Income tax withholding account (including withholding for pensions or trusts) rhode island unemployment insurance account (including rhode island temporary disability insurance (tdi) and rhode island job development fund tax) only the registration for the permit to make sales at retail (including litter fee, cigarette license, gasoline license). If your small business has employees working in rhode island, you'll need to withhold and pay rhode island income tax on their salaries.

2

Taxable income between $65,250 and $148,350 is taxed at 4.75%, and taxable income higher that amount is taxed at 5.99%.

Rhode island income tax withholding. This is in addition to having to withhold federal income tax for those same employees. Send payment within working days of the pay date. The rhode island withholding law requires employers in the state to withhold rhode island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

Click on the appropriate category below to access the forms and instructions you need: For a copy of the 2021 withholding tax payment calendar for employers, click here. The rhode island tax is based on federal adjusted gross income subject to modification.

There are three tax brackets and they are the same for all taxpayers regardless of filing status. The rhode island division of taxation has released the state income tax withholding tables for tax year 2020. $ 0 $ 65,250 $ 0.00 :

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Here are the basic rules on rhode island state income tax withholding for employees. In rhode island, income from nonresident employees who normally work there, but are temporarily working somewhere else, is still subject to its state income taxes.

A resident is defined as anyone who is domiciled in the state or who spends 183 days of a tax year in. The amount of rhode island tax withholding should be: Rhode island does not have any local income taxes.

The normal deadline is june 15, but that falls on a weekend this year. To have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov; Let’s say you sell an investment property in rhode island.

A personal income tax is imposed for each taxable year (which is the same as the taxable year for federal income tax purposes) on the rhode island income of every individual, estate and trust. Information for employers about withholding. The supplemental withholding rate for 2020 continues at 5.99%.

Reporting rhode island tax withheld: The first $65,250 of rhode island taxable income is taxed at 3.75%. 148,350 < and over :

The income tax is progressive tax with rates ranging from 3.75% up to 5.99%. Therefore, the withholding tax should be similar to the state income tax. All forms supplied by the division of taxation are in adobe acrobat (pdf) format;

The rhode island division of taxation reminds taxpayers and tax professionals that monday, june 17, is the deadline for the second installment of estimated tax under the rhode island personal income tax. The steps in computing the income tax to be withheld are as follows: If your state tax witholdings are greater then the amount of income tax you owe the state of rhode island, you will receive an income tax refund check from the government to make up the difference.

Multiply the amount of one withholding exemption ($1,000 annually for 2019) by the number of exemptions and allowances claimed by the employee — note, however, that if the. Most forms are provided in a format allowing you to fill in the form and save it. Like most other states in the northeast, rhode island has both a statewide income tax and sales tax.

But a rhode island resident who normally works across state lines, but is temporarily telecommuting from rhode island, does not need ocean state taxes withheld during the pandemic. The division of taxation has posted the new booklet of income tax withholding tables (used by employers and others to calculate how much to withhold from an employee’s pay in 2021 for. Rhode island annual income tax withholding tables (percentage method) for wages paid on or after january 1, 2019.

The highest marginal rate applies to taxpayers earning more than $148,350 for tax year 2020. The income tax withholdings for the state of rhode island will include the following changes: Employers must report and remit to the division of taxation the rhode island income taxes they have withheld on the following basis:

If you are not a resident of rhode island or a corporation that isn’t formed in rhode island, the buyer of your property will have to file income tax on your behalf. If you cannot withhold the full amount of support for any or all orders for this employee/obligor, withhold. Therefore, the deadline moves to the next business day:

The annualized wage threshold where the annual exemption amount is $0.00 will increase from $217,350 to $221,800. You must begin withholding no later than the first pay period that occurs days after the date of.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

2

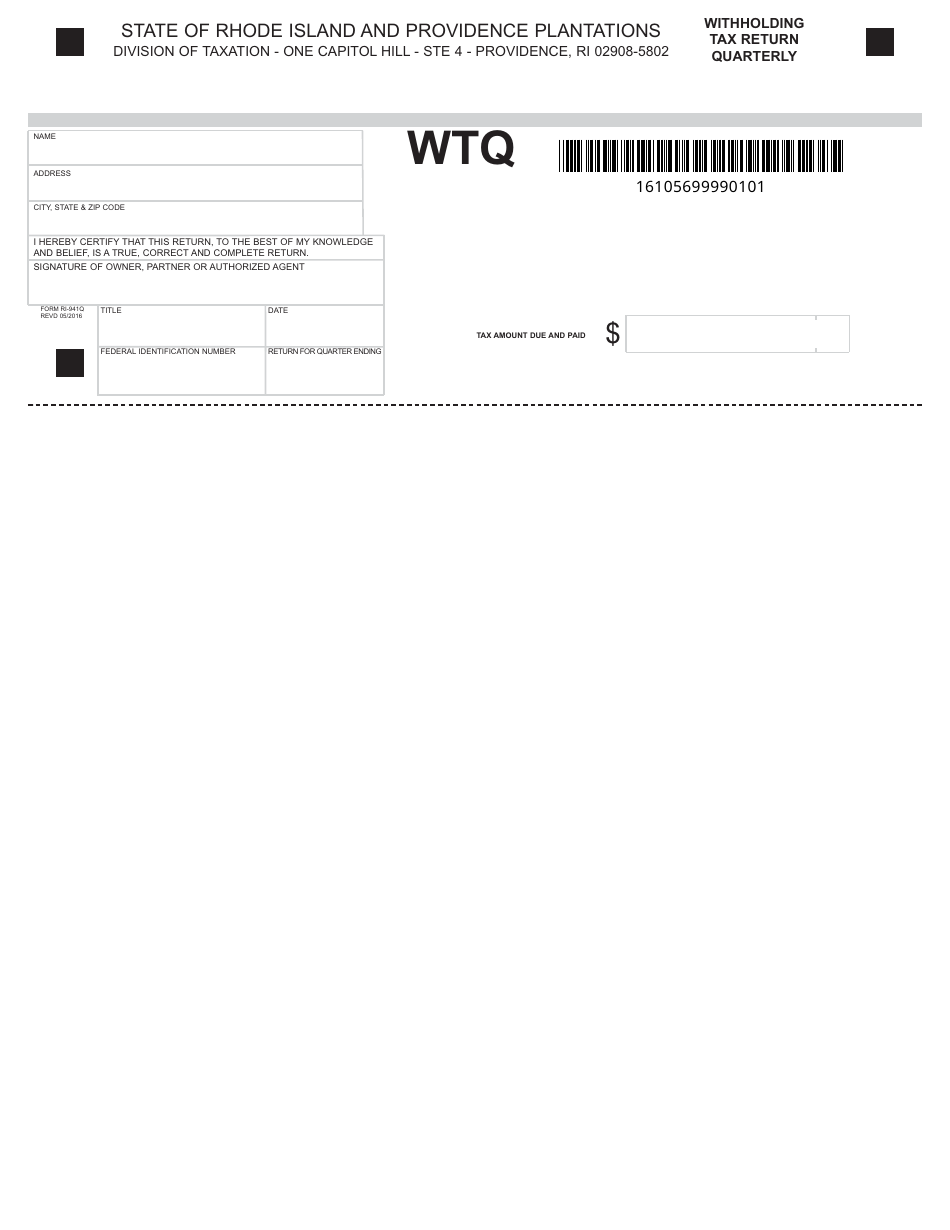

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

Rhode Island Tax Forms And Instructions For 2020 Form Ri-1040

State Of Rhode Island Division Of Taxation Division Rhode Island Government

2

Farm Books Accounting Software List Of Reports Payroll Template Resume Template Free Payroll Checks

Cleverus Wins Most Promising Awards At Star Outstanding Business Awards Soba 2019 Business Awards Internet Marketing Strategy Online Marketing

Pin En Personal Financial Literacy For Ells

2

Rhode Island Income Tax Ri State Tax Calculator Community Tax

2

Rhode Island Income Tax Calculator – Smartasset

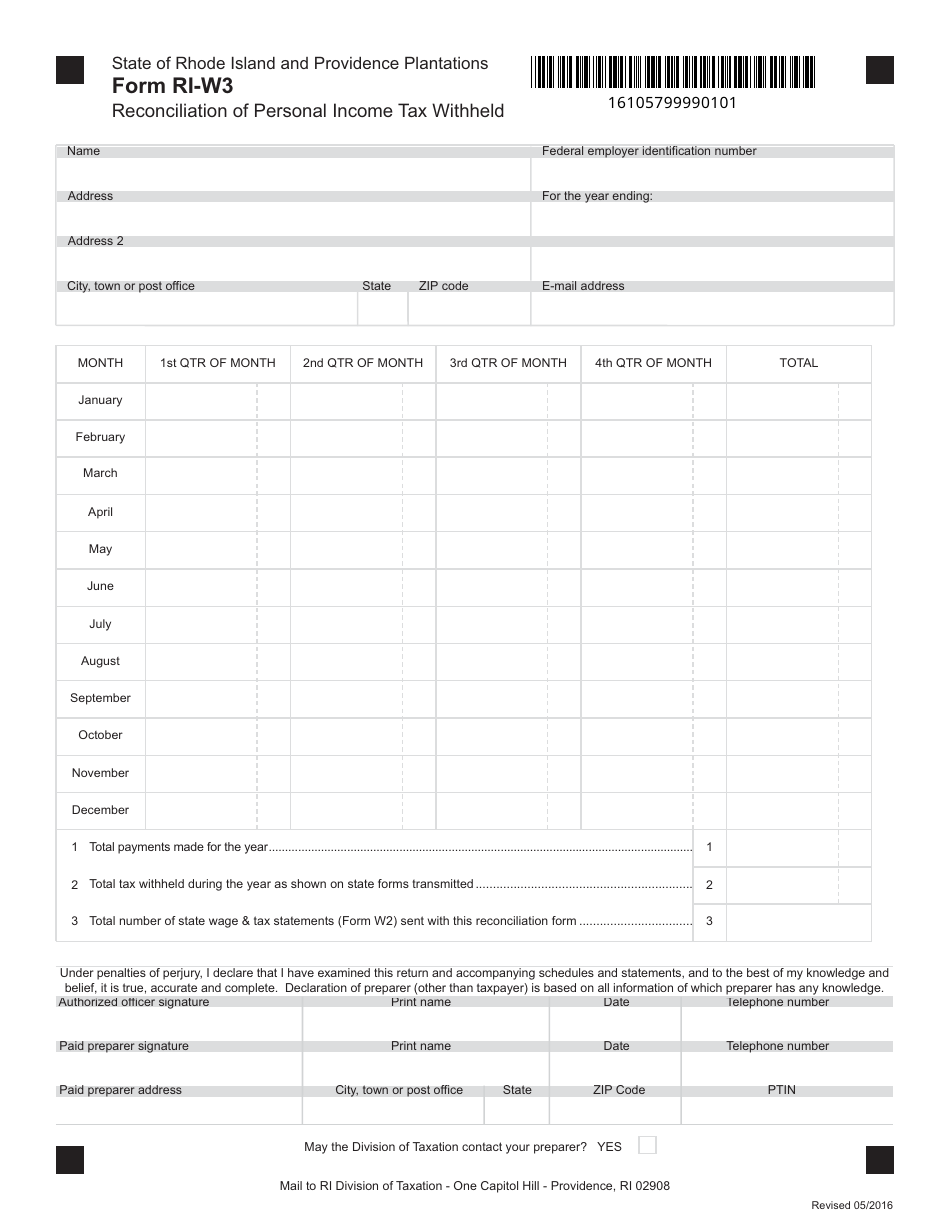

Form Ri-w3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Pin On Class Warfare

2

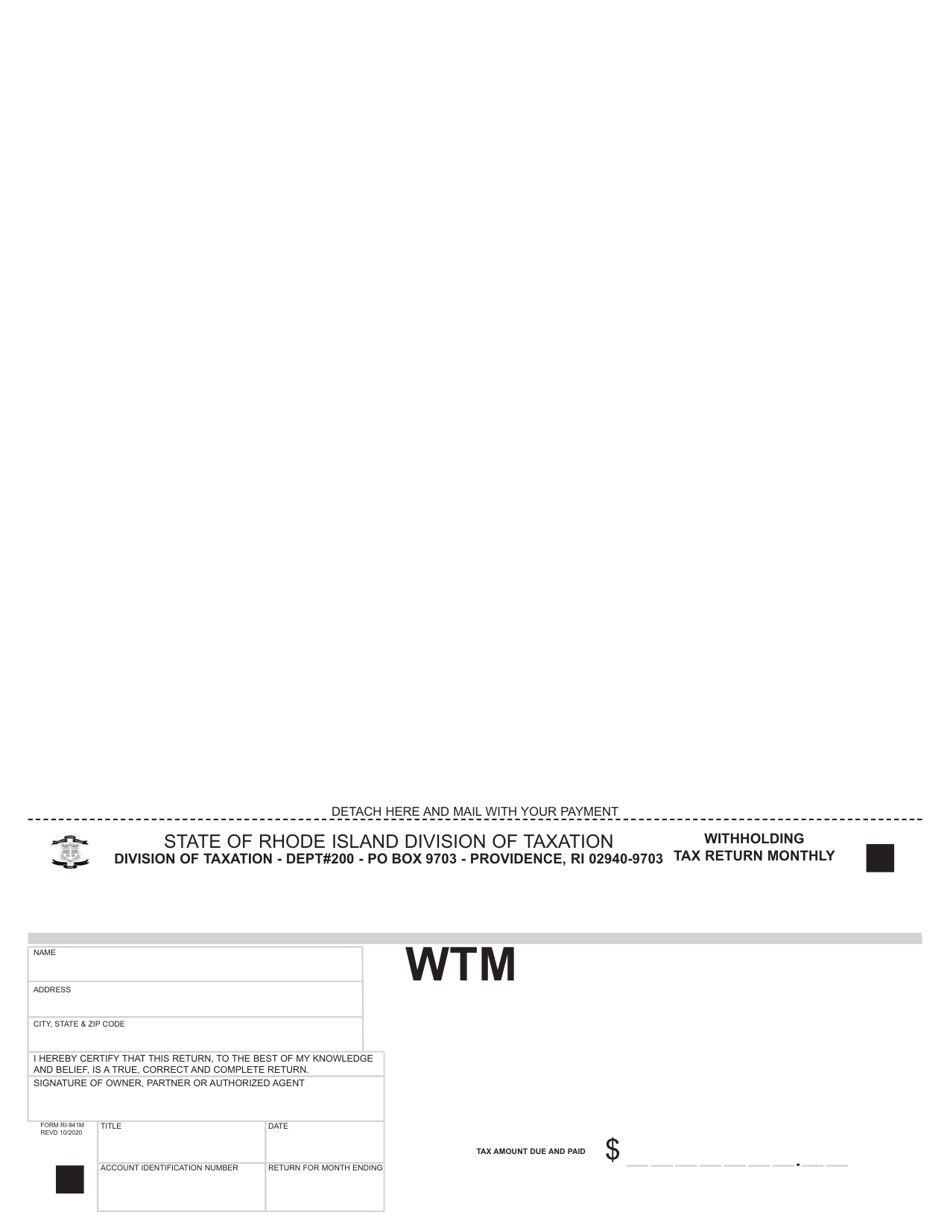

Form Ri-941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

State W-4 Form Detailed Withholding Forms By State Chart