That change would take effect for 2020 through 2025, after which time nearly all of the 2017 law’s tax changes for individuals, including the salt deduction cap, expire. Accordingly, the taxpayer’s 2018 salt deduction would still have been $10,000, even if it had been figured based on the actual $6,250 state and local income tax liability for 2018.

72500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

A $10,000 cap on the federal deduction for the state and local taxes that individuals pay would rise to $72,500, with the limit on the tax break extended beyond its original expiration date, under the latest version of a massive piece of budget legislation congressional democrats have.

Salt tax cap expiration. The salt cap created in 2017 is due to expire in 2026, after which point there would be no limit on salt deductions. This would be in place of the house plan to lift the cap to $80,000 through 2030 and reinstate it. Several senators are apparently pursuing revenue neutral state and local tax (salt) deduction cap relief, meaning the cost of increasing the salt deduction cap through 2025 would be fully paid for on paper by extending it past its current expiration date of 2026 through 2031.in this case, revenue neutrality is simply a budget gimmick, and the resulting salt cap relief will be both costly.

According to press reports, the senate is considering repealing the $10,000 cap on the state and local tax (salt) deduction for those making $500,000 per year or less. Nov 19, 2021 | taxes. For tax years beginning between january 1, 2021, and january 1, 2022, the elective tax is due and payable on or before the due date of the tax.

According to media reports, democratic negotiators are working on a repeal of the salt deduction cap for up to five years, which would cost $475 billion and give the. Washington — house republicans last week doubled down on the tax overhaul the gop and president donald trump enacted last year, offering a plan. She also got in some other issues, including whether congress might actually repeal the salt cap before its scheduled expiration, which obviously would impact whether these policies are going to.

The existing $10,000 limit on salt is scheduled to expire at the end of 2025. The tax law trump signed in december 2017 imposed a cap on the salt deduction of $10,000. The salt deduction, however, will continue to be important for those who itemize—which is to say, for wealthier taxpayers.if congress does not make permanent the individual tax provisions, the salt cap will expire as scheduled after 2025.

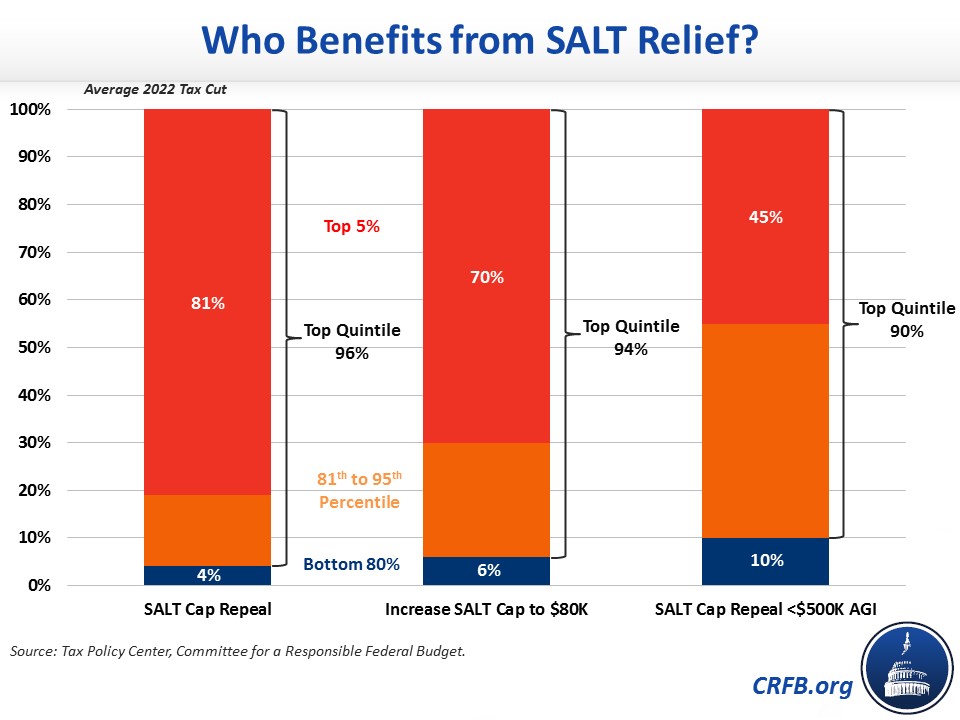

Starting with the 2018 tax year, the maximum salt deduction available was $10,000. Because of how republicans structured the 2017. With or without the cap, however, wealthy taxpayers will continue to be the greatest beneficiaries of the salt deduction.

Tax cuts for higher earners wouldn’t span the full decade under the house plan because it extends the cap past its current 2025 expiration. The tax cuts and jobs act placed a temporary cap on the salt deduction, and that cap is set to end after the tax year 2025. But some policymakers are pushing to get rid of it even sooner.

The election is available for tax years beginning on january 1, 2021, and ending before january 1, 2026, when the federal state tax limit is set to expire, or if the state and local tax deduction cap is repealed before the expiration—whichever comes first. Democrats have republicans to thank for clearing the way for the budgeting tricks that will allow them to do that. Unless salt deduction supporters want to wait until the cap expires at the end of 2025, her plan might be the best compromise to help taxpayers who.

Republicans capped the deduction in order to raise. Under the package the democrats are now pushing, the annual salt deduction cap would be raised to $80,000 through 2030, before reducing it back to $10,000 in 2031. Some state policymakers have argued that the salt cap has limited their ability to raise taxes.

The taxpayer did not receive a tax benefit on the taxpayer’s 2018 federal income tax return from the taxpayer’s overpayment of state income tax in 2018. Other impacts of limiting the salt deduction tax increases under a salt cap. It would repeal the salt cap for three years while raising the top income tax rate for six years.

Prior to the tcja, a $1 state tax increase only increased a taxpayer’s liability by between $0.60 to $0.90, depending on the individual’s federal marginal rate.

As Albany Debates A Permanent Property Tax Cap How Is The Cap Affecting School Budgets Rockefeller Institute Of Government

State And Local Tax Deduction Cap Back In Play For Coronavirus Relief Package – Roll Call

Whats The Deal With The State And Local Tax Deduction – Publications – National Taxpayers Union

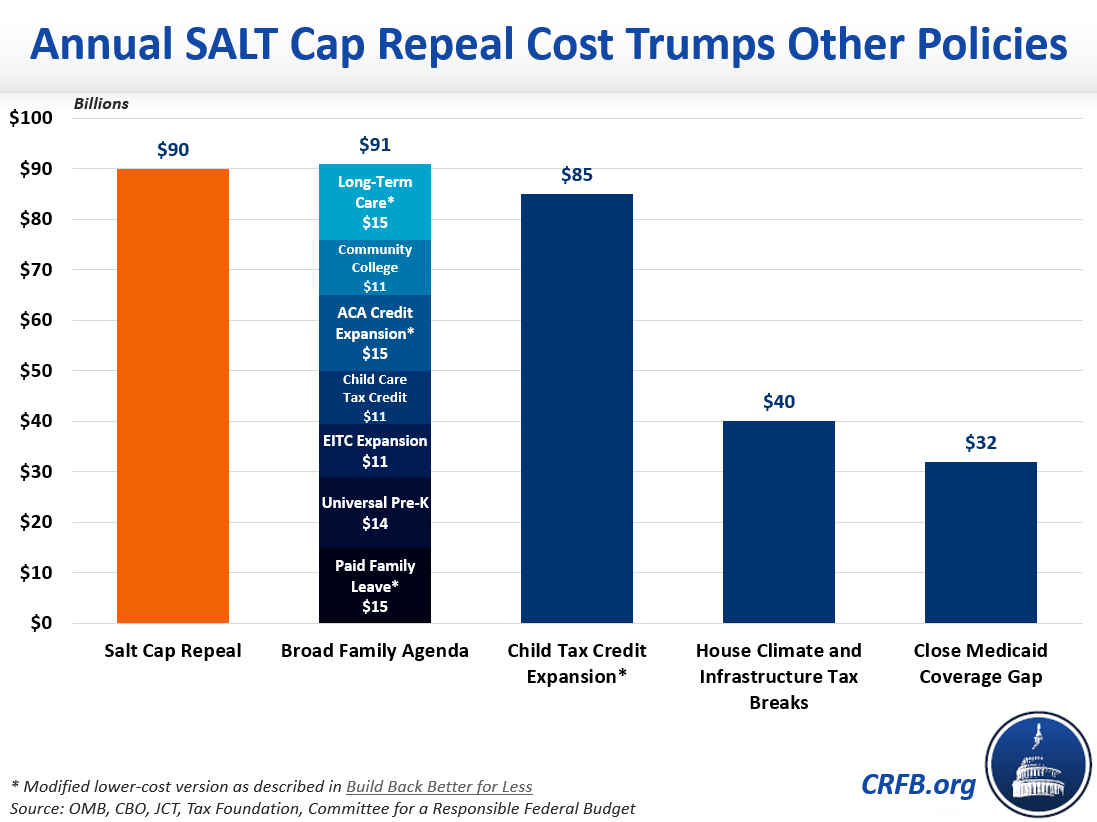

5-year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

The Salt Deduction The Second-biggest Item In Democrats Budget That Gives Billions To Rich – The Washington Post

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Whats The Deal With The State And Local Tax Deduction – Publications – National Taxpayers Union

Whats The Deal With The State And Local Tax Deduction – Publications – National Taxpayers Union

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less

Biden Tax Plan And 2020 Year-end Planning Opportunities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Salt Deduction The Second-biggest Item In Democrats Budget That Gives Billions To Rich – The Washington Post

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law – Center For American Progress

Gaming The Salt Cap May Be Congresss Worst Tax Idea Of The Year

Opinion End Of Cap On Salt Deductions Would Help California Homeowners But Progressives Oppose – Times Of San Diego

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

As Albany Debates A Permanent Property Tax Cap How Is The Cap Affecting School Budgets Rockefeller Institute Of Government