Depending on the zipcode, the sales tax rate of chattanooga may vary from 7% to 9.25%. Gallatin, tn sales tax rate:

Tennessee Sales Tax Rates By City County 2021

The tennessee sales tax rate is currently %.

Sales tax calculator chattanooga tn. The chattanooga, tennessee, general sales tax rate is 7%. For addtional information regarding property assessments and calculations, visit state of tn comptroller division of property assessments. Find 429 listings related to sales tax calculators in chattanooga on yp.com.

The county sales tax rate is %. Property tax payments that include the original tax bill with the barcode and payment for the total amount due can be mailed from october through the last day in february to the following address: Tax laws, their interpretation, and.

This is the total of state, county and city sales tax rates. 101 rows the 37421, chattanooga, tennessee, general sales tax rate is 9.25%. Please consult your local tax authority for specific details.

The sales tax calculator is for informational purposes only, please see your motor vehicle clerk to confirm exact sales tax amount. Clarksville, tn sales tax rate: Sales tax amount = net price x (sales tax percentage / 100) total price = net price + sales tax amount

Germantown, tn sales tax rate The county’s average effective tax rate is 0.89%. Net price is the tag price or list price before any sales taxes are applied.

The chattanooga sales tax rate is %. Chattanooga, tn sales tax rate: Taxes are calculated per $100 of assessed value multiplied by tax rate set by city of chattanooga.

• $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 • clerk negotiates check for $1,771 tn sales tax paid by dealer if county clerk has received the payment from dealer. The hamilton county sales tax is collected by the merchant on. 9.75% is the highest possible tax rate ( alexandria, tennessee) the average combined rate.

Franklin, tn sales tax rate: Depending on the zipcode, the sales tax rate of chattanooga may vary from 7% to 9.25% every 2016 combined rates mentioned above are the results of tennessee Depending on local tax jurisdictions, the total sales tax rate can be as high as 10%.

Chattanooga, tn sales tax rate the current total local sales tax rate in chattanooga, tn is 9.250%. Every 2021 combined rates mentioned above are the results of. Cleveland, tn sales tax rate:

For state, use and local taxes use state and local sales tax calculator. Cookeville, tn sales tax rate: The hamilton county, tennessee sales tax is 9.25% , consisting of 7.00% tennessee state sales tax and 2.25% hamilton county local sales taxes.the local sales tax consists of a 2.25% county sales tax.

How 2016 sales taxes are calculated in chattanooga. In chattanooga, the county’s largest city, the total mill rate is $2.2770 per $100 in assessed value, which is equal to 25% of market value. The information in this guide is current as of the date of publication.

The minimum combined 2021 sales tax rate for chattanooga, tennessee is. You may also be interested in printing a tennessee sales tax table for easy calculation. Collierville, tn sales tax rate:

East chattanooga, tn sales tax rate: This leaves $80 due at. See reviews, photos, directions, phone numbers and more for sales tax calculators locations in chattanooga, tn.

The chattanooga, tennessee, general sales tax rate is 7%. 101 rows the 37499, chattanooga, tennessee, general sales tax rate is 7%. Document or a substitute for tennessee sales or use tax statutes or rules and regulations.

How 2021 sales taxes are calculated in chattanooga. You can use our tennessee sales tax calculator to determine the applicable sales tax for any location in tennessee by entering the zip code in which the purchase takes place. The tennessee (tn) state sales tax rate is 7.0%.

The december 2020 total local sales tax rate was also 9.250%. Columbia, tn sales tax rate: Tennessee state rate (s) for 2021.

Total price is the final amount paid including sales tax. 7% is the smallest possible tax rate ( denver, tennessee) 8.5%, 8.75%, 9%, 9.25%, 9.5% are all the other possible sales tax rates of tennessee cities. This sales and use tax guide is intended as an informal reference for clerks who wish to gain a better understanding of tennessee sales and use tax requirements regarding motor vehicles and boats.

If sales tax value is greater than $1600 but less than $3200 your single article tax is 2.75% after $1600 if sales tax value is more than $3200 your single article tax is $44.00 disclaimer:

Tax Comparison – Florida Verses Tennessee

Chattanooga And Hamilton County Tax Calculator Metro Ideas Project

Tennessee Paycheck Calculator – Smartasset

Sams Club Class Action Says Retailer Overcharges Sales Tax – Top Class Actions

Tennessee Business Taxes Fees A Primer

2021 Overseeding Cost Calculator Chattanooga Tennessee Manta

Chattanooga And Hamilton County Tax Calculator Metro Ideas Project

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Tennessee Income Tax Calculator – Smartasset

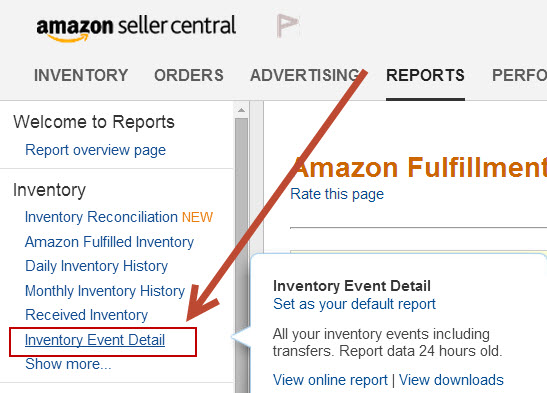

How To Find Where Amazon Fba Gives You Sales Tax Nexus – Taxjar

Tennessee County Clerk – Registration Renewals

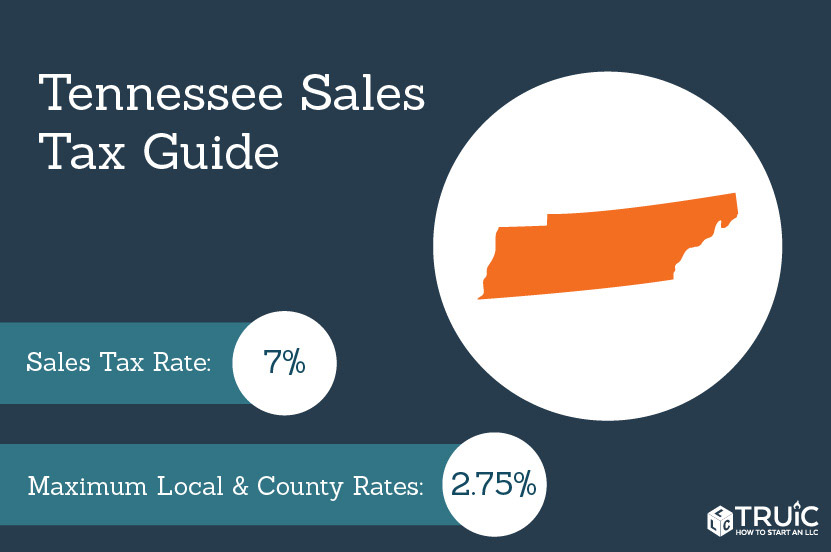

Tennessee Sales Tax – Small Business Guide Truic

2021 Overseeding Cost Calculator Chattanooga Tennessee Manta

Tax Comparison – Florida Verses Georgia

Tennessee Sales Tax – Taxjar

Tennessee Sales Tax And Other Fees – Motor Vehicle – County Clerk – Knox County Tennessee Government

2

Sales Tax On Grocery Items – Taxjar

How To Find Where Amazon Fba Gives You Sales Tax Nexus – Taxjar