Welcome to the salt lake county property tax website. The local sales tax rate in salt lake county is 0.35%, and the maximum rate (including utah and city sales taxes) is 7.75% as of november 2021.

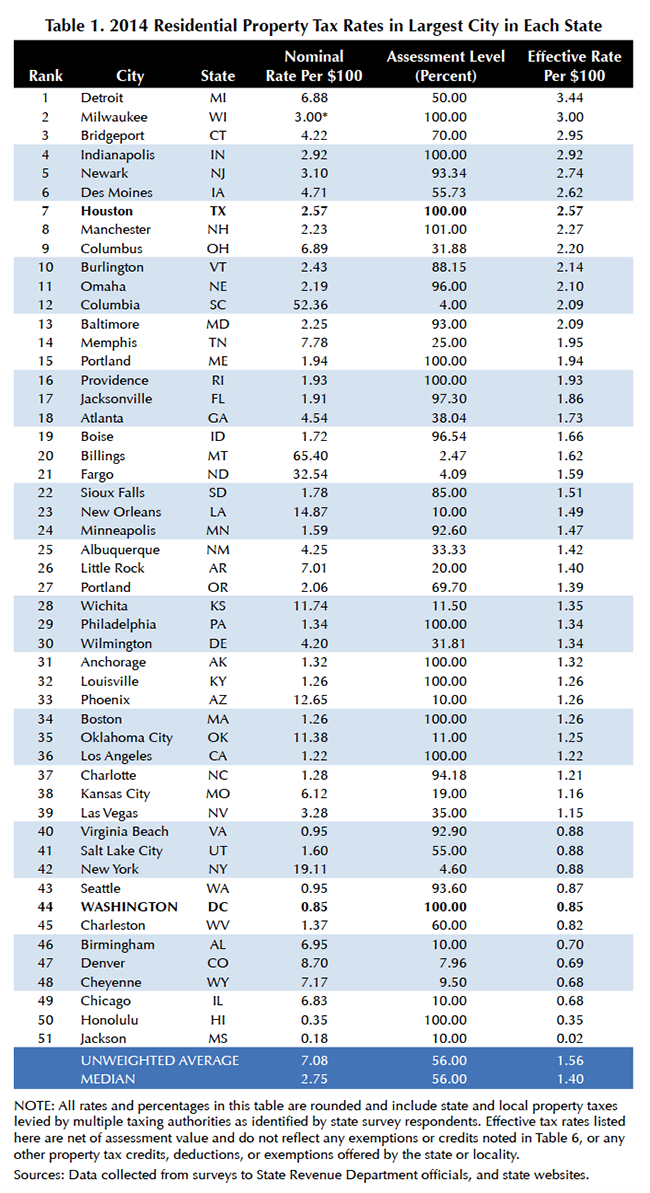

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Please refer to the utah website for more sales taxes information.

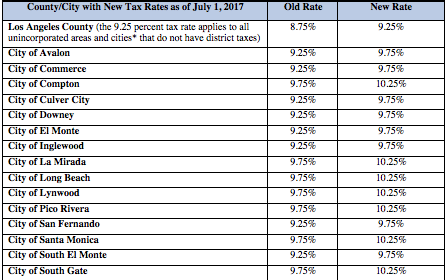

Salt lake county sales tax rate. The current total local sales tax rate in salt lake city, ut is 7.750%. Sales and use tax salt lake city, utah has a 6.85% sales and use tax for retail sales of tangible personal property and select services, which include, but are not limited to, admissions to places of amusement, intrastate transportation service, and hotel and motel accommodations. The median property tax in salt lake county, utah is $1,588 per year for a home worth the median value of $237,500.

[ 1 ] state sales tax is 4.85%. Sales tax and use tax rate of zip code 84151 is located in salt lake city city, salt lake county, utah state. The 84129, salt lake city, utah, general sales tax rate is 7.25%.

North salt lake, ut sales tax rate the current total local sales tax rate in north salt lake, ut is 7.250%. The combined rate used in this calculator (7.25%) is the result of the utah state rate (4.85%), the 84129's county rate (1.35%), and in some case, special rate (1.05%). In other words, it is the rate that will produce the same amount of revenue that the entity budgeted.

The salt lake city's tax rate may change depending of the type of purchase. The following flow chart will help you decide what should be taxed at this lower rate. Grocery food sales tax flowchart.

The minimum combined 2021 sales tax rate for salt lake city, utah is. Tax rates property tax sale current tax sale list bidder registration property aerial map procedures & rules contaminated properties Salt lake city, ut sales tax rate.

The restaurant tax is an additional 1%. This is the total of state, county and city sales tax rates. The 7.75% sales tax rate in salt lake city consists of 4.85% utah state sales tax, 1.35% salt lake county sales tax, 0.5% salt lake city tax and 1.05% special tax.

The december 2020 total local sales tax. The tax sale will be held may 27, 2021. The auditor’s office calculates certified tax rates for all entities in the county that levy property taxes.

The current total local sales tax rate in salt lake county, ut is 7.250%. The december 2020 total local sales tax rate was also 7.250%. Sales tax and use tax rate of zip code 84103 is located in salt lake city city, salt lake county, utah state.

The utah sales tax rate is currently %. The link for the tax sale is bid4assets.com/saltlake. The statewide grocery food sales tax rate is 3 percent.

Average sales tax (with local): Utah has state sales tax of 4.85% ,. The county sales tax rate is %.

The current total local sales tax rate in south salt lake, ut is 7.450%. The value and property type of your home or business property is determined by the salt lake county assessor. Residential property owners typically receive a 45% deduction from their home value to determine the taxable value, which means you.

The 2021 tax sale will be held online through bid4assets. 89 rows the entire combined rate is due on all taxable transactions in that tax jurisdiction. Salt lake county has one of the highest median property taxes in the united states, and is ranked 704th of the 3143 counties in order of median property taxes.

The certified tax rate is the base rate that an entity can levy without raising taxes. Salt lake county sales tax. The salt lake city sales tax rate is %.

, ut sales tax rate. [ ] state sales tax is 4.85%. Every 2021 combined rates mentioned above are the results of utah state rate (4.85%), the county rate (0.35% to 1.35%), the salt lake city tax rate (0% to 1%), and in some case, special rate (0.8% to 1.05%).

Salt lake county collects, on average, 0.67% of a property's assessed fair market value as property tax.

Utah Sales Tax – Small Business Guide Truic

Los Angeles County Property Tax Rate 2015 – Property Walls

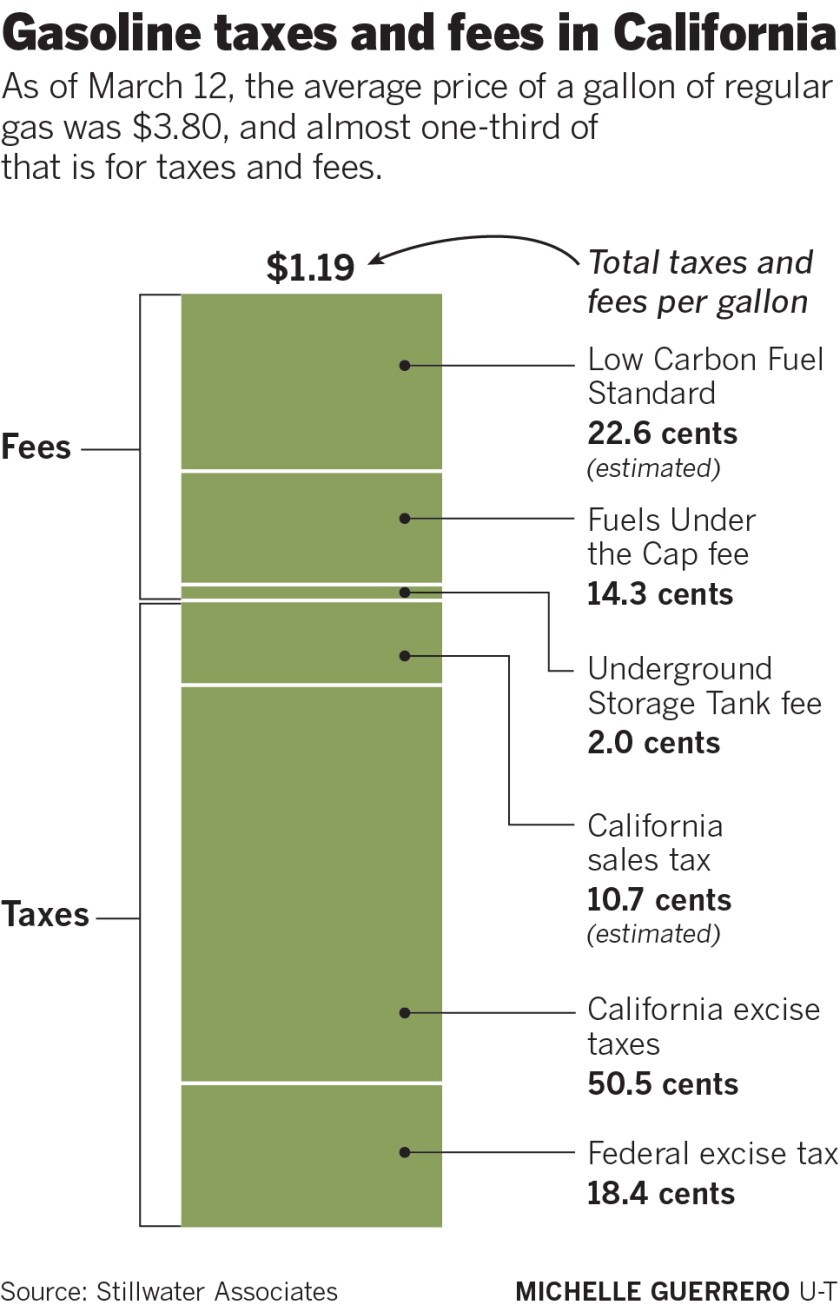

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

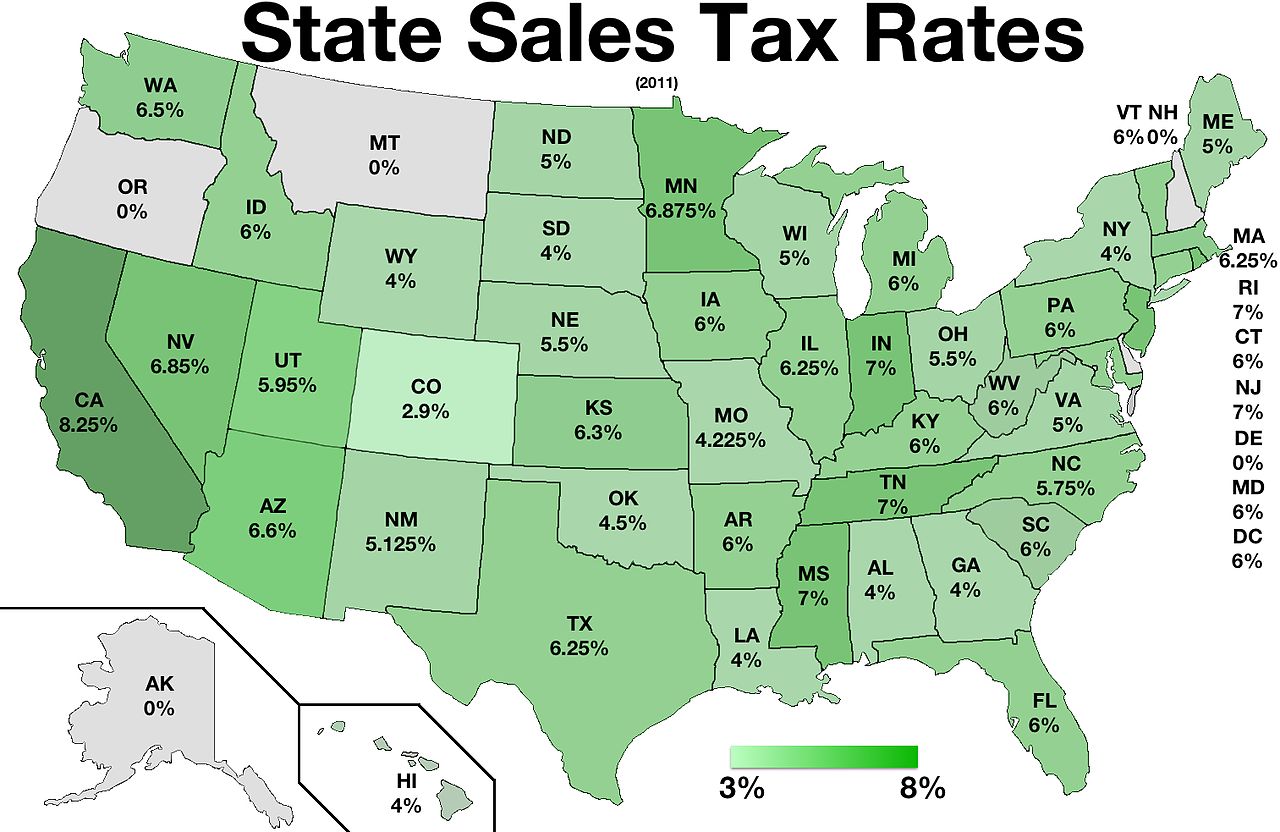

Sales Taxes In The United States – Wikiwand

Salt Lake City Utahs Sales Tax Rate Is 775

Sales Taxes In The United States – Wikiwand

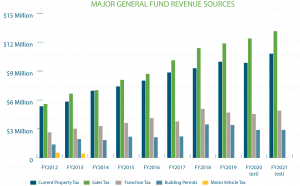

Revenue Taxation – Lehi City

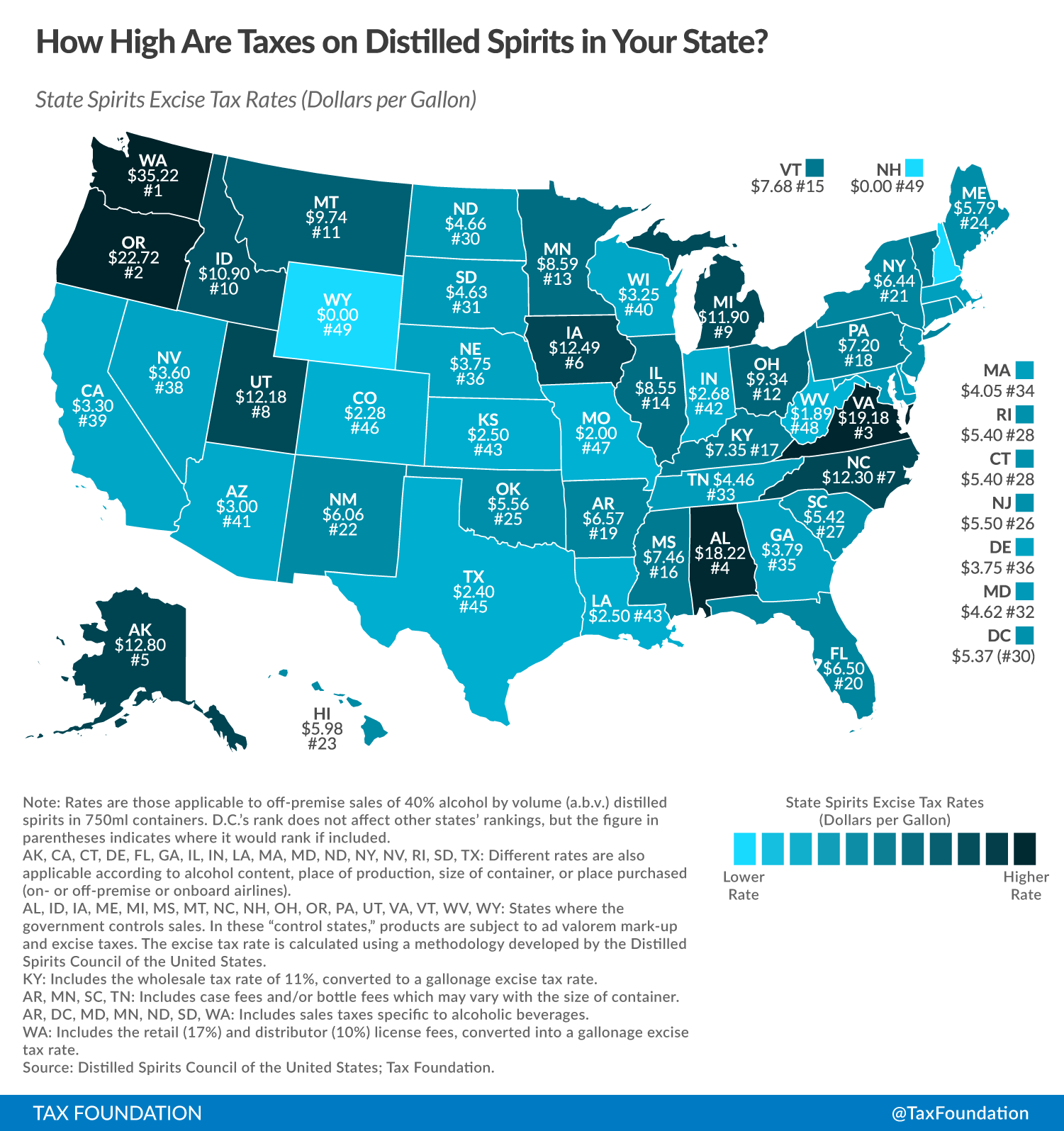

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic – Distillery Trail

Sales Taxes In The United States – Wikiwand

What Is The Austin Texas Sales Tax Rate – The Base Rate In Texas Is 625

Article – Real Estate Center

States With The Highest And Lowest Property Taxes Property Tax High Low States

Sales Taxes In The United States – Wikiwand

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates – Orem Ut The Best Guide To Orem Utah

Grocery Food

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

California Sales Tax Rates By City County 2021

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

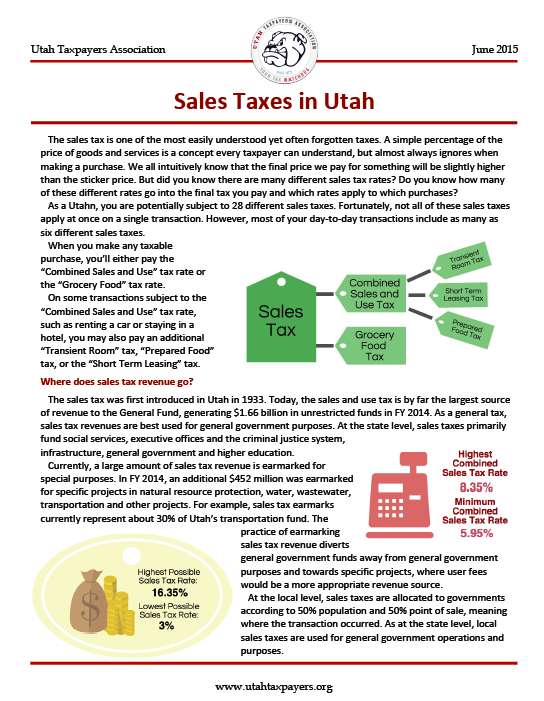

Sales Taxes Utah Taxpayers