Rsus are taxed at the ordinary income tax rate when they are issued to an employee, after they vest and you own them. Because there is no actual stock issued at grant, no section 83 (b) election is permitted.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Value added tax (vat)/sales tax.

Rsu tax rate ireland. The office of the revenue commissioners. At any rate, rsus are seen as supplemental income. The beauty of rsus is in the simplicity of the way they get taxed.

Rsu’s are taxed on the date of vesting for the full vested amount. While ireland's corporate tax is only 16% of total net revenues (see above), ireland's corporate tax system is a central part of ireland's economic model. Most companies will withhold federal income taxes at a flat rate of 22%.

The value of over $1 million will be taxed at 37%. On a same day sale, i would be paying capital gains at a higher tax rate (like a disqualifying disposition), similarly for a “sell to cover” option, i would be paying capital gains at a short term rate for the portion of shares i am selling on same day. Balance of income over 35,300:

The taxation of rsus is a bit simpler than for standard restricted stock plans. The capital gains tax rate when you sell the shares you own; Some rsu receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

Ireland’s corporate tax rate is among the lowest in the world at 12.5%. The ordinary earned income tax rate when the rsus vest, or; For your state tax rate, it’d be a little much for us to pull each state’s income tax and include it.

This is true whether we’re talking about: If the rsus and the holder is no longer irish resident, the rsus are not taxable in ireland, regardless of the fact Corporate tax rates have been one of the principal reasons that companies have been attracted to ireland.

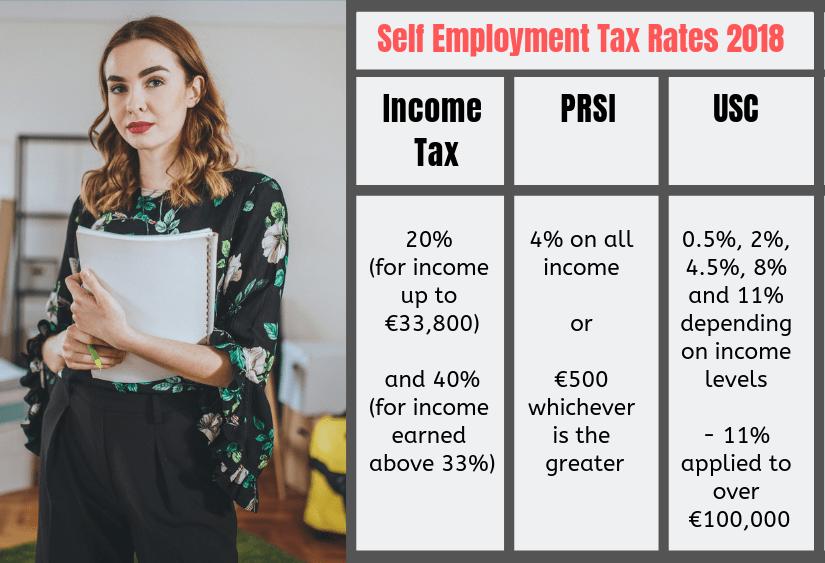

Personal income tax rate in ireland averaged 45.65 percent from 1995 until 2020, reaching an all time high of 48 percent in 1996 and a record low of 41 percent in 2007. Schedule f (wh = withholding tax) 25% wh. The personal income tax rate in ireland stands at 48 percent.

Engine size if your car was manufactured before july 2008, co2 emissions output (nedc) if your car was registered between 1st july 2008 and 31st december 2020, or co2 emissions output (wltp) if your car was registered after january 1st 2021. There is a combined irish marginal withholding tax rate of 52% (41% paye, usc 7%, and prsi 4%) applying to rsus. So it’s up to you to enter a percentage.

It’s important to remember that the rsu tax rate will be the same as your income tax rates. A foreign withholding tax liability could mean that the individual has a total withholding tax liability approaching the full value The withholding rate is what might be different, which is a common source of confusion.

In 2017 the rsus were vested and she paid tax on this vest at the marginal rate. We use these aggregate tax indicators to compare the developments in the irish tax policy mix with the rest of the european union countries and investigate any potential relation with ireland’s macroeconomic performance. The exact tax rate will depend on your specific tax bracket as determined by your income.

The vat or value added tax rate for ireland is a standard 12%. Two incomes (of at least eur 26,300 each) income up to 70,600: The government policy in relation to the 12.5% rate of corporation tax is clear regime this refers to the additional elements of irelands broader corporation tax

Special savings account (ssa) 33%. Rsus can trigger capital gains tax, but only if the stock holder chooses to not sell the stock and it increases. Rsus are fully taxable in the state if they vest at a time when the holder is irish tax resident, without any apportionment by reference to any part of the vesting period during which holder was resident elsewhere.

In ireland, the price you pay for road tax is based on three different assessments; Unlike the much more complicated espp, they get taxed the same way as your income. Ireland's taxation system is distinctive for its low headline rate of corporation tax at 12.5% (for trading income), which is half the oecd average of 24.9%.

The latest capital gains tax rates in ireland for 2021 are displayed in the table below the capital gains tax formula. Balance of income over 44,300: What is the tax rate for an rsu?

This is because rsus, stock grants, and. When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income. Balance of income over 70,600

A big note here, you must enter a value even if the value is 0%.

Taxinstituteie

Taxinstituteie

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Nathan Trust On Twitter Do You Pay Capital Gains Tax On Rsus When The Shares Are Sold Disposed Of This Is Taxable And Falls Within The Scope Of Capital Gains Tax The

Blog Upstart Wealth

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Tax Treatment Of Restricted Stock Units – Gallagher Keane

Nathan Trust – Do You Pay Capital Gains Tax On Rsus When The Shares Are Sold Disposed Of This Is Taxable And Falls Within The Scope Of Capital Gains Tax The Cgt

Rsu Tax In Ireland – What You Need To Pay File We Have The Expertise

Agenda Introduction Us Payroll Deposit Rules Managing Non-us Employment Tax Obligations Business Travelers Global Rewards Updates Questions And Contact – Ppt Download

Rsu And Tax In Ireland In 2021 – Youtube

Rsu Tax In Ireland – What You Need To Pay File We Have The Expertise

Your Bullsht-free Guide To Self-assessment Taxes In Ireland

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation – Flow Financial Planning

Your Bullsht-free Guide To Self-assessment Taxes In Ireland

.png?width=1952&height=840&name=Add%20a%20subheading%20(2).png)

Tax On Share Options In Ireland – How Stock Options Are Taxed In Ireland

Rsu And Taxes Restricted Stock Tax Implications

Rsus – A Tech Employees Guide To Restricted Stock Units