Sacramento county is located in northern california and has a population of just over 1.5 million people. [ 1 ] state sales tax is 7.25%.

Californias Sales Tax Rate Has Grown Over Time Econtax Blog

Property tax is calculated by multiplying the property's assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting of any exemptions would pay.

Sacramento county tax rate. The sales tax rate for sacramento county in the state of california as on 1st january 2020 varies from 7.75% to 8.75% depending upon in which city you are computing the sales tax. Payments may be made as follows: The median property tax on a $324,200.00 house is $2,204.56 in sacramento county.

Sales tax and use tax rate of zip code 95835 is located in sacramento city, sacramento county, california state. The tax rates are expressed as dollars per 100 of assessed value, therefore the tax amount is already divided by 100 in order to obtain the correct value. Depending on the zipcode, the sales tax rate of sacramento may vary from 6.5% to 8.75% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25% to 1%), the sacramento tax rate (0% to 1%), and in.

The sacramento county assessor's office can help you with many of your property tax related issues,. The minimum combined 2021 sales tax rate for sacramento county, california is. The sacramento county tax assessor is the local official who is responsible for assessing the taxable value of all properties within sacramento county, and may establish the amount of tax due on that property based on the fair market value appraisal.

Sacramento county collects, on average, 0.68% of a property's assessed fair market value as property tax. The california state sales tax rate is currently %. The property tax rate in the county is 0.78%.

Estimated combined tax rate 8.75%, estimated county tax rate 0.25%, estimated city tax rate 1.00%, estimated. You can print a 8.75% sales tax table here. The sacramento county sales tax rate is %.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. This is the total of state and county sales tax rates. City level tax rates in this county apply to assessed value, which is equal to the sales price of recently purchased homes.

The current total local sales tax rate in sacramento county, ca is 7.750%. The sales tax jurisdiction name is sacramento tmd zone 1, which may refer to a local government division. 95835 zip code sales tax and use tax rate | sacramento {sacramento county} california.

The 8.75% sales tax rate in sacramento consists of 6% california state sales tax, 0.25% sacramento county sales tax, 1% sacramento tax and 1.5% special tax. The sacramento county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% sacramento county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 1.50% special district sales tax (used to fund transportation districts, local attractions, etc). The median property tax (also known as real estate tax) in sacramento county is $2,204.00 per year, based on a median home value of $324,200.00 and a median effective property tax rate of 0.68% of property value.

The median property tax on a $324,200.00 house is $2,399.08 in california. Sacramento county collects relatively high property taxes, and is ranked in the top half of all counties in the united states by property tax collections. The sacramento county sales tax is collected by the merchant on all.

Sacramento county has one of the highest median property taxes in the united states, and is ranked 359th of the 3143. Sales tax and use tax rate of zip code 95830 is located in sacramento city, sacramento county, california state. The median property tax in sacramento county, california is $2,204 per year for a home worth the median value of $324,200.

The median property tax on a $324,200.00 house is $3,404.10 in the united states. This does not include personal (unsecured) property tax bills issued for boats, business equipment, aircraft, etc. Sales tax and use tax rate of zip code 95837 is located in sacramento city, sacramento county, california state.

[ 1 ] state sales tax is 7.25%. Some cities and local governments in sacramento county collect additional local sales taxes, which can. The sacramento county sales tax is 0.25%.

It's also home to the state capital of california. [ 1 ] state sales tax is 7.25%.

Understanding Californias Sales Tax

Tax Rates Stripe Documentation

California Tax Rates Hr Block

Property Taxes Calculator Property Tax Property Tax

Tax Rate Setup – Gst Composition

How To Calculate California Sales Tax 11 Steps With Pictures

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

San Diego County Public Records Public Records San Diego San Diego County

Property Tax Calculator

How To Set Up Tallyprime For Gst Composition Tallyhelp

Understanding Californias Sales Tax

Understanding Californias Property Taxes

Understanding Californias Sales Tax

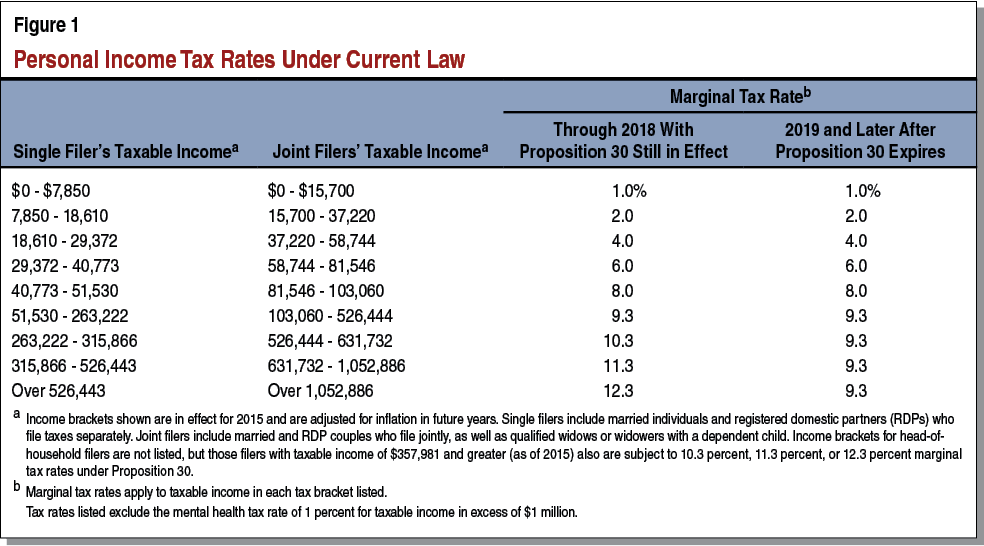

Personal Income Taxes And Funding For Education And Health Programs Amendment No 1 Ballot

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Why A Roth Ira Or 401k Might Not Be A Good Idea If Tax Rates Increase – Cbs News

Its Amazing To See Housing Inventory In The Sacramento Area Over The Past Decade Sacramento County 10 Years County

Alabama Tax Rate Hr Block

La Countys Sales Tax Increases Sunday To Help The Homeless Heres How Much Daily News