The tcja also made it harder for homeowners to maximize the mortgage interest tax deduction by limiting the deduction for state and local income taxes (salt) to $10,000 when there was previously. That means if you made $80,000 during the tax year and claimed $20,000 in deductions, then you only have to pay taxes on $60,000.

5-year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Limiting the two provisions helped broaden the tax base, offsetting tax revenue loss from reduced tax rates.

Salt tax cap mortgage interest. The salt deduction cap is unfair. What counts before the 2018 tax year, homeowners getting a new mortgage were allowed to deduct interest paid on loans of up to $1 million secured by a principal residence or second home. A bill from house ways and means chairman richard neal and others would modify and then repeal for two years the 2017 tax law’s cap on the federal deduction for state and local taxes (salt) and offset the cost over ten years by returning the top individual tax rate to.

• for 2019, the salt limit would be doubled for couples to $20,000. As of 2019, the maximum salt deduction is $10,000. Salt deduction cap was part of a package various changes made it more difficult to itemize, and therefore more difficult to deduct mortgage interest.

Singles would continue to have a $10,000 cap. 54 rows the internal revenue service (irs) has provided data on state and local. This limit applies to single filers, joint filers, and heads of household.

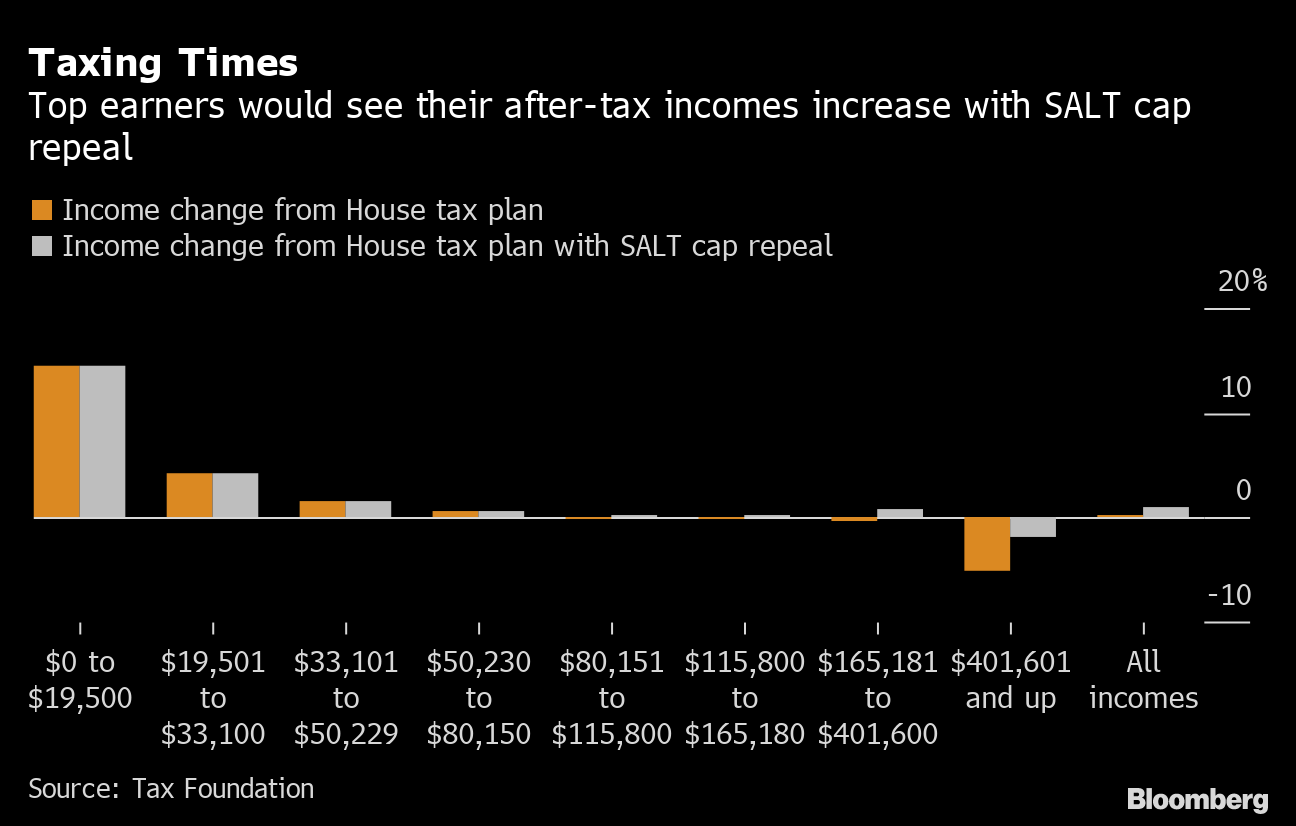

Who will be affected the most? Under the package the democrats are now pushing, the annual salt deduction cap would be raised to $80,000 through 2030, before reducing it back to $10,000 in 2031. Another proposal is to increase the cap on the salt deduction to $15,000 for individual filers and $30,000 for joint filers.

A tax deduction reduces your taxable income. This cap remains unchanged for your 2020 and 2021 taxes. Since mortgage interest is an itemized deduction, you’ll use schedule a (form 1040), which is an itemized tax form, in addition to the standard 1040 form.

Previously the deduction was unlimited. Taxpayers who have a mortgage may be eligible to claim a mortgage interest tax deduction. • for 2020 and 2021, the salt cap would be eliminated for all taxpayers.

Mortgage interest (subject to a limit of $1 million or $750,000, depending on when you got the loan) medical or dental expenses (if they make up. 57 percent would benefit the top one percent (a cut of $33,100); Under tcja, the salt cap, along with many other provisions, will expire after 2025.

To be impacted by the limit, 3 things must be true: You pay more than $10,000 in state and local taxes (or you haven’t reached the limit, obviously) state income tax. If you paid less than $600 in mortgage interest, you can still deduct it.

The 2017 law imposed a $10,000 limit on the deductibility of salt and a separate limit on mortgage interest deductions. Then it would expire permanently. The tax cuts and jobs act of 2017 placed a $10,000 cap on state and local tax (salt) deductions.

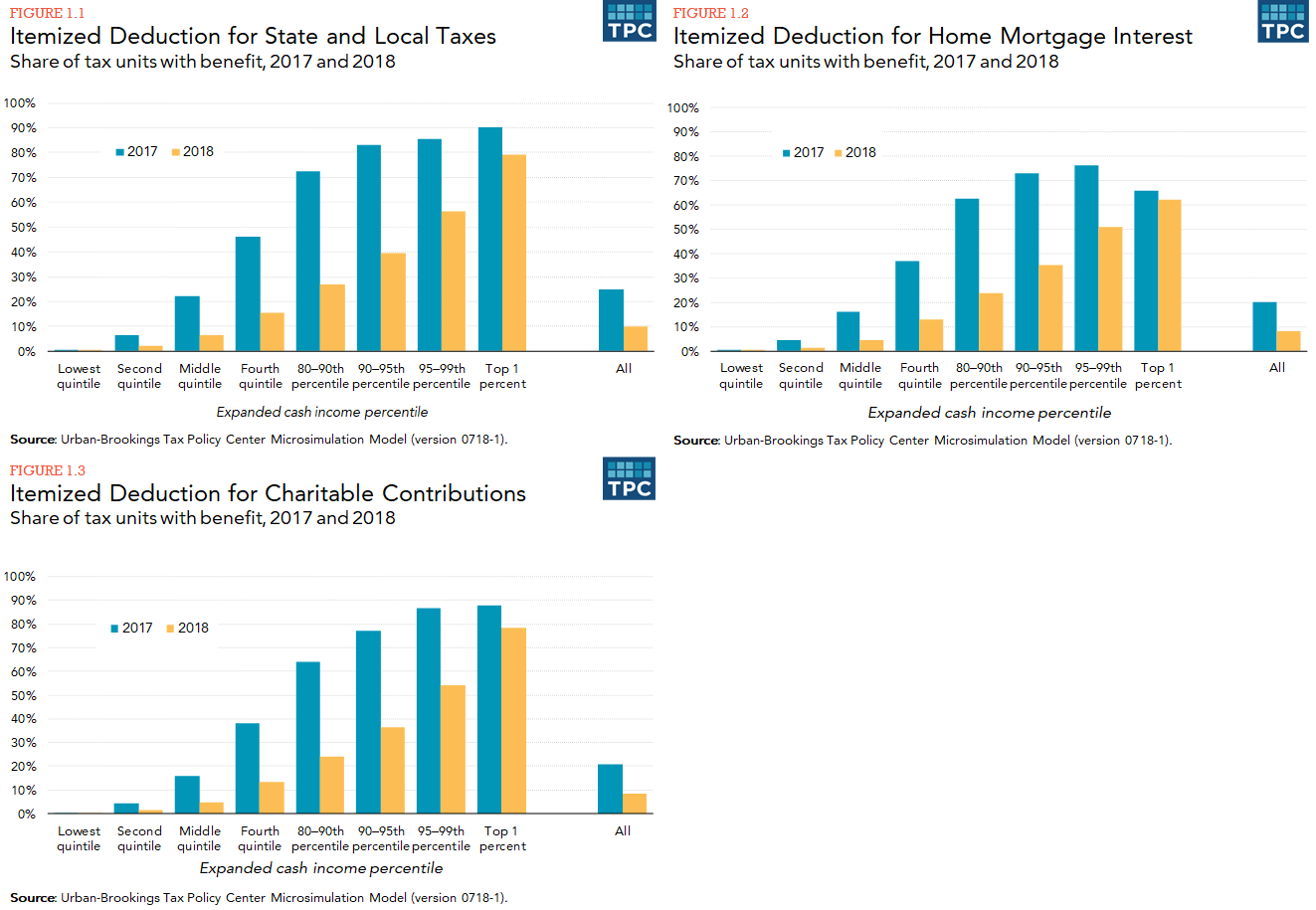

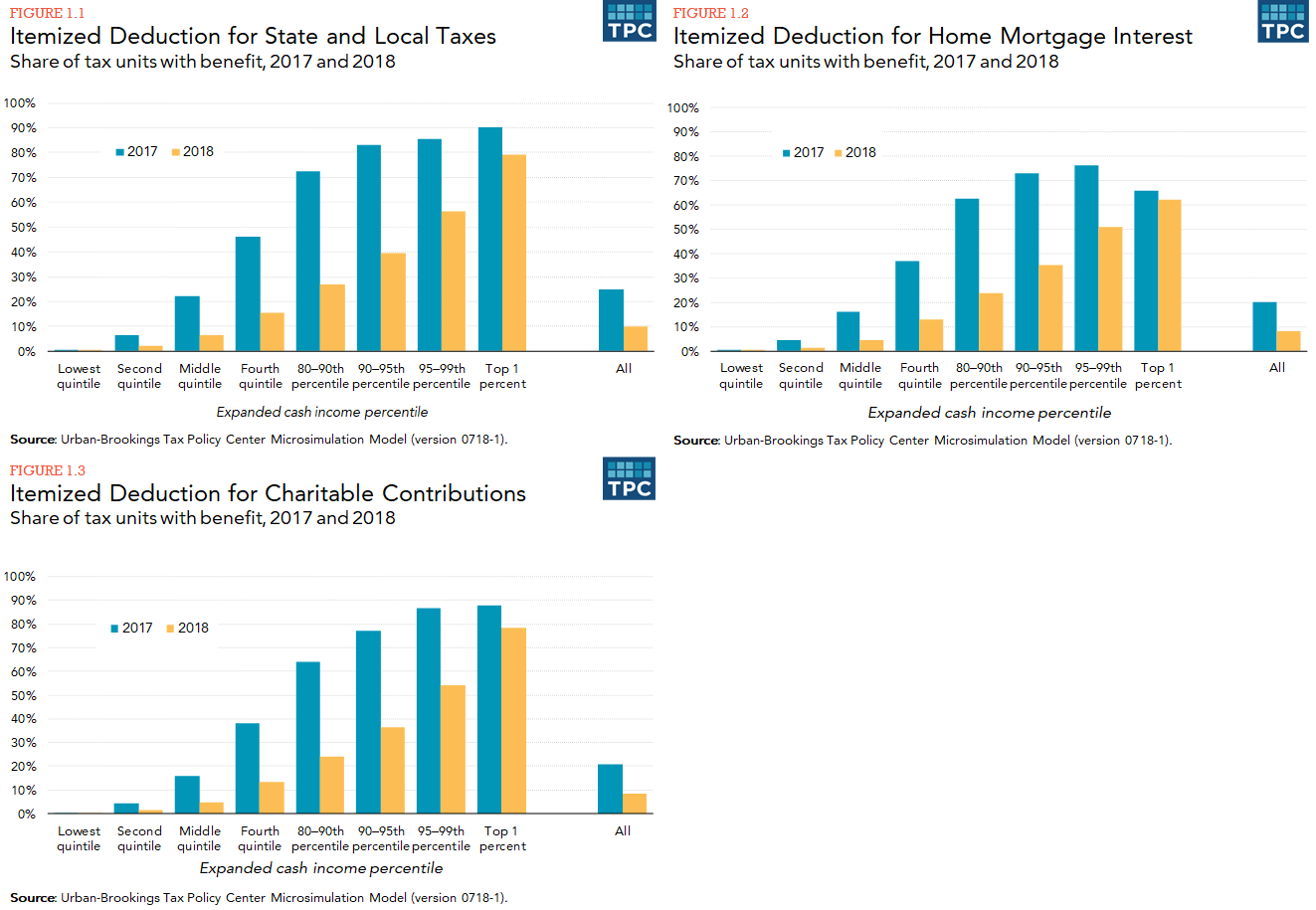

More in federal taxes because of the. • for 2022 through 2025, the salt cap would return to $10,000. Two major provisions in the federal tax code have been limited since the tax cuts and jobs act (tcja) of 2017:

Choose the correct tax forms. With changes to the tax deduction cap combined with 2019 salt deductions cap, mortgage lenders will need to. You’ll need to itemize your deductions to claim the mortgage interest deduction.

The state and local tax (salt) deduction and the home mortgage interest deduction (mid). These tax avoidance schemes would be rendered invalid under the proposed. The deduction has a cap of $5,000 if your filing status is married filing separately.

At the same time, the salt deduction is one of the largest federal tax expenditures. For many couples, the increase in the standard deduction will cancel out the benefit of itemizing, since their mortgage interest and $10,000. This form also lists other.

The cap on the principal for interest deductions went from $1 million to $750,000 and below, which means that high net worth individuals are no longer able to write off their mortgage interest payments on their income taxes. The salt cap is the only significant provision of the 2017 tax cuts and jobs act that limits tax breaks for the rich. Most homeowners can deduct all their mortgage interest.

This report catalogues numerous examples of private schools, voucher organizations, tax accountants, and financial advisors telling their clients and prospective donors that “giving” is a way to “make money” by “bypassing” the federal government’s $10,000 cap on salt deductions. Almost all (96 percent) of the benef its of salt cap repeal would go to the top quintile (giving an average tax cut of $2,640); The mortgage interest tax deduction allows homeowners to deduct from their taxable income some or all of the interest they pay on a qualified home mortgage loan.

Salt Break Would Erase Most Of Houses Tax Hikes For Top 1 – Bloomberg

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

State And Local Tax Salt Deduction Caps May Get Another Look

Gallery Of Bastion Community Housing Ojt – 15 Community Housing Community Bastion

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Gallery Of Bastion Community Housing Ojt – 15 Community Housing Community Bastion

Boe Passes On Opportunity To Confront A Surge In Bond Yields In 2021 Bank Of England England Economy

State And Local Tax Salt Deduction Salt Deduction Taxedu

Desain Perumahan Minimalis Perumahan Graha Purwosari Regency – 3d Site Smart City House Plans Regency

4hvvkbgluxi-xm

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

How Does The Deduction For State And Local Taxes Work Tax Policy Center

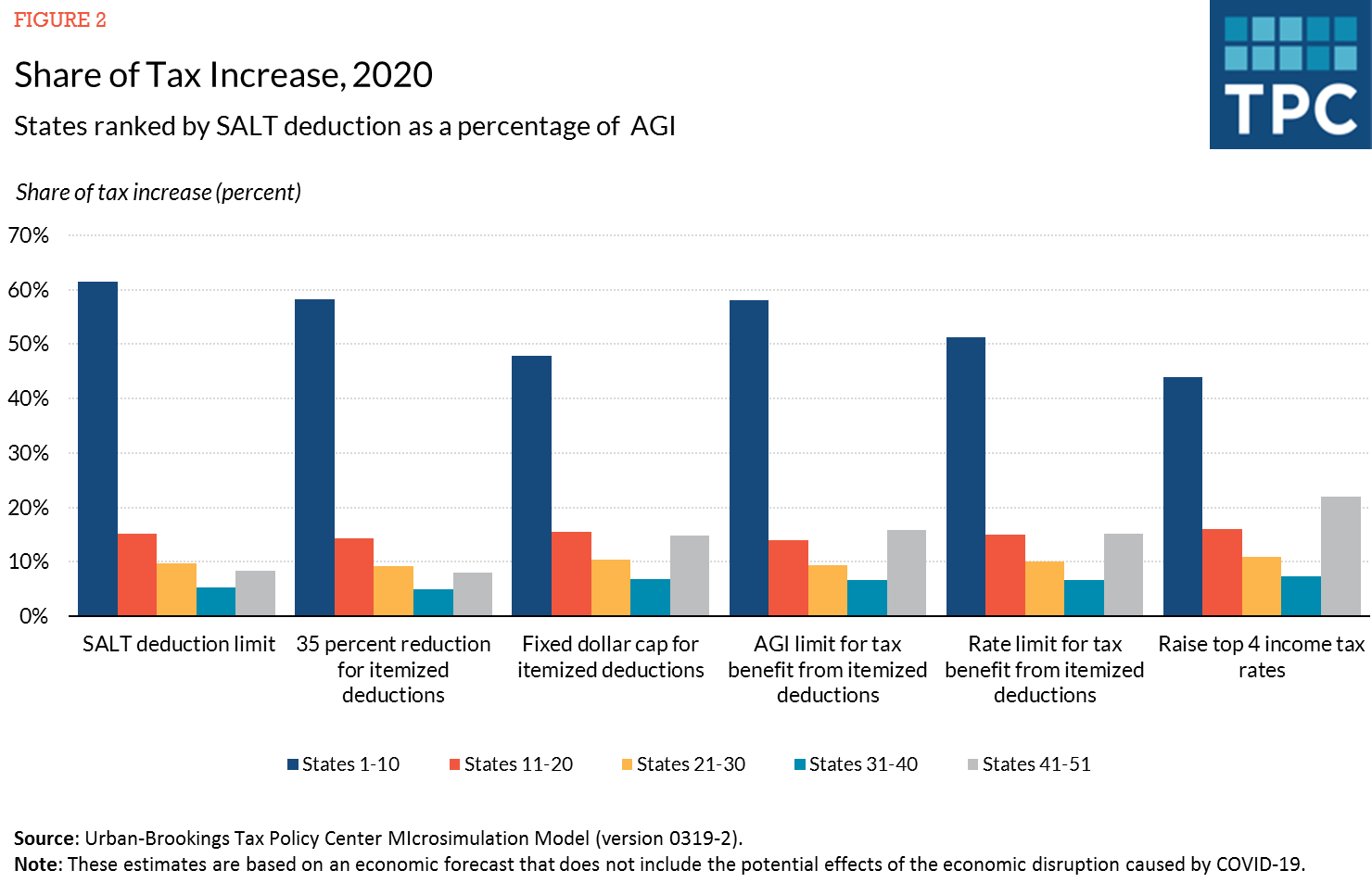

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Gallery Of Bastion Community Housing Ojt – 15 Community Housing Community Bastion

A Display Rack Created To Store My Current Lanyard Collection Displaying Collections Recycled Crafts Office Items

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less