By then, what is legally permissible (retroactively changing the capital gains rules) becomes far less politically feasible (as retroactive tax hikes tend to be viewed in an especially harsh light). At this point, though, it’s looking like the earliest the biden tax plan will be passed is q3 2021.

Bidens Capital-gains Tax Plan May Be Retroactive Worrying Top Bank Ceos Fox Business

There’s talk about the potential for a retroactive tax hike for capital gains.

Retroactive capital gains tax meaning. However, the losses can be carried forward to the next succeeding tax year as a deduction. And the new administration has indicated a big increase in the. The change means investors would lose the ability to exit their winning positions at the lower tax rate and be trapped at the hiked rate.

Biden plans to increase this to 43.4 percent for households earning more than $1 million. President and congress hold the power to raise taxes retroactively, meaning that the increase could apply anytime during that same calendar year. Introduces a 3% surtax on income >$5m (including capital.

In washington, governor jay inslee recently signed into law a 7 percent capital gains tax. The biggest may be an upcoming increase in the capital gains tax. In new york, lawmakers have proposed a tax hike on the state’s highest earners that would be retroactively implemented with an effective date of jan.

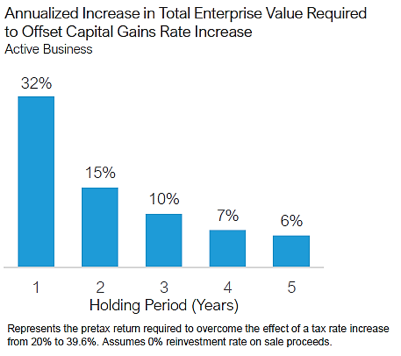

Ordinary capital gains, proceeds from sales of holdings less than a year, are still taxed at ordinary rates… meaning 37% for those mfj making more than $628,301. Raising the capital gains tax from 20% to approximately 39.6% would have huge potential impact on what you, as a business owner, could expect to net from the sale of your business. Biden plans to increase the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million, though congress.

Supreme court has reaffirmed that both income and transfer tax (e.g., estate and gift taxes) changes may be implemented retroactively, “provided that the retroactive. Although congress may reinstate the tax retroactively in 2010, perhaps as part of broader tax reform, this is by no means a certainty. I don’t get your angst.

The top rate for 2021 is 37%, plus the medicare surtax of 3.8% (plus state tax). That question is much more difficult to answer. The following state regulations pages link to this page.

This provision will be retroactive to tax years beginning after december 31, 2020. 1, 2021 in order to pay for the state’s heavy $212 billion budget, which includes a $15,600 cash payout for illegal immigrants. Biden plans to increase the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million, though congress.

A retroactive capital gains tax increase. In some cases, you add the 3.8% obamacare tax, but at worst, your total tax bill is 23.8%. President joe biden and many progressive democrats have proposed taxing capital gains as ordinary income at a top rate of 39.6% to the extent adjusted gross income exceeds $1 million, effective for transactions after an unspecified “date of announcement.”

A tax law will be found unconstitutional if “the retroactive imposition of the tax after the [taxable event] was arbitrary, harsh, and oppressive.” in other words, if the retroactive application is arbitrary, harsh, or oppressive, as applied to a particular taxpayer, it will be unconstitutional as applied to. Up until now, the tax rate on capital gain has been zero, 15% or 20%, depending on your income. Long term gains, those holdings of more than a year, are taxed at 20%.

Currently, the top capital gain tax rate is 23.8 percent for gains realized on assets held longer than a year. Under the house tax proposals, section 461(l) will be amended to permanently disallow noncorporate taxpayer’s excess business losses; Gains recognized after the effective date that arise from transactions entered into pursuant a written binding contract (with no material modifications thereafter) would be treated as occurring prior to the effective date.

Biden plans to increase the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million, though congress must ok any hikes and retroactive effective. Perhaps, had congress looked to enact such changes earlier in 2021, the chance to make the capital gains tax changes retroactive (to, perhaps, the start of the year) would have been greater.

Bidens Capital-gains Tax Plan May Be Retroactive Worrying Top Bank Ceos Fox Business

Biden Plans Retroactive Hike In Capital-gains Taxes So It May Be Already Too Late For Investors To Avoid It Report – Marketwatch

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Estate Taxes Under Biden Administration May See Changes

Capital Gains Tax Hike And More May Come Just After Labor Day

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

2

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

.png)

Bidens Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp – Jdsupra

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Biden Budget Said To Assume Capital-gains Tax Rate Increase Started In Late April – Wsj

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive – Bloomberg

Advisors Look For Ways To Offset Bidens Retroactive Capital Gains Tax Hike

![]()

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Bidens Tax Plan Reportedly Includes Retroactive Capital Gains Hikes – Axios

Proposed Impactful Tax Law Changes And What You Can Do Now – Johnson Pope Bokor Ruppel Burns Llp

A Retroactive Tax Increase – Wsj