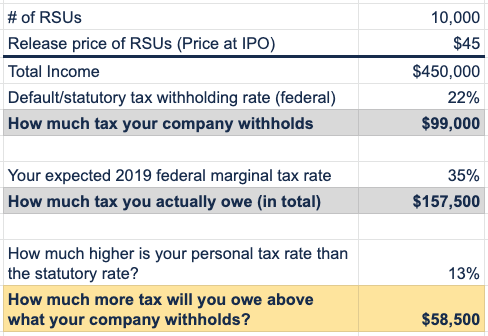

On the date that your rsus vest you will get shares net of the tax your employer withholds. In some states, such as california, the total tax withholding on your rsu is around 40%.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

So you have to pay tax on all rs 1 lac, however if its rsu of a public listed indian company , your tax will be nil , because of long term capital gains, but if its a out side india listed company , then 20% of 1 lac , which is rs 20,000

Rsu tax rate india. In case a company is granting 200 rsus with a condition of 25% rsu vesting every year, then 25% (50 shares) can be claimed at the end of the first year. Current tax rate levied on petrol is 178.40%. What is the tax rate for an rsu?

5 lakh to 10 lakh: 2, 50,000 but less than rs. Vat rate and petrol prices differ highly in the different states.

3 lakh to 5 lakh: ₹62500 + 20% of total income exceeding ₹7,50,000. ₹12500 + 20% of total income exceeding ₹5,00,000.

Tax on the capital gains. The value of over $1 million will be taxed at 37%. 25%* if turnover/gross receipts do not exceed inr 4 billion for fy 2018/19;

At any rate, rsus are seen as supplemental income. 15% if taxable income exceeds rs 1 crore. When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income.

Personal tax rates in india: 10% if taxable income exceeds rs 50 lakh. Plus 4% cess on tax:

Otherwise, 30% (surcharge ranging from 7% to 12% of tax applicable); The exact tax rate will depend on your specific tax bracket as determined by your income. The government earns nearly 45% to 50% of tax revenue on petrol and diesel from the states.

A big note here, you must enter a value even if the value is 0%. So it’s up to you to enter a percentage. 51.54 as tax when you buy one litre of petrol which retails at a price of 80.43 rs./litre in new delhi.

Impact of gst on petrol. 0 but less than rs. For taxable income above rs.

Plus 4% cess on tax: Additionally, health and education cess at 4% of tax and surcharge. 5% on taxable income between rs.

Frozen vegetables and engine parts. This doesn’t include state income, social security, or medicare tax withholding. Nri taxation covers aspects of income tax, wealth tax and property tax, among others but the focal point of taxation lies on income tax.

5% for taxable income between rs. 5 lakh and 10 lakh. Another 25% or 50 shares can then be claimed in the second year, and only at the end of the fourth year will an.

The vat ranges from as high as 40% to as low as 6. Telephony, banking, insurance, accommodation between rs 2,500 and rs 7,499 per night, restaurants with alcohol license, entrance to cultural and entertainment events, capital goods, heavily processed foods; Applicable tax rates & cess:

₹37500 + 15% of total income exceeding ₹7,50,000. A restricted stock unit (rsu) is a form of compensation issued by an employer to an employee in the form of company shares. 5, 00,000, rate of tax deduction is.

On the sale of rsus, esops and espps, the gains/profit made are subject to capital gains tax. Most companies will withhold federal income taxes at a flat rate of 22%. For rsus, the profit/gain is the difference between the sale price and the vesting price.

The central government collects approximately 25% of the fuel prices, while the state governments collect vat. 3,00,000 in case of an individual who is above the age of 60 and below the age of 80 years and residing in the country, rate of tax deduction is 0% ; Total income (rs) rate up to 2,50,000 nil from 2,50,001 to 5,00,000 5% from 5,00,001 to 7,50,000 10% from 7,50,001 to 10,00,000 15% from 10,00,001 to 12,50,000 20% from 12,50,001 to 15,00,000 25% above 15,00,000 30% surcharge:

₹12500 + 10% of total income exceeding ₹5,00,000. State tax (vat & local levies) levied on petrol is 18.56 rs./litre. For your state tax rate, it’d be a little much for us to pull each state’s income tax and include it.

5 lakh + 20% on taxable income between rs. 2,50,000, rate of tax deduction is 0%; For taxable income above rs.

40% (surcharge ranging from 2% to 5% of tax applicable); For taxable income less than rs.

Understanding Esops Rsus Espps – Indias First Online Finance Dictionary

Restricted Stock Units Everything You Need To Know – India Dictionary

Income Tax Implications On Rsus Or Espps

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Tax On Esops Finance Ministry May Look Into Taxation Of Employee Stock Ownership Plans

Filing Of Income Tax Return For Sale Of Stock Options Rsus Espps Esops – Rsus Esops – Veeresh And Ajay Chartered Accountants Jayanagar 9th Block Bengaluru Karnataka

Getting Esop As Salary Package Know About Esop Taxation

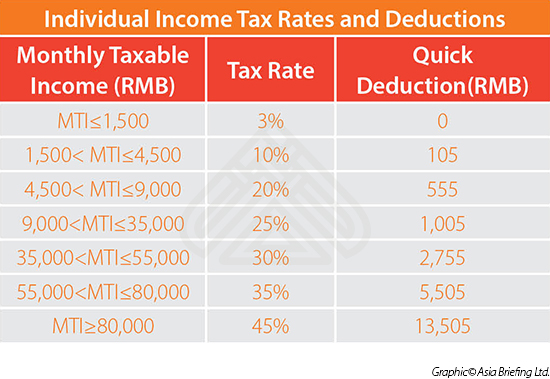

Granting Restricted Stock Units To Your Employees In China – China Briefing News

Understanding Esops Rsus Espps – Indias First Online Finance Dictionary

Tax In India On Income Earned From Rsu Vested In Foreign Countries And Exemption From Such Income – Taxontips

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Income Tax Implications On Rsus Or Espps

Tax Planning For Stock Options

How Are Foreign Shares And Rsus Taxed In India – Youtube

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Of Mnc Perquisite Tax Capital Gains Itr