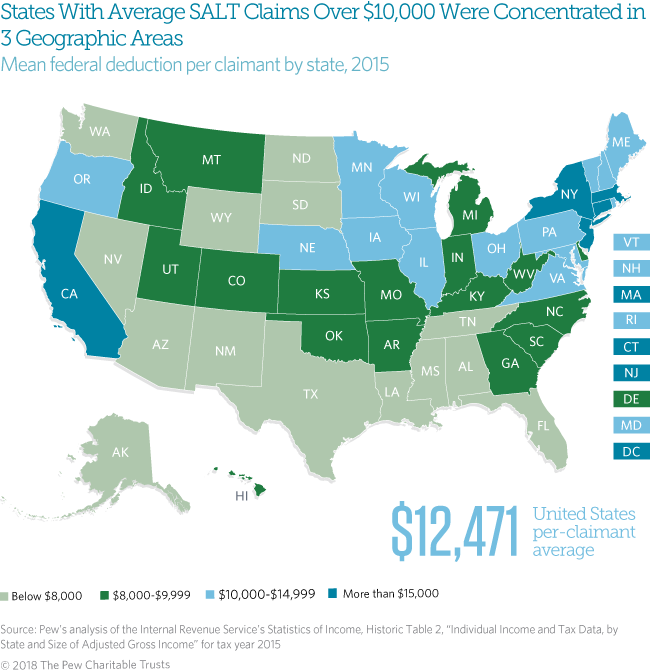

The bbba would raise the salt deduction limitation from $10,000 per year to $80,000 per year from 2021 through 2030, lower it to $10,000 in 2031, and then eliminate it altogether. 27 with the enactment of a.b. Taxpayers in california would receive $12.5 billion of the $55.9 billion national tax reduction, or 22.3 percent.

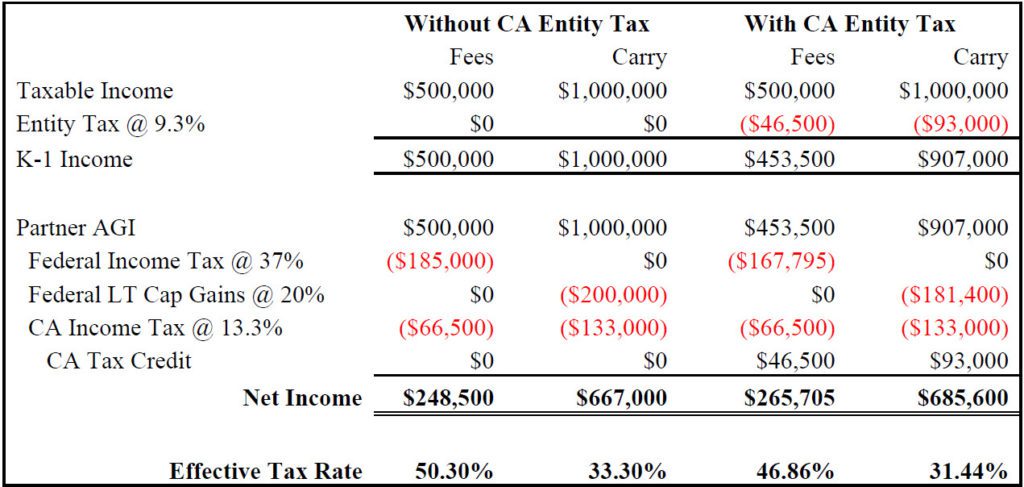

California governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the deduction for state and local taxes paid for individuals that was established by the tax cuts and jobs act of 2017 (tcja). “that households so high on the income spectrum can expect a net tax cut from the build back better act is entirely due to the increase in the salt deduction cap from $10,000 to $80,000,” the. The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes.

This tax will apply for california residents on their entire distributive share, and for nonresidents, their california source amount. House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes, known as salt. The deduction has a cap of $5,000 if your filing status is married filing separately.

As of 2019, the maximum salt deduction is $10,000. Among them is pelosi's 12th congressional district where the average salt paid by households claiming a deduction is $62,769—well under the. We speak of the $10,000 cap on the state and local tax deduction, or salt, designed to drain revenues from the likes of california, new york, new jersey and massachusetts.

On july 16 th, the governor signed ab 150, a budget trailer bill containing language outlining california’s pte tax guidelines that. For tax years beginning on or after jan. California sb104 seeks to circumvent the salt cap deduction by.

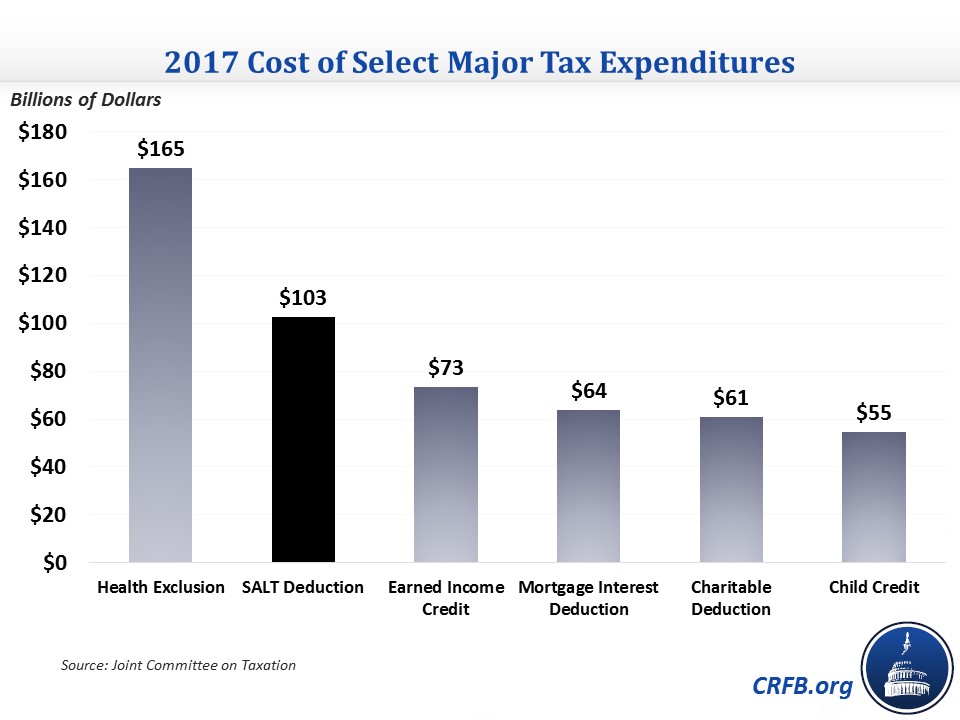

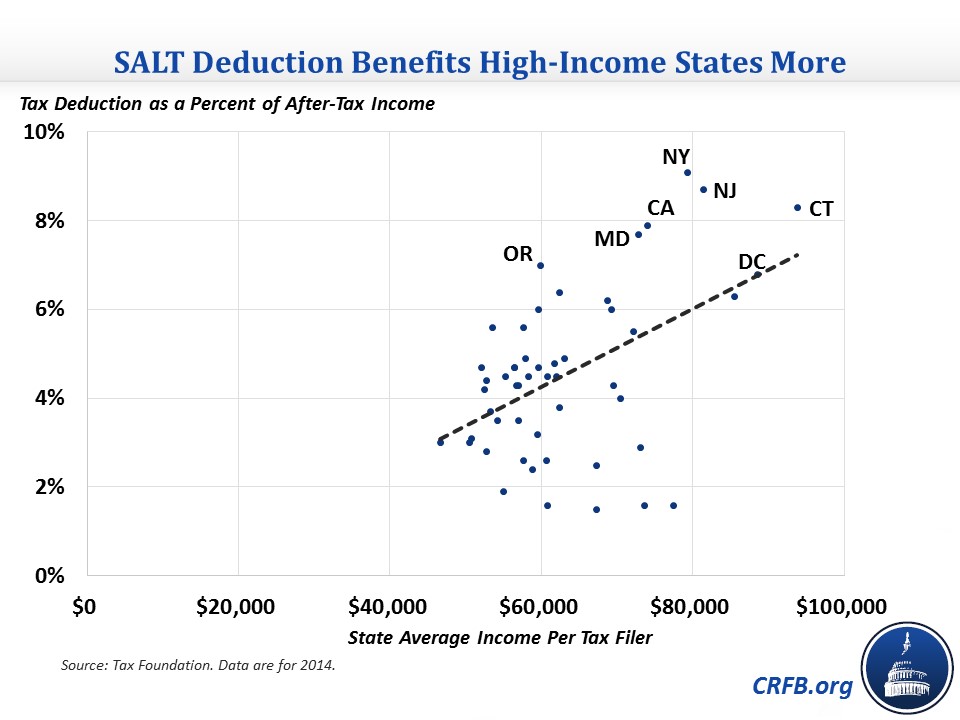

164 to limit the deductibility of state taxes to $10,000 for individuals, but imposed no similar limitation on business entities. For tax years beginning on or after jan. According to the nonpartisan tax policy center, the top 20% of taxpayers may receive more than 96% of the benefit of a salt cap repeal and the top 1% would see about 54% of the benefit.

California has joined the ranks of states who have developed a way to circumvent the $10,000 federal deduction limitation state and local taxes (known as salt) limitation with the enactment of a.b.150 recently signed by governor gavin newsom. How households would be affected by three changes in the salt tax deduction. This cap remains unchanged for your 2020 and 2021 taxes.

Adding the $10,000 cap increases the payment of an average california taxpayer who previously took the full salt deduction by about $4,000, according to a statement against the changes by several. 1, 2022 and ending before jan. 1, 2022, the tax is due on or before the original due date of the entity’s return, without regard to extensions.

1, 2021, and ending before jan. This limit applies to single filers, joint filers, and heads of household.

State And Local Tax Deductions Implications For Reform – Aaf

Congress And The Salt Deduction – The Cpa Journal

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Client Alert Gov Newsom Signs Ab 150 – Salt Workaround – Shartsis Friese Llp

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction – Vox

California Democrats Have Chance To Restore Salt Deductions – Los Angeles Times

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Salt Cap Workarounds Will They Work Accounting Today

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained – Vox

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

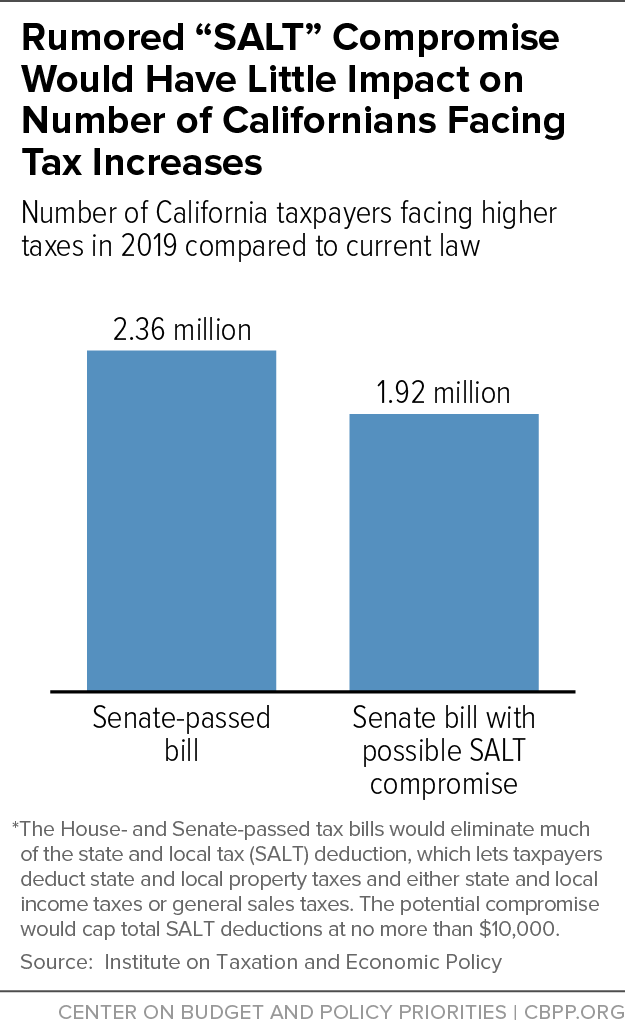

Update California House Members Appear To Be Settling For Bad Salt Compromise Center On Budget And Policy Priorities

California Lawmakers Governor Float Salt Cap Workaround Plans

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Cap Repeal Salt Deduction And Who Benefits From It

Schumer Pushes For Elimination Of Salt Deduction Cap

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained – Vox