At any rate, rsus are seen as supplemental income. Only the federal income tax applies.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

The ordinary earned income tax rate when the rsus vest, or;

Rsu tax rate texas. Texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%. * original rate of.010000 was increased effective 10/01/2021. On a same day sale, i would be paying capital gains at a higher tax rate (like a disqualifying disposition), similarly for a “sell to cover” option, i would be paying capital gains at a short term rate for the portion of shares i am selling on same day.

Select the texas city from the list of popular cities below to see its current sales tax rate. Texas is one of seven states that do not collect a personal income tax. While the texas unemployment tax rate range remains the same for 2021, from a minimum of 0.31 percent to a maximum of 6.31 percent, it is not all good news for employers.

Texas unemployment tax rate range remains the same. Senior citizen (who is 60 years or more at any time during the previous year) net income range: Income tax @ 45% of remaining = £7,758;

The median property tax in texas is $2,275.00 per year for a home worth the median value of $125,800.00. Click here for a larger sales tax map, or here for a. The district excludes for sales tax purposes, the city of liberty hill.

Some rsu receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. What is the tax rate for an rsu? There are a total of 815 local tax jurisdictions across the state, collecting an average local tax of 1.377%.

Texas has one of the highest average property tax rates in the country, with only thirteen states levying higher property taxes. Deducting employer’s nic @ 13.8% = £2,760; This is because rsus, stock grants, and.

Total tax and nic = £10,862; Employee nic @ 2% = £344; Williamson county emergency services district no.

Tax rate compression and adoption of tax rate for tax year 2021. The exact tax rate will depend on your specific tax bracket as determined by your income. The state sales tax rate in texas is 6.250%.

Counties in texas collect an average of 1.81% of a property's assesed fair market value as property tax per year. Rsu’s are taxed on the date of vesting for the full vested amount. With local taxes, the total sales tax rate is between 6.250% and 8.250%.

On the date that your rsus vest you will get shares net of the tax your employer withholds. If the bill becomes law, cities and counties would be limited to a 3.5% annual tax. Most companies will withhold federal income taxes at a flat rate of 22%.

Not all texas cities and counties have a local code. Total income (rs) rate up to 2,50,000 nil from 2,50,001 to 5,00,000 5% from 5,00,001 to 7,50,000 10% from 7,50,001 to 10,00,000 15% from 10,00,001 to 12,50,000 20% from 12,50,001 to 15,00,000 25% above 15,00,000 30% surcharge: You pay unemployment tax on the first $9,000 that each employee earns during the calendar year.

The value of over $1 million will be taxed at 37%. Maximum tax rate for 2021 is 6.31 percent. It’s important to remember that the rsu tax rate will be the same as your income tax rates.

When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income. Cities and counties without a local code do not charge a local sales and use tax. 55% tax and nic paid

Salary £150,000, rsu value £20,000. Texas has recent rate changes (thu jul 01 2021). The withholding rate is what might be different, which is a common source of confusion.

Employee total salary before rsu is £150,000. 70% tax and nic paid. The capital gains tax rate when you sell the shares you own;

Texas house passes cap on rate of property tax increases. This is true whether we’re talking about: Most employers will withhold taxes on your rsus at a rate of 22%, but you could easily be in a higher tax bracket than that.

Your taxable wages are the sum of the wages you pay up to $9,000 per employee per year. Texas has no state income tax. Plan for the rsu vesting event once you’ve used the rsu tax calculator to determine your estimated taxes and estimated proceeds, you’ll want to make a plan so you know what you want to do with your company shares after the vesting date.

However, the combined rate of local sales and use taxes cannot exceed 2%, making the highest possible combined tax rate 8.25%.

Restricted Stock Units Rsus Facts

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Blog Upstart Wealth

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation – Flow Financial Planning

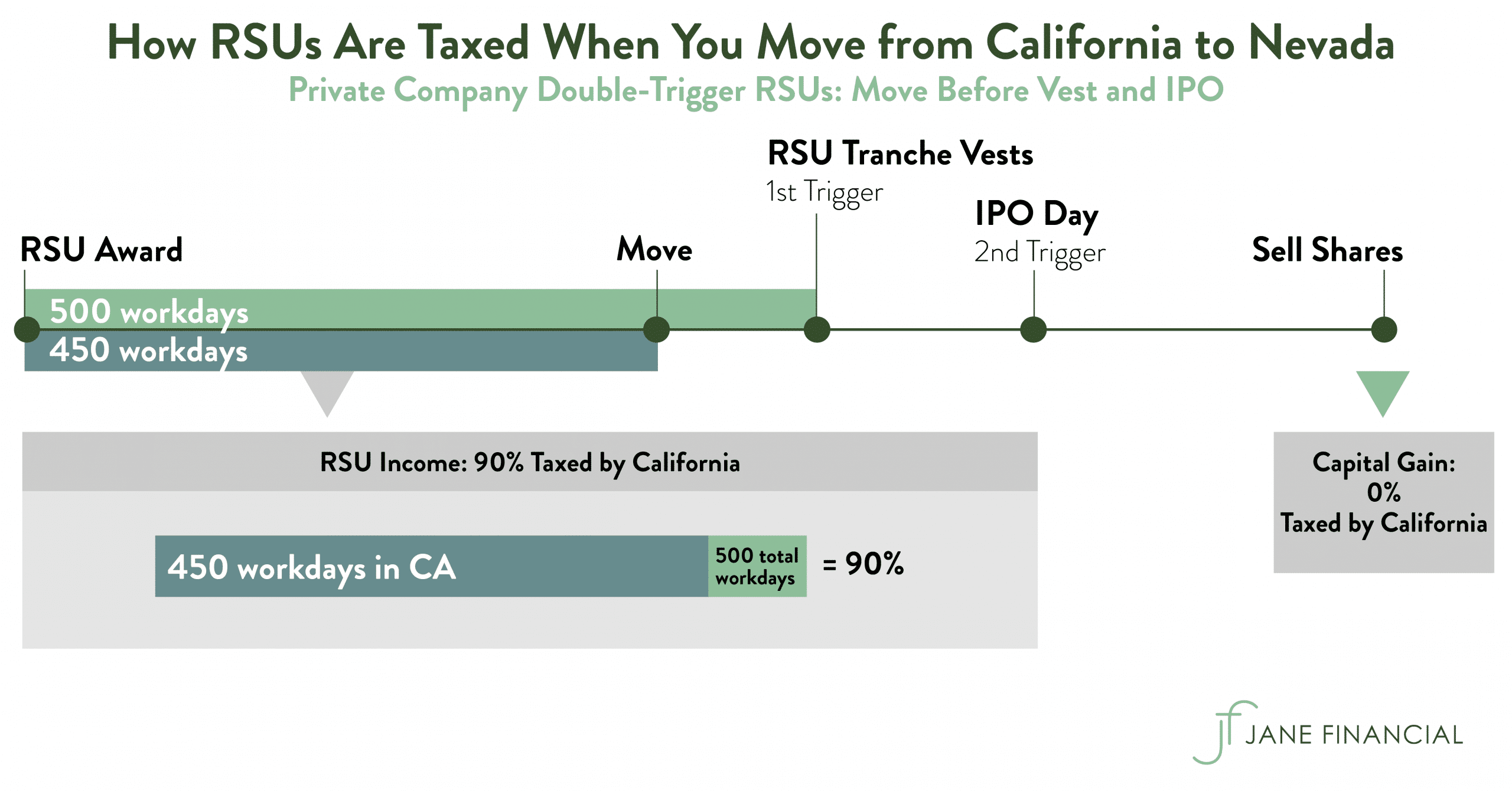

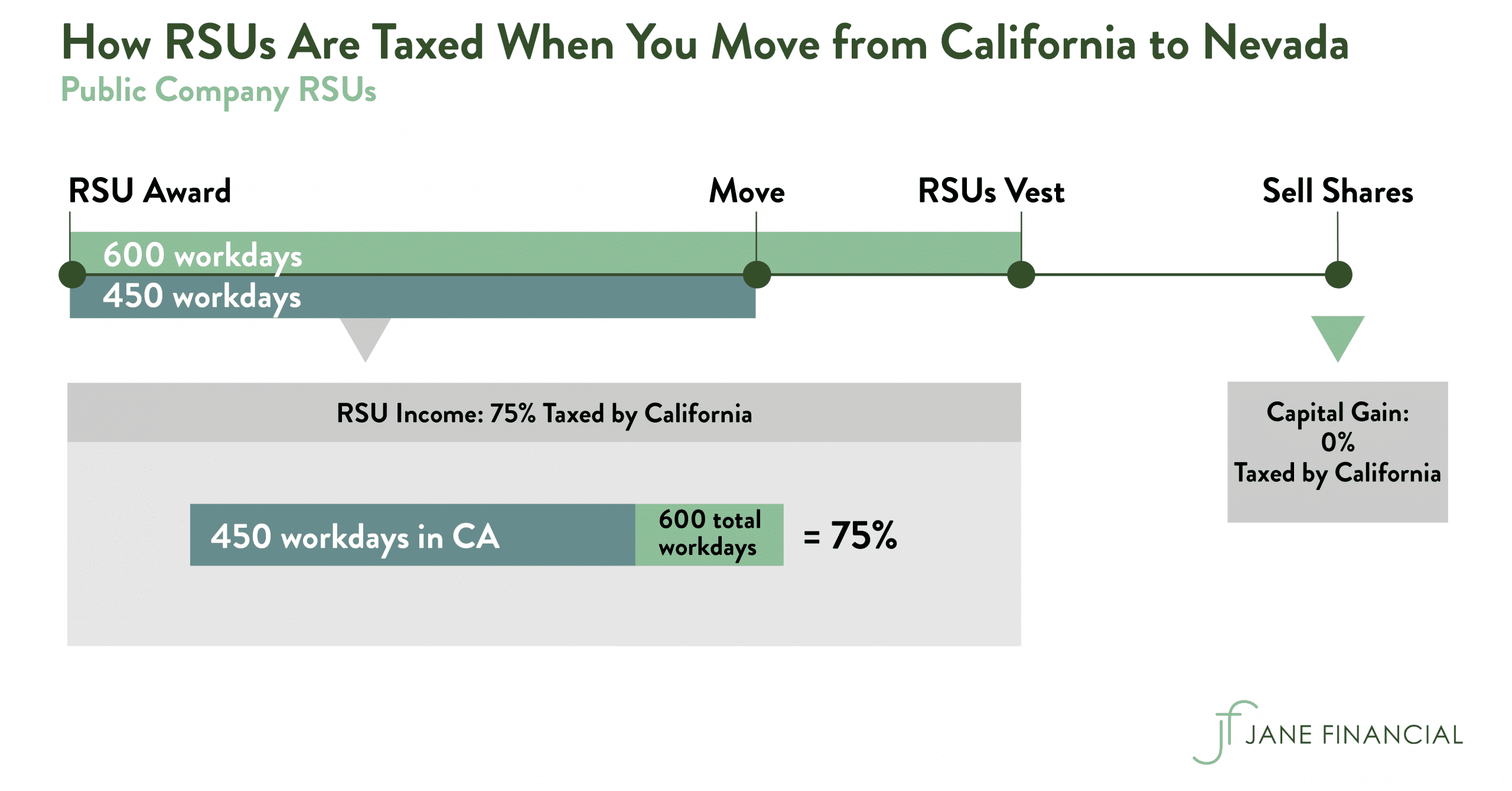

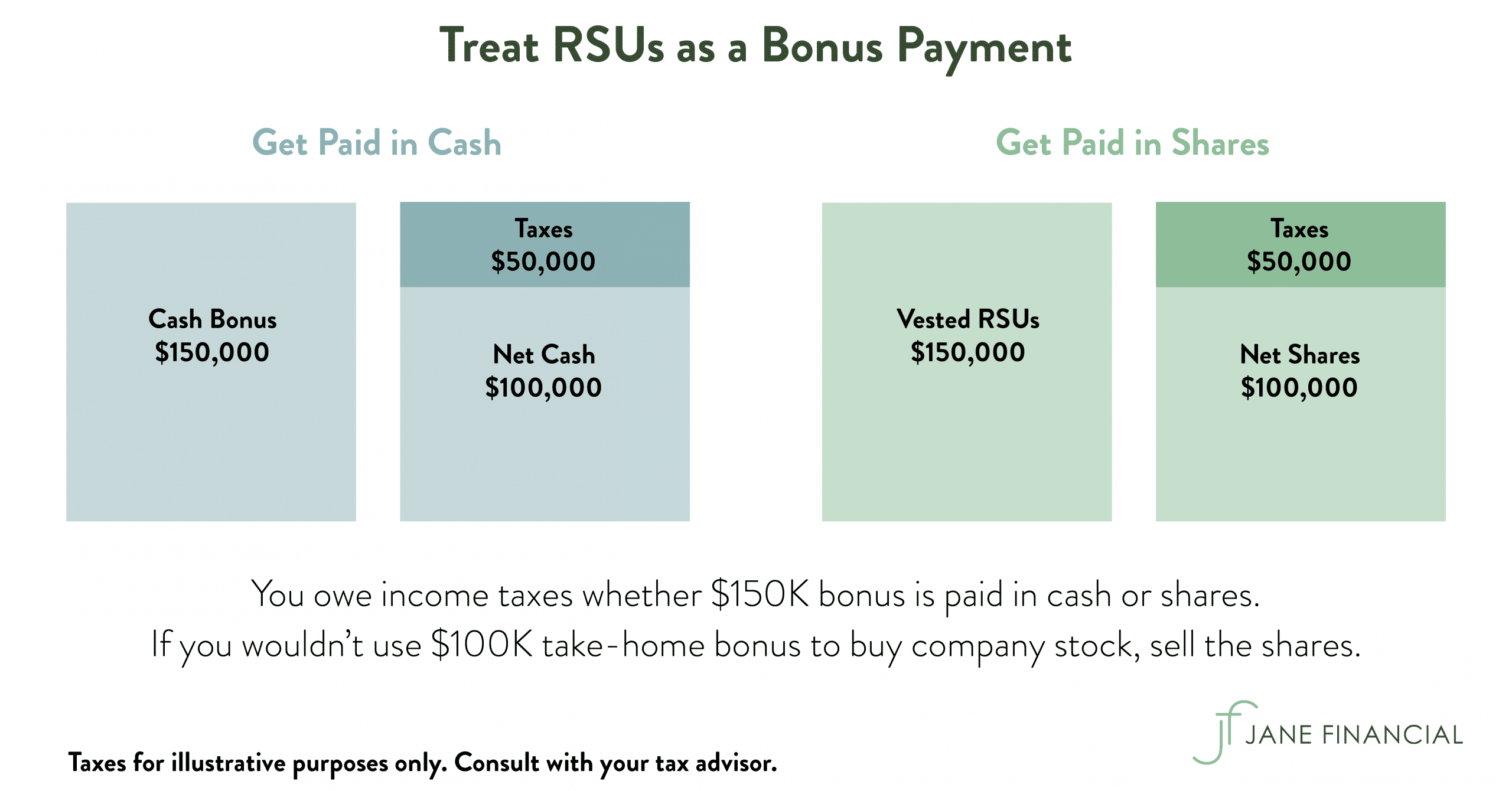

Restricted Stock Units – Jane Financial

Restricted Stock Units – Jane Financial

Rsu And Taxes Restricted Stock Tax Implications

Restricted Stock Units – Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Blog Upstart Wealth

Restricted Stock Units – Jane Financial

Restricted Stock Units 10 Fast Facts Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

Restricted Stock Units – Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units – Jane Financial

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Blog Upstart Wealth