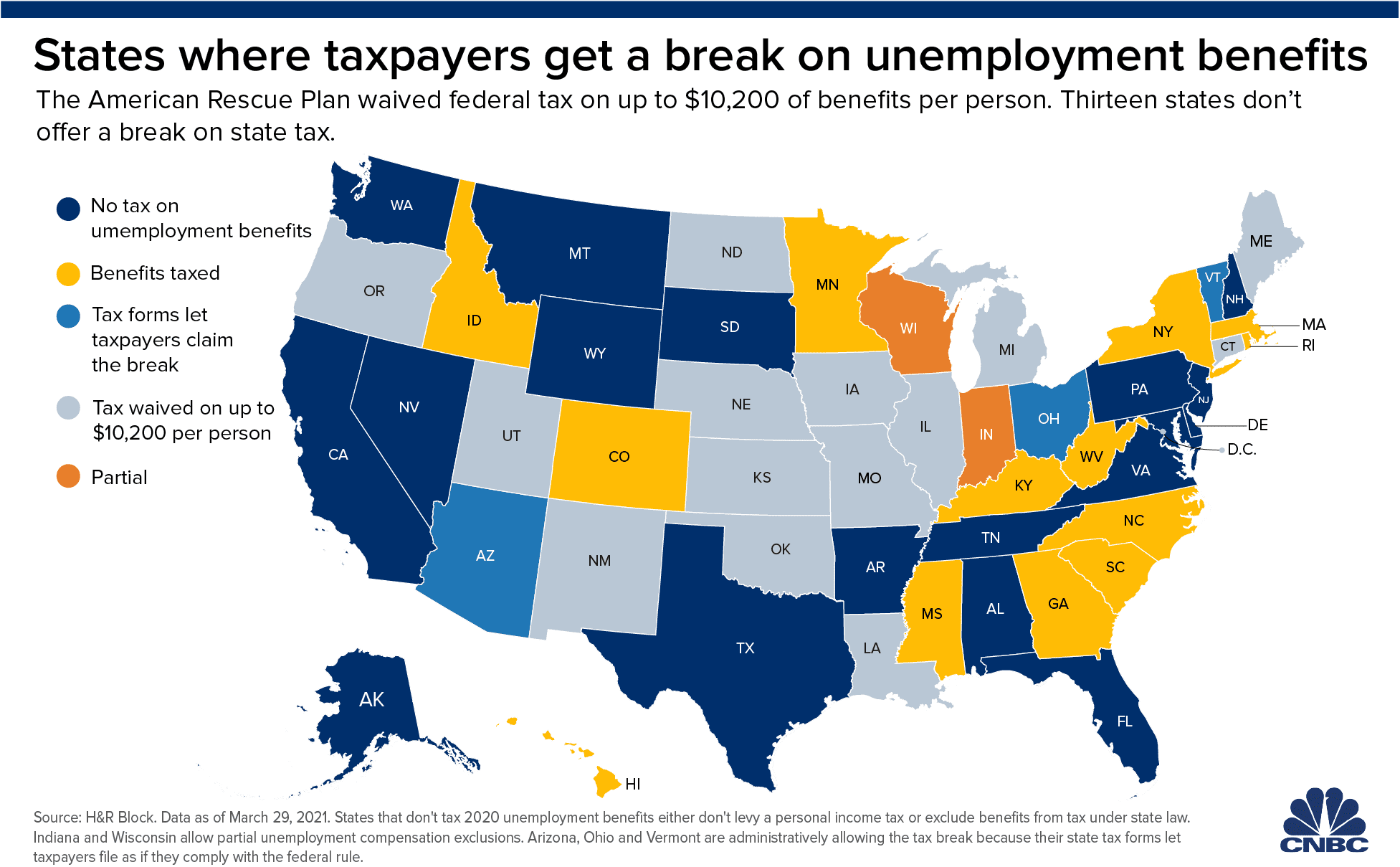

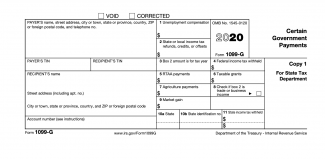

(wpri) — any rhode islanders who received unemployment benefits during 2020 will have to pay state taxes on them. Unemployment benefits are normally taxable income, but federal.

2

You will need to pay 6% of the first $7,000 of taxable income for each employee per year, which makes your maximum futa tax per employee per year $420.note that if you pay state unemployment taxes in full and on time, you are eligible for a tax credit of up to 5.4%, making your futa tax rate effectively 0.6%.

Ri tax rate on unemployment benefits. Unemployment tdi / tci insurance insurance taxable wage base $24,600 $74,000 for employers at the highest tax rate $26,100 tax schedules/ schedule h: Employers pay an assessment of 0.21% to support the rhode island governor's workforce board, as well as employment services and unemployment insurance activities. The minimum amount is currently $51.

The minimum amount is currently $53. Employer handbook rhode island department of labor & training. If you are eligible to receive unemployment, your weekly benefit rate will be 3.5% of your average quarterly wages in the two quarters of the base period in which you earned the most.

Is it possible that the 2021 tax rate schedule will be adjusted as a result of the number of Workers aged 14 and 15 are exempt from wage deductions and coverage. Ui tax rate schedule that applies to all employers could change for 2021.

State unemployment tax is a percentage of an employee’s wages. Or $2,300 in one of the base period quarters and total base period wages of at least 1.5 times the highest quarter earnings, and total base period earnings. The maximum weekly benefit amount is currently $566;

Effective january 1, 2021, the unemployment insurance tax schedule will go to schedule h, with tax. The current withholding rate as of january 1, 2021 is 1.3% of your first $74,000 in earnings. — the department of labor and training (dlt) today announced next year's rates for the unemployment insurance (ui) program.

Tax rate for new employers the tax rate for employers who have not had employees long enough to be assigned an experience rating (new employer) is based on the average rate for the employer’s industry.this ensures that new employers have a rate that aligns with other businesses in their industry. If you chose to have taxes withheld, the amount of taxes withheld is in line 4 and line 11. Contributions collected from rhode island employers under this tax are used exclusively to pay benefits to unemployed workers.

If you are eligible to receive unemployment, your weekly benefit rate will be 3.5% of your average quarterly wages in the two quarters of the base period in which you earned the most. Employers pay this tax to fund benefits for workers during periods of unemployment. If you worked for more than one ri employer in a calendar year and your total wages were more than $71,000 (in 2019), you may be entitled to a tdi tax refund.

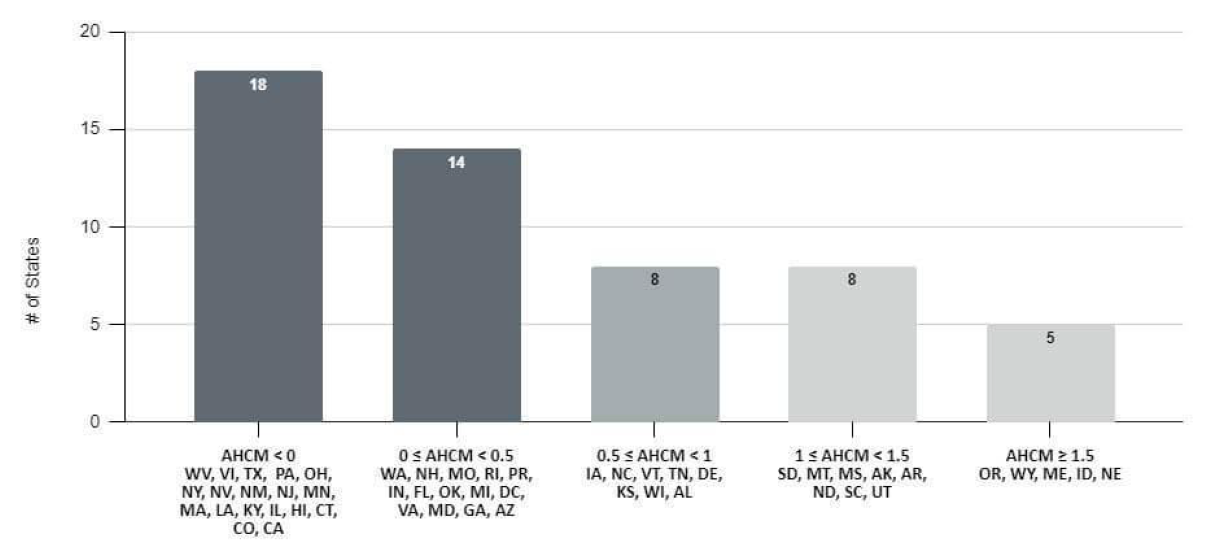

The unemployment tax rates for experienced employers in 2022 will range from 0.33% to 6.4% (0.33% to 5.4% in 2021). The rhode island ui tax rate schedule, known as the “experience rate table” (schedules a ‐ i) under rhode island general laws § 28‐43‐8, is determined based on the amount. Keeping this in view, what is the maximum unemployment benefit in rhode island?

As a result of the twc's. 1.3% tax rates 1.20% to 9.80% deducted from employment security 0.99% to 9.59% employee's wages job development assessment (jda) 0.21% new employer rate 0.95% (not including 0.21%. Which reimbursable employers are required to reimburse states for benefits paid to their workers who claim unemployment insurance by 50 percent through december 31, 2020.

The unemployment tax rates for new employers vary by industry and range from 1.0% to 1.31% in 2022 (1.0% to 1.23% in 2021). The extra $600/week, the extra. Your tax rate might be based on factors like your industry, how many former employees received unemployment benefits, and experience.

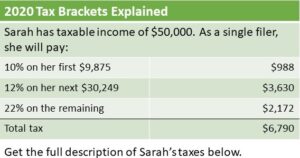

The taxable wage base increases from $27,000 to $28,700 in 2022. The maximum weekly benefit amount is currently $599; Tax brackets and thresholds for single filers in 2020 tax year.

Amount and duration of unemployment benefits in rhode island. Each state sets a different range of tax rates. 29 rows the employer tax rates in these schedules include a 0.21% job development.

Contributions collected from rhode island employers under this tax are used exclusively to pay benefits to unemployed workers. 10 percent — $0 to $9,525 12 percent — $9,526 to $38,700 22 percent — $38,701 to $82,500 Tax rate — taxable income bracket.

However, some states require that you withhold additional money from employee wages for state unemployment taxes.

2022 Sui Tax Rates In A Post-covid World Workforce Wise Blog

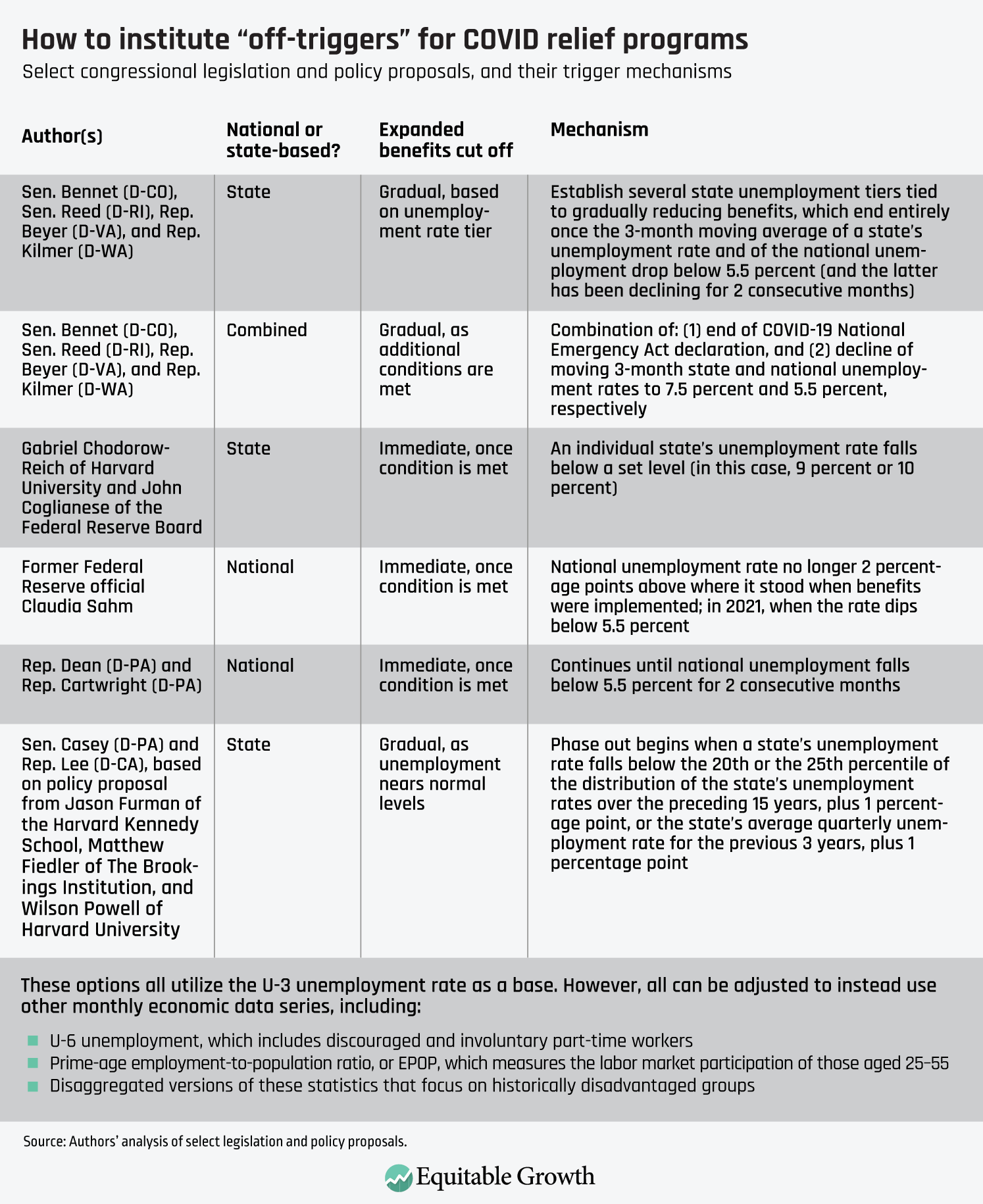

How To Replace Covid Relief Deadlines With Automatic Triggers That Meet The Needs Of The Us Economy – Equitable Growth

10200 Unemployment Tax Break 13 States Arent Giving The Waiver

Andy Boardman Heres How A Rhode Island Employment Bonus Proposal Would Work – And How It Can Be Improved Uprise Ri

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

2

2

Unlike Federal Government Ri Will Fully Tax Unemployment Benefits Wpricom

What Are The Tax Brackets Hr Block

Ri Promise More Info On Unemployment Fraud

Andy Boardman Heres How A Rhode Island Employment Bonus Proposal Would Work – And How It Can Be Improved Uprise Ri

Rhode Island Tax Forms And Instructions For 2020 Form Ri-1040

Unemployment Benefits Comparison By State – Fileunemploymentorg

1099-g Tax Information Ri Department Of Labor Training

2

Golocalprov Scam Email Claiming To Be Ri Division Of Taxation Prompts Warning By State Officials

Out Of Work In Ri Due To Covid-19 Heres What Youre Eligible For Wpricom

10200 Unemployment Tax Break 13 States Arent Giving The Waiver

Partial Benefits Calculator Ri Department Of Labor Training