Tax bracket tax rate ; Current tax rates warwick, rhode island.

2

40 rows tax rates have been rounded to two decimal places in coventry and north smithfield.

Rhode island tax rates 2020. 2) municipality had a revaluation or statistical update effective 12/31/19. The employer tax rates in these schedules include a 0.21% job development assessment which is credited to the job development fund and a 0.03% reemployment assessment (for calendar years 2001, 2002,and 2003) that is credited to the employment security reemployment fund. Read the rhode island income tax tables for married filing jointly filers published inside the form 1040 instructions booklet for more information.

Additional publications, forms, and links can be found in the resources section » The supplemental withholding rate for 2020 continues at 5.99%. The highest marginal rate applies to taxpayers earning more than $148,350 for tax year 2020.

The income tax is progressive tax with rates ranging from 3.75% up to 5.99%. Rhode island has three marginal tax brackets, ranging from 3.75% (the lowest rhode island tax bracket) to 5.99% (the highest rhode island tax bracket). Groceries, clothing and prescription drugs are exempt from the rhode island sales tax.

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower The state has a progressive income tax rate ranging from 3.75% to 5.99%. Computing the amount of rhode island taxes to be withheld from an employee:

The rhode island income tax has three tax brackets, with a maximum marginal income tax of 5.99% as of 2021. The ui taxable wage base will be $24,600 for most employers and $26,100 for employers at the highest rate. 2020 rhode island tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

The rhode island state sales tax rate is 7%, and the average ri sales tax after local surtaxes is 7%. Residents of rhode island are also subject to federal income tax rates, and must generally file a federal income tax return by april 15, 2021. For the convenience of employers, the attached tables show the amount of rhode island taxes to be.

Of this, the state allocated $394,955 in state funds to tobacco prevention in fiscal year 2020, 3.1% of the centers for disease control and prevention’s annual spending target.4. This means that in most cases, you will pay less income. Home» departments» assessment division» tax rates.

Rhode island new employer rate. The current tax rates and exemptions for real estate, motor vehicle and tangible property. As the irs and many states effectively double the width of most mfj brackets when compared to the single tax bracket at the same tax rate level.

Overall rhode island tax picture rhode island income taxes are in line with the national average. Detailed rhode island state income tax rates and brackets are available on. 1) rates support fiscal year 2020 for east providence.

The rhode island division of taxation has released the state income tax withholding tables for tax year 2020. Each marginal rate only applies to earnings within the applicable marginal tax bracket, which are the same in rhode island for single filers and couples filing jointly. Tax schedule f with rates ranging from 0.9 percent to 9.4 percent was in effect in calendar year 2020.

By law, the ui taxable wage base represents 46.5% of the average annual wage in. Above rates do not include job development assessment of.21% or 0.08% adjustment for 2020. 75% of nada value and a $5,000 exemptionall rates are per $1,000 of assessment

Rhode island received $196.9 million (estimated) in revenue from tobacco settlement payments and taxes in fiscal year 2020.4. Any tax not paid when due is subject to interest from the time the tax was originally due at the rates of 18% per annum (1.5% per month). Like most other states in the northeast, rhode island has both a statewide income tax and sales tax.

Exact tax amount may vary for different items.

Taxation Of Social Security Benefits – Mn House Research

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Opiniondibiase Hiking Personal Income Taxes In Ri Will Hurt Economy

Us Sales Taxes By State 2020 Us Tax Vatglobal

25 Percent Corporate Income Tax Rate Details Analysis

2

States With Highest And Lowest Sales Tax Rates

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Calculator – Smartasset

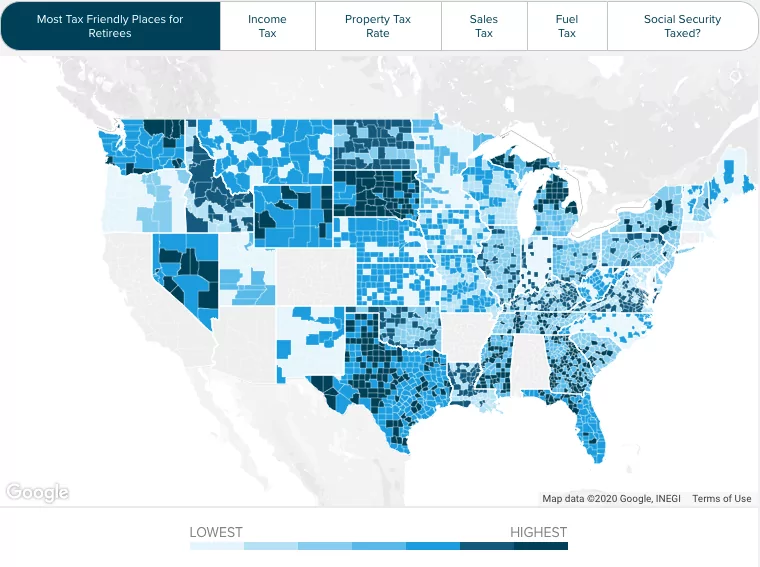

Rhode Island Retirement Tax Friendliness – Smartasset

Rhode Island Income Tax Rate And Ri Tax Brackets 2020 – 2021

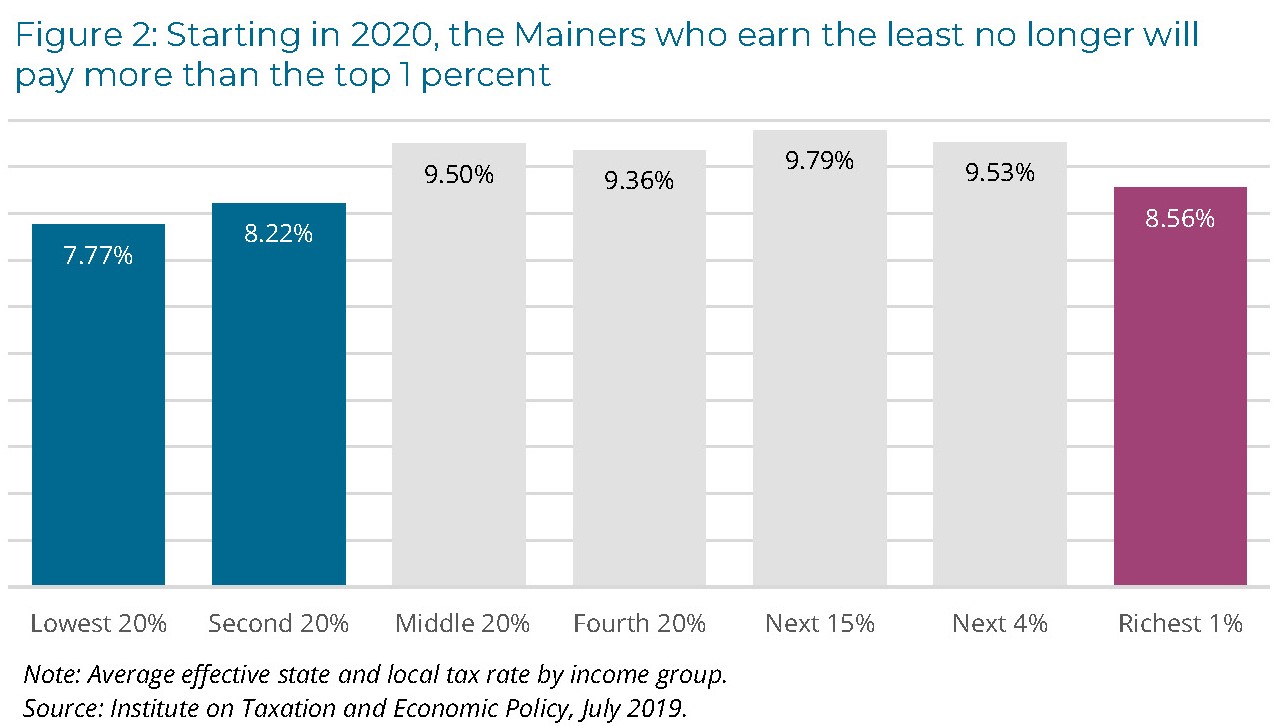

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent Uprise Ri

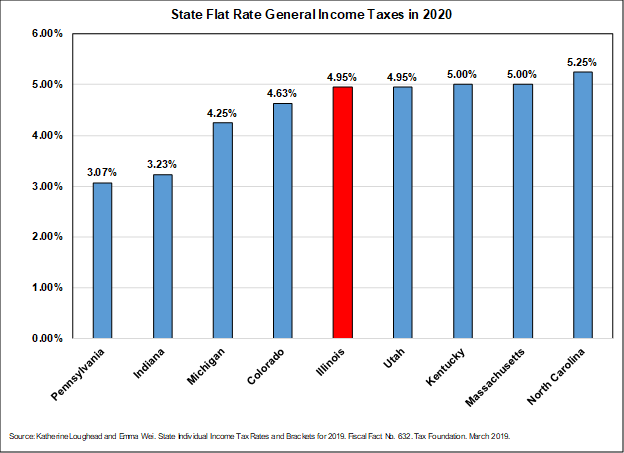

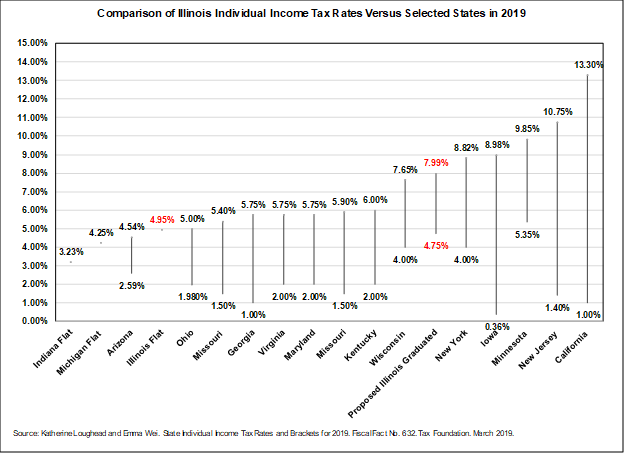

Individual Income Tax Structures In Selected States The Civic Federation

Maine Reaches Tax Fairness Milestone Itep

Rhode Island Income Tax Calculator – Smartasset

Individual Income Tax Structures In Selected States The Civic Federation

Sales Tax On Grocery Items – Taxjar

Rhode Island Tax Forms And Instructions For 2020 Form Ri-1040

2