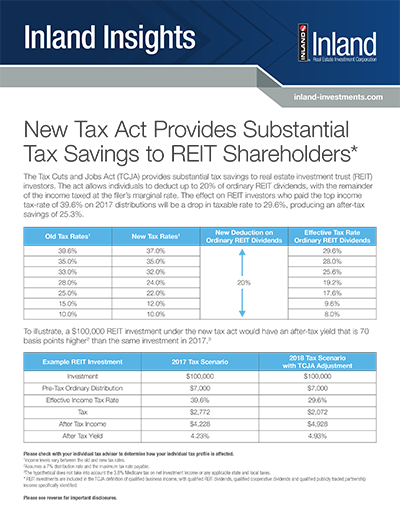

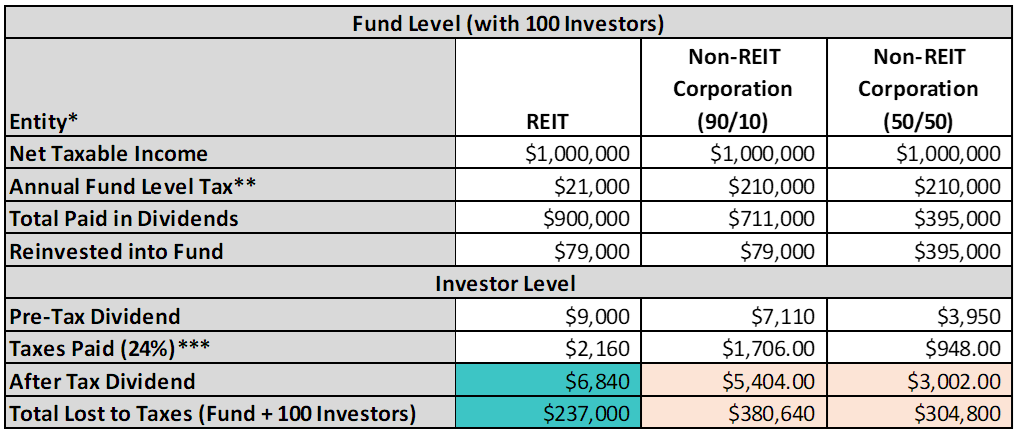

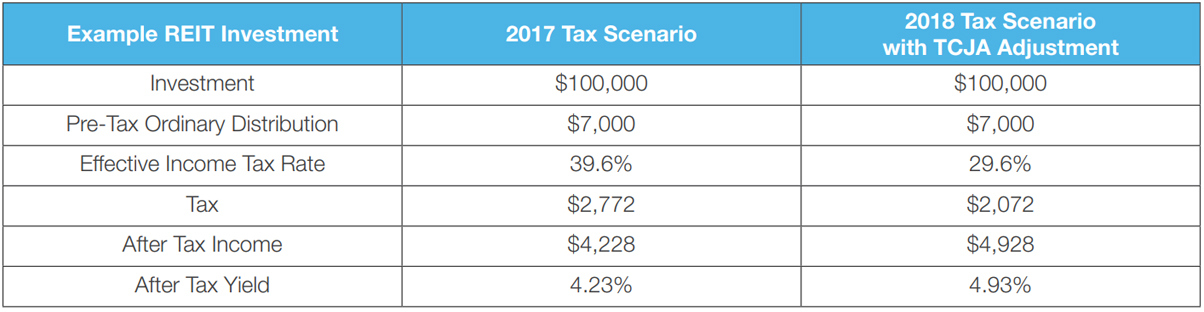

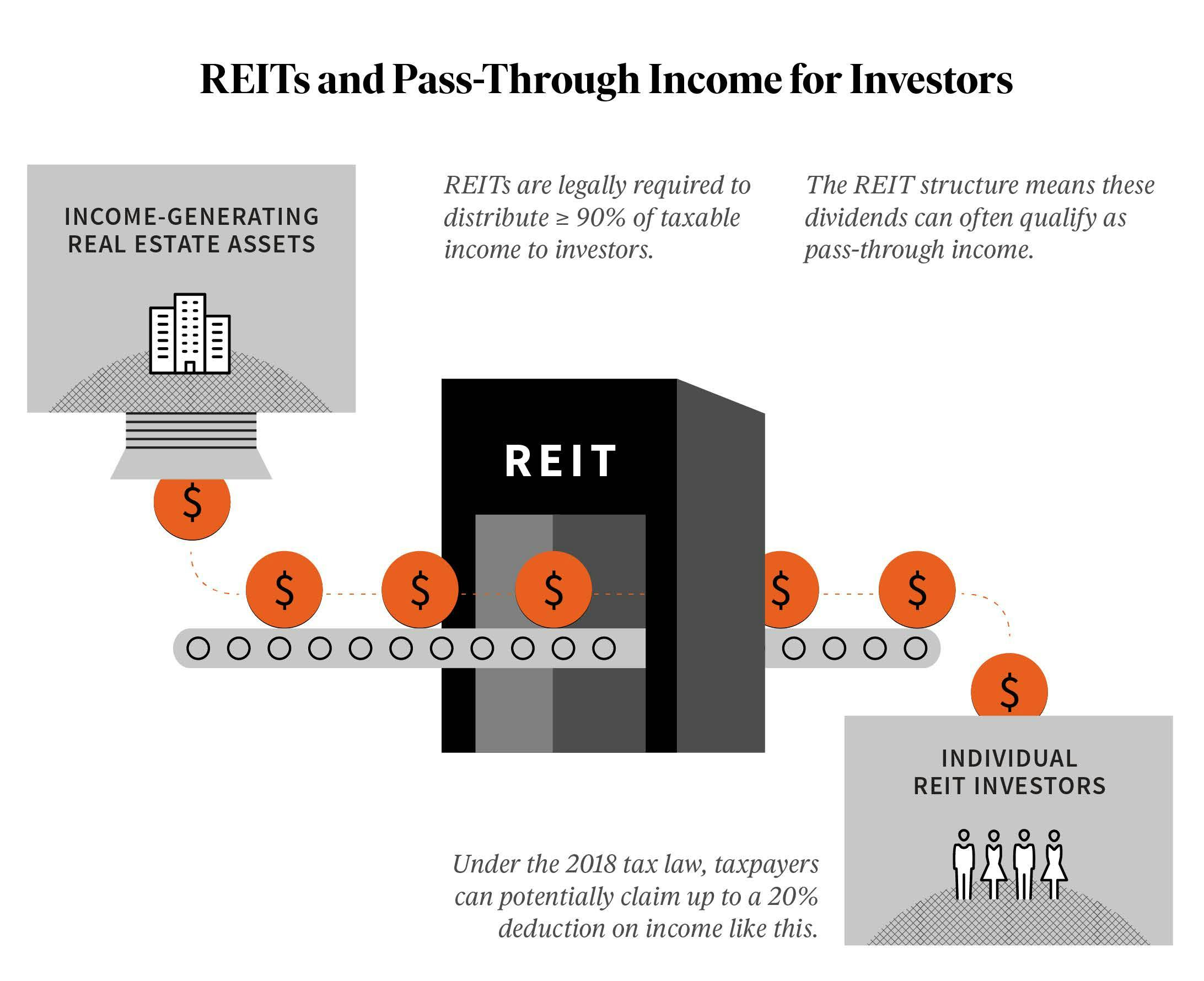

If you’re in the top bracket, the tax bill on your dividends could go from 37% to 29.6%. Investors who park their funds in a reit can benefit in these following ways.

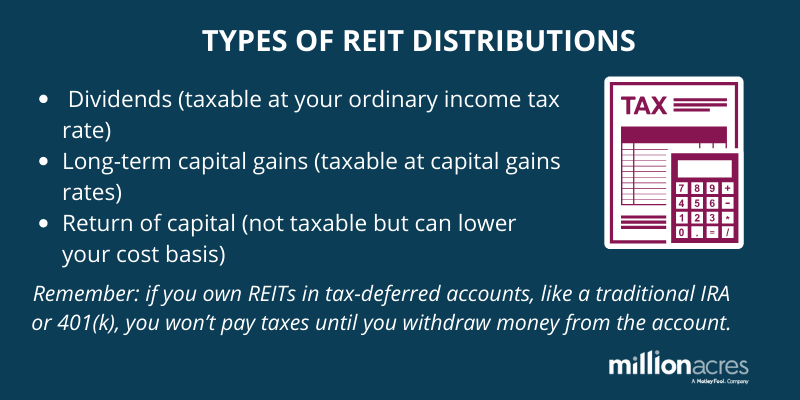

How Are Reits Taxed Millionacres

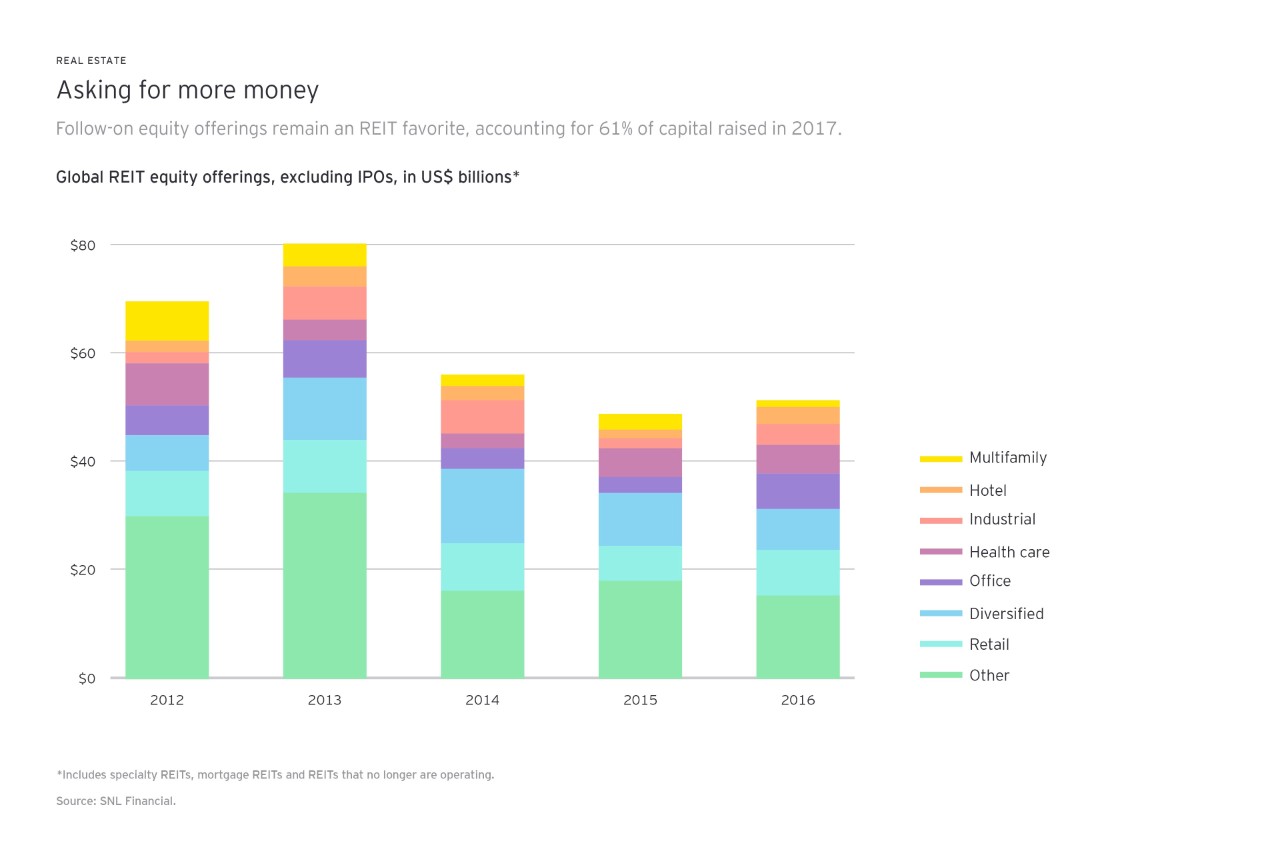

Steady dividend income and capital appreciation:

Reit tax benefits ireland. Withholding tax documentation to the u.s. Reits facilitate collective investment in property therefore providing the benefits of risk diversification to investors of all sizes. Again, this could reach a combined rate of 51%.

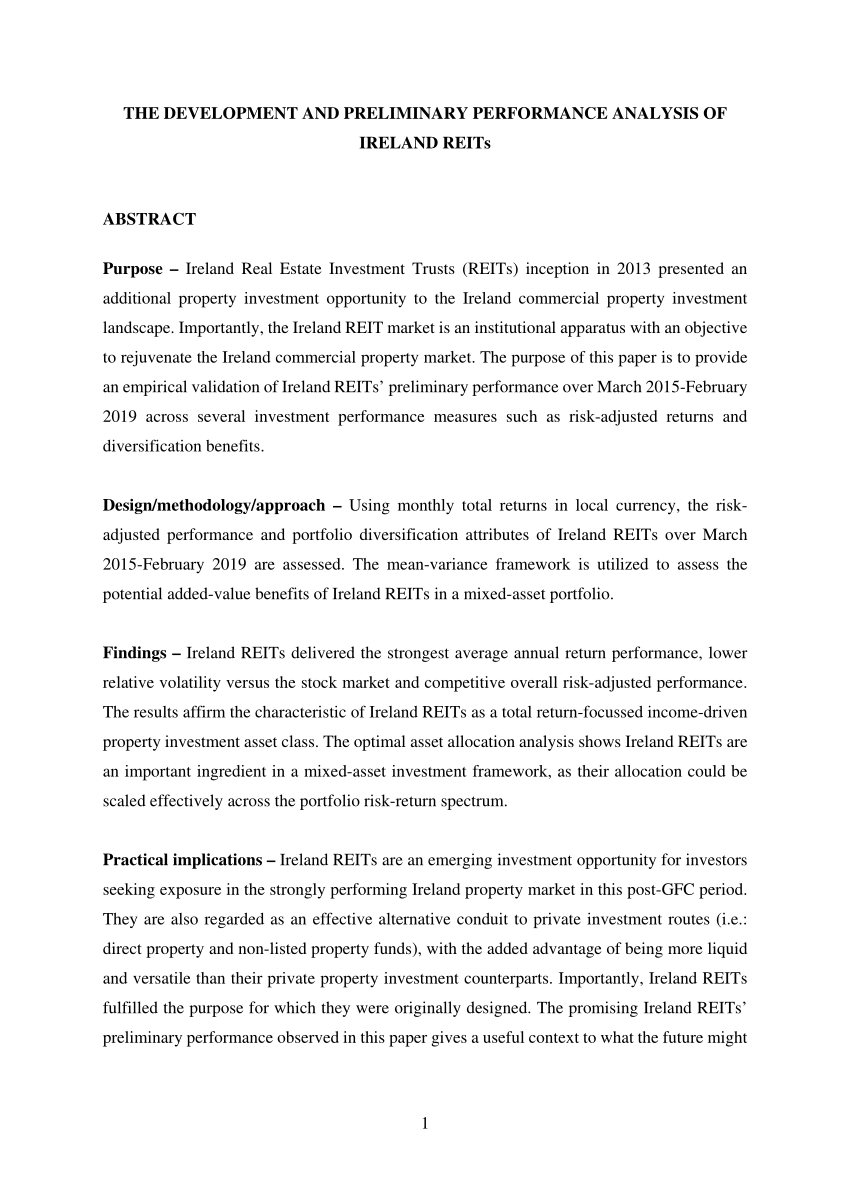

Taxation of reit’s shareholders irish resident shareholders in a reit will be liable to income tax on income distributions from the reit plus prsi and usc. An irish resident individual, owning shares in an irish reit, will be subject to income tax and usc on the dividends from the reit. There has been a surge in coverage of reits in the press in ireland and policymakers continuously refer to generous tax conditions that they have since 2013 and argue that this gives them unfair leverage.

Irish resident investors will be liable to capital gains tax at a rate of 33% on a disposal of shares in the reit. Real estate investment trusts (reits) are known as a tax efficient way to invest in real estate. However, certain investors may be able to qualify.

Other jurisdictions such as ireland opt for a simpler form which allows a reit company or a group of companies where the parent is a reit to list on the irish stock exchange on the basis of a notification being served upon the revenue commission and the adherence with a number of conditions. Are taxed at the gains tax rate (currently 41%) and no loss relief is available unless you are in an 'umbrella' structure. Financial institutions operating in ireland are obligated to withhold tax (deposit interest retention tax or dirt) out of interest paid or credited on deposit accounts in the beneficial ownership of resident companies, unless the financial institution is authorised to pay the interest gross.

Equally, it is not chargeable to capital gains tax (cgt) accruing on the disposal of assets of its property rental business. Treaty benefits and provides valid and complete u.s. Stamp duty, which is currently at a rate of 7.5% in respect of commercial property and 2% in respect of residential property, (1% for residential property up to a value of €1m), should apply to properties acquired.

They are generally exempt from corporation tax (ct) on income from their property rental business only. Thanks to the tax bill that signed into law in 2017, reits now boast a new and lucrative tax benefit: This withholding tax can be reduced when an international investor qualifies for u.s.

The interest and dividends received by the reit/invit from the spvs is exempt from tax. In exchange for paying out at least 90% of. Irish resident corporate investors will be liable to 25% corporate tax on such distributions.

Real estate investment trusts (reits) reits are companies who earn rental income from commercial or residential property. Dividends and gains are taxed at the gains tax rate of. Benefits of the reit regime 20.

Also they are generally exempt from chargeable gains made on the disposal of assets of their property rental business only. Purchases of reit shares will generally be subject to stamp duty or stamp duty reserve tax at the rate of 0.5%, compared to a top rate of stamp duty land tax of 5% for commercial property investments held directly. The reit is also exempt from tax on its rental income, which it may have earned if it owned a property directly.

Taxation of a reit [section 705g tca] a company which is either a reit or a member of a group reit is not chargeable to corporation tax (ct) on income from its property rental business. Real estate structures and tax treaty issues: What are the benefits of reits?

This in turn brings new sources of capital into the irish property market and contributes to reducing dependence on bank The withholding tax on ordinary dividend income is reduced to 15 percent in most u.s. Investing in reits is said to provide substantial dividend income and also allows steady capital appreciation over the long term.

Worldwide real estate investment trust (reit) regimescompare and contrast48. The application of tax treaties on reits.

Diversify Your Income With Irish Reits Seeking Alpha

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

How Reit Regimes Are Doing In 2018 Ey – Global

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

How Reit Regimes Are Doing In 2018

Assetskpmg

Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 India Corporate Law

Reksadana-manulifecom

Reit Tax Efficiency A Case Study Fundrise

Reit Tax Advantages – Streitwise

Real Estate Investment Trusts Tax Adviser

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Reits Real Estate Investment Trusts And Tax – Tax – Worldwide

Guide To Reits Reit Tax Advantages More – Wall Street Prep

Pdf The Development And Initial Performance Analysis Of Reits In Ireland

Algoodbodycom

How Big Landlords In Ireland Minimise Their Tax Bills On Rental Properties

The Taxman Cometh Reits And Taxes

Reits 101 A Beginners Guide To Real Estate Investment Trusts Fundrise